Teamjackson

We present our note on Veolia Environnement SA (OTCPK:VEOEF) (OTCPK:VEOEY), the leading global provider of environmental services to municipal and industrial clients, with a Buy rating. We are drawn by Veolia’s exposure to structural tailwinds, cost-cutting efforts, synergies execution leading to significant growth CAGR, dividend coverage, and a cheap valuation. We see the upcoming Capital Market Day next week as a meaningful catalyst for the stock’s rerating. We will provide a brief overview of the firm, analyze key value-creation drivers, discuss risks, and value the shares.

Introduction to Veolia

Veolia is the world’s leading provider of environmental solutions with activities across the entire value chain of water, waste management, and energy

Veolia’s water division includes resource management, production and delivery of drinkable water and industrial processed water, collection and treatment of wastewater, and design and construction of related infrastructure. The company’s waste management business spans across the entire waste life cycle including collection, processing, treatment, recovery, and conversion to energy of both non-hazardous and hazardous waste. Moreover, it includes urban and industrial cleaning services. Veolia’s energy business includes expertise in heating and cooling services, energy efficiency optimization, as well as renewables.

More than 60% of group EBITDA was generated in Europe with >20% in France, around half of group EBITDA comes from Water – the firm’s most profitable business. Veolia is headquartered in Paris and is a CAC40 constituent. The company has a current market capitalization of nearly €22 billion.

Veolia CMD 2023

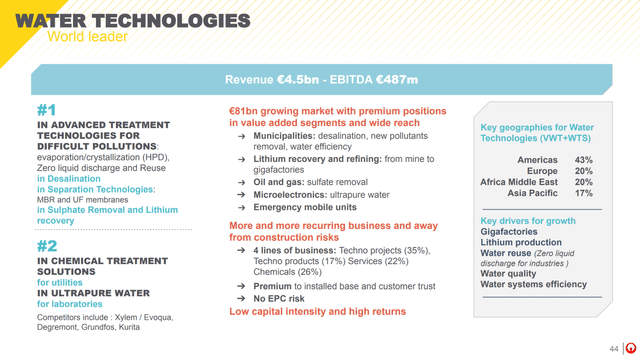

Strong water business

In 2022, Veolia completed the transformational acquisition of Suez, reinforcing its position in the water business. The water division – primarily due to Veolia’s municipal and regulated activities – generates higher EBITDA margins than the group. France and Spain, Veolia’s main municipal water markets, are concessions-based and the company is remunerated based on tariff indexation, benefiting from inflation. In the US and Chile, Veolia is remunerated on the basis of RAB indexation, ensuring that investment needs are met. We believe that changing water regulations, a renewed focus on resource resiliency, as well as digitalization of water services are supportive for Veolia. Moreover, as presented by the firm, increasing lithium production and desalination should provide additional support for Veolia’s water technologies business as the company has expertise in those areas. In addition, the acquisition of Suez provides cross-selling opportunities, further increasing growth in the water division. The tailwinds are also reflected in Veolia’s peer guidance and management comments.

Veolia CMD 2023

Energy and waste tailwinds

Veolia is exposed to a range of structural tailwinds that will support and accelerate its growth also in the energy and waste divisions. We expect higher volumes of hazardous waste driven in part by stricter regulation, and this is also reflected in comments by Veolia’s management. Moreover, we find trends related to recycling also supportive. The EU is increasingly focused on energy efficiency as a means of driving decarbonization and has set ambitious targets for member states. We believe this should further spur growth in services related to energy efficiency provided by Veolia.

Self-help and synergies

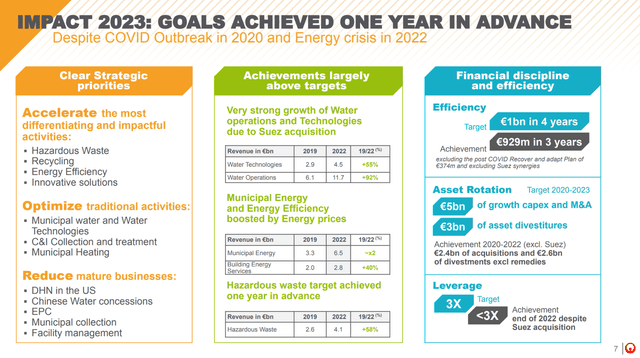

The group’s revenue and EBITDA have grown at low double digits CAGR driven by the acquisition of Suez, synergies, as well as cost-cutting programs.

Veolia has announced it aims to obtain over €500 million of synergies by 2025 from the acquisition of Suez, mainly through efficiencies, procurement, IT, and optimization. The execution so far has exceeded the stated goals, and we believe (in line with various analysts) that Veolia can obtain an additional €150 million per year of synergies by 2027 on top of the current targets.

Over the last decade, Veolia has cut costs by nearly half. The company has positively surprised the markets consistently by overdelivering on its cost-cutting plans. Through 2020-23 alone, the company cut more than €250 million per year of costs. Around half the cuts have been achieved through increasing operational efficiency. We expect that further cost-cutting will continue to remain a significant driver of growth over the midterm.

Veolia CMD 2023

Valuation and investment case

We value Veolia using forward PE and EV/EBITDA multiples. We forecast €48.2 billion of sales in FY2025 (4% YoY growth) and an EBITDA of €7.3 billion, at an EBITDA margin of 15.2%. Moreover, we forecast an EBIT of €3.8 billion and a net income of €1.6 billion in FY2025 (or an EPS of nearly €2.2). This implies a forward EV/EBITDA ratio of 5.6x and a forward PE ratio of 14x. The broader utilities sector trades at nearly 13x. We believe that Veolia, with significantly higher growth as a result of long-term structural tailwinds as well as cost-cutting, synergies, and with a balanced diversified portfolio, deserves to trade a premium to the sector. We set a target 25% premium to the sector, arriving at a target PE ratio of 16.3x. This implies a 17% upside and a share price of €35.3 per share. In addition, we forecast an additional 5% per year dividend yield (€1.5 of DPS in 2024). We forecast a low-teens IRR over two years.

We expect the upcoming Capital Markets Day to be a significant catalyst for the stock’s rerating. We believe the firm is likely to further optimize its portfolio, focusing on key geographies and divisions.

Risks

Downside risks include but are not limited to a deterioration of macroeconomic conditions leading to worse performance in cyclical divisions, lower than expected inflation, failure to execute cost-cutting programs, failure to obtain synergies from the integration of Suez, lower than expected contract wins, adverse regulatory changes, FX risk, misallocation of capital including value destructive M&A

Conclusion

Given the solid fundamentals combined with an attractive valuation, we recommend buying Veolia shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.