Bruce Bennett

Recap

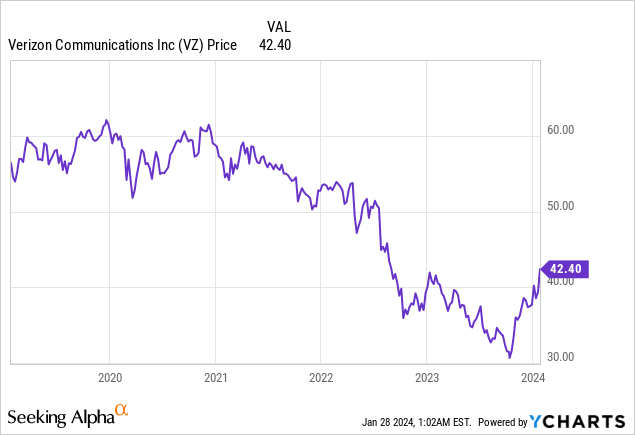

In our last article on Verizon (NYSE:VZ), we highlighted the impact of losing Consumer postpaid phone subscribers on the stock price. But, we also pointed out signs of promising improvement. Additionally, our view is that the recently-cleared C-band spectrum “will help strengthen its competitive position in the FWA space.” Lastly, we believe that Verizon should have ample room for deleveraging, and we can anticipate discussions about share buybacks to emerge in two years.

Since we reiterated our BUY call, shares have surged by an impressive 27%. The stock was a strong buy, trading at less than seven times of forward earnings (-2 standard deviation) with nearly 8% dividend yield. We will delve into the recently released 4Q23 earnings, and discuss about the ongoing competition in the market.

4Q23 Earnings Update

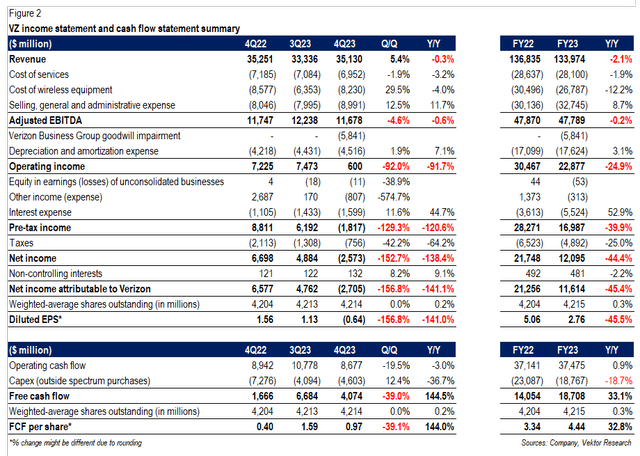

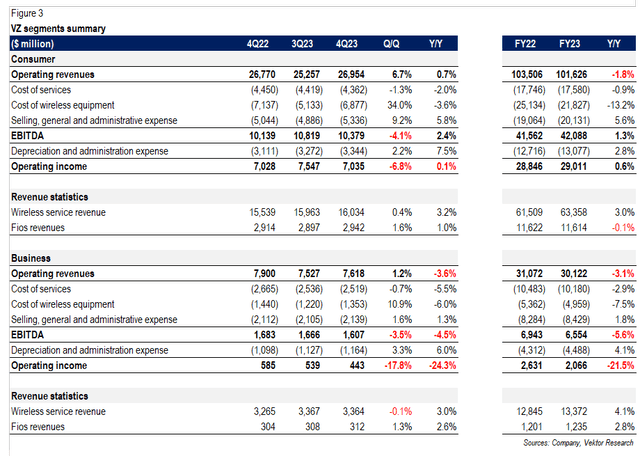

Below is the summary of Verizon’s 4Q23 results:

VZ 4Q23 Results (Company) Verizon 4Q23 Segment Details (Company)

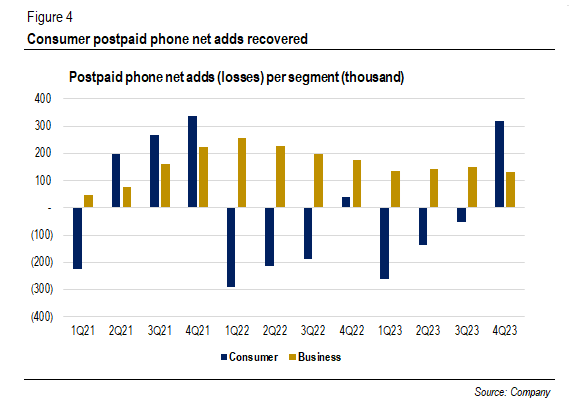

Verizon reported 449,000 postpaid phone net adds in 4Q23, beating consensus of only 231,600. It means that the market consensus expected a slight uptick in net adds vs. 217,000 in 4Q22, but Verizon was doing much better than anticipated. This surge was supported by 318,000 net adds in the Consumer segment, marking a positive figure for the first time in the last four quarters. Additionally, the Business segment contributed 131,000 net adds. In total, gross adds grew 5% (Y/Y) and 21% (Q/Q).

Postpaid phone net adds (thousand) per segment (Company)

The management attributed this notable strength to the success of myPlan, which has garnered over 13 million subscribers since its launch in May, and to the strategy of operational decentralization. The words “decentralization,” “regionalization,” or “localization” have been consistently emphasized previously. For instance, as Hans Vestberg said during the recent UBS Conference:

It’s everywhere. So we have six market presidents that is overseeing six regions. We have the same for network. We are much more targeted. We’re doing thousands of local activities every quarter right now. I mean you saw around the playlist, for example, not sure how much you follow us, hopefully, a lot, where basically every NFL team are doing their own playlist.

On the last quarter:

As the C-Band, it’s sort of rolling out in different ZIP codes all the time, we are engaging locally. The same we did with the Consumer group to be much more local, to be able to do local marketing, cater for what the local market, have local flavors of our marketing.

When asked about whether localization or myPlan has a more significant on driving gross adds, the management said:

Yeah, Walt, just to add on to what Hans said, the regional structure is a lot closer to the customer, and we’ve run the business this way for many, many years. And we can do things like different promos for different markets and local resources, and decision making and the localization offset some of the price ups as well.

This implies that adopting a more localized operational approach has proven to bear fruit in driving gross adds. Additionally, the management also provided some color on the impact of C-band spectrum:

In our first 76 C-Band markets, fourth quarter Consumer postpaid phone gross add growth was 8 percentage points better than in non-C-Band markets. Additionally, Consumer postpaid phone churn in C-Band markets was 4 basis points better than in non-C-Band markets.

The quality of the business we are writing in Consumer remains high as myPlan continues to drive premium plan adoption. The premium take rate in C-Band markets for the quarter was more than 10 percentage points higher than in non-C-Band markets.

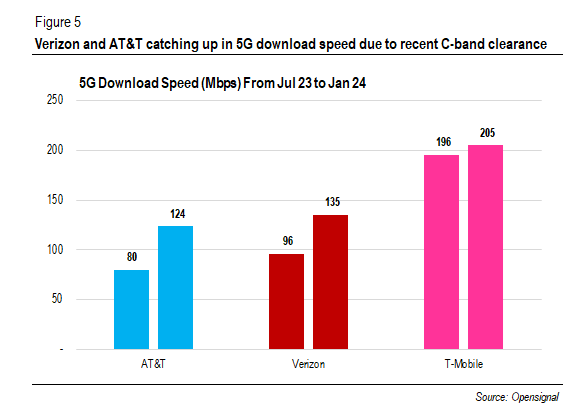

The additional C-band spectrum should yield similar outcomes: stronger gross adds, higher retention rate, and more premium plan upgrades. Notably, Verizon showed resilience in the “Tier 1 markets,” while they were “net add positive” in Tier 2 and Tier 3 markets. Unsurprisingly, a significant portion of the recently-cleared C-band spectrum was deployed in urban areas. Further, Opensignal’s findings suggest that AT&T (NYSE:T) and Verizon narrowed the gap with T-Mobile (NASDAQ:TMUS) in 5G download speed, thanks to additional C-band spectrum.

5G Download Speed Change (Mbps) (Opensignal)

On the other hand, T-Mobile claimed a 17.5% market share in smaller and rural areas, representing 40% of the US population (140 million people). This marks a 1% increase from the 16.5% reported in 1Q23, equating to an additional 1.4 million subscribers in nine months. So, we assume that at least 30% of T-Mobile’s overall net adds, including postpaid and prepaid, came from this segment. In other words, T-Mobile is gaining traction in some markets where Verizon and AT&T historically have stronger presence, while Verizon is doing better in the urban markets.

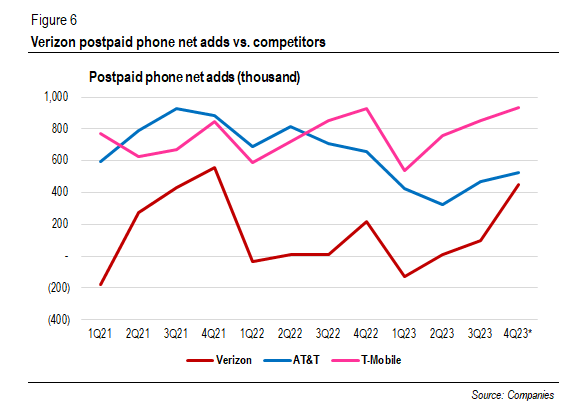

Thus, in our view, a more localized operational approach, myPlan, and additional C-band spectrum helped Verizon regain its share in postpaid phone net adds among the big three carriers.

Meanwhile, AT&T booked 526,000 postpaid phone net adds, and T-Mobile experienced a robust growth with 934,000. Robust gains by these three carriers can be attributed to seasonality, migration from prepaid and postpaid, and, in part, the conclusion of Charter’s (NASDAQ:CHTR) 12-month promotional period, in our view. Yet, we still have to look at Charter’s upcoming numbers early next month.

Postpaid phone net adds (thousand) (Companies)

Verizon’s postpaid phone churn saw a slight uptick to 0.93%, while Consumer ARPA grew nearly 5% (Y/Y). The industry is becoming more rational through pricing actions, as they demand higher returns after pouring so much money into their network buildout. We expect price hikes and subscribers stepping up to more premium plans will continue to drive carriers’ ARPU this year. AT&T has hinted at additional pricing actions, and T-Mobile has not ruled out the possibility, as indicated in their latest earnings call:

But I will tell you that I’m pleased that customers are getting such incredible value from this category, and that certainly does open up opportunities for us to make sure for T-Mobile that if there are opportunities for us to monetize that in smart ways that it will be appreciated by customers, we’ll find ways to do that.

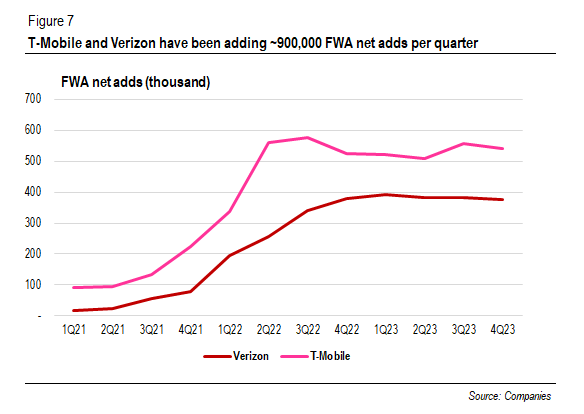

In addition to price increases, we anticipate further growth in the fixed wireless access (“FWA”) space as we move forward. Verizon secured 375,000 net adds in 4Q23, while its closest competitor, T-Mobile, added 541,000. In the same period, AT&T posted 67,000 net adds. But unlike its counterparts, AT&T views its FWA product as a “stop-gap” solution for serving copper-based broadband customers while actively building out fiber. Its focus on fiber suggests that a significant FWA growth from AT&T is unlikely, in our view.

FWA net adds (thousand) (Companies)

If we assume the current run-rate to remain constant, we might see both Verizon and T-Mobile to be ahead of their 2025 targets by one year. Nevertheless, T-Mobile’s management spoke about how ~400,000 quarterly net adds are sufficient to reach its target, as they are pulling back promotional pricing, and customers are more “sticky.” Concerns persist about FWA taking up capacity, given that FWA users typically use up to 20 times higher than that of mobile users. Another estimate suggests usage could be up to 40 times higher.

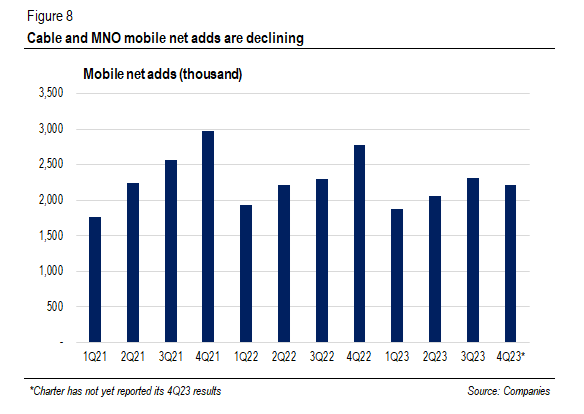

Our take is that while FWA growth is likely to decelerate, but it is possible for FWA operators to go beyond their targets. Our key rationale is that the mobile user “TAM” expansion decelerates, as most individuals already had phones, a trend exacerbated by slowing population growth. According to our calculation, total postpaid phone net adds by the major three operators have declined by around 1 million annually in the past two years. Even if we factor in Comcast (NASDAQ:CMCSA) and Charter MVNOs, net adds decreased by 200,000 to 300,000 annually. The counterargument to this is the increasing data usage per user (for instance, AT&T’s traffic is up over 30% annually). But Verizon has historically improved spectral efficiency and continues to do so.

Cable + MNO mobile net adds (thousand) (Companies)

Second, analysts at Wells Fargo have highlighted opportunities in suburban and rural areas for FWA since it is “less penetrated” in these regions, pointing out mid-band “availability largely in more urban environments.” A study conducted by MoffettNathanson shows that a significant portion of T-Mobile’s FWA net adds originated from rural areas, while Verizon was leaning urban. This makes sense since Verizon has been deploying most of its C-band spectrum in urban areas. But now the company is increasingly looking towards suburban and rural areas, which should have more available capacity for FWA. Meanwhile, T-Mobile will soon acquire its 2.5 GHz licensed spectrum, primarily in rural areas, that it won during the Auction 108.

Overall, total wireless service revenue rose 3.2% (Y/Y). But excluding the reallocation of “administrative and telco recovery fees,” the growth would have been 1.3% (Y/Y). Further, Verizon generated $4.1 billion in free cash flow during the quarter, up from $1.7 billion last year thanks to lower CapEx. Lastly, net unsecured debt to adjusted EBITDA ratio remained at 2.6x, flat compared with the last quarter, with unsecured debt rising by $2.1 billion. This increase was driven by a one-time payment of $3.7 billion to satellite operators for the clearance of C-band spectrum.

What Should We Expect Going Forward?

This year, the management is guiding a 2%-3.5% of wireless service revenue growth. This increase from 1.3% is attributed to factors such as postpaid phone net adds, premium plan upgrades, price increases, and FWA, with the prepaid business facing challenges. Higher interest rates due to C-band spectrum and higher pension and other post-employment benefits (“OPEB”) will impact EPS by $0.23-$0.28.

Overall, the management expects adjusted EPS between $4.50 and $4.70, slightly below the $4.71 of adjusted EPS in 2023. Capital expenditure is expected to be in the range of $17 billion and $17.5 billion, a decrease from the $18.8 billion in 2023 as Verizon completes its 5G massive build-out. Free cash flow is expected to exceed $18 billion.

In terms of competition, we expect pricing actions by carriers to drive revenue growth. T-Mobile is likely to lead in the postpaid phone net gains thanks to its extensive mid-band spectrum holdings. But Verizon will compete more effectively with the recently-cleared C-band spectrum. In addition, FWA growth may decelerate, as operators increase prices, and cable companies are rolling-out DOCSIS 4.0 for better “marketing claims.”

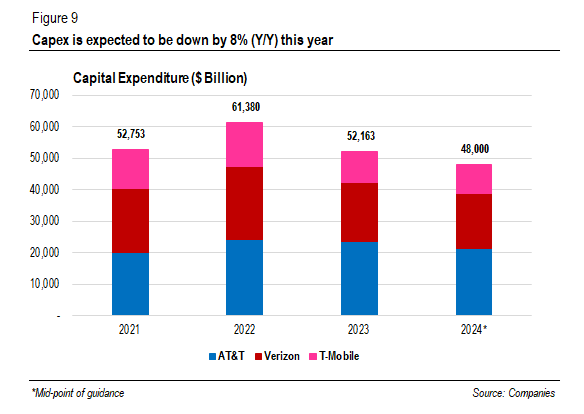

Mobile network operators (“MNO”) are reducing capital expenditures as they exit the high-capex cycle. The mid-point guidance for this year implies that total CapEx by the big three will reach $48 billion, down 8% from 2023 and 22% from 2022. This should provide MNOs with ample room for deleveraging.

The big three total Capex ($ Billion) (Companies)

If we assume an annual dividend payout of $11 billion, Verizon would have at least $7 billion in cash annually for deleveraging. Verizon needs to reduce its net debt by $14.6 billion to reach the 2.25x net unsecured debt to adjusted EBITDA ratio target (assuming a 2% adjusted EBITDA growth per year). Given this scenario, we still anticipate discussions about share buybacks to emerge in the next two years.

Valuation

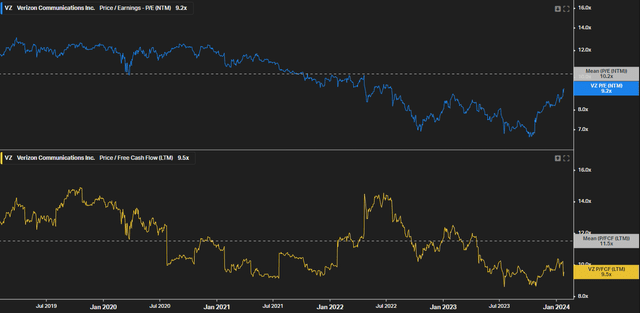

Verizon trades at 9x of its forward earnings, lower than the 5-year average of 10x. Price to FCF is 9.5x, implying an FCF yield of 10.5%. Dividend yield is 6% (~2% spread vs. US 10-year Treasury yield). In our view, while Verizon stock still holds upside potential, it is no longer a strong buy. In October, dividend yield was 8%, with 6.6x forward P/E (-2 standard deviation) and a 11.5% FCF yield.

Conclusion

We believe that the improvement in Consumer postpaid phone net adds contributed to the rise in Verizon’s stock price. This was driven by a more localized operational approach and myPlan offering, which encourages premium plan upgrades. In addition, the additional C-band spectrum has significantly increased Verizon’s 5G download speeds, likely leading to similar positive outcomes seen in the initial C-band markets: stronger gross adds, higher retention rate, and more premium plan upgrades.

Looking at competition, we will be seeing more pricing actions for growth. FWA growth might slow due to price increases and intensified competition from cable companies rolling-out DOCSIS 4.0. But we believe that FWA operators will achieve their 2025 targets and possibly go beyond their targets.

Verizon’s dividends are secure, and Verizon will have room for deleveraging. Interest rates cuts and share buybacks should drive the stock price, in our view. Investors will closely monitor Verizon’s ability to sustain its strength in the postpaid phone net adds.

Valuation-wise, while the stock still holds upside potential, but it is no longer a strong buy, in our view. Investment risks are competition from cable companies in the broadband space, and in the medium-term, elevated CapEx associated with 6G buildout medium-term. If you have any thoughts, please do not hesitate to comment below.