ExxonMobil could hit a half-trillion-dollar market cap in 2024.

ExxonMobil (XOM 1.96%) and the broader energy sector have been on a tear the last month, crushing the S&P 500‘s 3.6% gain. A big part of the run-up is due to rising crude oil prices.

Prices per Brent crude oil barrel (the international benchmark) rose around 11% in the first three months of the year — a big move for what was already a decently high oil price.

Here’s why ExxonMobil is well positioned to capitalize on higher oil prices and why the dividend stock has what it takes to make a new all-time high.

Image source: Getty Images.

A dream scenario for ExxonMobil

On Oct. 11, ExxonMobil announced its merger with Pioneer Natural Resources. Exxon stock had just hit an all-time high, but so had many exploration and production companies.

The merger looked like a common late-cycle move that cyclical companies will make when they earn outsized profits and need somewhere to deploy cash. However, Exxon stock, along with oil prices, tumbled toward the end of 2023 while the S&P 500 was on the rise. For a moment, it looked like Exxon had, once again, overextended itself. But then, oil prices started rising again, and renewed confidence flooded the oil patch.

Oil prices are strong, with Brent prices around $87 per barrel and West Texas Intermediate (the U.S. benchmark) around $83 per barrel.

For context, Brent prices averaged $82.41 in 2023. In its March short-term energy outlook, the U.S. Energy Information Administration updated its 2024 forecast to $87 per barrel Brent. Its earlier forecast called for $82 per barrel.

Oil prices above $80 per barrel are a dream scenario for ExxonMobil. After all, its corporate plan is based on $60 per barrel Brent. Anything above that is more cash it can use to reward shareholders with buybacks, make another acquisition, raise the dividend, and more.

Rinse and repeat

If Exxon can simply repeat its results from last year, it would be a huge win for shareholders.

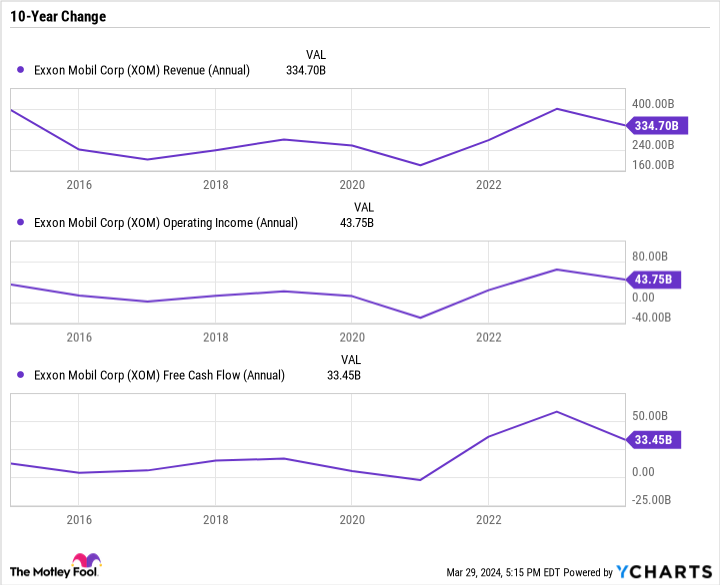

XOM Revenue (Annual) data by YCharts

Exxon posted sales and earnings near 10-year highs, a 13.1% operating margin (also near a 10-year high), and $33.5 billion in free cash flow. It returned $32.4 billion to shareholders through buybacks and dividends. Granted, investors shouldn’t expect too many buybacks in the near term due to the merger with Pioneer.

The higher the oil price, the faster Exxon can grow and the more money it can return to shareholders. But even at $60 Brent, it is still going to achieve its long-term objectives and pay and raise the dividend.

One less box to check

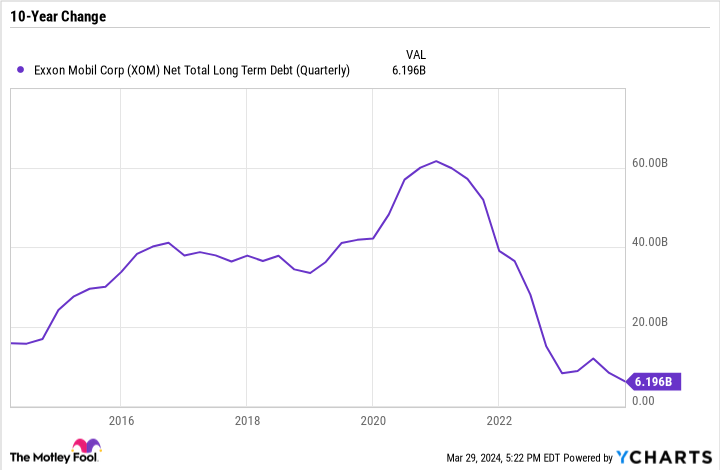

Normally, when companies generate outsized profits, they use some cash to pay down debt and improve the balance sheet. But Exxon has already done that.

XOM Net Total Long Term Debt (Quarterly) data by YCharts

The last few years have completely transformed Exxon’s financial health. It went from a dangerously high net debt position to having next to no net debt on the balance sheet — all thanks to high oil prices.

With the balance sheet in tip-top shape, Exxon can focus its FCF on dividends, buybacks, and long-term investments in oil and gas or its low-carbon efforts.

The stage is set

Exxon is down a little over 3% from its all-time high. If 2024 puts up similar results to 2023, and the outlook seems bright for 2025, I think Exxon will have no trouble setting a new record high and will probably outperform the S&P 500 too.

Despite Exxon’s recent success, it’s important to remember that it heavily depends on prices and the balance between oil and gas supply and demand. However, when Brent crude oil is above $80 per barrel, this is essentially a perfect business. And even when Brent is $60 per barrel, it’s still a very good business.

That kind of margin for error should give investors a lot of confidence about an investment in ExxonMobil. Given that the company should generate around the same profit this year as last year, its 13.1 price-to-earnings ratio seems more than reasonable. Throw in a 3.3% dividend yield, and Exxon is a balanced bet for 2024 and beyond.