Adam Berry

Investment thesis: As the world is on the path of dividing itself into two opposite, increasingly mutually antagonistic economic & geopolitical camps, those non-aligned factions still left in the middle can temporarily benefit from freely accessing both markets. Vietnam is one such nation, and its arguably most exciting company, VinFast (NASDAQ:VFS), part of the VinGroup conglomerate seems to be the best-positioned Vietnamese company to take advantage of the current geopolitical situation. Unlike its Chinese rivals for instance, that have rising barriers ahead of them in Western and other markets, VinFast is being welcomed anywhere in the Western World. Not only is their investment welcome in North Carolina, but the economic ties that this investment forms, arguably contribute to America’s geopolitical ambition to prevent nations such as Vietnam from aligning with the China-led alliances we see emerging. China’s calculations largely mirror America’s, therefore it can be argued that all doors are open for VinFast’s EVs, which can potentially become a real advantage over many of its North American, European, or Asian competitors.

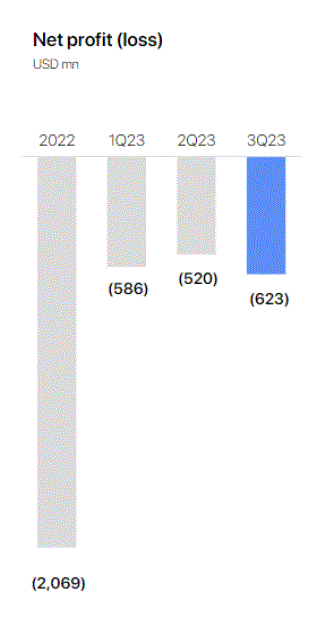

It will be many more quarters before we see whether VinFast can be profitable.

By far the most important determining factor that will arguably make or break this company is its North Carolina plant investment, which is set to start churning out cars at some point in 2025 if all goes to plan. The plant’s full capacity will be 150,000 cars/year. As we know, there tend to be high chances of things not going to plan for a variety of reasons, as we saw with other similar ventures. Even if VinFast starts producing and delivering cars in 2025, I am sure that some recalls will follow. It might take a few quarters past the commencement of production at the North Carolina plant before we get a clearer sense of how profitable VinFast’s venture will be.

In the third quarter of 2023, it sold just over 10,000 cars, which was a 5% improvement on the previous quarter. In the process, it generated $343 million in revenues. For the first nine months of 2023, it generated $755 million in revenues, compared with $436 million for the corresponding period of 2022.

VinFast

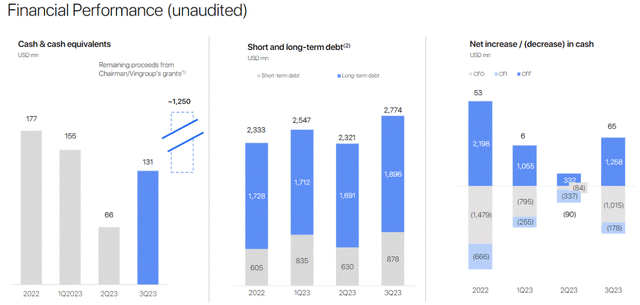

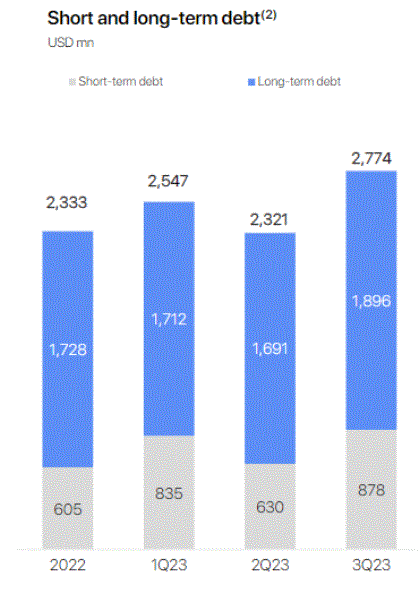

As we can see, the magnitude of VinFast’s net loss tends to be higher than its total revenues. We could start seeing a narrowing of those losses relative to revenues perhaps in the second half of next year, while in 2026, VinFast might have a shot at some positive quarterly earnings. In the meantime, stock dilution as well as growing the debt pile will continue to occur to cover for those losses.

VinFast

As we can see, the debt situation has not seen a dramatic deterioration this year. The number of shares outstanding is also stable for the third quarter of 2023, at 2.309 billion shares outstanding versus 2.299 billion shares at the end of Q3, 2023.

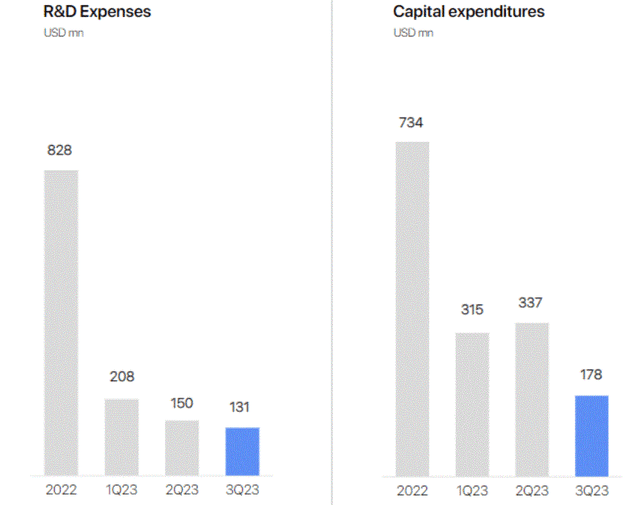

Based on R&D costs as well as capital expenditure trends, it does not seem that VinFast will need a great deal of stock dilution going forward, as long as recent trends will continue to prevail. The cash position of VinFast seems to be deteriorating at a relatively slow pace, considering that it is in the process of investing heavily in ramping up production.

A significant boost for VinFast has been a $1.5 billion donation from Vingroup’s chairman together with Vingroup, which is reflected in the chart above in the cash position section. It is a significant contributing factor to VinFast’s ability to keep from seeing its debt situation significantly deteriorating, as well as reducing its need to dilute its stock.

Beyond this year, if everything goes well with the commencement of production & sales of cars from its North Carolina plant, VinFast might be in a position to internally source most of the capital it needs for further expansions and R&D needs. Much depends on how the execution of the project will pan out, as well as the market reception of a new EV car brand on the market. In other words, just because VinFast will be able to produce 150,000 cars/year, it does not automatically mean that it can sell them.

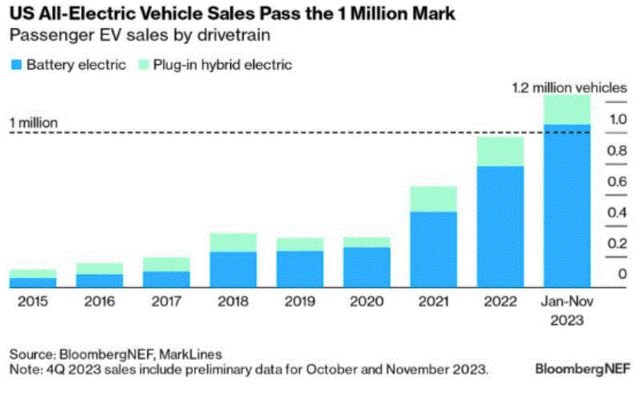

The US EV market is starting to show signs of meeting consumer resistance to further growth.

The US EV market is still seeing robust growth, based on the most recent sales numbers available.

While sales growth still seems robust, there is one dramatic shift in the market, namely the fact that while in years past, sales growth was mostly driven by supply, now it is solely driven by demand, because there is a very ample supply of most EV makes & models. In other words, we are starting to see a major inventory build for most EV producers. It takes on average about 25% more time to get an EV off of the dealership lot than it does for a regular gas-powered vehicle. In theory, VinFast could be on the verge of entering a market that is just starting to get over-saturated as new EV companies and legacy conventional automakers alike, are ramping up production, even as the consumer market is less than unanimous on abandoning conventional ICE-powered cars in favor of EVs.

The current market situation is just a snapshot of course, therefore there is no definite answer to what the market will look like in 2025, which is when VinFast will most likely enter full, consistent production of its EVs, and it will find out whether there is a market for its cars in the US or not. It is possible that in the meantime we will have more federal government as well as state government measures implemented to stimulate EV sales. Those measures may include more subsidies, or making buying & driving ICE-powered cars less attractive through various punitive policies. In an extreme hypothetical scenario, we may even see sales of ICE-powered cars limited to an extreme degree, where EVs will become the only realistic option. I find such an outcome to be somewhat unlikely in the next few years, but given the way things have gone so far this decade, I came to expect the unexpected.

If the current trends continue in terms of EV supplies seemingly outpacing consumer demand for EVs in the US market, the timing of VinFast’s launch of its North Carolina production facility could end up being most unfortunate. It might lead to all EV producers having to implement deep discounting on their cars, just to move their inventory. For VinFast, it could mean that there will be no hope for its expanded production to lead to positive net earnings any time soon.

A word on quality/price For VinFast’s VF8.

As far as the product that VinFast is bringing to the US market, it seems to be a decent offer overall, if one is focused on its price/range. The VF8 has the Eco version as arguably the most attractive offer, at least when it comes to the price/range ratio. It has a base price of $47,000 currently and it has a range of up to 264 miles. It seems to have the necessary range to be considered a practical vehicle, but just barely. Realistically speaking, assuming ample charging stations are available along the way, one could drive just over 200 miles on the initial full charge before having to stop to recharge, under ideal conditions. After the first charge, the 25-minute fast charge will provide 70% of the total ideal range, in other words, owners will have to stop every 150 miles or so for a 25-minute charge. Many people tend to stop every 2 hours or so when on a road trip, therefore it is not entirely impractical.

Some questions are being raised about the quality of the car’s infotainment system, as well as its suspension, which might arguably put it at a disadvantage relative to some of its EV peers in the same SUV category. Overall, for $47,000, it seems that one is getting slightly less compared with the cheapest versions of Ford’s (F) Mach-E, which, for a starting price of about $45,000 can deliver a car with a 250-mile range. It is also arguably a far more prestigious car, through the simple fact that it is a Mustang. It is however not outrageously out of step with its main competitors on the market in terms of price/quality. It remains to be seen what future customers will say once they experience the VF8, as well as other VinFast models. The consumers will have the final say, but for now, we can conclude based on what we know that it is a competitive offer overall, even if it is not necessarily beating the main competing EV models currently on the market in terms of price/utility that consumers can derive from it.

Aside from the VF8, which is set to be the main model, VinFast is banking on. The VF9 which starts at $84,000 is a more luxurious SUV offer, that offers a longer range of 330 miles, three-row seating, and other perks that one expects to see in the price range, including impressive infotainment features, and more. It is also seemingly about to see a price discount that might bring it under $80,000. It remains to be seen how much of a contribution this luxury model on offer will have to sales, but generally speaking, the higher price range EVs tend to provide automakers with an opportunity to improve on their profit margins. There is also a midsize truck potentially on the horizon perhaps within a few years. The company certainly is not lacking in ambition. It remains to be seen if it will be matched by execution, and whether market conditions will be beneficial in terms of the timing of its ramp-up of production and sales.

Investment implications:

My current position in VinFast is small, less than 1% of my overall stock portfolio, which is a reflection of my view of this company, as a high-risk/high-potential reward bet, where things could turn out very well for investors if all goes well, internally, as well as externally. If things go wrong, perhaps with execution lacking internally, and the market posing some challenges externally as signs currently suggest that might be the case, it can easily leave investors facing deep losses, which is why I want to keep my exposure in VinFast stock limited to around 1% to 2% of my overall portfolio, at most.

As far as evaluating VinFast’s attractiveness to be a buy at current levels, my approach is to look at the odds of success. On the surface, it seems that it has similar chances to establish itself as a prominent EV maker in the US as Rivian (RIVN) does. For full disclosure, I want to mention that I also have a small position in Rivian stock. Both have similar production volume outlooks going forward. Both of them trade at a similar market cap, with VinFast currently at $16.5 billion, versus $18.7 billion for Rivian.

The one great difference perhaps that might make VinFast a better bet is the fact that for Rivian, the North American market is make or break. It cannot fail here and then try in Europe or Asia. The Chinese market might not even be open for its EVs in the future if the US & Europe are both insistent on continuing with their protectionist measures against the Chinese EV industry. VinFast on the other hand could still recover from partial failure in the American market, assuming that its cars will be relatively decent in terms of performance. It is already set up to sell its cars in Europe, where it does not have production facilities. If for instance, the US market will prove too difficult to sell into, due to the EV inventory overflow that we are seeing developing, it could potentially ship a part of its North Carolina production to Europe. It could also try to make inroads in China. Neither market is likely to be hostile to VinFast, for the geopolitical reasons I mentioned.

I first announced my intention to start buying VinFast stock when it was trading at around $12/share, which was my initial entry point. I then bought some more at $6/share. I am content to ride my current position unless I see a reason to buy more perhaps in the next few months, in response to a hypothetical combination of positive internal or external developments and a share price that remains attractive at around current levels. I intend to watch both, US EV market conditions as they continue to develop, as well as any news of note that may come out of VinFast as it approaches the moment of commencement of production at its North Carolina plant. While I remain cautious about building a large position in this stock, given all that can go wrong with this startup, I find myself willing to increase my position somewhat, perhaps past the 1% of my portfolio mark, given the risk-reward considerations that do make it arguably somewhat more attractive relative to its peers.