ryasick

We previously covered V.F. Corporation (NYSE:VFC) in September 2023, discussing its underperformance since April 2021, thanks to its impacted top/ bottom lines and growing inventories as the global macroeconomic outlook remained uncertain.

While the stock had been rated as a Buy for speculative income oriented investors then, attributed to our belief that “the safest dividend might be the one that had just been cut,” it appeared that we had been proven wrong after all.

In this article, we shall converse why we are downgrading our rating to a Hold here, with the twice-cut dividend and lowered FY2024 guidance reflecting poorly on the management’s capability while encourage undermining investor confidence.

We shall converse encourage.

The VFC Investment Thesis Has Turned Even More Bearish Than Expected

For now, VFC has reported a bottom line miss in its FQ2’24 earnings call, with revenues of $3.03B (+45.6% QoQ/ -1.5% YoY) and adj EPS of $0.63 (+520% QoQ/ -13.6% YoY).

Despite the outperformance in multiple international regions, such as Greater China at +14% YoY, EMEA at +8% YoY, and APAC at +7% YoY, it is apparent that the Americas’ underwhelming performance of -12% YoY has directly contributed to its impacted top and bottom lines.

This is because the Americas region is VFC’s top-line driver, accounting for $1.56B (+32.2% QoQ/ -10.8% YoY) of its revenues in the latest quarter.

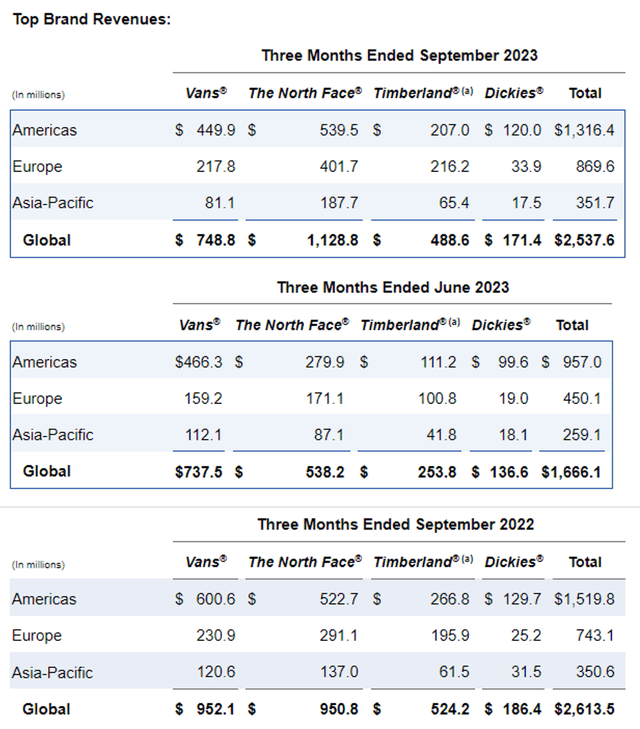

VFC’s Brand Performance

Most of the headwinds are attributed to the Vans brand underperformance with global revenues of $748.8M (+1.5% QoQ/ -21.3% YoY), and to a smaller extent, Timberland, at global revenues $488.6M (+92.5% QoQ/ +6.7% YoY).

While VFC has upped the promotional events, attributed to the declining gross margins of 51.3% (-1.5 points QoQ/ -0.1 YoY) compared to FY2020 (CY2019) margins of 55.5%, it is apparent that its brand power has been diminishing after all.

The same has been observed in its stagnant inventory levels of $2.48B (-10.7% QoQ/ -9.4% YoY) as well, encourage underscoring the management’s expectations of minimal demand recovery for Vans over the next two quarters.

The VFC management has also overly estimated the demand for its products, due to the kitchen sink guidance offered in the recent earnings call.

This is with the withdrawal of its FY2024 revenue/ earnings guidance and the reduction of its FCF guidance to approximately $600M (+173% YoY from -$821M), down from the previous $900M (+209.5% YoY).

It is no wonder then that VFC has had to encourage cut its quarterly dividends by -70% to $0.09 moving forward.

This is directly attributed to the drastic deterioration in its balance sheet, with moderating cash/ equivalents of $498.91M (-38.1% QoQ/ -9.7% YoY) and burgeoning short/ long-term debts of $6.67B (+15.3% QoQ/ +28% YoY) by the latest quarter.

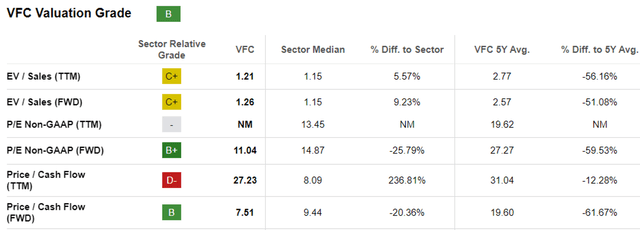

VFC Valuations

As a result of the headwinds discussed above, it is unsurprising that VFC trades at impacted FWD P/E valuation of 11.04x and FWD Price/ Cash Flow valuation of 7.51x, compared to its 3Y pre-pandemic mean of 22.18x/ 16x and the sector median of 14.87x/ 9.44x, respectively.

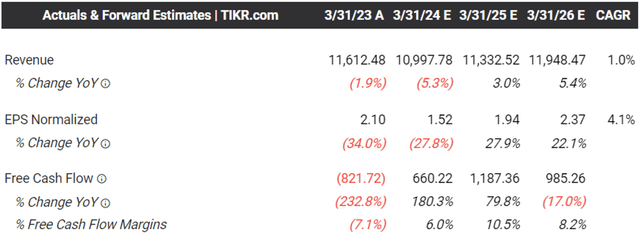

The Consensus Forward Estimates

The same has been reflected in the underwhelming consensus forward estimates through FY2026, with VFC expected to produce minimal top and bottom line expansions.

Most importantly, with impacted FCF generation, it is uncertain how the management may deleverage its deteriorating balance sheet, with $1B maturing in FY2025 and another $1.29B maturing in FY2026.

So, Is VFC Stock A Buy, Sell, Or Hold?

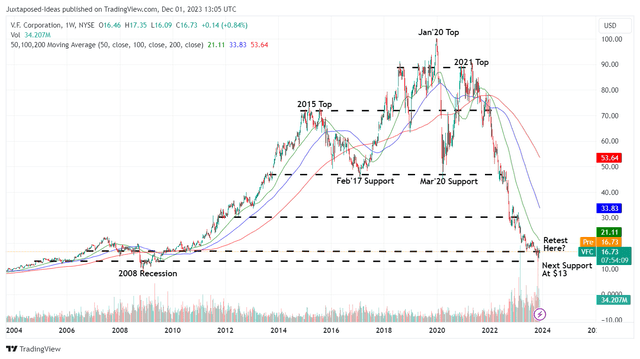

VFC 20Y Stock Price

For now, VFC has already lost much of its 15Y gains, with it currently trading sideways at its resistance levels of $18s, after the bulls swept in to save the day at its previous uphold levels of $13s.

Depending on their dollar cost averages and investing periods, we believe that most investors may have already been in the red, with the dividends insufficient to cover the capital losses thus far.

On the one hand, we applaud the difficult decision to reinvent its business in favor of balance sheet improvement, naturally explaining the two dividend cuts over the past few quarters.

On the other hand, we are of the opinion that VFC’s dividends should have just been prudently suspended since the start of its financial woes, rather than stubbornly insisting that it could “continue to pay quarterly dividends” over the past few quarters.

This is especially since a twice-cut dividend reflects poorly on the management’s capability while encourage undermining income-oriented investors’ confidence.

Combined with the increasingly unsustainable annualized interest expenses of $241.8M (+9.4% QoQ/ +74% YoY), the Seeking Alpha Quant’s deteriorating dividend grades, and uncompelling forward dividend yield of 1.99%, we prefer to prudently rerate the VFC stock as a Hold (Neutral) here.

We believe that there may be more pain ahead. Investors beware.