Tom Werner

Investment Thesis

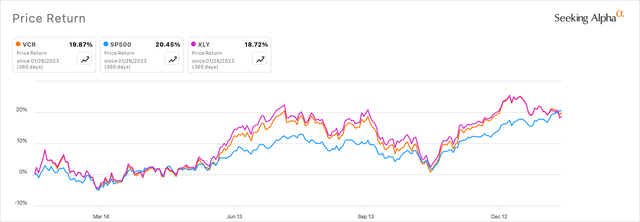

As markets complete the first trading month of this year, the Consumer Discretionary sector remains an unpopular sector for investment firms. Bank of America’s wealth management arm, Merrill Lynch, issued its outlook for the U.S. Consumer Discretionary sector last month by saying, “We remain underweight, as risks remain for future job cuts and as consumers continue to work down excess savings from the pandemic.” Yet, the Vanguard Consumer Discretionary Index Fund (NYSEARCA:VCR) has been consistently outperforming the S&P 500 index (SP500) over the past year.

I believe market participants are being too pessimistic in their outlook for American consumerism and discounting the relative fundamental optimism that has been building in this sector. For reasons that I will list later in this section, I rate the VCR fund as a buy.

About VCR

VCR is an ETF whose assets are owned and managed by the asset management firm Vanguard. The ETF aims to offer exposure to stocks that constitute the Consumer Discretionary sector of the U.S. markets. The fund primarily offers exposure to U.S.-based consumer discretionary stocks. According to Vanguard’s prospectus on the VCR ETF, the fund’s assets “include stocks of companies that manufacture products and provide services that consumers purchase on a discretionary basis.” Vanguard achieves the VCR ETF’s objective by tracking the performance of the MSCI US IMI Consumer Discretionary 25/50 Index benchmark.

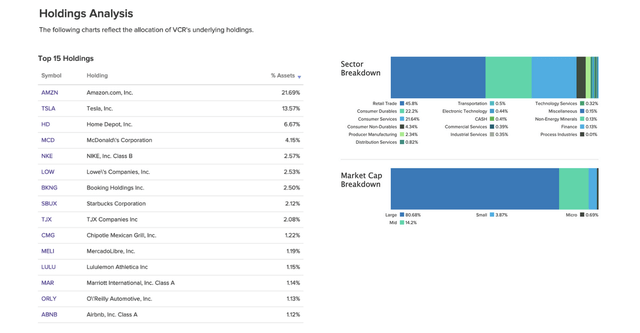

I have added a holding analysis of what the fund’s composition looks like from its top 15 holdings and sector holdings perspectives.

Peer comparison

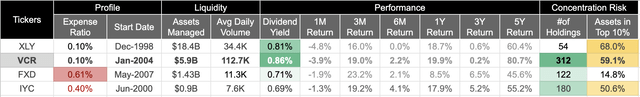

From the top 15 holdings that I see in the holdings chart above, about 35% of the fund’s assets are invested in Amazon and Tesla. The rest are spread across other Consumer Durables, Retail, and Discretionary Services stocks such as Home Depot (HD), Nike (NKE), McDonald’s (MCD), etc. This leads me to believe that despite the fund’s composition being distributed over 300 stocks, I suspect the VCR fund’s assets are moderately concentrated in its top 10-15 stocks, as can be seen below.

Another observation from the peer comparison chart above is that VCR performs much better than the larger State Street’s Consumer Discretionary Select Sector SPDR Fund (XLY), which is widely used as a benchmark to track the consumer discretionary complex of U.S. market stocks. I attribute some of this relative outperformance to a mix of its top holdings, which is similar to the XLY but at the same time diversified beyond its top holdings since it holds 312 stocks in its portfolio. Moreover, looking at the funds over longer time periods, such as 3-year and 5-year time periods, I see that the VCR fund significantly outperforms all its peers. All of the fund’s performance lapses reflect the performance distortions that were created by the 2020 pandemic lockdowns and the severe inflation that arose in 2022. This leads me to believe that the VCR fund is an all-weather fund, contrary to what most market participants may believe.

Improving Macro Picture Driving Upside in VCR

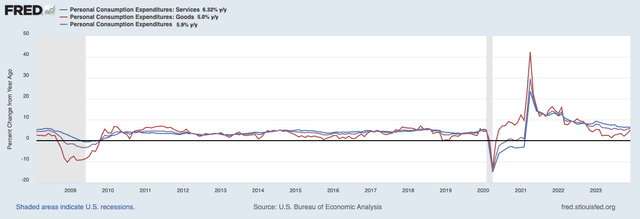

Last year, most economists started 2023 with their U.S. GDP outlook to be -0.2% in 2023 and 0.9% in 2024. However, the strength of the economy surprised most market participants as 2023 came to a close. With the final growth numbers for 2023 released last week, U.S. GDP grew at an impressive 3.3% in the last quarter of FY23. Going one level down into spending trends, I see spending remaining strong and persistent, as shown by the overall Personal Consumption Outlays (PCE). While spending on services has been strong, it’s really the weakness in goods that may have caused concern for economists at the start of 2023. However, as 2023 progressed, the weakness reversed, and consumers also resorted to spending on consumer goods, which can be seen in the uptick since July 2023.

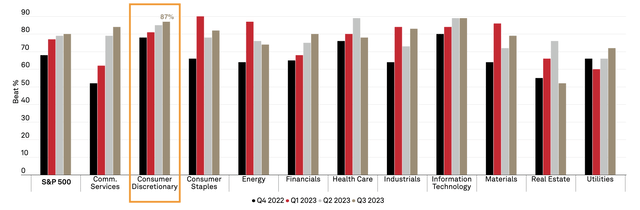

The strength in spending has also led the Consumer Discretionary stocks to outperform EPS estimates all through last year. As can be seen in the chart below from the S&P 500 Q3 2023 Sector Earnings Review, Information Technology and Consumer Discretionary stocks are two of the strongest-performing sectors in the S&P 500.

S&P Market Intelligence: Number of constituents per sector beating EPS estimates

In fact, unlike Information Technology, the Consumer Discretionary sector has the most stocks that have been consistently beating the estimates and still show strength as per the last FY23-Q3 report. Based on the continued strength I observed in PCE spending earlier, I expect this strength in the Consumer Discretionary stocks to sustain through the year, which will be a big boost to the VCR fund.

In terms of valuing the fund and arriving at an estimate, I will start by looking at how the market values the VCR fund today. As per Vanguard’s prospectus, the fund’s PE is 26.4 and its PB is 5.1. While a PE of 26.4 may be deemed expensive, I believe that such a PE still represents a valuable entry point over a 3-5-year horizon. Per the estimates from VCR’s peer, XLY, the entire Consumer Discretionary sector earnings are expected to grow by ~22% over the next 3-5 years. Given that S&P 500’s long-term average earnings growth is ~8%, I don’t mind the 26x today’s earnings multiple that the VCR fund has.

Risks to bull thesis

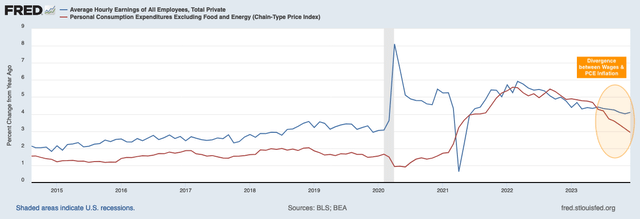

Since all stocks in the VCR fund are based on consumers’ discretionary spending patterns, it is important for consumer spending to continue based on the trends that I noted in earlier sections. However, if there are any slowdowns in the economy or the job markets that may force consumers to switch to a conservative spending mode, most discretionary stocks represented by the VCR fund will be impacted, as we saw in 2022. However, I do not see this as a major risk this year as the labor market continues to expand based on last month’s labor report. Moreover, last month’s labor report and PCE report showed a healthy divergence between inflation (represented by PCE excluding Food and Energy) and Average Hourly earnings, which bodes well for American consumerism to return this year again.

Takeaways

The VCR fund clearly presents an opportunity for investors today since there is too much pessimism built into the outlook of Consumer Discretionary stocks. With the macroeconomic perspective improving and consumer spending getting better, the VCR fund should outperform the markets again this year as well as over the next 3-5 years.