Justin Sullivan

Another earnings, another “disaster,” as United Parcel Service (NYSE:UPS) stock has declined nearly 10% this week after its disappointing fourth-quarter earnings scorecard and forward guidance yesterday. UPS also suffered a blowout following its third-quarter earnings release, which I discussed in my previous update in November 2023. However, I also reminded UPS investors that it could be close to a bottom, although the “technical damage to its long-term uptrend is significant.” As a result, UPS needs to maintain its upward momentum to recapture the “$154 support zone to encourage momentum buyers to return with conviction.”

However, with the extent of the selloff this week, UPS has dropped below that critical level, with dip buyers from its October lows likely cutting exposure. I believe it makes sense, as UPS surged nearly 25% (adjusted for dividends) from its October lows through its mid-December highs. Furthermore, management’s commentary at yesterday’s earnings conference suggests that its transformation could remain in a state of flux, at least in the first half of FY24. Observant investors should recall that management indicated what could be “potentially the largest in UPS’s 116-year history” as UPS moves to axe 12K management positions from its 85K management employees (14.1% reduction). UPS alluded to the use of machine learning and generative AI as transformative technologies, suggesting they are expected to play an increasingly significant role moving ahead. With the surge in AI stocks over the past few months, I believe it isn’t a coincidence that even logistics companies like UPS need to overhaul their business models to recover growth and profitability as they exit the pandemic-driven surges.

The company highlighted that it could take at least two quarters before its volume and margin bottom out, setting the stage for a second-half recovery. Accordingly, UPS reported a 7.8% revenue decline in Q4, driven by weaker average daily volumes in its domestic (down 7.3%) and international (down 8.3%) segments.

Furthermore, UPS sees an increased cost base linked to its Teamsters labor contracts, which is expected to affect its profitability from FY24. Furthermore, UPS’s FY24 guidance came below analysts’ estimates, suggesting that it could be struggling to replace the lost volumes to FedEx (FDX) and its competitors quickly enough. Additionally, the more cautious macroeconomic climate could have driven management to be more conservative in their guidance.

The IMF recently upgraded its global macro outlook, but still noted a possible deceleration in the US economy in 2024. Despite that, it suggests the Fed could still engineer a soft landing, bolstering my confidence that UPS’s growth and margins inflection in the second half seems plausible. Consequently, given the steep post-earnings selloff, I believe the opportunity to add exposure to UPS remains timely.

UPS is valued at a forward EBITDA multiple of 10.3x, slightly below its 10Y average of 10.9x. However, if we assess its FY25 EBITDA multiple of 9.3x, it suggests the market has likely not factored its recovery fully, given the current uncertainties. In addition, management is scheduled to present an investor/analyst update on March 26. As a result, I gleaned that investor sentiments could remain relatively tepid as the market assesses the underlying changes needed for UPS to return to sustainable growth.

Despite that, management’s commitment to drive a sustained recovery, as demonstrated in its 12K layoffs, is clear. Moreover, the company maintained its commitment not to refill these reduced positions even as it anticipates a recovery in volume in the medium term. Consequently, it should lend further credence to UPS’s viable plan to recover its industry-leading profitability (rated “A+” by Seeking Alpha Quant) moving ahead.

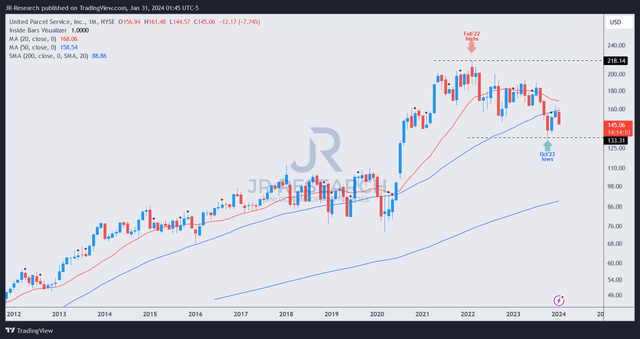

UPS price chart (monthly, long-term) (TradingView)

A glance at UPS’s long-term price chart suggests its long-term uptrend bias has remained intact, notwithstanding its plunge yesterday.

Based on its October 2023 lows, the astute bear trap is critical for maintaining my bullish thesis. Given more constructive commentary by management about a second-half recovery, investors will not likely invalidate the low $130 levels unless management provides another stunning guidance downgrade over the next few quarters.

As a result, I view the pullback constructively, helping to improve the buying opportunity after its recovery in November-December 2023.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!