Vietnamese authorities have arrested leading executives from its rare earths industry over mining violations and illegal sales, dealing a blow to the country’s ambitious plans to rival China’s dominance in the sector.

Vietnamese police arrested six people, including the chairman of Vietnam Rare Earth JSC (VTRE) – a company at the forefront of the country’s drive to boost its rare earth industry.

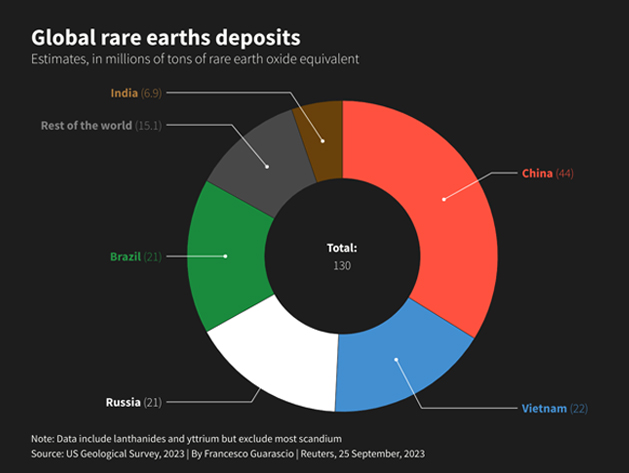

Vietnam has the second-largest deposits of critical minerals used in making electric cars and wind turbines, after China, according to United States Geological Survey estimates.

Also on AF: China Curbs Export of Key EV Metal as Tech War With US Deepens

The Southeast Asian nation has ambitious plans to boost its rare earth industry, raising annual output to 60,000 tons of rare earths oxides by the end of this decade from 4,300 tons in 2022.

The United States is also betting on Vietnam’s rare earths mines in a bid to ‘de-risk’ from Chinese supply chains. US President Joe Biden discussed plans to boost critical mineral trade between the two countries, on a visit to Hanoi last month.

VTRE’s chairman, Luu Anh Tuan, was accused of forging value added tax receipts in trading rare earths with Thai Duong Group, which operates a mine in the northern Vietnamese province of Yen Bai, the Ministry of Public Security said on Friday.

Calls to Tuan went unanswered on Friday. VTRE’s office in Hanoi has been shut for days, one person at the building said.

VTRE had been due to bid on the Vietnam government’s planned auction of new mining concessions for rare earths later this year.

Illegal sales to China suspected

The chairman of Thai Duong Group, Doan Van Huan, was also arrested, accused of making 632 billion dong ($25.80 million) from illegal sales of ore extracted from the mine his company operated in Vietnam’s Yen Bai province.

Police temporarily seized 13,715 tons of rare earths ores in a raid on Thai Duong’s premises, the ministry statement said.

Calls to Thai Duong Group went unanswered on Friday.

The government statement did not clarify what made the sales illegal, but a person with direct knowledge of the matter said that the Yen Bai mine raw ores had been exported to China, as the domestic refining costs for those ores were unprofitable.

Under Vietnamese rules, export of raw ores is largely restricted, as the country wants to boost its refining capacity.

The authorities have also intensified a clampdown on illegal rare earth mining from neglected or abandoned pits in recent months.

Australian giants caught in the middle

VTRE has partnered with Australian mining companies Australian Strategic Materials (ASM) and Blackstone Minerals. The two firms were, however, not named in the Vietnamese authorities’ investigation.

Blackstone said in September that it had agreed to partner with VTRE to win concessions at the country’s biggest mine, Dong Pao in Lai Chau province.

A Blackstone executive had said the company’s investment in the project would amount to about $100 million should it win the concession.

ASM also signed a binding agreement in April with VTRE for the purchase of 100 tons of processed rare earths this year, and committed to negotiating a longer-term supply deal.

Neither Blackstone or ASM responded to a request for comment on whether their agreements with VTRE would be affected by the arrest of its chairman.

Blackstone shares fell more than 8% on Friday and were flat on Monday. ASM shares fell more than 7% on Monday after a relatively stable trading session on Friday.

- Reuters, with additional editing by Vishakha Saxena

Also read:

Vietnam to Restart Giant Rare Earths Mine in Bid to Rival China

Rare Earth Magnet Firms Plan Vietnam Plants as China Hedge

US Eyeing ‘Creative Ways’ to Help Mongolia Export Rare Earths

Western Firms Struggling to Break China’s Grip on Rare Earths

China Metal Curbs, Rare Earths Risks Fuel Hunt For Safe Sources

Biden Keen to Upgrade US Partnership With Vietnam – Politico