SimonSkafar

I started coverage of Vertex Energy (NASDAQ:VTNR) in October with a “Hold” Rating, saying there were too many question marks around the stock to invest at this time. The stock is down about -70% since then. In December, meanwhile, I said that there were questions about the company’s path to profitability for its Renewables business, as well as how crack spreads will impact its traditional refinery business. Let’s catch up on the company following its Q4 earnings.

Company Profile

As a reminder, VTNR owns the Mobile Refinery in Alabama, which it acquired in 2022 from Royal Dutch Shell (RDS.A) for $75 million. The refinery processes crude oil and turns it into refined products such as gasoline, jet fuel, and diesel. The company then set out on a project to upgrade the refinery’s hydrocracking unit to produce renewable diesel.

VTNR was previously known for its re-refining business, and it still owns the Marrero facility in Louisiana. In this part of the business, the company recycles and re-refines used motor oil and other petroleum by-products into vacuum gas oil (“VGO”).

Q4 Results

For its most recent quarter reported last month, VTNR saw its revenue fall -16% to $732.7 million. That topped the analyst consensus of $720.2 million.

Its Refining & Marketing segment had a gross profit of -$10.3 million. Its conventional refinery had gross profits of $7.3 million compared to $86.2 million in Q3. Gross profit for its renewable business was -$17.6 million compared to -$8.5 million in Q3.

The company’s conventional fuels refinery had throughput of 67,083 barrels per day. The refinery operated at 89.4% of nameplate capacity. That compares to year-ago throughput of 77,964 barrels a day and 104.0% capacity utilization and 80,171 barrels a day and 106.9% capacity utilization in Q3.

Fuel gross margins per barrel came in at $4.79 a barrel versus $20.50 a year ago and $17.56 in Q3. About 65.9% of its production was finished products, with gasoline 25.9%, ULSD 21.1%, and jet fuel 18.8%.

On the renewable side, the company had throughput of 3,926 barrel a day. That was down from 5,397 barrels a day in Q3. Capacity utilization was 49.1%, down from 67.5% in Q4. Its gross margin per barrel was $12.11 versus $4.78 in Q3. Direct opex per barrel rose to $27.32 from $23.05 in Q3.

Overall, the company recorded -$35.1 million in adjusted EBITDA compared to only $75.2 million a year ago. Adjusted EBITDA for conventional refining was -$3.9 million, -$21.2 million for its renewable refining, and -$0.2 million for its Black Oil & Recovery segment.

Turning to its balance sheet, VTNR ended the quarter with cash & equivalents of $80.6 million and $255.7 million in debt. It ended the quarter with net leverage of 12.0x. That compares to 1.3x leverage in Q3 and 1.0x leverage a year ago.

The company generated -$58.5 million in operating cash flow in 2023 and -$198.8 million in free cash flow.

Looking ahead, the company projected Q1 conventional throughput volumes of between 60,000-63,000 barrels per day, representing 80-84% capacity utilization. Between 64-68% is projected to be finished products. On the renewable side, it is looking for throughput volumes of between 3,000-5,000 barrels per day, representing 38-63% capacity utilization. Combined, it expects direct operating costs of between $4.59-4.95 a barrel.

On its Q4 earnings call, CCO Doug Haugh said:

“I want to share that our feedstock optimization strategy has progressed according to plan. … We expect that we will receive LCFS credits based on these improved CI scores for imports into California during 2024, which will improve our per gallon credit values as compared to the temporary CI values received last year. With our provisional pathway application filed for our first 4 feedstocks, we have shifted our focus to completing additional 90-day runs of lower CI feeds, specifically UCO and poultry fat. These feeds represent not only improved CI values but also outright lower cost. We’ve started aggregating the inventory needed to support these runs and expect to complete the runs for these additional feeds during the second quarter. Across all families of feedstocks, the team has been able to double our supplier base over the last quarter, and the market continues to provide tremendous support for our facility. Logistically, we’ve continued to receive supply primarily via barge and rail. Both the addition of UCO and poultry fat to our supply base has added truck deliveries to our logistics mix. We’ve started to rationalize our feedstock inventories of each grade as we build confidence in each supply chain and in each supplier. This optimization allows us to create more flexible blending schedules, and having multimodal delivery capacity across dedicated tanks for each class of feedstock allows us to capture price changes quickly as volatility in feedstock pricing has continued to be very material.”

VTNR turned in a poor quarter, as the margins in its conventional fuels business dropped like a rock during the quarter. This, combined with the decision to make a repair, led to lower capacity utilization as well. However, fuel margins did begin to recover in December and have continued to rebound throughout Q1.

The company did see a nice improvement in its renewable margins, although that included LCFS (low carbon fuel standard) credits from Q2 and Q3 production. Otherwise, its Q4 gross margin per barrel would have been a negative -$4.78. At the same time, throughput and capacity utilization was also much weaker compared to Q3.

VTNR’s Q1 guidance, meanwhile, didn’t exactly indicate a big reversal was coming. I would expect better gross margins in its conventional business compared to Q4, but utilization will be low due to a planned turnaround in the quarter. Meanwhile, renewable fuel output is expected to remain muted. Gross fuel margins for the renewable business will likely depend on when it receives LCFS credits.

Valuation

VTNR trades at a 12.8x EV/EBITDA multiple based on the 2024 EBITDA consensus of $42.0 million. Based off of the 2025 EBITDA consensus of $47.4 million, it trades at around 11.4x.

It’s projected to see revenue fall nearly -2% in 2024 and then grow nearly 8% in 2025.

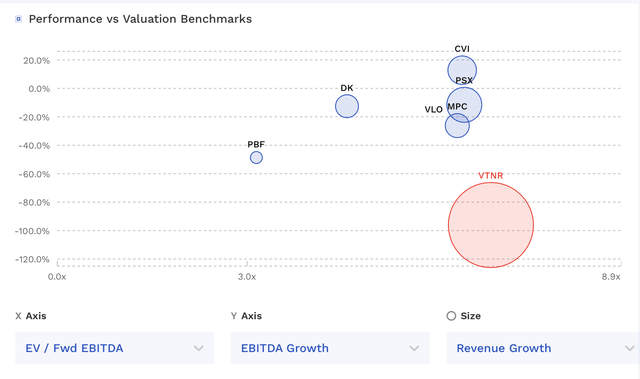

VTNR trades at a premium to other refiners, despite its poor operational performance over the past year.

VTRN Valuation Vs Peers (FinBox)

At this point, I think current estimates for VTNR are unreliable, as fuel margins can bounce around and the company’s operational performance has been very uneven and unpredictable.

Conclusion

Despite the -70% drop since I first looked at VTNR, it can still be argued that the company is overvalued. It still has an enterprise value of about $540 million, while it recently bought its only traditional refinery for $70 million and then put $110 million into the facility. Meanwhile, that capex has yet to show any type of return. It also has a legacy re-refining plant, but it hasn’t generated any type of meaningful profit recently, so it is difficult to say how much this facility is worth. It previously had a deal to sell it a few years ago, but given its performance, its value may have declined.

So, has VTNR done anything that makes the Mobile Refinery worth double what it paid for it in 2022 plus the upgrades it has spent on it? Right now, the answer is no.

Now, if VTNR can prove that its investments will pay off in a meaningful way in the next few years, then the stock has potential. However, a lot of questions still remain, and the company is racking up more debt in the meantime. As such, I remain neutral on the name.

Risks to the downside would be weak crack spreads and continued issues ramping up its renewable business. Upside could come from improved crack spreads for its conventional business, as well as better prices and margins for LCFS and improved capacity utilization from its renewable business.