Three Images/DigitalVision via Getty Images

At a Glance

As Viatris (NASDAQ:VTRS) contends with shrinking revenues and increasing R&D expenses, the company’s aggressive divestiture strategy reveals a dual focus on operational streamlining and deleveraging. This isn’t just a balance sheet exercise but a reorientation towards higher-margin opportunities, exemplified by the retention of high-equity brands like Viagra and Dymista. The elevated long-term debt does ring alarm bells, especially with dwindling cash reserves, yet it is offset, to some extent, by a disciplined debt management strategy and an ambitious move into the potentially lucrative ophthalmology space. The impending launch of products in various clinical stages in this sector could be the catalyst the company needs for long-term growth. With capital allocation strategies in flux due to reduced free cash flow, the company seems to be at a pivotal juncture, warranting a measured evaluation by investors.

Viatris’ Q2 Earnings

To begin my analysis, looking at Viatris’ most recent earnings report for Q2 2023, we observe a decline in total revenues to $3.92B from $4.12B year-over-year. Gross profit also tapered off to $1.61B from $1.70B. Notably, operating expenses saw a marked rise, specifically in R&D, which increased from $162.6M to $208.3M, indicating aggressive investment in innovation. Earnings from operations plummeted to $369.2M from $548.7M. Net earnings stand at $264M, down from $313.9M YoY. Diluted EPS remained stagnant at $0.22, albeit with a slight increase in diluted shares outstanding from 1,217.1M to 1,203.5M, pointing to minimal share dilution.

A closer look reveals nuanced changes across markets and product categories. Total net sales declined by 5%, largely driven by a 5% dip in Developed Markets and a 12% decrease in the Japan, Australia and New Zealand region. Emerging Markets remained flat while Greater China sales only dipped by 3%. In terms of product categories, the 61% plunge in Complex Gx sales is concerning and overshadowed the 5% uptick in Generics. U.S. GAAP Gross Margin slipped marginally from 41.4% to 41.1%, but Adjusted Gross Margin improved to 59.5% from 58.6%. EBITDA contracted by 7% to $1.16B, signaling reduced operational profitability. Adjusted Net Earnings also dropped by 15% to $905.4M. Importantly, free cash flow plummeted by 38% to $447.1M, potentially impacting future capital allocation strategies.

Financial Health

Turning to Viatris’ balance sheet, the company reported $629.2M in cash and cash equivalents as of June 30, 2023, down from $1,259.9M at the end of December 2022. The total current assets stand at $9,778.0M. The current ratio, calculated as total current assets divided by total current liabilities ($6,523.8M), is approximately 1.5, suggesting a satisfactory level of short-term liquidity. On the debt front, Viatris has $17,246.0M in long-term debt, making its total debt significantly higher than its cash and current assets, a potential red flag.

Net cash provided by operating activities for the six months ended June 30, 2023, is $1,486.1M. This translates to a monthly cash generation of about $247.7M, adding substantial liquidity to the company’s resources.

Finally, the odds of Viatris requiring additional financing within the next twelve months appear to be low, considering the positive cash flow from operations and the current ratio above 1. Despite the high long-term debt, the company’s capacity to generate cash internally minimizes immediate liquidity concerns.

Market Sentiment

According to Seeking Alpha data, Viatris’ market capitalization of $11.31B seems to indicate market caution, especially when juxtaposed with its stagnant growth and elevated debt levels. The revenue projections for FY 2023 to FY 2025 show a decelerating trend with a dip in YoY sales, which underpins the stock’s ‘F’ growth rating. The dividend yield of 5.09% with a low payout ratio of 15.62% suggests sustainable returns. Over one year, Viatris underperformed SPY, posting a -1.87% return versus SPY’s +18.90%, signaling bearish momentum. Short interest stands at 2.95%, which is neither negligible nor alarming.

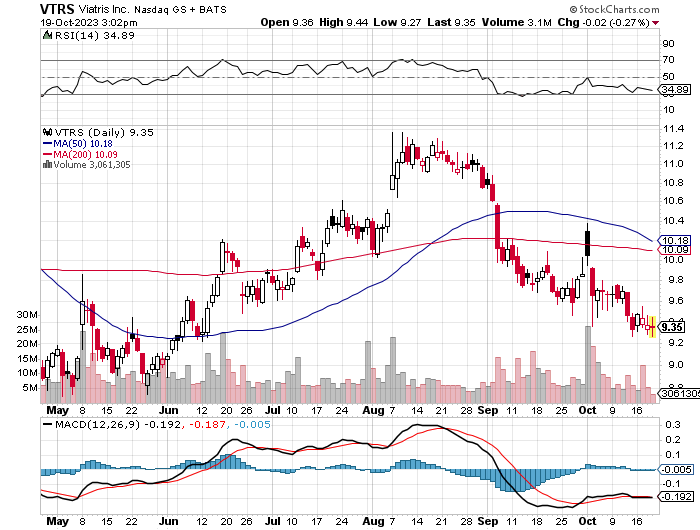

StockCharts.com

Regarding stock technicals, VTRS displays a bearish trend with the stock trading below both the MA(50) and MA(200). The MACD line remains under the signal line, reinforcing the bearish sentiment. RSI at 34.76 is nearing oversold territory, suggesting potential for a short-term rebound. However, overall momentum leans negative.

Institutional ownership is robust at 77.77%, with Vanguard and BlackRock as notable holders. New Positions include 79 holders with 27,158,234 shares, while Sold Out Positions numbered 93, relinquishing 5,389,002 shares—indicative of a mixed institutional outlook. Insider activity reveals a net of 660,775 shares sold over the last 12 months, which while not drastic, warrants attention.

Assessing Viatris’ Roadmap for Operational Efficiency and Shareholder Value

Viatris’ announcement of divesting multiple business segments for up to $6.94 billion is a strategic recalibration rather than a mere shedding of assets. Achieving a multiple above 12x on 2022 estimated Adjusted EBITDA indicates that Viatris is commanding premium valuations for these divestitures. This is a strong signal to investors that the company is not in distress but is rather executing a well-thought-out deleveraging strategy. The high multiple also suggests that Viatris could see a stock price appreciation as the market digests this positive financial outcome.

The decision to retain rights to key products like Viagra and Dymista is particularly noteworthy. These are high-margin, high-equity brands, and their retention could offer more upside in terms of future growth than the capital freed by selling them. The estimated $1.6 billion in retained value might even be a conservative figure, offering a potential upside that the market may not have fully priced in yet.

The aggressive debt paydown strategy, aiming for a gross leverage target of 3.0x, is a prudent move that could lower the cost of future capital. This sets the stage for the company’s Phase 2 strategy which could involve growth-oriented investments or acquisitions in higher-margin sectors. The capital unlocked from these divestitures could be strategically deployed into higher-growth, higher-margin areas, possibly in specialized medicines or biologics, which could be a catalyst for long-term growth and increased shareholder value.

The operational impact of these divestitures is also significant. The transfer of up to 12 facilities and a 15% reduction in the global workforce will result in a leaner, more focused organization. While there may be short-term dislocations and costs, the long-term benefit could be improved operational efficiencies and higher profit margins.

The choice of buyers for each divested segment—Cooper Consumer Health for the OTC business, Iquest Enterprises for the API segment, and Insud Pharma for Women’s Healthcare—suggests that Viatris is aiming for smooth transitions and lower risks of deal failures. However, investors should be cautious about regulatory hurdles, as any delays or rejections could impact the financial metrics and timelines.

Building on its strategic divestitures, Viatris is laying the groundwork for its Phase 2 strategy for 2024-2028. The company aims for $1 billion in eye care sales by 2028, backed by a diverse ophthalmology portfolio. Tyrvaya, a nasal spray for dry eye disease, launched in 2021, and several other assets like MR-140 (Rehydration of Mydriasis) and MR-141 (Presbyopia) are in various clinical stages. This suggests a calculated move to diversify into the high-margin ophthalmic sector, possibly using capital from recent divestitures.

Viatris also plans a $250 million share repurchase, signaling confidence in its stock and a commitment to returning capital to shareholders. This, along with an aggressive debt paydown strategy, indicates a balanced approach to financial management.

Viatris’ Long-term Debt: A Structured Outlook

Viatris maintains a structured approach to its debt obligations, underscored by its compliance with customary affirmative and negative covenants. These covenants encompass a range of requirements, from the timely delivery of financial statements to compliance with existing laws. Notably, the company has set a Maximum Leverage Ratio at 3.75 to 1.00 for the quarter ending March 31, 2023, and for each subsequent quarter. As of June 30, 2023, Viatris is in full compliance with these covenants and anticipates maintaining this status for the next twelve months.

Long-term Debt Maturity

The company’s long-term debt profile is diversified, with varying interest rates ranging from 1.023% to 5.4%. The maturity schedule is as follows:

-

2023: $500 million

-

2024: $1.909 billion

-

2025: $1.295 billion

-

2026: $2.527 billion

-

2027: $1.677 billion

-

Thereafter: $10.132 billion

As of June 30, 2023, the total long-term debt stands at approximately $17.246 billion. The aggregate fair value of the company’s outstanding notes is approximately $15.03 billion, providing a market-based perspective on Viatris’ credit risk.

Viatris’ compliance with debt covenants and a clearly defined Maximum Leverage Ratio are positive indicators of the company’s disciplined approach to debt management. The detailed maturity schedule and interest rates offer valuable insights into the company’s long-term financial obligations and cost of capital. The fair value of the debt also serves as a market barometer for assessing the company’s credit risk.

My Analysis & Recommendation

The financial voyage of Viatris unfolds a narrative akin to navigating turbulent waters. The decline in revenue juxtaposed against an uptick in R&D expenditure manifests a strategic pivot towards innovation, albeit with a consequential strain on operational profitability. The divestitures, emblematic of a pragmatic financial recalibration, are seemingly directed at deleveraging a balance sheet under duress. The retention of high-equity brands like Viagra and Dymista underscores a discerning focus on high-margin segments, an astute move amidst the generic drug market’s price erosions and competitive pressures.

The downgrade by Barclays last Summer, anchored on a “show-me narrative,” echoes the market’s yearning for a clearer strategic panorama from Viatris, especially amidst the competitive maelstrom where market dynamics are rapidly morphing. The portrayal of Viatris’ roadmap, in some respects, reads more like a “survivor guide” given the stock’s steady descent over the past ten years and upcoming debt obligations.

In the ensuing weeks, a vigilant monitoring of the operational ramifications of the divestitures, the regulatory sanctioning trajectory, and the fruition of Viatris’ Phase 2 strategy, particularly the market inroads of its ophthalmology portfolio, will be crucial. Risk abatement could embody a diversified portfolio strategy, accentuated by a stringent oversight of Viatris’ debt management framework and the meticulous execution of the proposed share repurchase.

Considering the fiscal complexity and ongoing strategic shifts, maintaining a ‘Hold’ position seems judicious until further evidence of operational gains and strategic clarity emerge. Viatris is in the midst of a pivotal strategic transformation within a tough market, warranting cautious but incisive scrutiny from investors. Although the company’s cash position appears stable through 2027, thanks to impending asset sales, its long-term viability post-2027 (“Thereafter”) is less certain.