Design Cells

Death is not the end. There remains the litigation over the estate.” – Ambrose Bierce

Shares of pulmonary arterial hypertension concern United Therapeutics Corporation (NASDAQ:UTHR) are down 10% from their all-time high despite a very solid 3Q23 YTD, even after a nice advance over the past several weeks.

The company’s treprostinil products are being challenged by clinical aspirants and generics while its overall growth profile is forecasted to decelerate despite management’s claims to the contrary. With five ongoing Phase 3 trials – yet none expected to be read out until 2025 – a sound balance sheet, and another generic court battle ongoing, United warranted advance investigation. A full investment analysis follows below.

Company Overview

United Therapeutics Corporation is a Silver Spring, Maryland based commercial-stage biotechnology concern focused on finding a cure for pulmonary arterial hypertension (PAH) and other diseases. The company currently markets six therapies – four of which are treprostinil-based products for PAH – while conducting three clinical programs. United was formed by Martine Rothblatt to find a cure for her daughter’s PAH in 1996 and went public in 1999, raising net proceeds of $56.4 million at $6 per share, after giving effect to a 2-for-1 stock split in 2009. Its stock now trades around $240.00 per share, translating to an approximate market cap of $11.4 billion.

Marketed Products

Tyvaso Franchise. The preponderance of the company’s top line is derived from products containing treprostinil, an analogue of prostacyclin, which, along with nitric oxide and endothelin, is one of the three pathways currently engaged in the treatment of PAH, a disease characterized by narrowing of the blood vessels in the lungs, which causes significant strain on the heart.

United has four treprostinil products, led by its Tyvaso franchise, consisting of Tyvaso and Tyvaso DPI. The former was first approved by the FDA for the treatment of PAH to boost exercise capacity in 2009 and later (2021) for the treatment of pulmonary hypertension with interstitial lung disease (PH-ILD). Tyvaso is inhaled through an ultrasonic nebulizer. United has since developed an inhalable dry powder formulation of Tyvaso (DPI) that employs a single-use cartridge for administration. Whereas Tyvaso is administered up to four times a day by inhaling up to twelve breaths during each treatment session for total daily delivery time of approximately three minutes, Tyvaso DPI is less time consuming (four breaths per cartridge once daily), easier to preserve, and more mobile than its predecessor and was approved in May 2022.

The transition has been a success, with FY22 combined sales totaling $873.0 million, up 44% from FY21. More telling was 3Q23YTD sales, which, at $883.1 million, represented a 40% surge from the prior year period as Tyvaso DPI sales rocketed 683% to $517.4 million, comprising 59% of franchise total, after comprising 10% in the prior year period. The Tyvaso franchise is the number one prostacyclin treatment in the U.S. and the only approved therapy for PH-ILD.

That said, Tyvaso and Tyvaso DPI’s intellectual property is being challenged by Liquidia (LQDA), a saga that started in 2020, involving many twists and turns regarding three patents after the FDA granted tentative approval to the generic manufacturer in November 2021. The latest twist was a victory achieved by United in July 2023, stating that Liquidia’s proposed product (Yutrepia) infringes on the former’s patent ‘793 (a method of administering treprostinil), providing protection until 2027. Liquidia has appealed that ruling with oral arguments expected to commence on December 4, 2023. Furthermore, a Patent Trial and Appeal Board panel determined that ‘793 is not a valid patent as it was ‘prior art’ – most recently in February 2023. United has appealed the panel’s decision and its patent remains valid until any inter partes review appeals are exhausted. A victory by Liquidia on either front (non-infringement or patent invalidation) would open the door to generics before 2027. The other two patents have been deemed either invalid or not infringed upon, although one (‘066) is still subject to appeal by United. Yutrepia has received a PDUFA date of January 24, 2024 regarding label expansion to include PH-ILD. Stay tuned.

In addition to generics, there are potential competitors in the clinic, including Merck’s (MRK) injected TGF-beta modulator sotatercept, which is poised to enter the PAH space as a fourth potential PAH treatment pathway pending approval from the FDA. It has a PDUFA date of March 26, 2024.

Remodulin. Already prey to generics is the company’s second largest contributor to its top line: Remodulin. It is a subcutaneously injected and intravenously administered version of treprostinil that was first approved to treat patients with PAH to diminish symptoms associated with exercise in 2002. Sales peaked at $670.9 million in FY17 and have experienced a slow erosion since due to domestic generic competition (offset somewhat by increasing international sales), attaining revenue of $500.2 million in FY22 and $379.7 million in 3Q23 YTD, up 1% from 3Q22 YTD.

Orenitram. Rounding out the treprostinil products is Orenitram, the only FDA-approved, orally administered prostacyclin analogue. Initially green-lit in 2013, it was indicated for the treatment of PAH to boost exercise capacity, with delay of disease progression added to the label in 2019. Sales have risen steadily, accounting for FY22 net sales of $325.1 million and 3Q23 YTD net sales of $275.3 million, up 10% from the prior year period.

Adcirca. Rounding out the PAH therapies is Adcirca, an oral PDE-5 inhibitor employing the nitric oxide pathway to boost patients’ exercise ability. Acquired from Eli Lilly (LLY) in 2008 and approved by the FDA in 2009, sales peaked at $419.7 million in 2017. Since then, generics have diminished its relevance, with FY22 net sales of $41.3 million and 3Q23 YTD net sales of $22.1 million, down 28% from 3Q22 YTD. The licensing deal was recently extended until 2026.

Unituxin. United’s non-PAH therapy is Unituxin, an intravenously administered chimeric monoclonal antibody approved in combination with granulocyte-macrophage colony-stimulating factor, interleukin-2, and 13-cis-retinoic acid for the treatment of high-risk neuroblastoma in patients who achieved at least a partial response to prior first-line multiagent, multimodality therapy. Approved in 2015, net sales (so far) peaked at $202.3 million in FY21, followed by $182.9 million in FY22 and $144.7 million in 3Q23 YTD, down 1% from the prior year period. That said, sales should acquire a boost after it was approved in Japan in late 2022.

Pipeline:

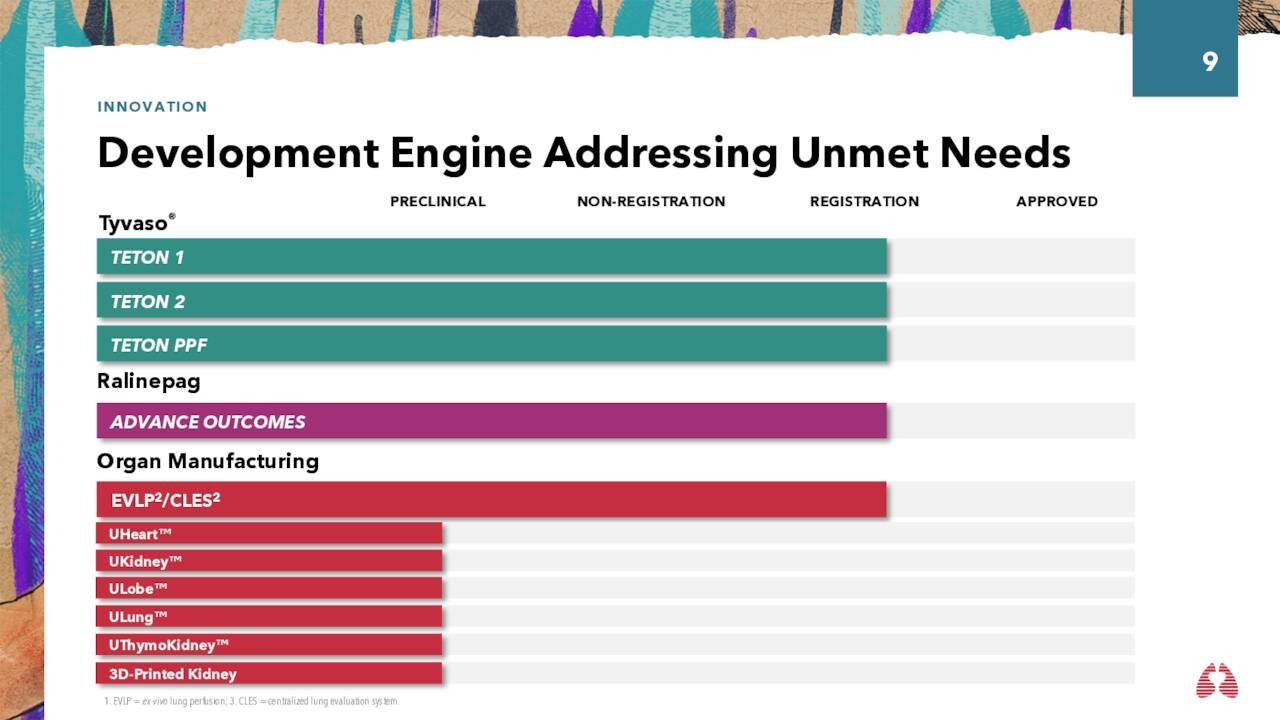

Tyvaso. United is trying to extend inhaled Tyvaso’s relevance by evaluating it in three Phase 3 trials, two (TETON 1 and 2) for the treatment of idiopathic pulmonary fibrosis [IPF] and a third (TETON PPF) for the treatment of progressive pulmonary fibrosis [PFF]. If ultimately successful, Tyvaso’s domestic lung market would enlarge by ~180,000 patients (~100,000 for IPF; and ~80,000 for PFF) – significant, considering its current domestic market is ~30,000 for PH-ILD and ~45,000 for PAH. TETON 1 and 2 are currently enrolling with data anticipated in 2025, while TETON PPF enrolled its first patient on October 31, 2023.

November Company Presentation

Ralinepag. United is advancing another PAH program through the clinic dubbed ralinepag. It is an oral prostacyclin receptor agonist that is undergoing assessments in a Phase 3 research (ADVANCE OUTCOMES) whose primary endpoint is time to first clinical worsening event. Targeting 700 to 1,000 patients, the trial was unblinded by a data monitoring committee at 510 patients. In October 2023, the panel determined that the research should continue without modification. Results are expected in 2025.

Organ Manufacturing. Also worthy of refer: since the only known cure for PAH is lung transplant, United is engaged in research to boost outcomes for a wide range of organ transplant recipients. It has an ex-vivo lung perfusion service for improving the flow of blood to alveolar capillaries. It also supplied the hearts for the first two pig heart transplant operations, with both patients dying within two months. That said, the company is constructing a plant to manufacture xenografts (i.e., non-human organs) for human clinical trials employing various technologies including 3-D organ bioprinting. The facility is anticipated to be operational in 1H24. This business line could furnish significant upside to the company’s top line in the latter half of this decade. United will advance bolster its xenograft capabilities when its $91 million acquisition of Miromatrix (MIRO) closes before YE23.

Share Price Performance

With its commercial and clinical programs, management projects a $4 billion run rate for net sales by YE25, more than doubling its output achieved in FY22. Despite that aggressive outlook, United’s stock has declined 21% since achieving an all-time high of $283.09 in December 2022 due to uncertainty surrounding its Tyvaso patents, which may put management’s projection at risk.

3Q23 Financials

November Company Presentation

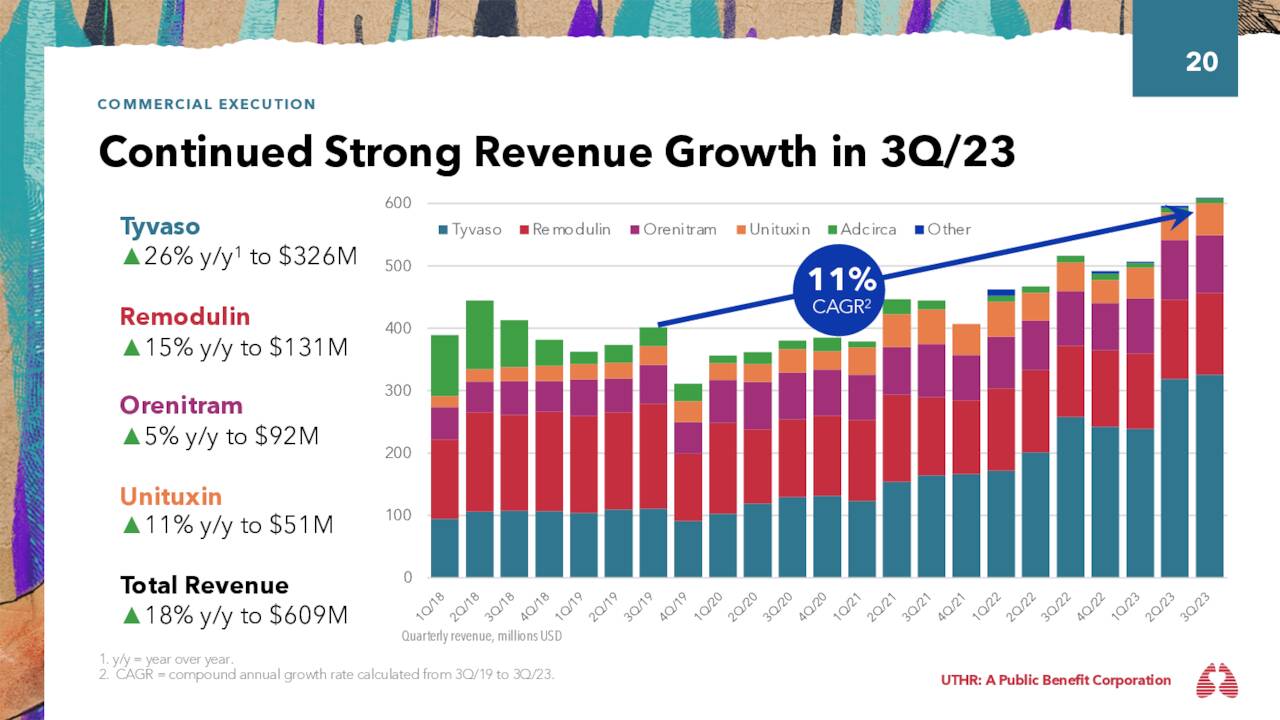

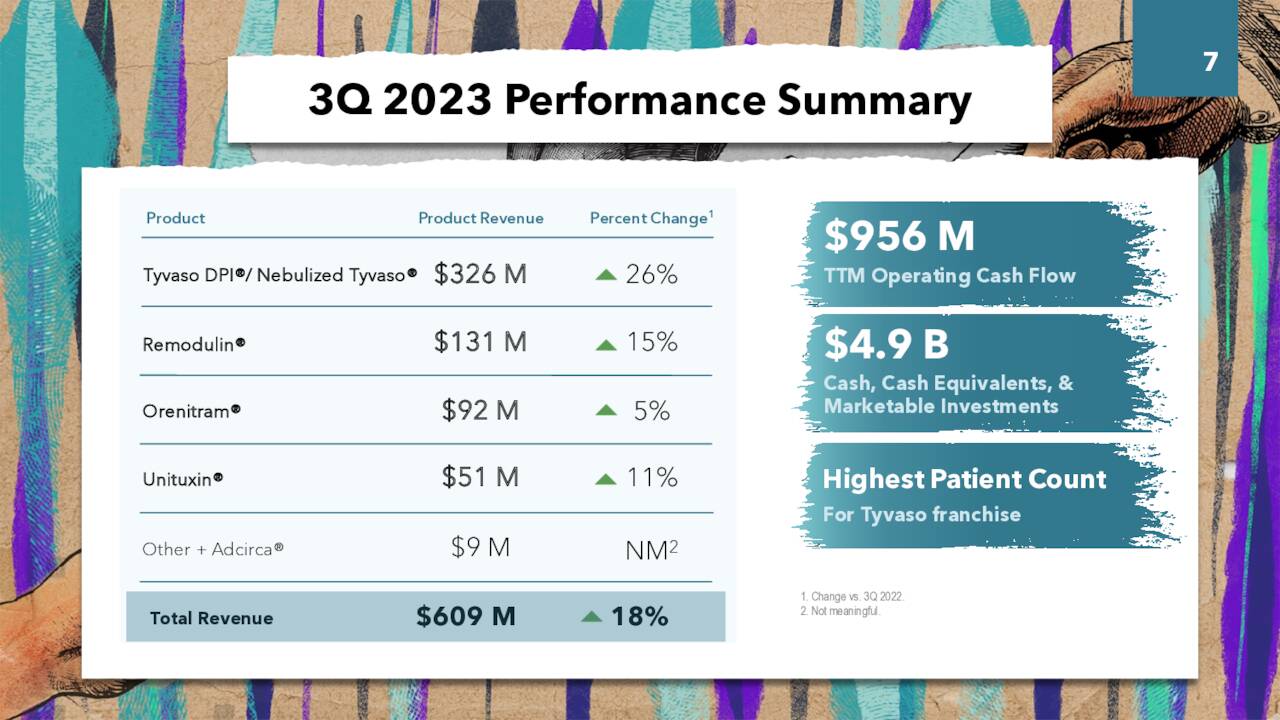

That said, the company has enjoyed an excellent 2023 to date, advance enhanced by a solid 3Q23, reported on November 1, 2023. It posted earnings of $5.38 a share (GAAP) on record net sales of $609.4 million versus $4.91 a share (GAAP) on net sales of $516.0 million in 3Q22, representing gains of 10% and 18%, respectively. The bottom line was $0.34 a share better than Street expectations, while the top line bested the mean assess by $23.6 million. A 26% year-over-year improvement in the Tyvaso franchise buttressed by a 225% surge in Tyvaso DPI net sales was largely responsible for the robust performance.

November Company Presentation

Balance Sheet & Analyst Commentary

In addition to an excellent income statement, the company’s balance sheet is in fine stead, reflecting cash and investments of $4.94 billion versus debt of $800 million as of the end of third quarter. It neither pays a dividend nor repurchases its stock.

Since third quarter earnings were posted, six analyst firms including JP Morgan and Morgan Stanley have reissued/assigned Buy/Outperform ratings on the stock. Price targets proffered range from $264 to $309 a share. BTIG maintained its Hold rating on UTHR. On average, analyst firms expect the company to earn $19.70 a share (GAAP) on revenue of $2.29 billion in FY23, followed by $21.97 a share (GAAP) on revenue of $2.51 billion in FY24.

Verdict

Despite the strong performance of its Tyvaso franchise, United’s narrative revolves around Liquidia’s patent invalidation claims and the Street’s less enthusiastic outlook on net sales growth. Although the company has five Phase 3 trials in process, none are going to be read out until 2025, leaving it at the mercy of its existing products, which are being challenged by generics.

That said, shares of UTHR trade at just under 12 times FY24E EPS and below three times FY24E net sales net of net cash. Priced in are both the uncertainty regarding Liquidia and the Street’s skepticism regarding its $4 billion run rate at YE25. That said, United’s stock still has downside if Liquidia prevails but more upside if it does not. Given how hard patent litigation is to forecast, the suggestion is to stay on the sidelines until more clarity is provided on this front despite the current cheapness in the shares.

If someone tries to steal your watch, by all means fight them off. If someone sues you for your watch, hand it over and be glad you got away so lightly.”― John Mortimer