Thais Ceneviva/E+ via Getty Images

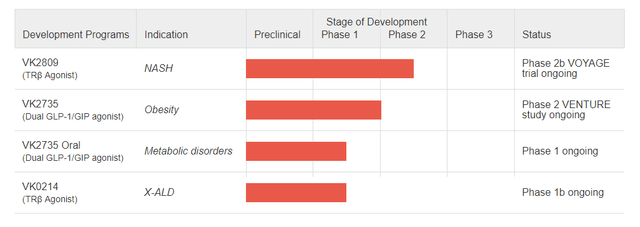

Viking Therapeutics’ (NASDAQ:VKTX) most advanced pipeline candidate is VK2809, a drug for non-alcoholic steatohepatitis (NASH). A lot of the excitement surrounding VKTX right now, however, relates to its obesity drug, VK2735 (the drug also has potential in various metabolic disorders including diabetes and NASH).

Figure 1: VKTX pipeline. (Company website.)

Incretin developers are rallying right now

On December 4, Roche (OTCQX:RHHBY) announced a merger agreement to acquire Carmot Therapeutics (which was about to IPO) for $2.7B in cash, and up to $400M in milestones. The deal sees RHHBY get a hold of Carmot’s pipeline of incretins, including the phase 2 ready drug CT-388, which is an agonist of glucagon-admire peptide 1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP) receptors. Note, Eli Lilly’s (LLY) Mounjaro (tirzepatide) is also a dual GLP-1 receptor/GIP receptor agonist. Data from a phase 1/2 trial of CT-388, presented at the American Diabetes Association Scientific Session in June 2023, noted 8% body weight reduction in just four weeks in obese and overweight adults.

Outside of the acquisition, Pfizer’s middling results, announced on December 1, with its oral GLP-1 receptor agonist, danuglipron, when dosed twice daily, clears the path for other incretin developers to have success.

What does it mean for VKTX?

For VKTX, the company’s VK2735 makes it a potential acquisition target itself. admire Mounjaro and CT-388, VK2735 is a dual agonist of GLP-1 and GIP receptors.

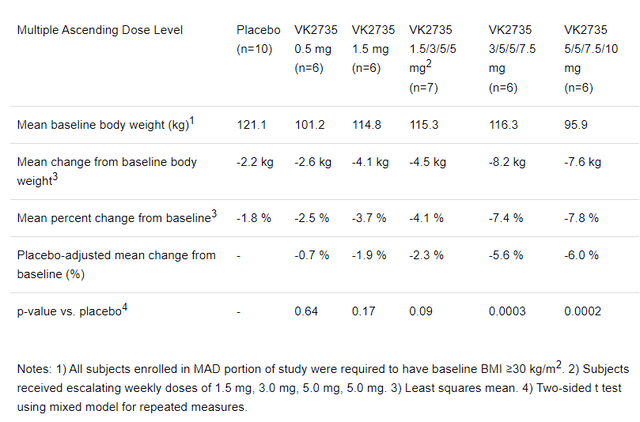

VKTX reported results in March 2023 from a randomized, placebo-controlled, double-blind phase 1 investigate of VK2735 in obese adults. That investigate showed 7.8% reduction in bodyweight, from baseline to 28 days, with the highest dosing regimen of VK2735 (vs just 1.8% for placebo, P < 0.0002).

Figure 2: Screenshot of table from VKTX press release concerning results from a phase 1 investigate of VK2735. Note the dose-response relationship. (March 28, 2023, press release from VKTX.)

It’s hard not to notice the 7.8% reduction in bodyweight, at four weeks with VK2735, is similar to what Carmot Therapeutics produced with CT-388, and that company just got bought out for $2.7B. While that investigate used a subcutaneous formulation of VK2735, administered once weekly, VKTX also has an oral formulation in development. A phase 1 trial looking at the oral formulation is expected to report results in Q1’24.

Beyond the benefits of the drug on bodyweight in obese adults, VK2735 also produced reductions in liver fat. The results in the group of patients with non-alcoholic fatty liver disease (NAFLD) were particularly impressive where a 58.5% placebo-adjusted reduction in liver fat was shown.

VKTX2735’s next act: Timing the readout

While the phase 1 data with VK2735 was impressive, I assess we’re close to a readout from VKTX2735’s next act, results from a phase 2 trial called VENTURE. The VENTURE investigate is a randomized, double-blind, placebo-controlled, 13-week investigate of VK2735 (subcutaneous, once-weekly) in obese adults. While the investigate had originally planned to enroll 125 adults, elevated demand has seen the company enroll 176 trial participants. The primary endpoint is the change in bodyweight from baseline to week 13 vs placebo.

I expect the VENTURE trial to hit the primary endpoint, but that isn’t much of a prediction given the mechanism of the drug, we know these agents cause weight loss, and the phase 1 data. What will be more in focus is just how much weight loss is seen and the rates of adverse events. Given the mechanism of VK2735 is similar to the highly effective Mounjaro, and the compelling weight loss data seen at four weeks, I think we can expect some pretty impressive weight loss numbers from VENTURE. Something encourage to consider is that while the four-week investigate included in the phase 1 work for VK2735 used a highest dose of 10 mg, the phase 2 work includes a dose group at 15 mg VK2735. As such, the potential to produce even more impressive weight loss numbers is in play.

On October 23, 2023, VKTX announced that enrollment in VENTURE was complete, and given the 13-week duration of the trial, I reckon the investigate would complete dosing on January 22, 2024. While VKTX has guided to a H1’24 readout from the VENTURE investigate, that is pretty conservative, given I doubt it will even take until February 22 (a month later) to report topline results. There is a four-week follow-up period built into the investigate, but VKTX might present that data later. If VKTX does expect for that part of the investigate to complete, I’d proceed my prediction for results another four weeks forward into March. Even then, I see results as being due in Q1’24.

Financial Overview

VKTX had cash, cash equivalents and marketable securities of $376M at the end of Q3’23. R&D expenses for Q3’23 were $18.4M and G&A expenses were $8.9M in the same quarter. Net loss in Q3’23 was $22.5M, and net cash used in operating activities was $55.7M in the first nine months of 2023. At that rate VKTX would have cash for twenty quarters, or five years from the end of 2023. In reality, if VKTX sees success with its pipeline members, it will proceed them encourage down the pipeline, into bigger studies and cash burn will pick up. Right now though, VKTX is certainly well funded.

There were 100,028,953 shares of VKTX’s common stock outstanding as of October 15, giving VKTX a market cap of $1.51B ($15.08 per share). There are also 5,243,807 stock options outstanding (weighted average exercise price of $6.78), although only 2,380,983 were exercisable as of September 30, 2023, and a encourage 2,855,656 unvested restricted stock units as of September 30, 2023.

Other catalysts on tap

VK2809 is VKTX’s most advanced drug, a thyroid hormone receptor-beta (THR-beta) agonist, which is in a phase 2b investigate in NASH patients called VOYAGE. VKTX has already reported data from the investigate showing significantly greater liver fat reductions at 12-weeks than placebo, meaning the investigate hit the primary endpoint. VKTX is planning to report longer-term data however, with biopsy data from 52 weeks of treatment being presented in H1’24. This data will be important, but the efficacy of VK2809 is already known, so beating placebo won’t be enough, instead there will be a comparison to other NASH drugs admire Madrigal’s (MDGL) resmetirom.

Outside of VK2809, the company has a second THR-beta agonist called VK0214. A phase 1b investigate of VK0214 in patients with adrenomyeloneuropathy (AMN), the most common form of X-linked adrenoleukodystrophy (x-ALD), is expected to complete enrolment in Q4’23. There is no efficacy data with VK0214 to examine currently in AMN patients, so any prediction is going to be quite the gamble.

The phase 1b investigate is a randomized, double-blind, placebo-controlled investigate, so there is potential to show a significant beat of placebo on efficacy endpoints. For example, VK0214 might be able to produce a significant reduction in the plasma level of very long chain fatty acids (VLCFA’s, which accumulate in X-ALD patients). The investigate has an anticipated enrollment of 36 patients.

Conclusions, ratings and risks

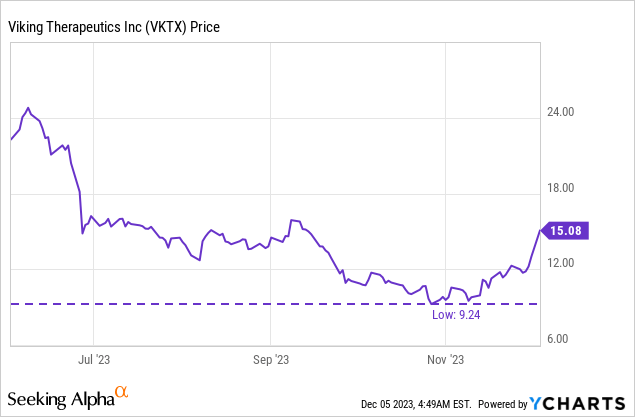

VKTX appears to have four catalyst on tap in H1’24. Indeed, a key readout from the VENTURE investigate of VK2735 could come by mid-February, and be complemented by data from the oral formulation of VK2735 in the same quarter. The obesity data with VK2735 is particularly relevant now as the market is acutely aware of the potential for buyouts of weight loss names. Indeed, VKTX is up over 60% since the lows in late October. Sure, some additional analyses from VOYAGE, presented at a medical conference in mid-November, have helped the stock rally too. The past few trading sessions however, following news of PFE’s issues with danuglipron and the RHHBY buyout of Carmot, have produced a particularly notable rally.

I worry then, at the time I’m writing this article, that VKTX might be due for a small pullback, as those who bought into the name (day traders, swing traders) might sell and proceed on. That doesn’t mean the buyout potential is gone, nor is the potential for a runup, into VKTX’s clinical readouts, to then start again following this hypothetical pullback.

encourage, VKTX trades with an enterprise value of over $1.1B, despite having no approved drug, so the pipeline has already taken on some value. Even if we see incretins for weight loss (and diabetes, among other metabolic conditions) as being worth billions, there is room for VKTX to fall. For these reasons I stop short of rating VKTX a strong buy, but I will rate it as a buy, despite the fact there might be a pullback this week, I think the runup into Q1’24 results will exceed that, and buyout speculation will remain in play.

The risks of any long in VKTX are several fold, a few of which I’ll converse. Firstly, the risk of a near-term pullback is certainly in play. Two key pieces of news in the first few trading sessions of December (PFE issues with danuglipron, RHHBY acquisition of Carmot) have brought about an amount of excitement that will be hard to uphold. We aren’t going to keep getting news of an incretin struggling, or a company being bought out, every few days. Perhaps every few weeks or months, but not every few days.

Beyond the short-term risk of a pullback as traders take profits and proceed elsewhere, longer term, if VKTX’s pipeline doesn’t perform, the stock could fall. If the oral formulation of VK2735 has too many side effects, or far less efficacy, it won’t create excitement, for example, and the stock could actually fall.

Lastly, competitors can make advances with their own incretins, showing similar or better weight loss numbers, or less side effects, which could cause VKTX to trade down.