Chun han

Use of coal in power generation fades. Cheap US natural gas has been hard to beat for 15 years.

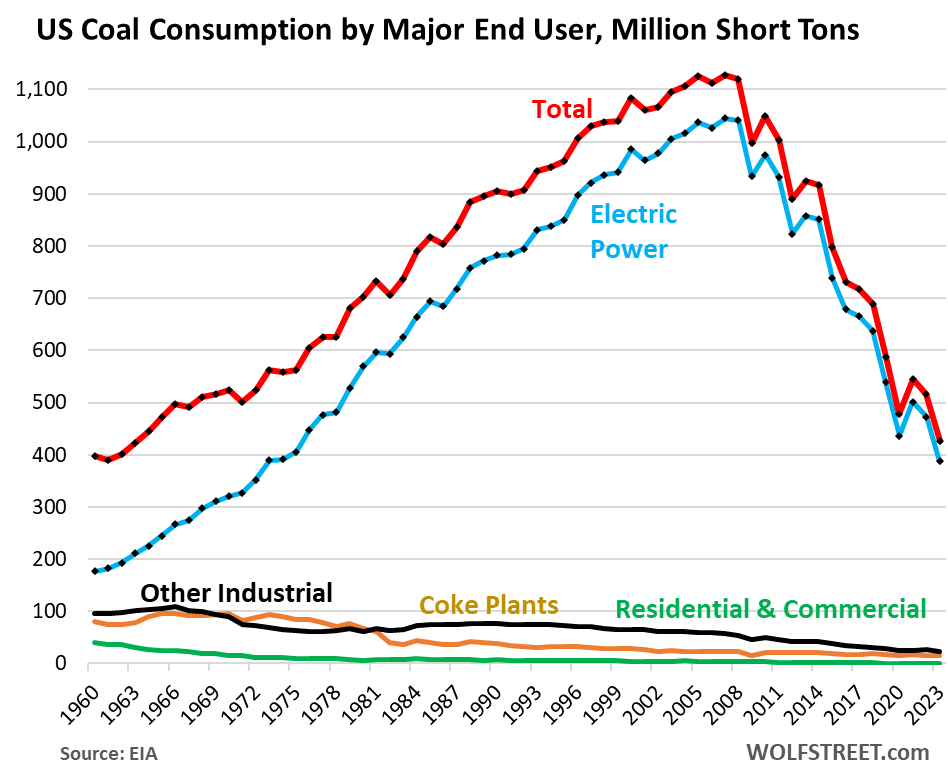

Coal consumption in the US plunged another 17.4% in 2023 from the prior year, to 426 million short tons, the lowest since 1963 (red line in the chart), according to data from the Energy Department’s EIA today. Coal consumption by tonnage peaked in 2007. But by energy content, coal consumption peaked in 2005 at 22.79 quadrillion Btu.

Of the total, 388 MMst were consumed by coal-fired power plants for electricity generation, down by 18.1% from the prior year, and the lowest since 1972 (blue).

Other industrial users consumed 22.2 MMst, the lowest in the data going back to 1950. Coke plants consumed 15.8 MMst, also the lowest in the data going back to 1950. Coal was once the dominant transportation fuel, and by the 1960s, that had vanished. Coal was also once an important residential and industrial heating fuel, and that has now largely vanished.

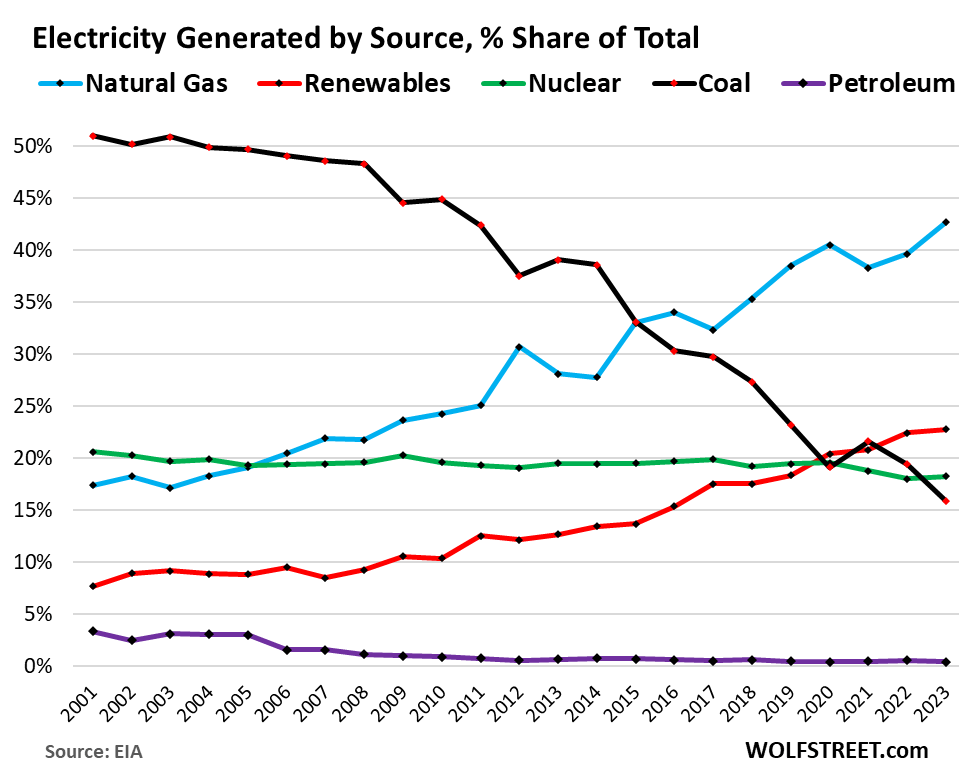

In terms of power generation, coal’s share in 2023 dropped to another record low to 15.9%, down from 51% in 2001 (black line in the chart below), according to earlier data from the EIA. The decline of coal in power generation was triggered by several events:

- In the 1990s, the arrival of the combined-cycle natural gas turbine, a technical innovation, vastly increased the efficiency of natural gas plants.

- In 2009, surging natural gas production from fracking caused the price of natural gas to collapse, and even today, natural gas costs just a fraction of what it cost 20 years ago.

- Cheap natural gas made these highly efficient combined cycle natural gas power plants more profitable to operate than coal plants, and no new coal plants were built, and the old ones have been getting retired in large numbers.

- Fracking has made the US the largest natural gas producer in the world in 2011, and in 2023, the largest LNG exporter in the world.

- In recent years, even wind and solar have become more cost-efficient than coal plants. The “fuel” is free, and all methods of power generation require costly plants and equipment.

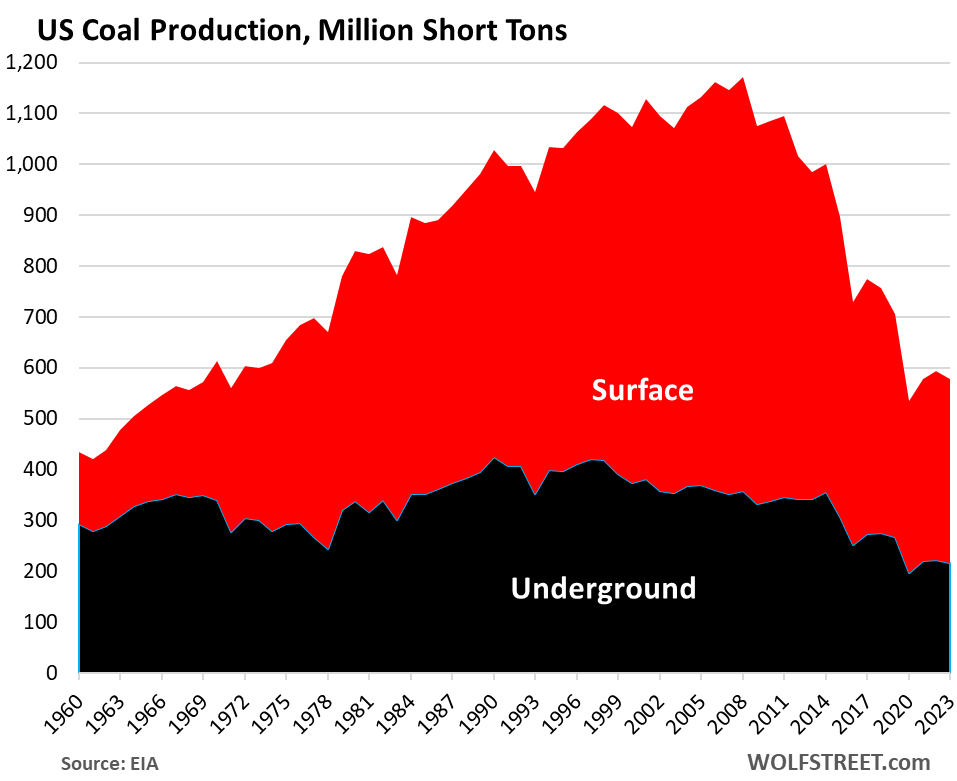

Coal production in the US has plunged by 47% since 2011 to 577 MMst in 2023 but has stabilized in recent years. Production was down 2.8% from a year ago, but the same as in 2021, and up from 2020. All of them were the lowest since the early 1970s.

Coal produced in the US is mostly bituminous and subbituminous, each with a share of about 46% of total production. Lignite amounts to 8% of total coal production, and anthracite to less than 1%.

A lively export business has been helping to stabilize production in recent years. The chart shows annual production in surface mines (red) and underground mines (black):

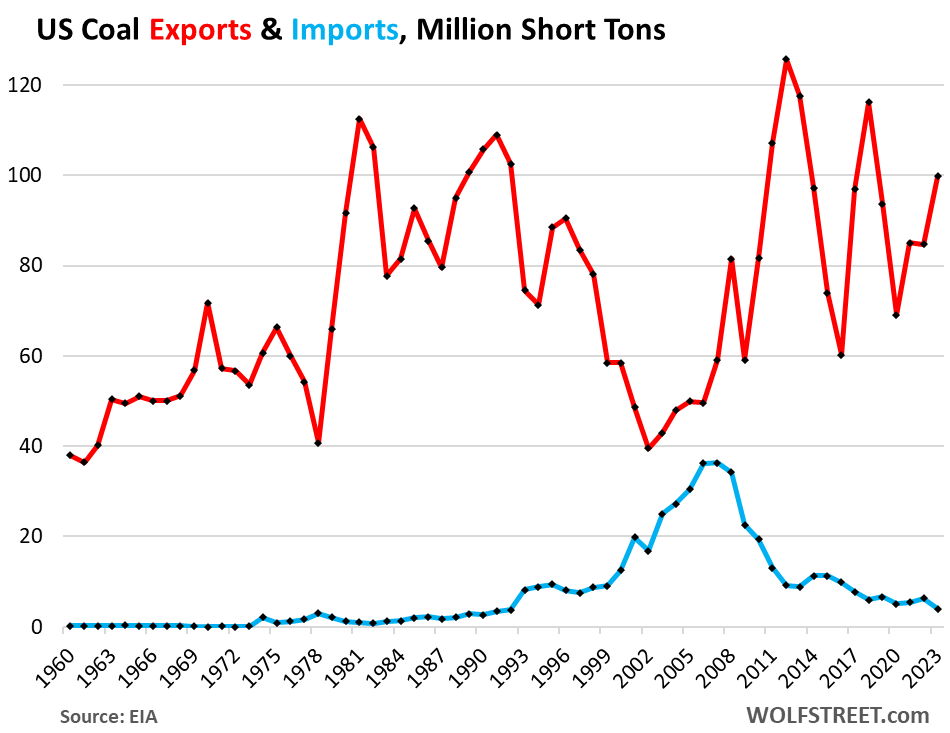

Coal Exports and Imports show a widening trade surplus. Coal imports (blue in the chart below) dropped to 4 MMst, the lowest since the 1990s.

Coal exports (red) rose to 99.8 MMst. Of those exports, 51.3 MMst were metallurgical coal and 48.5 MMst were steam coal. Exports in 2012 of 126 MMst had been the highest in the data going back to 1950.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.