malerapaso

Introduction

Last year, I started covering drug manufacturing giant Amgen Inc. (NASDAQ:AMGN).

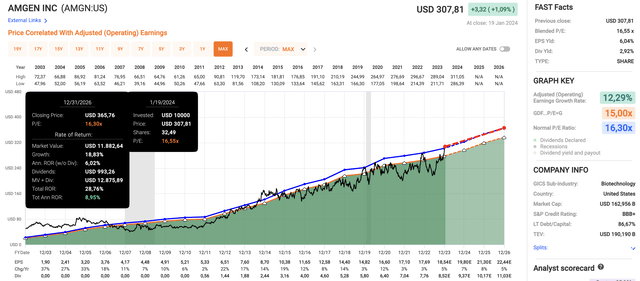

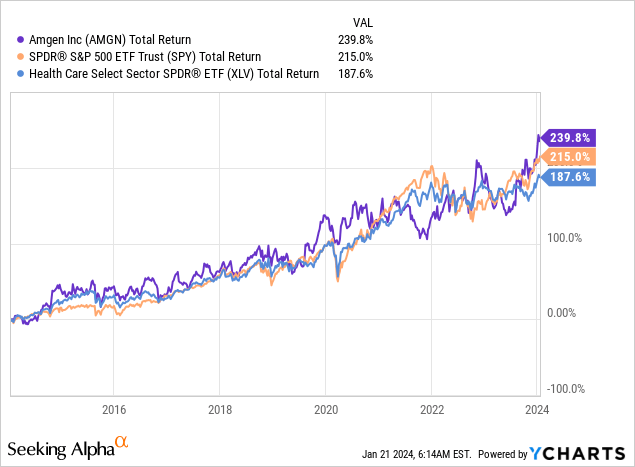

On June 30, I wrote an article titled “Amgen: A Healthcare Bargain With A 4% Yield.” Since then, shares are up 41%, beating the 9.5% performance of the S&P 500 (SP500) by a wide margin.

This rally restored the company’s longer-term performance, as it is now up 240% over the past ten years (including dividends). This beats the strong performances of the S&P 500 and the Health Care Select Sector SPDR Fund ETF (XLV).

My most recent article was written on November 11. Since then, the stock has returned 17%.

Here’s a part of my takeaway back then:

[…] The addition of TEPEZZA, KRYSTEXXA, and UPLIZNA expands its inflammation portfolio, ensuring global reach and capabilities.

With a solid financial foundation, innovative support, and anticipated growth, AMGN’s third-quarter success underscores its future potential.

The company’s commitment to shareholder value is evident through a strong dividend yield, share buybacks, and impressive historical performance.

With a favorable outlook and compelling fundamentals, AMGN appears poised for sustained double-digit annual returns.

With that said, it’s time for an update. Not only do we need to re-assess the risk/reward after the recent rally, but we also have a load of new comments and developments to work with, as the company presented at both the Evercore ISI HealthCONx Conference in November and the JPMorgan Health Conference earlier this month.

While the risk/reward hasn’t gotten better after the recent share price surge, I am sticking to a Buy rating, as the future looks too promising.

So, let’s get to the details!

Amgen Has A Very Promising Future

If I had to summarize the past few months, I would say that Amgen finally benefits from lower business uncertainties and a more bullish market, in general.

While the company did not influence investors’ decision to bet on a more dovish Fed this year, it did reap the benefits from the completed acquisition of Horizon Therapeutics.

As I wrote in my prior article, I noted that this $28 billion deal significantly expanded the company’s long-term growth potential – especially in a market where major biotech companies are facing expensive patent losses in the years ahead.

- Expanding Inflammation Portfolio: The addition of TEPEZZA, KRYSTEXXA, and UPLIZNA strengthens Amgen’s leading position in treating rare inflammatory diseases, enhancing its ability to address diverse medical needs.

- Global Reach and Capabilities: Amgen gains from its extensive presence in over 100 countries worldwide and its expertise in biologics research, development, and manufacturing. This positions them well to continue delivering high-quality medicines.

- Financial Strength and Innovation Support: The acquisition is expected to generate robust cash flow, supporting ongoing investments in innovation. This ensures that Amgen can continue to develop new and impactful treatments while maintaining a commitment to a strong credit rating.

- Anticipated Growth: The acquisition is projected to accelerate revenue growth and is expected to positively impact non-GAAP earnings per share from 2024 onward.

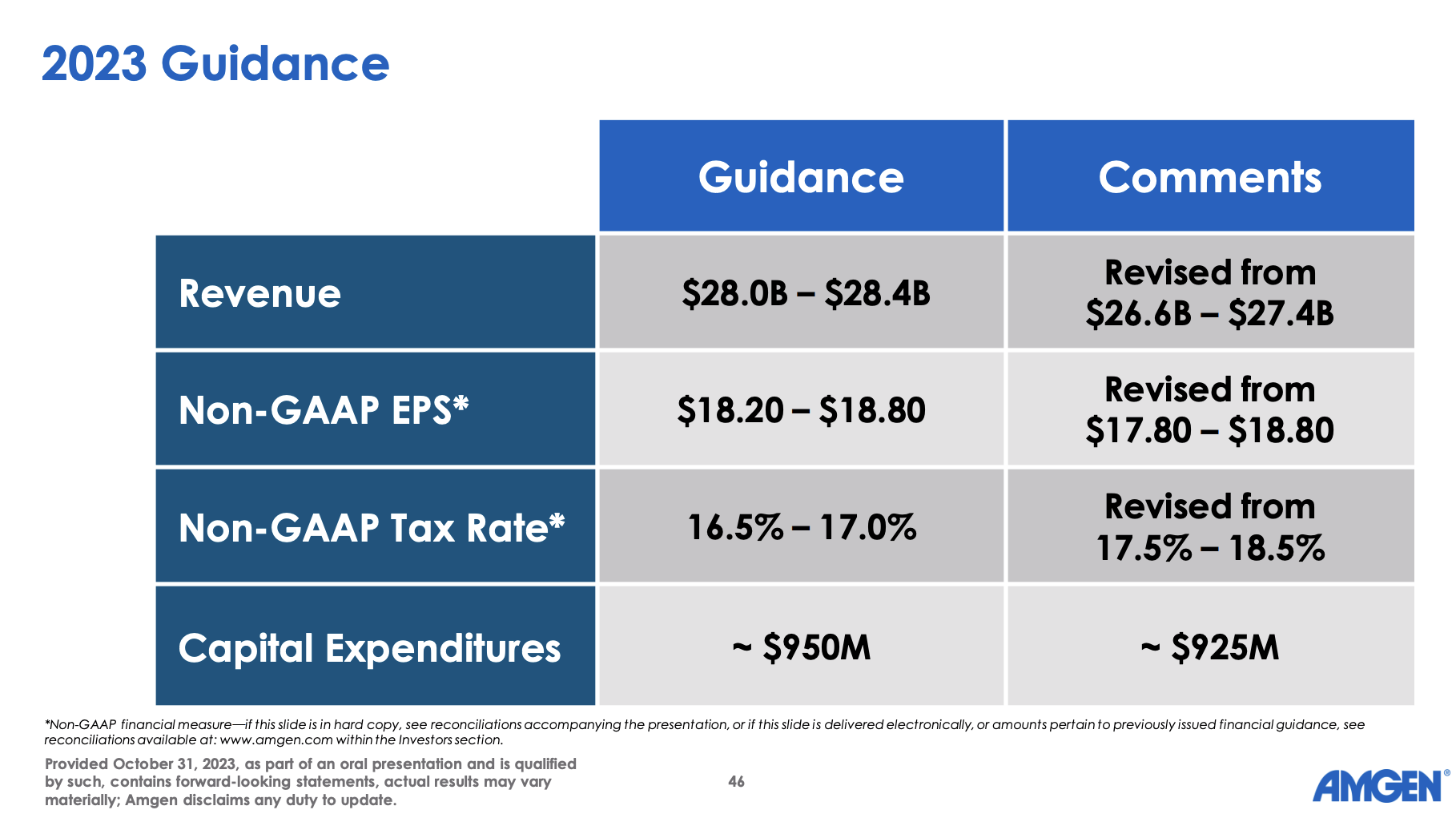

During its Q3 2023 earnings release, the company immediately updated its full-year guidance to reflect the deal.

The new revenue guidance range is $28.0 billion to $28.4 billion, and the non-GAAP earnings per share range was narrowed to $18.20 to $18.80.

Amgen

As we can see in the table above, the biggest factor was the lower bound of the earnings per share range.

Furthermore, the company expects Q4 results to include Horizon’s business without significant non-GAAP EPS dilution.

With that said, on February 6, AMGN is expected to report its earnings after the market closes.

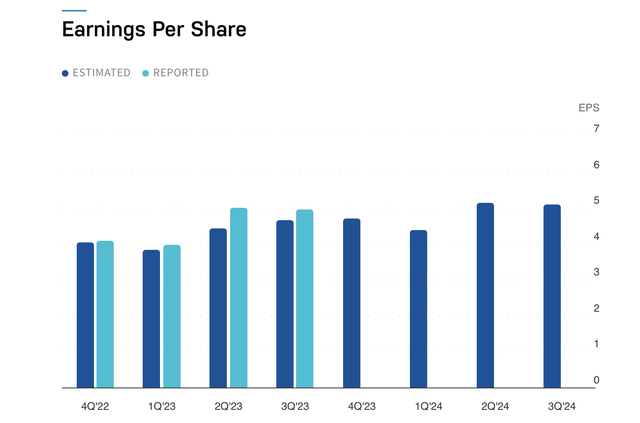

Analysts are looking for $4.70 in EPS, which is based on 11 estimates and one upgrade over the past four weeks. $4.70 in EPS would indicate a 15% year-over-year increase.

Over the past two years, AMGN has never missed EPS estimates!

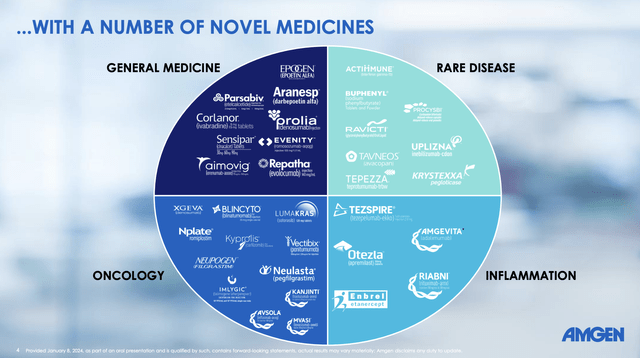

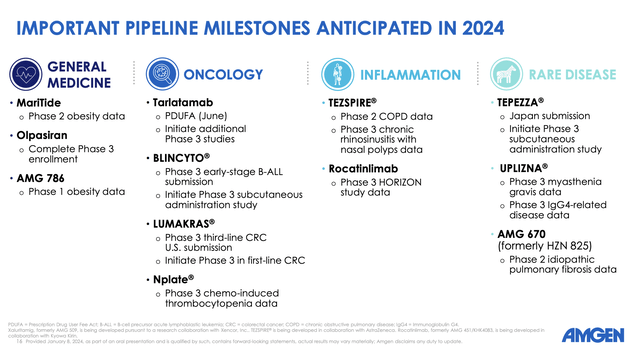

With that in mind, Amgen’s business is structured into four pillars: the general medicine franchise, oncology, inflammation, and the recently formed rare disease business unit.

During the JPMorgan conference earlier this month, the company expressed confidence in the growth of each pillar due to a combination of existing market products and innovations in the pipeline.

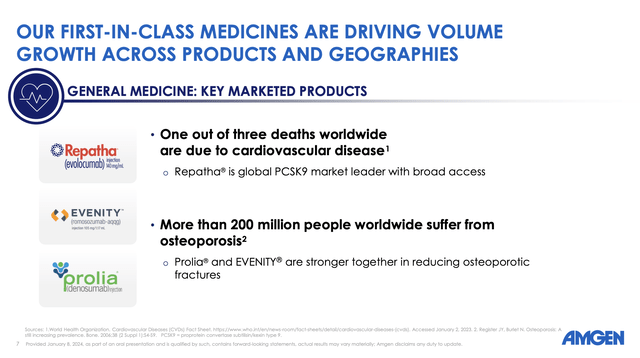

- Amgen’s general medicine franchise is a key growth pillar, including drugs targeted at significant diseases. Repatha, a global leader in PCSK9 inhibition therapies, performed well in 2023. The bone health franchise, represented by EVENITY and Prolia, also showed strong performance. According to Amgen, Repatha, which is focused on addressing the unmet medical need for patients at high risk of cardiovascular diseases, is expected to maintain momentum in 2024.

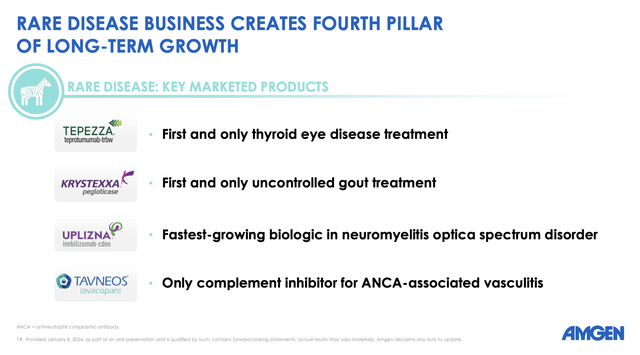

- The newly established rare disease business unit is a strategic growth pillar for Amgen. The unit focuses on approved medicines like TEPEZZA, KRYSTEXXA, UPLIZNA, and TAVNEOS, all performing well in the market. These medicines address thyroid eye disease, severe and uncontrolled gout, neuromyelitis optica spectrum disorder, and ANCA-associated vasculitis, respectively.

The rare disease pipeline of this segment includes ongoing studies for existing medicines and introduces innovative programs like dazodalibep and AMG 670, addressing disorders such as Sjogren’s syndrome and idiopathic pulmonary fibrosis.

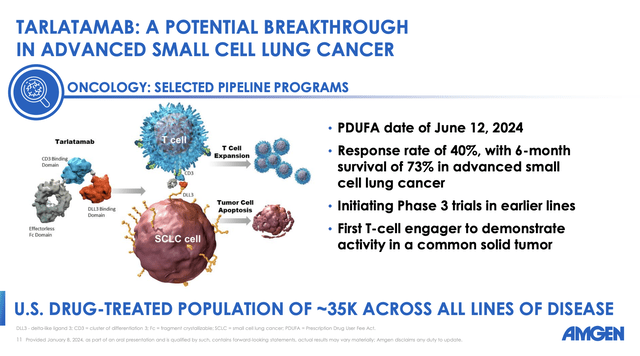

- Amgen’s broad oncology portfolio serves a significant proportion of cancer patients, with as many as 1 in 5 receiving an Amgen medicine. Key oncology drugs, including BLINCYTO, Vectibix, Nplate, and Kyprolis, achieved double-digit volume growth in 2023.

The oncology pipeline features ongoing studies for various therapies, including LUMAKRAS, an inhibitor for KRAS G12C, and antibody-based programs like bemarituzumab for gastric cancer.

- Meanwhile, Amgen’s inflammation franchise, focused on key products like ENBREL, continues to be a leader in addressing autoimmune disorders. Notably, TEZSPIRE, an innovative medicine for severe asthma, has been approved and is expected to contribute to growth.

Ongoing studies explore new indications for TEZSPIRE, including COPD, eosinophilic esophagitis, and chronic rhinosinusitis.

In general, all of its areas are expected to have major milestones this year, with various Phase 3 studies and pipeline updates.

These promising growth areas are just one reason for optimism.

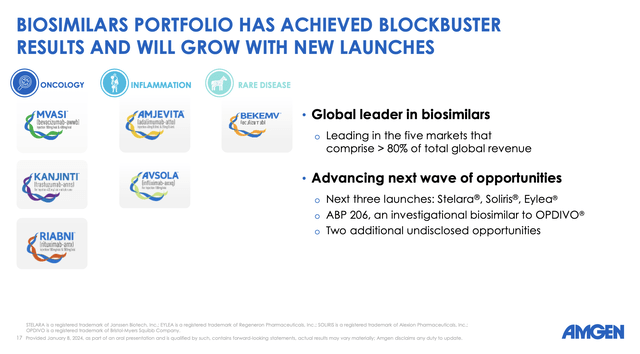

Amgen also holds a global leadership position in biosimilars, with existing brands integrated into key therapeutic areas.

For example, biosimilars for STELARA, SOLIRIS, EYLEA, and OPDIVO are in the pipeline, with expectations for future launches.

Amgen makes the case that its biosimilar business has demonstrated attractive returns for shareholders and contributes to providing society with choice and reliable quality in biosimilar options, which is essentially what biosimilars are all about.

I am quite happy with these developments, as the biotech industry is facing massive patent losses in the years ahead, which can be exploited by biosimilars.

This is what BioSpace wrote in 2022:

A patent cliff is looming once again for the biopharma industry, putting some $236 billion in pharmaceutical sales at risk between now and 2030. For context, the top 10 biopharmas in 2021 had total, global sales of approximately $512 billion. In the next eight years, more than 190 drugs will go off-patent for these companies. Of those, 69 are blockbuster drugs.

But wait, there’s more!

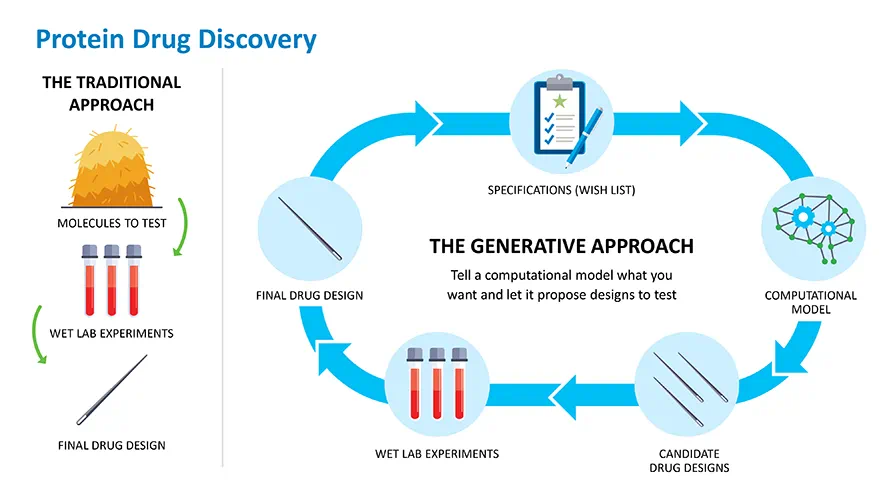

The big tech companies in the world aren’t the only ones benefitting from innovation in artificial intelligence (“AI”).

Healthcare companies have found AI to be a fantastic engine for growth.

Among them is Amgen.

As part of its long-term growth plans beyond 2030, Amgen is investing heavily in artificial intelligence, with a focus on generative AI and the inducible proximity platform.

These technologies are expected to play a major role in advancing the field of biotechnology.

So we are trying to position Amgen at the forefront of this exciting new opportunity of harnessing AI and generative AI for the benefit of the biotechnology business.

And so we’re investing heavily, as you would expect, in artificial intelligence across the company and advancing our investments in human data, which we’ve been talking to you about now for more than a decade, and harnessing those tools of AI against that data. – AMGN JPMorgan Healthcare Conference.

Amgen

Before we move over to the next part of the article, I also need to mention that Amgen has its eyes on the obesity market, which may be one of the hottest healthcare segments right now.

As reported by Fierce Pharma (emphasis added):

So far, the company has several assets to show for it. Aside from its phase 2 candidate MariTide, or maridebart cafraglutide, and an oral small molecule dubbed AMG 786 that’s currently in phase 1, Amgen has a preclinical pipeline of “a half dozen or so” obesity candidates that are “rapidly advancing.”

The drugmaker looks to stand out from the tough competition with a fresh approach. MariTide “agonizes the GLP-1 receptor while antagonizing the gastric inhibitory polypeptide receptor,” a strategy the company settled on after looking at human genetic data, Bradway said. Amgen hopes studies will prove that the two interventions together can provide quicker and more effective weight loss and possibly better weight loss maintenance.

Looking at the 2024 pipeline overview I provided in this article, we’ll get phase 2 study results this year, which I am looking forward to.

Shareholder Value

Even after its recent massive surge, AMGN still deserves a Buy rating.

Using the data in the chart below:

- Analysts agree with the rose outlook and expect the EPS growth to average 7% per year in the 2024-2026 period.

- The company is currently trading at a blended P/E ratio of 16.6x, which is a bit above its long-term normalized valuation of 16.3x.

- A combination of its 2.9% dividend yield, a 16.3x earnings multiple, and expected EPS growth paves the road for a theoretical annual return of 9% through 2026.

- Since 2003, AMGN has returned 10% per year.

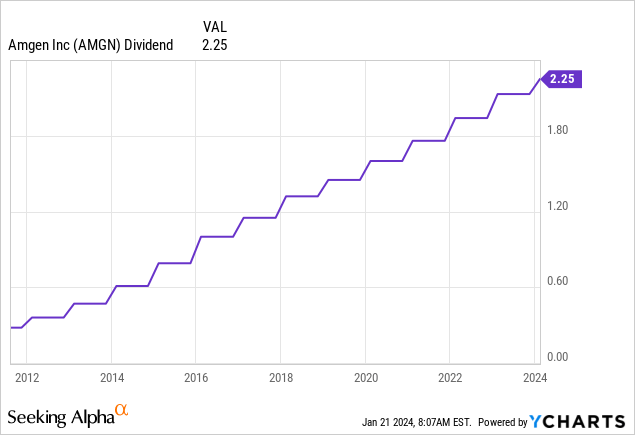

Speaking of its dividend, after raising its dividend by 5.6% on December 12, 2023, it now pays $2.24 per share per quarter, bringing the yield to 2.9%.

Furthermore, the dividend is protected by a 45% 2024E payout ratio.

The five-year dividend CAGR is 10.0%.

Since the company started to pay a dividend in 2011, it has hiked its dividend every single year.

The dividend is also protected by a 2024E net leverage ratio of 2.2x EBITDA.

This balance sheet comes with a BBB+ rating, just one step below the A range.

All things considered, I continue to like the value AMGN brings to the table.

I have little doubt the company will continue to deliver strong long-term value, thanks to a fantastic product portfolio, a very promising pipeline, consistent dividend growth, and a decent valuation.

Takeaway

Amgen has seen an impressive 41% surge since I initiated coverage last year, outperforming the S&P 500 by a wide margin.

The acquisition of Horizon Therapeutics and the expansion of its rare disease business unit position Amgen Inc. for substantial long-term growth, while its diverse portfolio, including biosimilars and a strategic focus on AI, reflects its commitment to innovation.

Despite the recent rally, AMGN remains a solid investment with a 2.9% dividend yield, a 10% annual return since 2003, and consistent dividend growth.

While I would prefer a pullback before buying AMGN, the company’s strong fundamentals and promising pipeline continue to make it a compelling buy.

Pros And Cons Of Investing In AMGN

Pros:

- Diversified Portfolio: With a strategic focus on general medicine, oncology, inflammation, and rare diseases, AMGN provides diversified growth opportunities. This also includes a focus on biosimilars and obesity drugs.

- Innovation in AI: AMGN’s investment in artificial intelligence positions it at the forefront of biotechnology advancements.

- Consistent Dividend Growth: A 10% annual return since 2003, a 9% annual return forecast, and a recent 5.6% dividend increase underscore its long-term potential.

Cons:

- Market Volatility: The healthcare industry and general market dynamics may impact AMGN’s stock performance.

- Pipeline Dependency: Potential pipeline setbacks could affect growth prospects.