Theo Wargo/Getty Images Entertainment

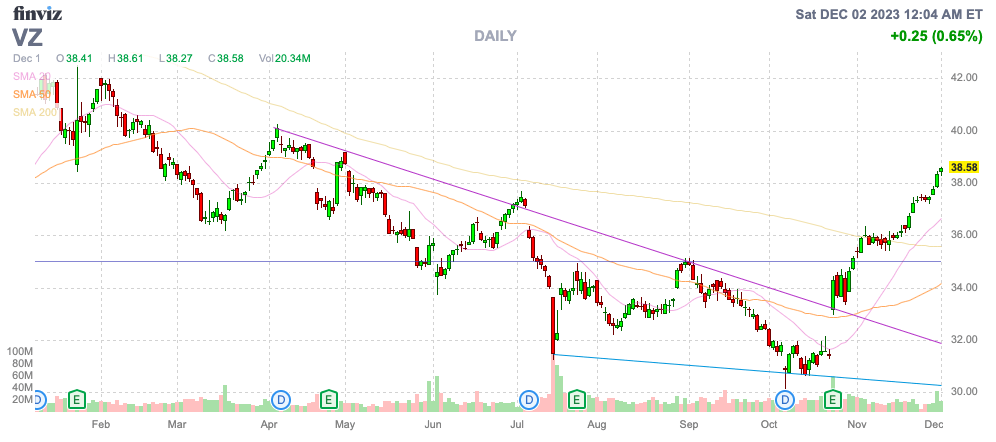

While Verizon Communications (NYSE:VZ) has reported some improvement in key financial metrics, the wireless business has not gotten any better. Companies in the telecom sector typically don’t cut their way to success, and the company has no real catalyst for growth after 5G hasn’t materialized into a growth driver. My investment thesis remains Neutral on the stock, especially after the recent rally back to $38.

Source: Finviz

Cutting To Success

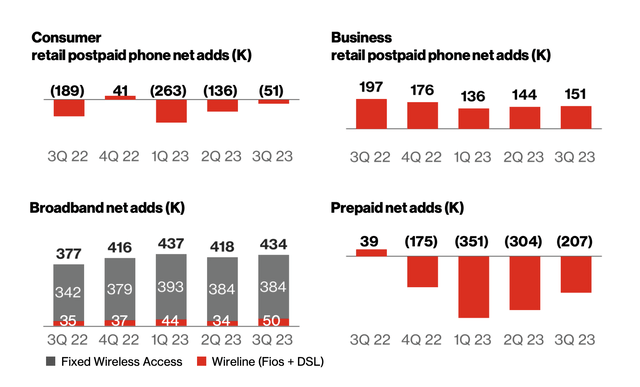

Verizon reported Q3’23 revenues fell 2.6% following a weak period during the Covid shutdowns. The wireless giant continues to bleed prepaid phone and consumer retail postpaid phone customers and has consistently reported periods of slumping sales going back to pre-Covid.

Source: Verizon Q3’23 presentation

The consumer retail postpaid phone net adds were down 51K during Q3. In general, Verizon maintains a mixed picture with broadband net adds up 434K led by Fios while a lot of the phone subscriber numbers dipped.

September quarter revenues were only $33.3 billion, down $1.5 billion from the Q3’19 levels. The company even reported a dip in EPS, though the numbers look impressive, beating analyst consensus estimates by $0.04 due to conservative guidance.

Ultimately, Verizon just isn’t able to turn the business around into growth. Now, the wireless giant appears set on cutting costs to hold profit levels steady. OpEx costs were down 4% YoY to more than offset the revenue loss.

Management even suggested a lower promotional period helped reduce costs, though the consumer still appears to have limited interest in spending more on an essential service, even for increased 5G speeds. News reports suggest Verizon is working on a deal to offer discounted streaming services to 5G customers, possibly in a sign the wireless giant needs to offer a promotion over the holidays to acquire new retail customers and reduce churn.

Temporary Cash Flow Boost

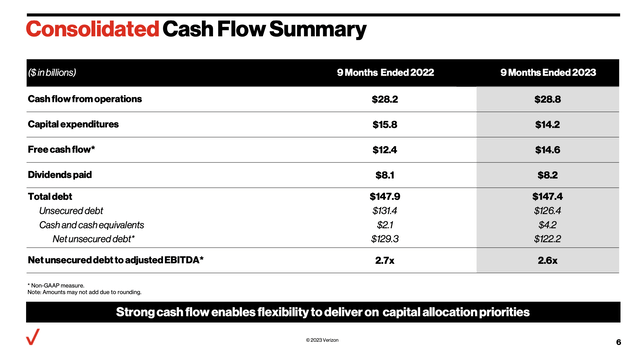

The stock rallied due to the company announcing a boost in cash flow projections for 2023. Both Verizon and AT&T (T) are transitioning to lower capex spending after ramping up the C-band portion of the 5G network. Verizon has guided to free cash flows jumping $1 billion above exceptions to $18 billion.

Source: Verizon Q3’23 presentation

Considering the debt position of Verizon at over $143 billion, the company needs all of the additional cash flows. Over the long term, though, Verizon can’t cut their way to success via lowered spending on capex.

The wireless giant plans to spend upwards of $19.25 billion on capex in 2023 with plans to cut the spending levels to $17.0 to $17.5 billion in 2024, but Verizon will likely have a difficult time ramping up revenues while spending less on capex.

As highlighted in the past, Verizon hasn’t been able to progress new product categories. The telecom giants were probably the better candidates for the cloud services offered by tech giants now, but these companies exited data centers a long time ago to focus on wireless services and missed huge opportunities to furnish additional premium services to network customers.

Now, Verizon expects to cut capex spending back to prior levels prior to ramping up spending for 5G. The real signal to investors is that the company has no projects to invest in order to drive future revenue growth, with the majority of annual capex more maintenance requirements to keep the wireless network updated to match competitors.

The consensus estimates have revenues rising in the 1%+ annual range, not amounting to much over the next few years. Analysts forecast the EPS is sticky around $4.70 per share through 2025 before a bump in 2026, but this assess is based on very few analysts.

The wireless giant has no catalyst for growth, with the only way to boost profits and cash flows via cutting costs and capex. Lumen Technologies (LUMN) now trades at only $1 after years of revenue declines from weak capex spending.

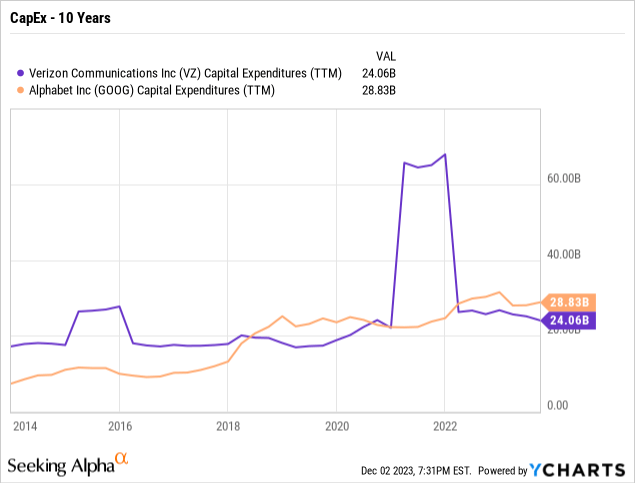

Google (GOOG) (GOOGL) is a prime example of how a growth company has to aggressive spend on capex in order to create a growth driver. The tech giant now has a Google Cloud business with $8.4 billion in quarterly revenues, providing growth at scale to an already large business. Google is now spending $8.1 billion per quarter on capex to nearly double the current spending rate of Verizon, and the tech giant now has another growth catalyst in generative AI.

Verizon has spent most of the last year, spending on wireless spectrum and network capex. The company has yet to invest aggressively in a business offering a growth driver, with wireless services basically turning into a utility with a premium offering built on top of the network.

Takeaway

The key investor takeaway is that Verizon has seen the dividend dip back below 7% as the stock has rallied. Investors will likely create solid, bond type returns in the stock over the next decade, but the ultimate risk is that a declining revenue base leads the stock lower over time. Until Verizon is able to invest aggressively in capex in a business with an actual growth catalyst, the stock will languish at these levels and the large debt levels make such an investment very difficult.