da-kuk

Bitcoin’s volatility surged with $30B cumulative volumes in new US ETFs, countered by dwindling futures and ETN outflows, suggesting potential market growth amid varied sector performance.

Please note that VanEck may have a position(s) in the digital asset(s) described below.

Bitcoin’s 30-day volatility reached its highest level since April 2023 in January after the approval and listing of 10 new spot bitcoin ETFs in the US, which attracted more than $30B in cumulative volumes and $1.5B+ in net inflows as of month-end. It has been gratifying to observe the bid/ask spread and the premium/discount to NAV of these ETFs trend lower such that these products can often be purchased at 1bps spreads and less than 30bps premium or discount to NAV. Such liquidity proves the use case of ETFs which we believe will drive transaction costs lower and thus take some market share from centralized exchanges.

Offsetting these US ETF inflows, however, futures activity (OI) on the CME dropped by $2B from an early January peak to $4.4B at the end of the month, while European bitcoin ETNs also experienced modest outflows, as investors “sold the news.” The consequence of this tug-of-war between futures and spot is that funding costs to hold futures and other leveraged positions fell dramatically in January. For example, the cost to hold a perpetual bitcoin futures position on Binance reached 21% on January 1st before falling sharply to 6% by month-end. We believe such a collapse in demand for leverage may set the market up for another leg higher if ETF inflows continue at the current pace, which exceeds the new Bitcoin supply.

Amidst the sideways bitcoin price, large-caps (+1%) outperformed small-caps (-9%), Ethereum (flat) outperformed Layer 1s (-6%), while Coinbase (COIN)(-26%) and Bitcoin miners (-28%) lagged.

| January | 1 Year | |

| Coinbase | -26% | 91% |

| Bitcoin | 2% | 82% |

| MarketVector Infrastructure Application Leaders Index | -9% | 58% |

| MarketVector Smart Contract Leaders Index | -6% | 57% |

| Ethereum | 0% | 41% |

| Nasdaq Index | 1% | 28% |

| MarketVector Decentralized Finance Leaders Index | -7% | 19% |

| S&P 500 Index | 2% | 18% |

| MarketVector Centralized Exchanges Index | -4% | -2% |

| MarketVector Media & Entertainment Leaders Index | -16% | -49% |

Source: Bloomberg, as of 1/31/2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Smart Contract Platforms

Monthly DEX Volume vs. Average DAUs

Source: Artemis XYZ as of 1/31/2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Airdrops and anticipated airdrops were all the rage in January following the blockbuster releases of the $PYTH (PYTH-USD) ($77M airdropped to 90k wallets) and the $JTO ($165M airdropped to 10k wallets) tokens in November and December. The most anticipated of these airdrops, also on Solana (SOL-USD) like $PYTH and $JTO, was Jupiter’s $JUP. Jupiter, a DEX aggregator, rewarded its users with 10% of the token supply in the first series of yearly airdrops, achieving a fully diluted market cap of $6B. In the Cosmos blockchain universe, the Dymension airdrop promised to airdrop 70M tokens, 7% of network supply, that are estimated to be worth $280M (~$4 per token) at the time of writing. Another token airdrop that occurred was the former Polkadot privacy project, which turned Ethereum zk L2 $MANTA was worth $156M. This brings us to the key question – what is an airdrop, and why are people getting lots of free money?

An airdrop can be thought of as marketing spend to bootstrap a user base. Rather than laboring over a target market and wading through various mechanisms to incentivize them to use your product, blockchains allow app builders to simply target current or potential users with an ownership share in that application’s network. This is accomplished by giving these target users tokens that accrue value from usage of the application’s service or product. Often, the optimal people to target are the ones who consistently utilize the application. In other cases, applications that want to do an airdrop look for users who would appear to be ideal customers for their businesses. This is easily achieved on the blockchain, where all user activity is perfectly transparent, and customer potential can be quantified. The theory behind these airdrops is simple – incentivize usage by potentially making people who patronize your business rich by giving them a share of the network’s future value in the form of token distributions. In turn, these new token holders each have a financial incentive to remain loyal to that application while also encouraging others to use the application as well.

A more cynical take on airdrops is to view them as unofficial token auctions. This is believed to be true, particularly in cases where user activity of that application, which costs money, may be targeted for retroactive airdrops in the future. This is because the user activity costs fees which accrue to the application and the fees were generated in a base currency, like USDC or ETH, in exchange for an indeterminate amount of future application tokens. As such, a project can effectively offboard tokens of whatever value they choose in exchange for user-generated revenues. Of course, there is a fine line for projects to walk, and being stingy with token allocations could crater their users, while overallocation could mean market dumping of a project’s tokens.

As users have been airdropped massive amounts of money over the past few months, many are looking to future airdrops as a source of return. Some of the most anticipated airdrops include Blast – an NFT-focused Ethereum L2, Starknet – an Ethereum zk rollup, Magic Eden – a Solana-based NFT marketplace, and AltLayer – a decentralized rollup service. However, the granddaddy of all anticipated airdrops that is driving user behavior is Eigenlayer.

Eigenlayer TVL

Source: Defillama as of 1/31/2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Anticipation has been building for months about the upcoming launch of Eigenlayer. Eigenlayer can be thought of as a service that escrows liquid staking tokens (LSTs), redeemable/tradable certificates of deposits for staked ETH, and leases out the value of those in exchange for fees. In essence, Eigenlayer is similar to a bank that lends out ETH LSTs that other applications can use to back faith in their business services. In exchange for the “repo” of this ETH, these collateralized services remit ETH, or other tokens as rewards. Eigenlayer is a middleman in this operation that will facilitate and standardize these agreements while also enforcing the contractual obligations of the agreements. The business services that may need this collateral ETH include Oracles, other blockchains, bridges, and businesses that must post an economic bond that can compensate users if those businesses’ services fail. The consequence of all this is that Eigenlayer unlocks new business types for blockchain while also allowing ETH holders additional yield on ETH by supplying it to Eigenlayer.

Eigenlayer and some of the initial businesses that will use Eigenlayer have promised uncertain rewards to users that “re-stake” ETH LSTs by supplying them to Eigenlayer. The result is that there has been a mad dash by less cautious users to “ape” Eigenlayer to garner these potential rewards. On the other end, businesses have cropped up that allow users to speculate on the value of potential rewards or offer new LSTs with the promise of even more rewards. As there is enormous uncertainty with the outcomes of Eigenlayer rewards and the ecosystem surrounding them, many ETH users have been betting according to their views of the value of these potential rewards. One of these re-staking protocols, EtherFi, reached over 100k ETH deposits by mid-January.

Ethereum’s January price action was characterized by concern over initial drops in the percentage of ETH supply being staked. The validator queue for Ethereum actually turned net negative early in the month as Figment and Celsius withdrew their stake. The result was that over several days, ETH stake figures declined from 28.7M to 28.5M. Despite this initial setback, Ethereum ended the month with over 28.8M in staked ETH. While this displays the confidence investors have in Ethereum’s future, the yield for staking ETH reached an all-time low of around 3.47% APY, not accounting for the expected boost from Eigenlayer’s re-staking activity.

Source: Enter Alpha as of 1/31/2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

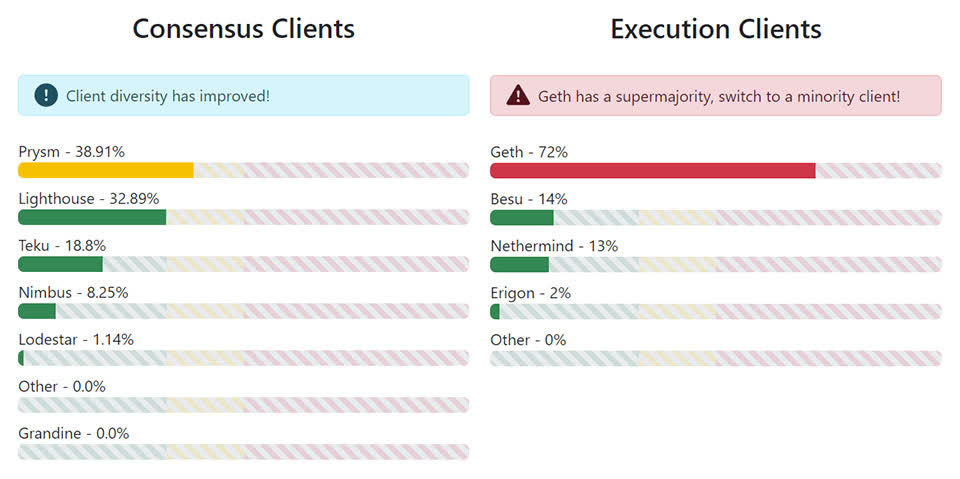

Another catalyst for Ethereum price action was the debate over the distribution of validators who run various versions of Ethereum’s core software. Ethereum validators run two types of software, an execution client and a consensus client. While there are 5 major consensus clients with a somewhat even distribution across them, there are 4 major execution clients, and one client, GETH, is run by 78% of all validators. As Ethereum seeks to be a reliable smart contract platform with 100% uptime, this presents an issue because a bug in GETH could cause the network to have downtime. Worse yet, the consensus mechanism of Ethereum might treat a GETH bug as indistinguishable from a coordinated attack, meaning that non-responsive validators could see their ETH slashed until 66% of the network’s ETH staked is responsive. That could be catastrophic. While this GETH dominance has been an ongoing issue, it came to a head in January when a bug in the Nethermind client caused 8% of Ethereum’s validator set to go offline. While Ethereum did not have any issues as a result, it raised concerns in the Ethereum community. Some proposed solutions to add economic incentives and penalties to get more validators to use different clients but at the time of writing, there was no concrete solution to the dilemma.

Solana (-4%) held up relatively well vs. other high beta L1s in January, thanks to a series of exciting announcements and improving fundamentals. Among the most exciting was news that Solana would be unveiling a new phone called Saga 2. 30k preorders for the phone, to be priced at $450, were recorded in the first 30 hours. Solana also released “extensions” for the SPL token standard. The SPL token standard is a library of code that projects can use to create coins. The new upgrade – called “extensions” – will allow new transaction types such as confidential transfers, augmented token interactions, token fees for transferred tokens, interest-earning tokens, and more. These customizations should help projects make novel products and better monetize existing ones. One early adopter is Japanese fintech GMO Payments (3769 JP, mkt cap $5B), who just announced two new stablecoins, the first regulated Japanese Yen stablecoin and a USD stablecoin, both on the Solana network. These stablecoins will use transfer hooks and permanent delegate authority, new extension features. Lastly, the Jupiter airdrop for Solana was successful, as more than 368k wallets claimed tokens, and Solana did not suffer an outage.

To round out the news for the month, Binance completed its monthly token burn worth $636M of BNB tokens. Binance does quarterly token burns as a consequence of usage to reduce BNB supply. Meanwhile, Monad, a parallelized EVM blockchain, announced it will use LayerZero for bridging. Aevo, a burgeoning options L2 on Ethereum recently declared it will be using Celestia for Data Availability. NEAR Foundation, which recently pushed into becoming a Data Availability layer, confirmed that it would lay off 40% of its workforce. In the Cosmos, the Cosmos Hub is considering liquidity incentive campaign to compel users to stake ATOM in exchange for voting rights to direct the Cosmos Hub’s future. Also in the Cosmos, Berachain is launching its much-anticipated EVM testnet which will employ the novel “Proof of Liquidity” consensus mechanism.

January’s Notable Performer

Sui (+105.9%)

Monthly Fees Generated

Source: Artemis XYZ as of 1/31/2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Sui (SUI-USD) was the top performer among smart contract platforms, as it more than doubled its price over the course of a month. Though month-to-month daily active user count was down (-11%), Sui saw a monstrous (+66.7%) uptick in TVL to reach $444M in total value locked and an (+88.8%) increase in DEX volume. Sui’s DEX volume and TVL in January ranked ahead of Coinbase’s Base blockchain metrics. Sui is a fascinating, relatively new entrant to the alternate layer-1 blockchain race that saw its Mainnet go live in May 2023. Created by former Facebook blockchain project Diem developers and built around Diem’s cutting-edge Move blockchain language, Sui boasts an impressive set of capabilities. We find Sui to be a compelling project because:

- Attractive Developer Funnel

- Faster developer time – projects claim 1/5th of developer time versus similar Solana project; one-half of the coding lines to accomplish the same task

- Language that prevents errors while making mental overhead for developers lower

- Assets on chain are treated intuitively as “objects” that can be owned, shared and mutated

- Vastly Improve User Experience

- Using zkLogin, users can permissionlessly control their funds using a Google or Facebook sign in

- Object-based programming language and account abstraction allows users to understanding in plain English what each transaction they sign will accomplish

- Blockchain Safety

- Bytecode verifier rejects faulty or unsafe smart contract when loaded onto Sui

- Object-based coding language system that prevents many types of blockchain attacks

- Ownership

- High Throughput (how many txs are processed per second)

- Recorded a record 65M transactions in one day

- Unique modular architecture for scaling that allows workers servers to be added to increase throughput rather than validators having to buy a better server

- Transactions can perform up to 2048 different functions at once; the equivalent on Solana is 64

- Fast Latency (how fast a user gets confirmation of a transaction being recorded)

- Soft confirmations as quick as 30ms

- Full finality as fast as 2 network roundtrips (300ms) for “owned objects”

- Full finality for “shared objects” as fast as (600ms)

- Talented Developer Team

- Blockchain architected from the ground up to take advantage of the Move language

While Sui has quite a bit of potential, it is very nascent and has not found a core identity or a very differentiated application ecosystem. Having a culture and a community often stems from personalities within the broader team. While Sui’s team is exceptionally bright, they have yet to assert a positive online presence to resemble that of successful chains like Ethereum or Solana. Social capital is very important in crypto, as is building an interesting community that appeals to the typical crypto user. While projects like Aftermath Finance have begun a grassroots movement of culture on Sui, it’s too early to tell if it can become sticky. Also, Sui’s daily active user count is low, putting it in the usership size cohorts with projects like MultiverseX, Fantom, and the Cosmos Hub, which each have far lower valuations than Sui. Finally, it is likely that much of the activity on Sui relates to the high level of rewards offered within Sui DeFI.

January’s Notable Laggard

Polygon (-17.4%)

Average DAUs vs. Average TVL, Last 30 Days

Source: Artemis XYZ as of 1/31/2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Polygon’s (MATIC-USD) MATIC token price once again had a very discouraging month. Though usership like daily active users was positive on the month, up (+39.2%) compared to December, the more important fundamental indicators of activity like DEX Volume and TVL were down (-21%) and (-1.8%) month-to-month. From a fee standpoint, MATIC was also down (-55.3%) in January compared to December. One catalyst for the negative price action is that Polygon is accused of intentionally misallocating 400M in tokens that were supposedly reserved for staking rewards. Instead, some claim that those tokens were sold on Binance to generate funds for Polygon. While it is not unusual for projects to change token tokenomics, typically they do so in an open, transparent manner. All else equal, this token shifting, especially when done almost 3 years ago, is considered an issue but not a price killer. However, Polygon suffers from a somewhat unfair reputation for making dubious claims. Generally, market sentiment for Polygon is weak due to confusion about Polygon’s long-term vision, its differentiation from other L2s, and the allocation of its token business partnerships, many of which have yet to generate meaningful fees on-chain.

However, there is ample reason to think Polygon is underpriced relative to its potential. Polygon still has the 7th largest DAU base in all crypto, ~571k over the last 30 days, and this usership is nearly 4x is that of the closest L2 blockchain competitors. Additionally, there are many interesting differentiated projects building on Polygon including a game-focused blockchain called ImmutableX, an automotive data project called Dimo, and GPS improvement entity called GEODNET. Most importantly, Polygon has a fascinating zk scaling approach and is moving towards becoming an aggregation layer for L2 blockchains.

In their vision, Polygon would earn revenue by operating a proving system as well as a settlement layer for zk rollup blockchains built using the Polygon CDK. This would enable Polygon to connect these chains through trustless bridging, a major pain point for L2s, to unite siloed liquidity while earning fee revenue. Additionally, Polygon recently announced an interesting partnership with Fox Corporation to launch Verify which will enable Fox to post proofs of authenticity of its media content to Polygon’s blockchain. Like anything else in crypto, Polygon’s MATIC token will likely be the beneficiary of a narrative. In Polygon’s case that market story will likely revolve around difficulties of bridging funds between L2s and other pain points associated with non-zk rollups L2s. While there is no certainty of if or when that positive narrative will form for Polygon, what is certain is that its aggregation layer is launching in February, and many will be watching to see how it performs.

Links to third party websites are provided as a convenience and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites. By clicking on the link to a non-VanEck webpage, you acknowledge that you are entering a third-party website subject to its own terms and conditions. VanEck disclaims responsibility for content, legality of access or suitability of the third-party websites.

DISCLOSURES

Index Definitions

S&P 500 Index: is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

The MarketVector™ Centralized Exchanges Index (MVCEX) is designed to track the performance of assets classified as ‘Centralized Exchanges’.

Nasdaq 100 Index: is comprised of 100 of the largest and most innovative non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

MarketVector Decentralized Finance Leaders Index: is designed to track the performance of the largest and most liquid decentralized financial assets, and is an investable subset of MarketVector Decentralized Finance Index.

MarketVector Media & Entertainment Leaders Index: is designed to track the performance of the largest and most liquid media & entertainment assets, and is an investable subset of MarketVector Media & Entertainment Index.

MarketVector Smart Contract Leaders Index: designed to track the performance of the largest and most liquid smart contract assets, and is an investable subset of MarketVector Smart Contract Index.

MarketVector Infrastructure Application Leaders Index: is designed to track the performance of the largest and most liquid infrastructure application assets, and is an investable subset of MarketVector Infrastructure Application Index.

MarketVector Digital Assets 100 Large-Cap Index is a market cap-weighted index which tracks the performance of the 20 largest digital assets in The MarketVector Digital Assets 100 Index.

MarketVector Digital Assets 100 Small-Cap Index is a market cap-weighted index which tracks the performance of the 50 smallest digital assets in The MarketVector Digital Assets 100 Index.

Coin Definitions

- Bitcoin (BTC) is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.

- Ethereum (ETH) is a decentralized, open-source blockchain with smart contract functionality. Ether is the native cryptocurrency of the platform. Amongst cryptocurrencies, Ether is second only to Bitcoin in market capitalization.

- Solana (SOL) is a public blockchain platform. It is open-source and decentralized, with consensus achieved using proof of stake and proof of history. Its internal cryptocurrency is SOL.

- Arbitrum (ARB) is a rollup chain designed to improve the scalability of Ethereum. It achieves this by bundling multiple transactions into a single transaction, thereby reducing the load on the Ethereum network.

- Avalanche (AVAX) is an open-source platform for launching decentralized finance applications and enterprise blockchain deployments in one interoperable, scalable ecosystem.

- Ordinals (ODI) is a decentralized finance project that uses blockchain technology to store text, images, and other data on the Bitcoin network.

- Stacks (STX) is a Bitcoin Layer for smart contracts; it enables smart contracts and decentralized applications to use Bitcoin as an asset and settle transactions on the Bitcoin blockchain.

- Uniswap (UNI) is a decentralized exchange built on Ethereum that utilizes an automated market making system rather than a traditional order-book.

- Blur (BLUR) is the native governance token of Blur, a unique non-fungible token (NFT) marketplace and aggregator platform that offers advanced features such as real-time price feeds, portfolio management and multi-marketplace NFT comparisons.

- Polygon (MATIC) is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development. Its core component is Polygon SDK, a modular, flexible framework that supports building multiple types of applications.

- Celestia (TIA) is the first modular blockchain network that enables anyone to easily deploy their own blockchain with minimal overhead.

- Immutable (IMX) is a Layer-2 scaling solution for Ethereum that focuses on NFTs and game economies.

- Manta Network (MANTA) is a plug-and-play privacy-preservation protocol built to service the entire DeFi stack.

- Jito Network (JTO) is a major contributor to the Solana ecosystem through its JitoSOL liquid staking pool, and its collection of MEV products.

- Jupiter (JUP) utilizes military grade encryption to secure user data and powers secure dApps on public and private networks.

- Sui (SUI) is a Layer-1 smart contract platform developed by Mysten Labs, which utilizes an object-centric data model intended to scale network throughput.

- Aptos (APT) is a Layer-1 blockchain network focusing on decentralization, speed, and scalability.

- NEAR Protocol (NEAR) is a layer-one blockchain that was designed as a community-run cloud computing platform and that eliminates some of the limitations that have been bogging competing blockchains, such as low transaction speeds, low throughput, and poor interoperability.

- Optimism (OP) is a layer-two blockchain on top of Ethereum. Optimism benefits from the security of the Ethereum mainnet and helps scale the Ethereum ecosystem by using optimistic rollups.

- Tether (USDT) is a fiat-collateralized stablecoin platform offering individuals the advantage of transacting on blockchains while mitigating price risk. USDT is their US dollar pegged stablecoin.

- Worldcoin (WLD) is a cryptocurrency project that aims to distribute a global digital currency to every person on Earth. Their vision is to provide equal access to digital assets, making use of blockchain technology for financial inclusion.

- Tron (TRX) is a multi-purpose smart contract platform that enables the creation and deployment of decentralized applications.

- THORChain (RUNE) is an independent blockchain built using the Cosmos SDK that will serve as a cross-chain decentralized exchange (DEX).

- Lido DAO (LDO) is a liquid staking solution for Ethereum and other proof of stake chains.

- Aave (AAVE) is an open-source and non-custodial protocol to earn interest on deposits and borrow assets with a variable or stable interest rate. It also enables ultra-short duration, uncollateralized flash loans designed to be integrated into other products and services.

- Curve (CRV) is a decentralized exchange optimized for low slippage swaps between stablecoins or similar assets that peg to the same value.

- Maker (MKR) is the governance token of the MakerDAO and Maker Protocol – respectively a decentralized organization and a software platform, both based on the Ethereum blockchain – that allows users to issue and manage the DAI stablecoin.

- Axie Infinity (AXS) is a blockchain-based trading and battling game that is partially owned and operated by its players.

- The Sandbox (SAND) is a blockchain-based virtual world allowing users to create, build, buy and sell digital assets in the form of a game. By combining the powers of decentralized autonomous organizations (DAO) and non-fungible tokens (NFTs), the Sandbox creates a decentralized platform for a thriving gaming community.

- Mythos (MYTH) is the interoperable utility token used in these decentralized efforts and provides opportunity for anyone to participate and contribute within the ecosystem – adding governance, and value to game developers, publishers, and content creators.

Risk Considerations

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

Index performance is not representative of fund performance. It is not possible to invest directly in an index.

The information, valuation scenarios and price targets presented on any digital assets in this commentary are not intended as financial advice, a recommendation to buy or sell these digital assets, or any call to action. There may be risks or other factors not accounted for in these scenarios that may impede the performance these digital assets; their actual future performance is unknown, and may differ significantly from any valuation scenarios or projections/forecasts herein. Any projections, forecasts or forward-looking statements included herein are the results of a simulation based on our research, are valid as of the date of this communication and subject to change without notice, and are for illustrative purposes only. Please conduct your own research and draw your own conclusions.

Investments in digital assets and Web3 companies are highly speculative and involve a high degree of risk. These risks include, but are not limited to: the technology is new and many of its uses may be untested; intense competition; slow adoption rates and the potential for product obsolescence; volatility and limited liquidity, including but not limited to, inability to liquidate a position; loss or destruction of key(s) to access accounts or the blockchain; reliance on digital wallets; reliance on unregulated markets and exchanges; reliance on the internet; cybersecurity risks; and the lack of regulation and the potential for new laws and regulation that may be difficult to predict. Moreover, the extent to which Web3 companies or digital assets utilize blockchain technology may vary, and it is possible that even widespread adoption of blockchain technology may not result in a material increase in the value of such companies or digital assets.

Digital asset prices are highly volatile, and the value of digital assets, and Web3 companies, can rise or fall dramatically and quickly. If their value goes down, there’s no guarantee that it will rise again. As a result, there is a significant risk of loss of your entire principal investment.

Digital assets are not generally backed or supported by any government or central bank and are not covered by FDIC or SIPC insurance. Accounts at digital asset custodians and exchanges are not protected by SPIC and are not FDIC insured. Furthermore, markets and exchanges for digital assets are not regulated with the same controls or customer protections available in traditional equity, option, futures, or foreign exchange investing.

Digital assets include, but are not limited to, cryptocurrencies, tokens, NFTs, assets stored or created using blockchain technology, and other Web3 products.

Web3 companies include but are not limited to, companies that involve the development, innovation, and/or utilization of blockchain, digital assets, or crypto technologies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

© Van Eck Associates Corporation.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.