Olivier Le Moal

I will say this pick is based more on a hunch (honed over 37 years of trading) than any concrete news catalyst or technical trading evidence. I bought a stake in Gilead Sciences (NASDAQ:GILD) recently on the view a bear market and recession will eventually force investors to move money into defensive ideas like pharmaceuticals. This group has an excellent history of witnessing massive flight-to-safety money flows during stressful periods overall on Wall Street.

Specifically, Gilead has performed admirably during the last two major credit crises of the original Tech Bubble bursting between 2000-03, plus the Great Recession (real estate bust) of 2007-09. In addition, the early 2020 pandemic equity market dump with a minor quarter of GDP contraction, and 2022 bear market in stocks proved some of the best times to own this biotech, now Big Pharma business.

Which leads me to believe – Gilead’s years of underperformance could be ready to reverse strongly to the upside the remainder of 2024 and perhaps all of 2025, if trouble lies ahead for the U.S. economy.

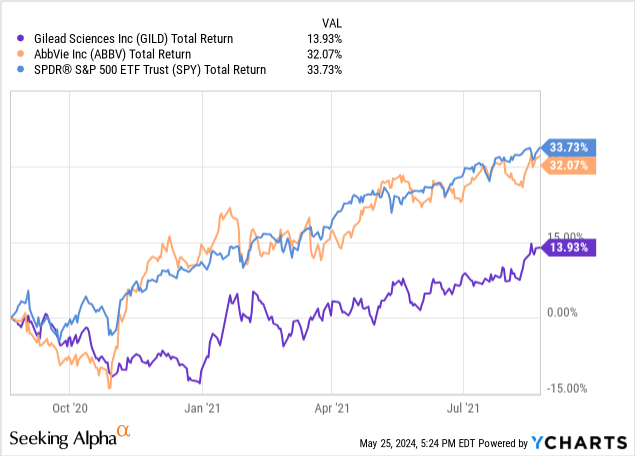

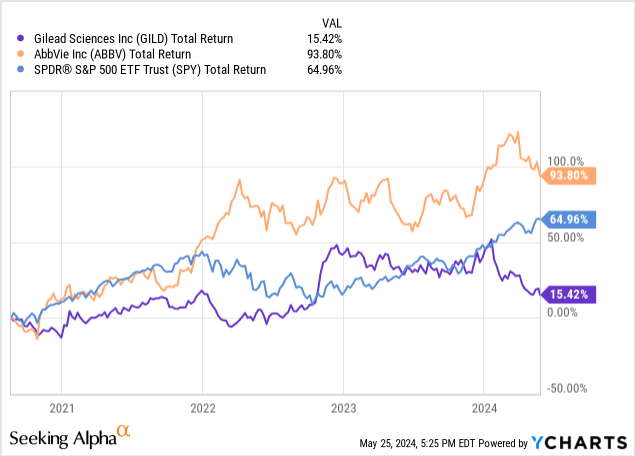

Let me start with a brief personal history note. The only other time I mentioned this name in a full-length article on Seeking Alpha was during August 2020 here. I explained the stock was likely to “underperform” the general market represented by the S&P 500 index and specifically a higher-growth, better trading momentum idea in AbbVie (ABBV). Over the next 12 months, AbbVie achieved a total return of +34%, the S&P 500 gained +32% with dividends, and Gilead lagged with a +14% advance (pictured below). Measured over the last roughly four years, AbbVie has delivered a total return of +94% and the S&P 500 +65%, versus a relatively weak Gilead advance of +15%.

YCharts – Gilead vs. AbbVie and S&P 500 ETF, 12-Month Total Returns, After August 22, 2020 Article YCharts – Gilead vs. AbbVie and S&P 500 ETF, Total Returns, Since August 22, 2020 Article

So, I hope this successful past projection affords some credibility to my next forecast. Much of my research effort over the past month has centered on the improving momentum picture, often with lower-volume, minimal-volatility reversal patterns in the pharmaceutical sector (which can be the kind with great odds of upside trading success). Let’s review the quickly evolving Gilead bull argument in more detail.

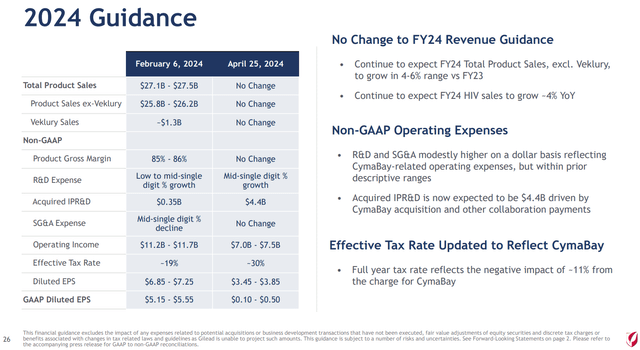

Main Reason for Early 2024 Weakness

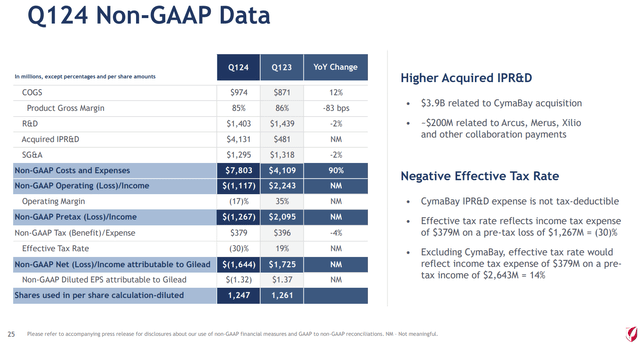

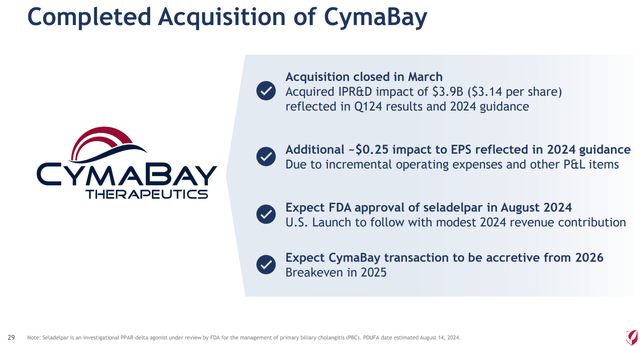

One excuse for investor selling in Gilead of late revolves around the earnings hit taken to write-off expenses related to its recently closed CymaBay Therapeutics acquisition. Essentially, some of the buyout value is “expensed” upfront, instead of overtime like goodwill or intangibles. The In-Process Research & Development (IPR&D) one-time Q1 number of $3.9 billion is explained with some slides below, found inside its earnings presentation. The good news is this was a non-cash accounting expenditure for Gilead, which adds a new drug anticipated to be approved and launched later in 2024.

Gilead Sciences – Q1 2024 Earnings Presentation, Accounting for CymaBay Acquisition Gilead Sciences – Q1 2024 Earnings Presentation, Accounting for CymaBay Acquisition Gilead Sciences – Q1 2024 Earnings Presentation, Accounting for CymaBay Acquisition

The “reduced” earnings guidance from management on the upfront immediate accounting charge for its buyout of CymaBay has upset some shareholders. A number of them decided to exit their shares on the initially dilutive deal announced in February. A major chunk of the -10% share price decline over three months since can be attributed to this management decision. On top of the January announcement of weak trial results for its best-selling cancer drug Trodelvy in patients with lung cancer, investor moods on Gilead have soured considerably.

To me, this selloff may have opened a smarter buy entry for those looking forward to a resumption of $7+ EPS next year, alongside steady and enviable free cash flow generation approaching 10% on the stock quote. So, the short-term pain caused by its CymaBay purchase may, in fact, serve to produce even better long-term gains for new share purchases in the $65 area.

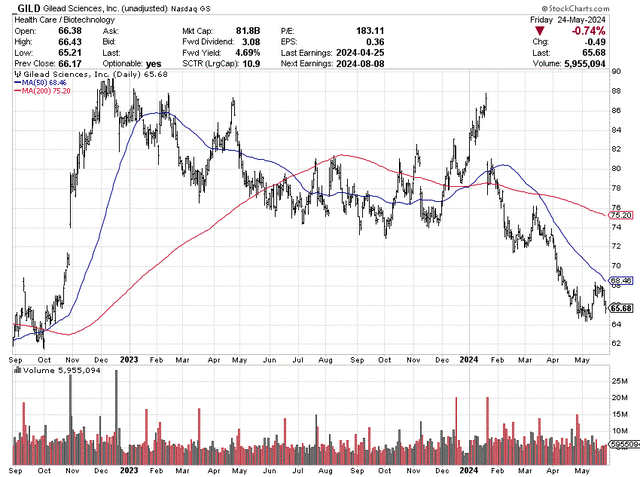

StockCharts.com – Gilead Sciences, 21 Months of Daily Price & Volume Changes

Defensive Buys = Drug Stocks + Trouble Hits

The logic for a major bottom in the prescription drug group as a whole during April-May is a Wall Street bear market and U.S. recession could be approaching faster than conventional wisdom believes possible. All we may need for a rotten price decline on Wall Street to materialize is a “black swan” event, which by definition gives you little time to prepare your portfolio. This view aligns with why Warren Buffett‘s Berkshire Hathaway (BRK.A) (BRK.B) huge cash buildup is taking place, or important financial titans like Jamie Dimon, CEO of America’s largest bank JPMorgan Chase (JPM), are selling their stock and warning we are not out the woods yet from credit tightening.

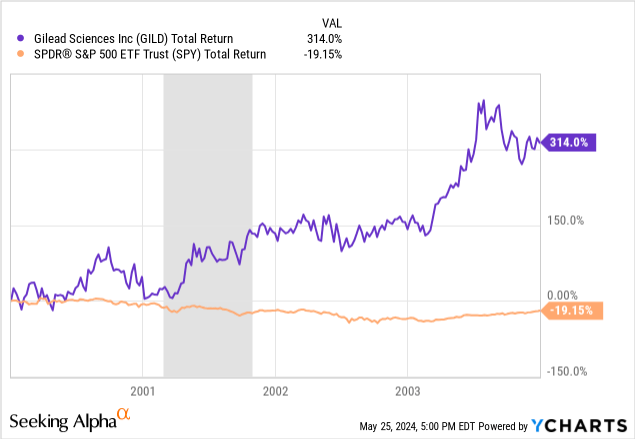

Big Pharma names in particular have an “A+” trading record when large bear markets and recessions arrive. And, one of the best individual names to own during trouble in the markets since the year 2000 Tech Bubble peak has been Gilead. Let me illustrate the bullish countertrend thesis by showing some historical graph patterns for the stock.

Dotcom Tech Bust of 2000-03

One of the best relative performance periods to own Gilead vs. pricing action in the SPDR S&P 500 ETF (SPY) took place AFTER the Dotcom Technology Bubble peak in the year 2000. On the chart below, you can compare GILD’s +314% total return gain vs. the -19% SPY loss over four years into the end of 2003. Relative performance was even better, measured against the Tech-heavy NASDAQ 100 implosion of -70% over the same span (not pictured)!

YCharts – Gilead Sciences vs. S&P 500 ETF, Total Returns, Jan 2000 to Dec 2003

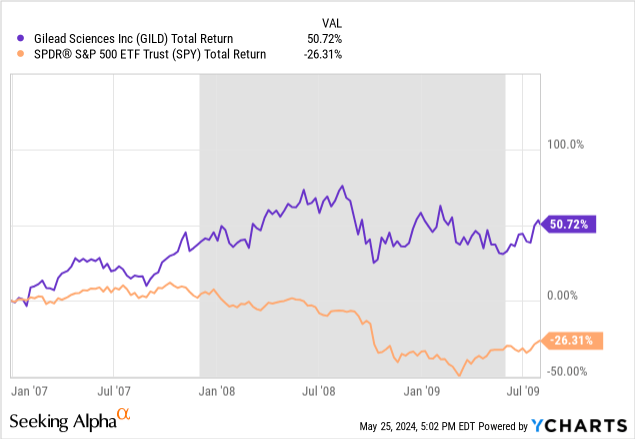

2007-09 Great Financial Crisis

Again, a terrific time to own Gilead came during the 2007-09 Great Recession and bear market on Wall Street. From January 2007 to July 2009, GILD experienced a total return gain of +51% vs. the equivalent-period -26% investment loss for SPY investors.

YCharts – Gilead Sciences vs. S&P 500 ETF, Total Returns, Jan 2007 to July 2009

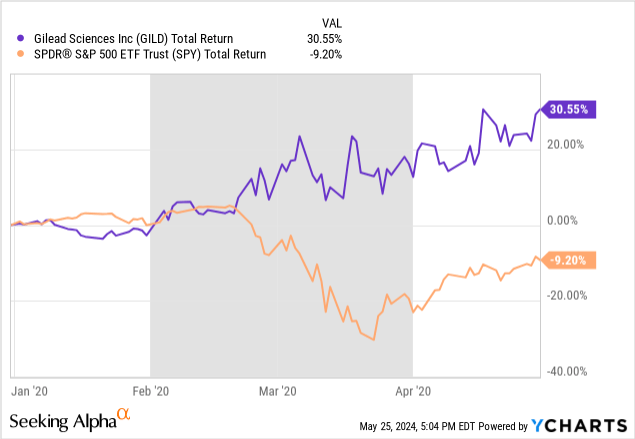

2020 Pandemic Shutdown

Even during the early 2020 COVID pandemic period, Gilead experienced very robust flight-to-safety inflows. Between January 1st and the end of April of that fateful year, GILD rose consistently, despite wild daily swings and an overall decline in the S&P 500 index. Even after the Fed announced Unlimited QE and government bailouts were announced to stabilize Wall Street in March-April, GILD was able to climb +30% vs. the net -9% decline in SPY over four months.

YCharts – Gilead Sciences vs. S&P 500 ETF, Total Returns, Jan to Apr 2020

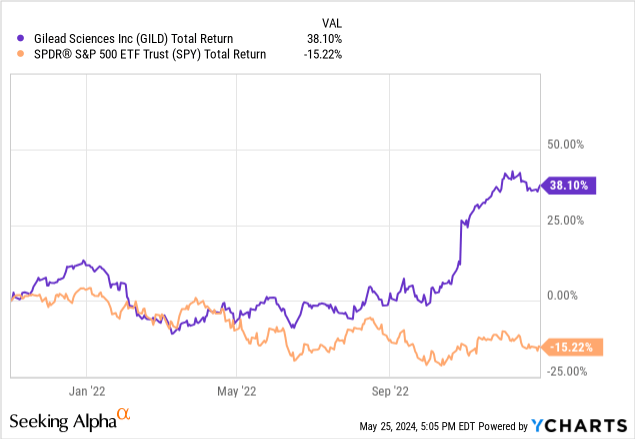

2022 Interest Rate Spike

My final example of a countertrend rally for Gilead appeared just a few years ago during 2022’s bear market in equities, caused by short-term bank interest rates rising from near ZERO to a level above 4%. Had you purchased shares in November 2021 when most Big Tech names peaked, and held until the end of 2022, GILD’s +38% total return advance trounced the -15% drop in net SPY worth?

YCharts – Gilead Sciences vs. S&P 500 ETF, Total Returns, Nov 2021 to Dec 2022

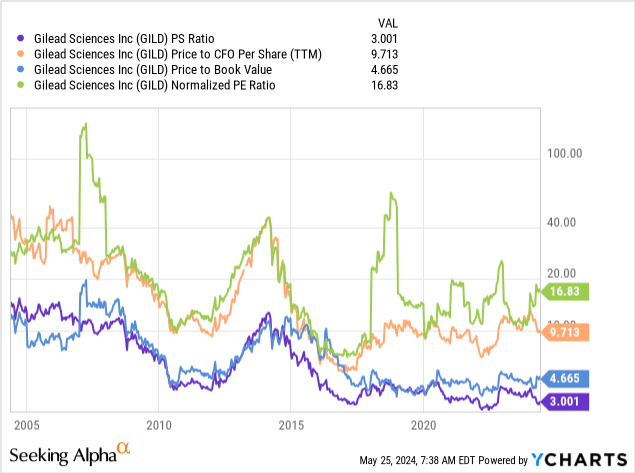

Improving Valuation Stats

So, if a similar defensive-backed, money inflow move higher is approaching for Gilead, what kind of valuation supports each share? Actually, a much-improved underlying foundation exists than in the recent past. My research suggests it is one of the “cheapest” Big Pharma choices to own today.

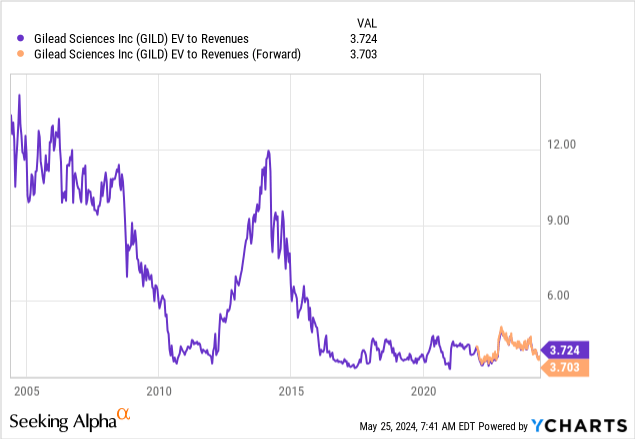

A 20-year review of price to sales, cash flow, book value, and “normalized” earnings is drawn below. Is Gilead a once-in-a-generation bargain idea today? No, but the valuation on trailing operating metrics has been higher about 75% of the time since 2004.

YCharts – Gilead Sciences, Price to Trailing Fundamentals, 20 Years

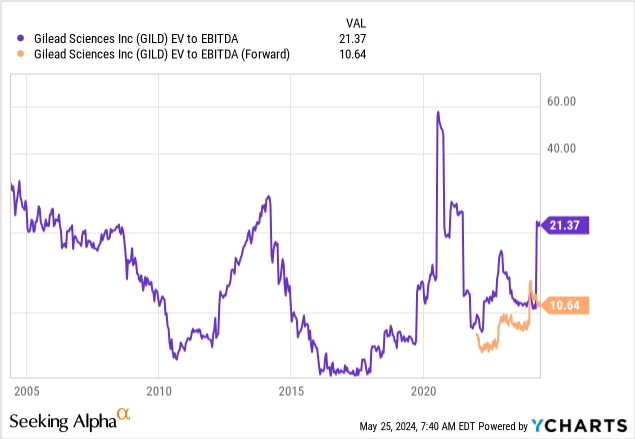

With a number of bolt-on takeovers accomplished since my 2020 article, the growth argument has moved in the right direction. Yet, the amazing business expansion found 10-20 years ago is no longer the main upside story. Looking at total enterprise value (equity + debt – cash), forward estimated ratios on EBITDA of 10.6x and sales of 3.7x are a good 50% and 30% lower (respectively) than August 2020 valuations.

YCharts – Gilead Sciences, EV to EBITDA, 10 Years YCharts – Gilead Sciences, EV to Sales, 10 Years

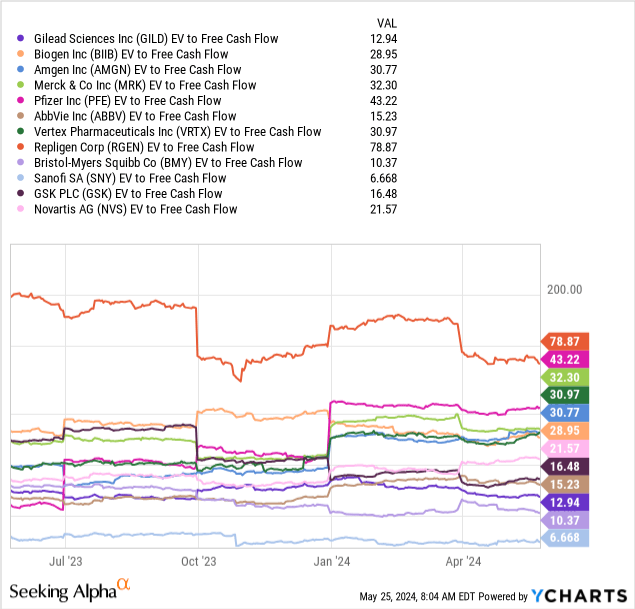

The most interesting and bullish valuation data revolves around free cash flow generation. Compared to the largest biotechnology and pharmaceutical rivals, Gilead’s EV to trailing Free Cash Flow multiple of 13x is one of the lowest in the group. This sort list includes Biogen (BIIB), Amgen (AMGN), Merck (MRK), Pfizer (PFE), AbbVie, Vertex (VRTX), Repligen (RGEN), Bristol-Myers Squibb (BMY), Sanofi (SNY), GSK plc (GSK), and Novartis (NVS). Most other Big Pharma names not pictured either have little free cash flow generation, or unsustainable rates beyond 2024-25 on patent expirations and changing market demand. For example, Eli Lilly (LLY) is heavily investing in new production for GLP-1 product, and BioNTech (BNTX) is coming off high COVID vaccine-related sales rates.

YCharts – Gilead Sciences vs. Big Pharma Peers, EV to Free Cash Flow, 1 Year

Dividend Story

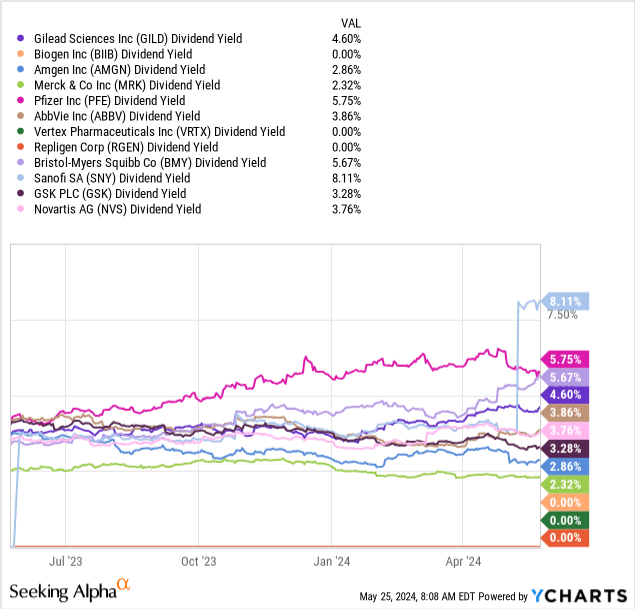

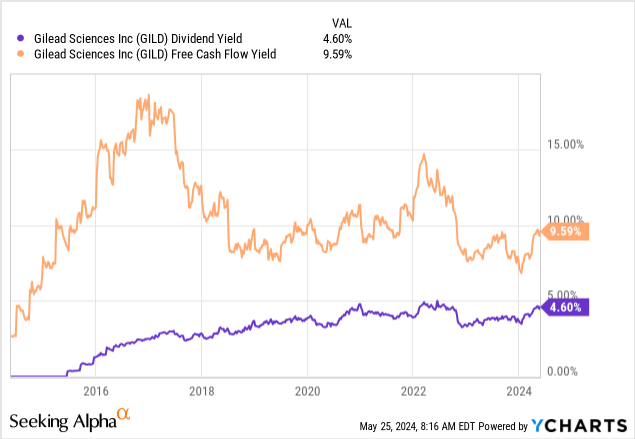

In terms of cash in your pocket, Gilead’s 4.6% dividend yield is also one of the highest in the sector right now. As an aside, you will notice Sanofi scores quite well for its valuation on both FCF and dividend yield. I mentioned SNY as one of my top Big Pharma choices in an article during March here.

YCharts – Gilead Sciences vs. Big Pharma Peers, Dividend Yields, 1 Year

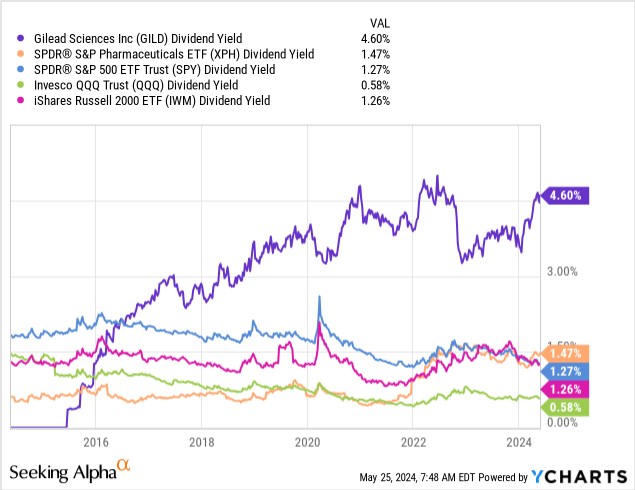

For a little perspective, Gilead’s dividend yield spread to the rest of the U.S. stock market is about as wide (in a positive fashion) as it has ever been, since starting a dividend in 2015. The 4.6% yield is at least 3x the equivalent cash distribution levels of the SPDR S&P Pharmaceuticals ETF (XPH), SPDR S&P 500 ETF, Invesco QQQ Trust (QQQ), and iShares Russell 2000 ETF (IWM).

YCharts – Gilead Sciences vs. U.S. Equity Averages, Dividend Yield, Since 2015

Is Gilead’s high dividend yield sustainable? The current dividend sent to shareholders represents less than 50% of trailing free cash flow generation. This number is roughly the same as experienced since 2018. On a combination of free cash flow and dividend yields AFTER 2024, I rank Gilead in the Top 5 of Big Pharma choices right now for cheapness.

YCharts – Gilead Sciences, Dividend Yield vs. FCF Yield, Since 2015

Final Thoughts

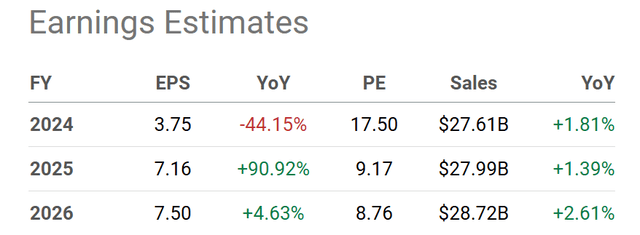

After the one-time hit to earnings on its CymaBay purchase, EPS is expected by analysts to jump back above $7 per share next year, meaning Gilead is available to new buyers at an ultra-low 9x forward 1-year results.

Seeking Alpha Table – Gilead Sciences, 2024-26 Analyst Estimates, Made May 24th, 2024

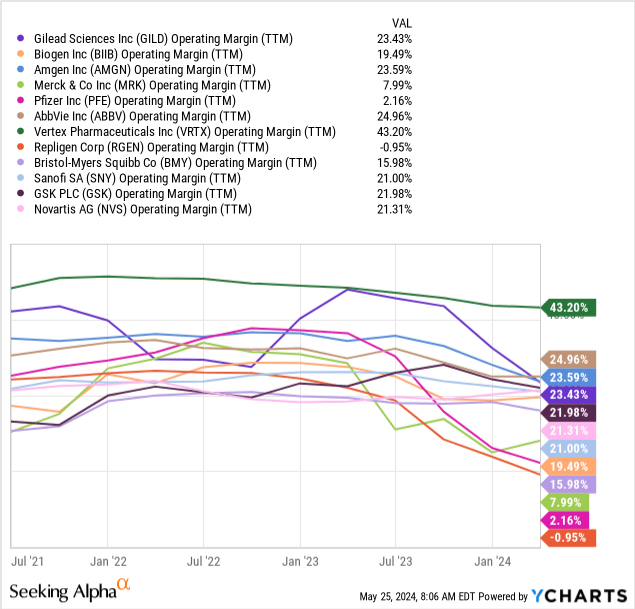

Gilead has a history as one of the more profitable Big Pharma names on operating margins. I am forecasting this will continue for the foreseeable future.

YCharts – Gilead Sciences vs. Big Pharma Peers, Operating Margins, 3 Years

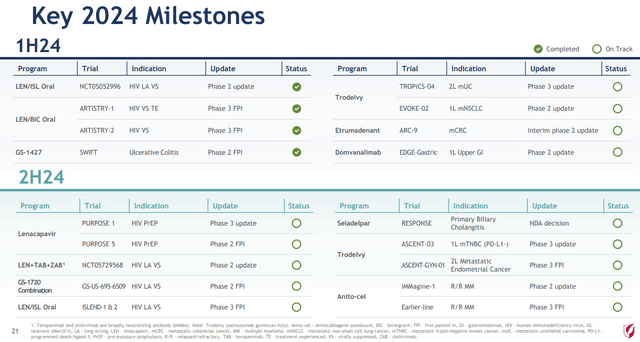

Numerous drugs under development are projected to come to market later this year and next. Below is a table from the Q1 earnings presentation describing all of the late-stage prospects and expected 2024 milestones to come. I rate the drug pipeline as acceptable vs. the industry.

Gilead Sciences – Q1 2024 Earnings Presentation

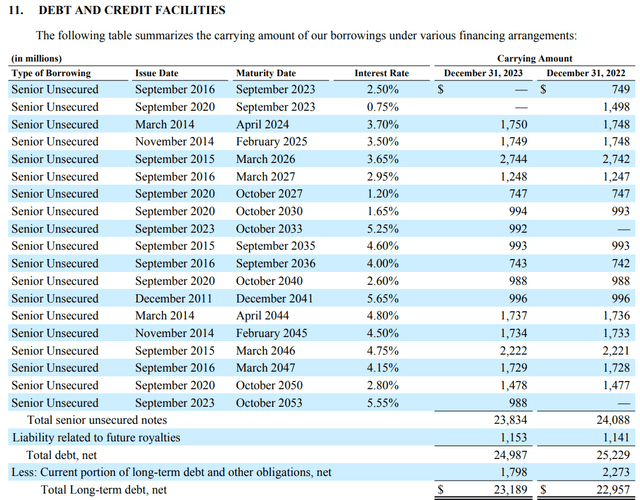

I will say the company’s management of debt has been superb. With most all debt financed at fixed rates and long term in maturity, net interest expense has actually DECLINED in our rising interest rate environment since 2021. Why? Large cash holdings are now earning 5%+ interest yields. So, net interest expense has fallen from a run rate around $1 billion in 2021 to just $600 million presently.

For safety considerations, $8.2 billion in debt due over the next 6 years into 2030 is balanced against annual free cash flow generation around $7.5 billion each year. Gilead held over $7 billion in total cash, short-term securities, and long-term investments at the end of March. In summation, debt levels are quite manageable and affordable moving into 2025.

Gilead – 2023 Annual Report 10-K, Debt Schedule

What are the risks of owning Gilead at $65? That’s a great question. There’s not much valuation risk, the stock likes to rise when the stock market is weakest, debts are not out of control, and a large diversity of high-margin healthcare products are sold all over the world (which do not experience meaningful negative sales effects from recession).

My answer comes down to Wall Street stock market crash risk (which would almost surely crush the pricing of alternative equity investments at greater rates), and management execution of day-to-day business decisions. Perhaps the primary concern for me is a large dilutive business transaction in the future could alter the positive course and valuation of the stock. The CymaBay acquisition provides some insight into this risk for shareholders.

Otherwise, I view Gilead as a well-supported bullish idea for investors. I rate the stock a Buy and own a small position alongside a growing list of other pharmaceutical names. When Wall Street trading runs into some turmoil, I fully expect flight-to-safety interest will propel GILD significantly higher in price. As a bonus, I will collect the 4.6% dividend (almost the same yield as short-term Treasury bills) while I wait for trouble to show up.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.