miniseries

Dear Fellow Investor,

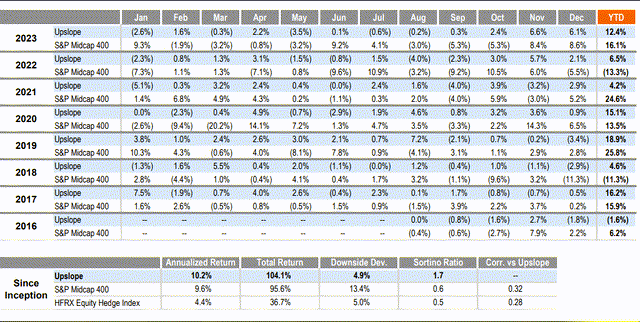

Upslope’s objective is to deliver attractive, equity-like returns with significantly reduced market risk and low correlation versus traditional equity strategies. Q4 was unusual for Upslope’s typically defensive strategy. Similar periods in the past (markets going vertical) have been relatively challenging for Upslope. This quarter, however, saw the strongest absolute performance since inception. While I’ve worked hard to improve on this particular front (better up-market capture), I have not and will not lose sight of Upslope’s defensive focus.

|

Upslope Exposure & Returns[1] |

Benchmark Returns |

|||

|

Average Net Long |

Net Return |

S&P Midcap 400 ETF (MDY) |

HFRX Equity Hedge Index |

|

|

Q4 2023 |

69% |

+15.8% |

+11.5% |

+3.6% |

|

FY 2023 |

61% |

+12.4% |

+16.1% |

+6.9% |

|

Since Inception |

51% |

+10.2% |

+9.6% |

+4.4% |

|

Downside Deviation |

4.9% |

13.4% |

5.0% |

|

|

Sortino Ratio[2] |

1.69 |

0.56 |

0.47 |

|

Note: LPs/clients should always check individual statements for returns, which may vary due to timing, fee schedules and other factors. Since inception returns, downside standard deviation, and Sortino are all annualized figures (from August 2016).

MARKET CONDITIONS – AI REVOLUTION

A recent podcast with a well-regarded hedge fund manager offered such a perfect window into markets today that I had to listen twice. As they wrapped up the episode, the upbeat co-hosts asked the fund manager what “worries or excites” him most today. The guest laid out a long, thoughtful answer, focused almost exclusively on war and other geopolitical risks and events. After an awkward pause, one of the hosts earnestly blurted out, “it…does sound like you’re excited about the AI revolution?” The other host immediately thanked his colleague for attempting to end on a positive note.

I continue to believe events in Ukraine, Israel, and China have broader implications than are appreciated by markets today. This doesn’t automatically make me “bearish” and admittedly I don’t really know what those implications are (no one does). But, while most investors view simmering geopolitical risk as a distraction, I think it’s closer to the main event. For now, my takeaways are simple (from most to least confident): own defense stocks and broad reshoring winners, and don’t get caught off-guard by tail events. The last point – the haziest of the bunch – is a consideration for virtually every decision in the portfolio.

With sharp up and down volatility throughout, Q4 was very active. Some notable additions (all long): Chemring (UK-based defense company that Upslope previously owned and re-added), North West Co (Canadian specialty retailer), nVent Electric (electrical connection/protection supplier), and Intel (leading semiconductor device manufacturer). Upslope also exited Man Group (UK-based alt. asset manager). As always, further details are below.

PORTFOLIO POSITIONING

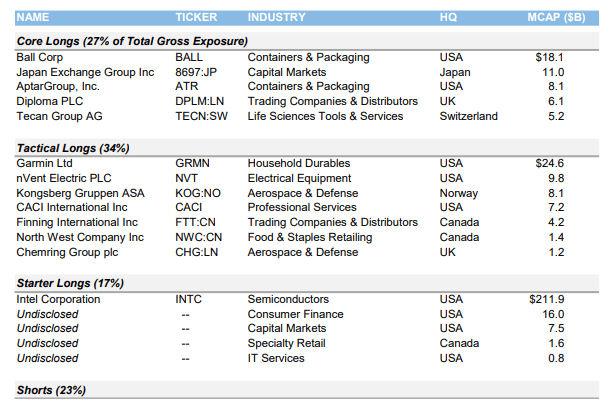

At quarter-end, gross and beta-adjusted net exposures were 147% and 44%, respectively3. Positioning continues to reflect a high number of perceived opportunities – both long and short.

Exhibit 1: Portfolio Snapshot4

Note: as of 12/31/23 and may change without notice. Positions disclosed at Upslope’s discretion. Source: Upslope, Sentieo

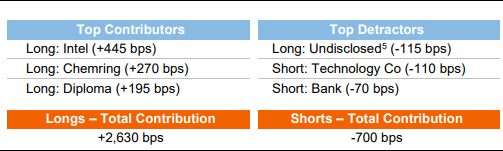

Exhibit 2: Gross Exposure by Market Cap & Geography (Total Portfolio)

Note: as of 12/31/23. Market cap ranges: Micro (<$400mm), Small ($400mm – $3bn), Mid ($3bn – $13.5bn), Large (>$13.5bn). Source: Upslope, Interactive Brokers, Sentieo

PORTFOLIO UPDATES

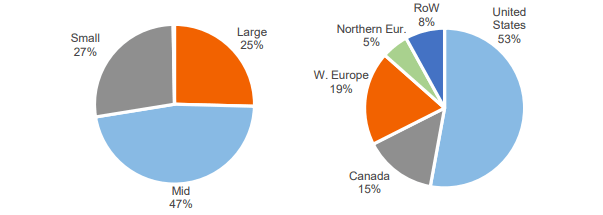

The largest contributors to and detractors from quarterly performance are noted below. Gross contribution to overall portfolio return is noted in parentheses.

Exhibit 3: Top Contributors to Quarterly Performance (Gross)

Source: Upslope, Opus Fund Services, Interactive Brokers

Note: Amounts may not tie with aggregate performance figures due to rounding.

Man Group (OTCPK:MNGPF)[EMG.LN] – Exited Long5

Man Group is a UK-based alternative asset manager. Upslope exited the position during the quarter, primarily to make room for new, higher-conviction longs.

Chemring (OTCPK:CMGMF)[CHG.LN] – ‘New’ Long

Chemring is a UK-based niche defense contractor focused on flares, specialty explosives, and cyber warfare. Upslope was long Chemring for much of 2022 before exiting in Q1 2023, when I noted: “we may be [Chemring] shareholders again in the future.” Sure enough, an opportunity arose to purchase shares at an attractive valuation, even prior to the disturbing events in the Middle East. Shares had languished YTD as 1H results suffered from a pure timing issue (now resolved) and the company committed to investing in new capacity for desperately needed (by NATO allies) energetics (apparently capex = bad, even when it accelerates growth and generates strong returns).

While the Street couldn’t have cared less about shares, which sat at sector and 5-year low valuation multiples at the end of Q3, management initiated a serious (7%+ of shares) buyback for the first time in CHG history. Regulatory filings show the company ramped the buyback sharply in October and November. Cheap valuation, strong and accelerating sector tailwinds, clean balance sheet, strategic assets, and an aggressive buyback – what more could one want? Shares have now re-rated, but the rising demand outlook and strategic value of the company still appear under-appreciated.

nVent Electric (NVT) – New Long6

nVent Electric is a leading supplier of electrical protection and connection components and systems. The company was originally spun out of Pentair in 2018. NVT is an inherently attractive business because it holds mostly dominant or leading market share positions for products with a high cost of failure and a relatively low overall cost to customers. This provides customer stickiness and real pricing power when needed. While macro-sensitive, the company is unusually well positioned today as a clear beneficiary of the IRA (Inflation Reduction Act) specifically, as well as the more general trends of reshoring and electrification. While the current up-cycle won’t last forever, NVT also appears to have a long runway for inorganic growth that should bolster growth over the long-run. Since its 2018 spin, NVT has begun to establish a solid track record of acquisitions, with six (mostly tuck-in) transactions representing over $700mm in company sales today.

Some other details and nuances that attracted me to the company: geographically, nVent is focused on North America (~70% of sales) and EMEA (20%). Most NVT products are simple in nature (see examples below), which reduces supply chain complexity/risk. In its core Enclosures segment (half of sales), NVT holds ~80% market share and is considered the gold standard (“the Kleenex of electrical enclosures” as one former employee effectively put it). In the Electrical & Fastening segment (30% of sales), NVT maintains a leading market position in a highly fragmented market. The company recently completed a big step towards consolidating this market by acquiring ECM Industries. NVT’s largest acquisition to date, ECM generated over $400mm of LTM sales and $100mm of EBITDA.

Exhibit 4: Sample nVent Products

Source: nVent website

Financially, nVent generates significant free cash flow – historically converting ~100% of Adj Net Income (currently lower due to leverage from the ECM deal, but should revert as the company de-levers). Even post-ECM, NVT has a reasonable balance sheet (2.5x net debt/EBITDA). And finally, valuation appears reasonable at a ~5% 2024E FCFF yield.

Risks primarily include: cyclical end-markets (tied to industrial RE construction), potential for IRA/reshoring demand to wane, and M&A execution risk.

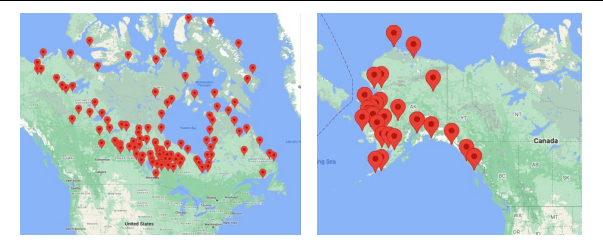

North West Company (OTCPK:NNWWF)[NWC.TO] – New Long

North West is a specialty retailer focused on geographically remote and hard-to-reach regions throughout Canada (56% of sales), Alaska, as well as islands in the South Pacific, Caribbean and BVI. Although its operations are diverse, 75% of revenue comes from food-related sales. The remainder is “general merchandise” products (apparel, health products, basic goods and other products). Given the nature of its business, NWC has a JV investment in an arctic shipping business and operates its own small regional cargo/passenger airline.

Exhibit 5: North West Co Footprint (Select Banners)

Note: only Alaska Commercial Company and Northern Store banners are shown. Source: North West Co website

“Other than that,” what’s interesting about shares of North West today? First, as investors have warmed up (an understatement) to the idea of a “soft landing” for the broader economy, economically defensive stocks have been discarded. North West is about as defensive of a business as I’ve seen – selling essential food and goods, often as the sole source for such products in the small communities it serves. While NWC shares have not been “discarded,” they trade near historic lows on most valuation metrics (currently 7x NTM EBITDA, 13x EPS, 7% FCFE yield, and 4% dividend) despite reasons for optimism. Second, the reasons for optimism: a significant portion of NWC’s customer base is comprised of indigenous peoples who are beginning to see a significant increase in directed government investment and settlement payments. Ultimately, this should be a positive for North West and the communities it serves. There is precedent for such a situation for North West: customers saw a similar windfall during 2007-08.

Key risks for shares include: weather/natural disasters, sensitivity to the price of oil (due to some Alaskan customer reliance on annual state dividend), FX (mostly Canadian Dollar), and potential regulatory/political risk given the delicate nature of the company’s relationship with many of its communities and the essential nature of the company’s products.

Intel (INTC) – New Long7

This is not a traditional long for Upslope in any sense. Intel is outside of the box in terms of typical sector and market cap focus, and the position is really a portfolio hedge (and structured as such). The thesis is very simple: Intel is uniquely positioned to benefit in two important scenarios, both of which require “protection” for Upslope’s portfolio: a continued melt-up in technology stocks and/or rising tensions over Taiwan. Combined with expectations and sentiment around Intel that were incredibly low, this nudged me to add exposure via long-dated INTC call options. While still material in terms of delta-adjusted exposure, the position has been reduced repeatedly and is much more modest today.

CLOSING THOUGHTS

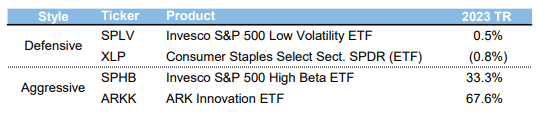

I am excited about the year ahead. It’s not an exaggeration to say 2023 was a relative disaster for many defensive-oriented stocks and, by extension, strategies (see table below). Despite this, Upslope’s uncorrelated portfolio delivered solid returns and remains positioned today to take advantage of volatility that seemingly has only one way to go (not down).

Exhibit 6: Total Returns for Select Index Funds

Source: Upslope, FactSet

As always, thank you for the trust you’ve placed in me and Upslope to manage a portion of your hard-earned money. If you have any questions at all, would like to add to your investment, or know a qualified investor who may be a good fit for Upslope’s atypical approach, please call or email anytime.

Sincerely,

George K. Livadas

Appendix A: Long/Short Strategy Performance (Net)

Source: Upslope, Interactive Brokers, Opus Fund Services, LICCAR, Sentieo, Morningstar

Note: Returns from inception to May 2023 shown for composite of all separate accounts invested according to Upslope’s core long/short strategy. Returns from June 2023 onward shown for Class A interest in Upslope Partners Fund, LP. Performance for a composite of all accounts managed by Upslope from inception is available upon request. Performance for S&P Midcap 400 represented by total return for related exchange-traded fund (ticker: MDY). Individual investment performance may vary. Investors should always review statements for actual results. Data from inception (August 29, 2016) to June 24, 2017 based on portfolio manager’s (“PM”) performance managing the strategy under a prior firm (as sole PM). Thereafter, PM managed the strategy/accounts on a no-fee basis through August 11, 2017, after which Upslope became operational. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

Appendix B: Portfolio Company (Long) Descriptions

AptarGroup (ATR): Specialty packaging business focused on pumps and sprayers, with a highly profitable, defensive, and growing Pharma unit. Misclassified and undervalued due to legacy/traditional packaging businesses (Food + Beverage, Beauty + Home), which historically contributed a majority of sales but just less than one-fifth of EBIT.

Ball Corp. (BALL): Leading global producer of aluminum cans for beer, carbonated soft drinks, and other beverages. Facing several temporary challenges that appear to be stabilizing, likely coinciding with the divestiture of the company’s Aerospace segment for a significant cash windfall.

CACI International (CACI): Specialized technology and consulting services provider, primarily to U.S. defense and intelligence agencies. Anticipate company will benefit from geopolitical tailwinds, strong position in cyber defense, and continued consolidation opportunities.

Chemring (OTCPK:CMGMF)[CHG.LN]: Niche, UK-based defense contractor focused on defensive flares, specialty explosives and cyber warfare. Setup for shares includes undemanding valuation, accelerating sector tailwinds, clean balance sheet, strategic assets, and an aggressive buyback.

Diploma (OTCPK:DPMAY)[DPLM.LN]: U.K.-based specialty distributor focused on essential consumable products across life sciences, seals (machinery), and controls (aerospace wiring/harnesses). Unique model and conservative M&A strategy have historically enabled attractive free cash flow growth through the cycle.

Finning (OTCPK:FINGF)[FTT.TO]: World’s largest dealer and distributor of Caterpillar (CAT) equipment, operating in Canada, South America, and UK/Ireland. Well-managed cyclical business, with “pick and shovel” type exposure to commodities and infrastructure.

Garmin (GRMN): Leading technology business known for its smartwatches, navigation, and control/communication systems across retail, aviation, marine and auto. Well-managed discretionary business that is a potential beneficiary of recent and prospective advances in public health.

Intel Corp. (INTC): Global semiconductor product manufacturer uniquely positioned to benefit in two extreme tails: continued melt-up of technology stocks or rising saber-rattling over Taiwan. Position structured as a portfolio hedge.

Japan Exchange Group (OTCPK:JPXGY)[8697.JP]: Largest exchange operator in Japan with exposure to equities, derivatives, and information services. Key driver and beneficiary of ongoing efforts to reform Japanese equity market structure and corporate governance standards.

Kongsberg Gruppen (OTCPK:NSKFF)[KOG.NO]: 200+ year old defense (missile/defense, remote weapons systems) and maritime (offshore, commercial) business, majority owned by Norwegian government. Dominant positions in niche products with cyclically attractive end markets, strong management team and solid balance sheet.

North West Co. (OTCPK:NNWWF)[NWC.TO]: Canada-based specialty retailer focused on geographically hard-to-reach regions, including Northern Canada, Alaska, Caribbean and BVI. Defensive underlying business model (75% food and faces little competition) that should benefit from elevated government investment and settlement measures.

nVent Electric (NVT): Leading provider of niche electrical protection and connection components and systems. Clear beneficiary of reshoring and electrification trends, with a developing track record and runway for inorganic growth.

Tecan Group (OTCPK:TCHBF)[TECN.SW]: Switzerland-based lab automation and consumables business, with leading market position in automated liquid handling. Attractive and defensible base business greatly enhanced by exceptional execution during the pandemic.

Appendix C: Terminology

Core Longs: Higher “quality” businesses (defined as low cyclicality, clean balance sheet, obvious and durable competitive advantages) managed with less valuation sensitivity (i.e. typically won’t exit a Core long solely because of valuation) and assuming a multi-year time horizon.

Tactical Longs: Traditional “value” investments of more modest quality (reasonably or very cyclical, currently experiencing operational, competitive or financial challenges) managed with greater valuation sensitivity (i.e. typically begin to exit if shares approach full valuation) and assuming a shorter time horizon (typically 6-18 months).

Starter Longs: Generally smaller, undisclosed longs that fall into at least one of the following groups:

- Ideas where I’ve completed enough work to establish a toehold, but still have more to do.

- Companies facing obvious short-term challenges where I believe the near-term path in shares is likely lower, but the stock is ‘cheap enough’ and outright attractive over the longer-term.

- ‘Counter-shorts’ – higher-beta longs with good risk/reward that trade more in-sync with Upslope’s shorts on a daily basis and can be used to manage overall net long exposure more effectively and tax-efficiently.

Alpha Shorts: Individual company short positions.

Hedges: Diversified index hedges (either long or short).

Important Disclosures

General

Upslope Capital Management, LLC (“Upslope”) is a Colorado registered investment adviser. Information presented is for discussion and educational purposes only. This presentation is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. Securities of the fund managed by Upslope are offered to selected investors only by means of a complete offering memorandum and related subscription materials which contain significant additional information about the terms of an investment in the fund (such documents, the “Offering Documents”). Any decision to invest must be based solely upon the information set forth in the Offering Documents, regardless of any information investors may have been otherwise furnished, including this presentation. Investments involve risk and, unless otherwise stated, are not guaranteed.

The information in this presentation was prepared by Upslope and is believed by Upslope to be reliable and has been obtained from public sources believed to be reliable. Upslope makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this presentation constitute the current judgment of Upslope and are subject to change without notice. Any projections, forecasts and estimates contained in this presentation are necessarily speculative in nature and are based upon certain assumptions. It can be expected that some or all of such assumptions will not materialize or will vary significantly from actual results. Accordingly, any projections are only estimates and actual results will differ and may vary substantially from the projections or estimates shown. This presentation is not intended as a recommendation to purchase or sell any commodity or security. Upslope has no obligation to update, modify or amend this presentation or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, project on, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

The graphs, charts and other visual aids are provided for informational purposes only. None of these graphs, charts or visual aids can and of themselves be used to make investment decisions. No representation is made that these will assist any person in making investment decisions and no graph, chart or other visual aid can capture all factors and variables required in making such decisions.

This presentation is strictly confidential and may not be reproduced or redistributed in whole or in part nor may its contents be disclosed to any other person without the express consent of Upslope.

Investment Strategy

The description herein of the approach of Upslope and the targeted characteristics of its strategies and investments is based on current expectations and should not be considered definitive or a guarantee that the approaches, strategies, and investment portfolio will, in fact, possess these characteristics. In addition, the description herein of the fund’s risk management strategies is based on current expectations and should not be considered definitive or a guarantee that such strategies will reduce all risk. These descriptions are based on information available as of the date of preparation of this document, and the description may change over time. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

The investment targets described in this presentation are subject to change. Upslope may at any time adjust, increase, decrease or eliminate any of the targets, depending on, among other things, conditions and trends, general economic conditions and changes in Upslope’s investment philosophy, strategy and expectations regarding the focus, techniques, and activities of its strategy.

Portfolio

The investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles or SMAs managed by Upslope and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. Past performance of Upslope’s investment vehicles, investments, or investment strategies are not necessarily indicative of future results. Investors should be aware that a loss of investment is possible. No representation is being made that similar profits or losses will be achieved.

Performance Results

Performance results presented are for information purposes only and reflect the impact that material economic and market factors had on the manager’s decision-making process. No representation is being made that any investor or portfolio will or is likely to achieve profits or losses similar to those shown.

Performance results are shown for the Fund’s Class A interests net of all fees, including management and incentive, Fund operating expenses, as well as all trading costs charged by the custodian, to the investor. Historical SMA composite performance calculations (inception – May 2023) have been independently verified by LICCAR, LLC. Subsequent returns based on Fund performance data from Opus Fund Services. Performance of individual investors may vary based upon differing management fee and incentive allocation arrangements, the timing related to additional client deposits or withdrawals and the actual deployment and investment of a client portfolio, the length of time various positions are held, the client’s objectives and restrictions, and fees and expenses incurred by any specific individual portfolio. Performance estimates are subject to future adjustment and revision. The information provided is historical and is not a guide to future performance. Investors should be aware that a loss of investment is possible.

This presentation cannot and does not guarantee or predict a similar outcome with respect to any future investment. Upslope makes no implications, warranties, promises, suggestions or guarantees whatsoever, in whole or in part, that by participating in any investment of or with Upslope you will experience similar investment results and earn any money whatsoever.

Indices Comparisons

References to market or composite indices, benchmarks, or other measures of relative market performance over a specified period of time are provided for information only. Reference or comparison to an index does not imply that the portfolio will be constructed in the same way as the index or achieve returns, volatility, or other results similar to the index.

Indices are unmanaged, include the reinvestment of dividends and do not reflect transaction costs or any performance fees. Unlike indices, Upslope’s investments will be actively managed and may include substantially fewer and different securities than those comprising each index. Upslope’s performance results as compared to the performance of HFRX Equity Hedge Index and S&P Midcap 400 (ticker: MDY) are for informational purposes only. HFRX Equity Hedge Index is an index that maintains positions both long and short in primarily equity and equity derivative securities. S&P Midcap 400 (ticker: MDY) is a stock market index that serves as a gauge for the U.S. mid-cap equities sector.

The investment program of Upslope does not mirror the indices and the volatility may be materially different than the volatility of the indices. Direct comparisons between Upslope’s performance and the aforementioned indices are not without complications. The indices may be unmanaged, may be market weighted, and indices do not incur fees and expenses. Due to the differences among the portfolios of Upslope and the aforementioned indices, no such index is directly comparable to Upslope.

Fund Terms

The summary provided herein of the terms and conditions of the fund managed by Upslope does not purport to be complete. The fund’s Offering Documents should be read in its entirety prior to an investment in the fund.

Footnotes

1Returns prior to June 2023 are for a composite of all separate accounts invested according to Upslope’s core long/short strategy. Subsequent returns are for Class A interest in Upslope Partners Fund, LP. See important performance-related details and disclosures in Appendix A.

2Calculated as: (Net return since inception – 2.0% risk-free rate) / downside deviation.

3Net exposure adjusted for hedges that rolled off in early January.

4The format for this section has been updated, and while not as “pretty” as before, this layout hopefully provides a clearer snapshot of the portfolio.

5“Starter” that has since been exited.

6Initiated as a “Starter” in Q3 2023.

7Initiated as a “Starter” in Q3 2023.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.