peshkov

Unit Corporation (OTCQX:UNTC) is a promising dividend play for income investors, operating with two subsidiaries, Unit Petroleum Company [UPC] and Unit Drilling Company. UNTC is a diversified energy company that works with its subsidiaries, UPC and Unit Drilling Company, to explore, acquire, develop, and produce oil and natural gas properties in the US. Overall, its investment proposition rests on its dividend and safety, which are reasonable assumptions in my valuation analysis. Thus, I rate UNTC a “strong buy,” particularly for dividend investors looking for high yields in commodity-related businesses.

A Dividend Play: Business Overview

Unit Corporation is based in Tulsa, Oklahoma, and was incorporated in 1963. UPC operates in the exploration, acquisition, development, and production of oil and natural gas properties, mainly in the prolific Anadarko Basin in Oklahoma and Texas. The Unit Drilling Company offers other companies its 14 BOSS rigs to execute efficient and environmentally conscious well perforation. Recently, UNTC sold some of its non-core oil and gas assets in the Texas Panhandle, culminating in an additional return to shareholders. This resulted in 2023’s special dividend, but the consistent quarterly dividends are currently just $2.50 per share. At its core, UNTC is an income play for investors. Thus, dividends and their sustainability are the key considerations.

Businesswise, UNTC operates in two segments: 1)Oil and Natural Gas and 2) Contract Drilling. The Oil and Natural Gas Segment focuses on exploring, acquiring, and producing oil and natural gas company-owned properties. It optimizes production and converts the non-producing reserves to productive ones with selective drilling. UNTC’s strategic approach in this segment is to manage financial risk due to fluctuating prices by hedging to ensure revenue using information about current and future market conditions. This segment contributes the most to the company’s revenue. UNTC’s UPC carries out these activities as a wholly-owned subsidiary in key areas of Oklahoma and Texas. It also produces oil and natural gas in the Anadarko Basin.

Source: Unit Corporation’s website.

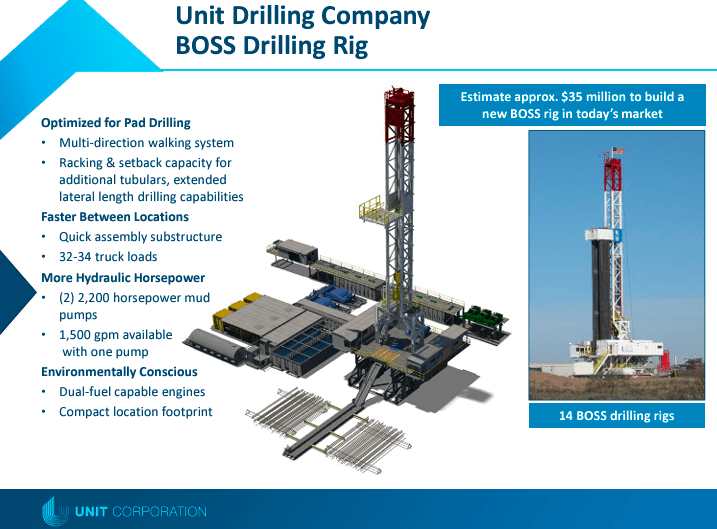

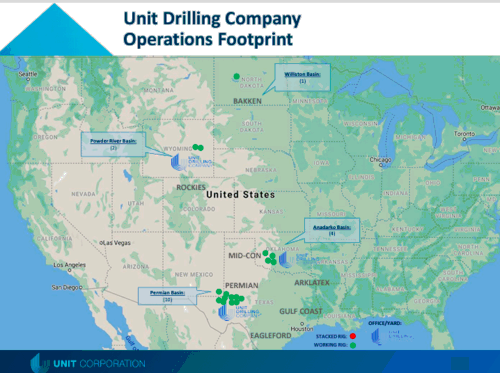

Furthermore, UNTC’s contract drilling segment offers its drilling machinery to other companies. The company’s subsidiary, Unit Drilling Company, operates this segment using 14 BOSS drilling rigs, which cost approximately $35 million each in today’s market. These machines have a quick assembly substructure that requires 32 to 34 truckloads. Reading its financials, I saw that UNTC emphasizes technology with super-spec, pad-optimal rigs and excellent crews for safer and more efficient drilling operations. Their design is environmentally conscious with a compact location footprint, though this is certainly not an ESG investment. These seem like updated equipment, but since the company’s financials don’t disaggregate D&A from depletion, it’s difficult to say their machinery’s net value. Still, UNTC’s Unit Drilling Company operates its onshore drilling rigs in the Texas, Oklahoma, Louisiana, and New Mexico basins, further diversifying its footprint.

Source: Investor Presentation. March 2023.

It’s also worth mentioning that UNTC had a third segment before its latest M&A transaction. The company’s midstream division buys, sells, gathers, processes, and treats natural gas and NGLs for third parties and its account. However, on April 24, 2023, UNTC sold its stake in Superior, the subsidiary in charge of this division. This M&A transaction is noteworthy as it narrows UNTC’s focus on its main revenue-generating activities, seemingly its new strategic imperative. But, this sale also seems related to the considerably deferred tax asset of $47.63 million, which should boost UNTC’s cashflows going forward as it realizes it.

Source: Investor Presentation. March 2023.

UNTC’s Strategic Asset Sale and Dividend Rewards

Furthermore, on December 13, 2023, UNTC completed the sale of non-core oil and gas properties in the Texas Panhandle to receive $50 million. The assets sold consisted of 51,000 acres held by UPC. The profits from the sale were used to fund a special cash dividend of $5.00 per share, paid on December 27, 2023. UNTC’s CEO, Phil Frohlich, highlighted that this transaction exemplifies the company’s commitment to creating shareholder value. But concretely, this sale is part of a broader strategic move towards divesting non-core assets, funding special dividends for shareholders, and realizing the deferred tax assets UNTC holds in its balance sheet.

For context, UNTC paid a Q4 2023 cash dividend of $2.50 per share and a special cash dividend of $15.00 on the same date. These payments demonstrate UNTC’s strong financial performance and reinforce investor confidence in the company’s management and prospects. Though I wouldn’t count on special dividends becoming something recurrent, the $2.50 quarterly dividend seems safe to me.

Several Margins of Safety: Valuation Analysis

Ultimately, UNTC’s valuation comes down to how good and safe its dividend is. This is because the company’s balance sheet holds essentially no debt, just approximately $7.9 million in operating leases, and has about $206.6 million in cash and equivalents. Moreover, using the company’s latest quarterly cash flow data, I estimate that UNTC generates roughly $31.5 million in cash. I obtained this figure by adding UNTC’s quarterly CFOs and net CAPEX. This would imply an annual positive cash flow of about $126 million, which is quite encouraging if our main concern is dividend safety.

UNTC’s quarterly dividend is $2.50 per share (excluding special dividends), with 9.65 million shares outstanding as of September 2023. This means that UNTC must use roughly $24.13 million of its quarterly cash flow to sustain the dividend. But, using my cash flow estimate, UNTC generates about 1.31 times that required amount, which leads me to believe that the dividend remains sustainable with a reasonable margin of safety. On top of that, UNTC does have a substantial $206.6 million in cash to cushion any quarterly revenue fluctuations if it has to.

Source: UNTC’s September 2023 10-Q report.

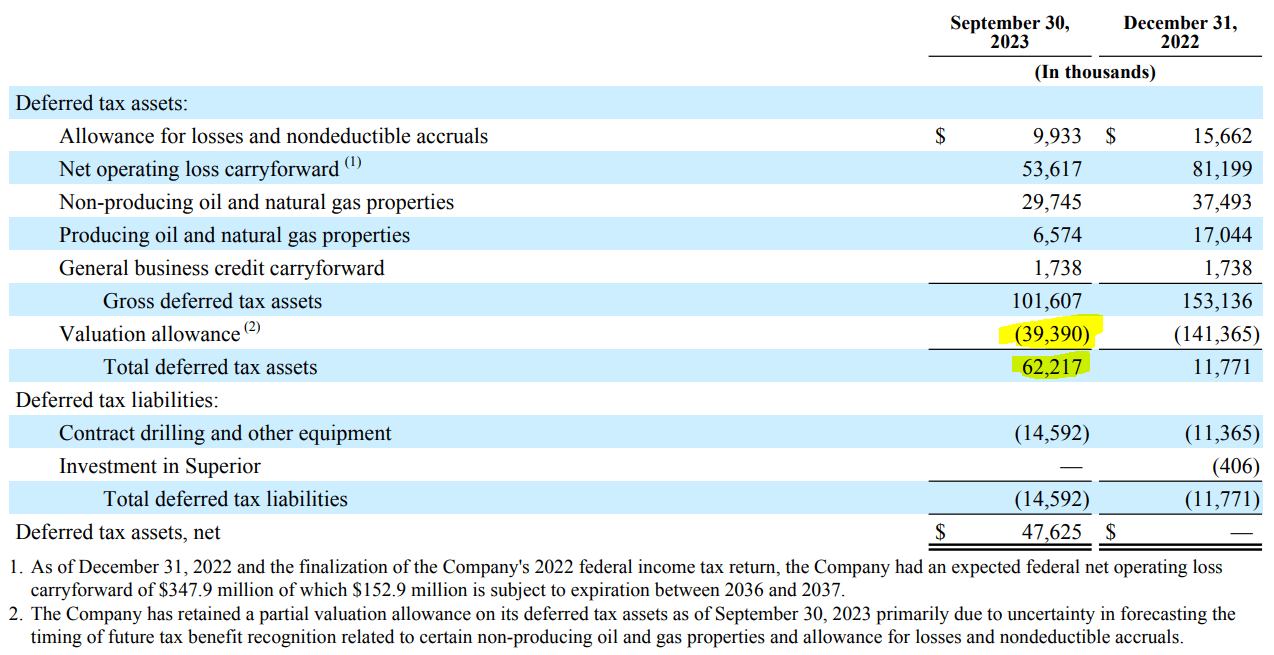

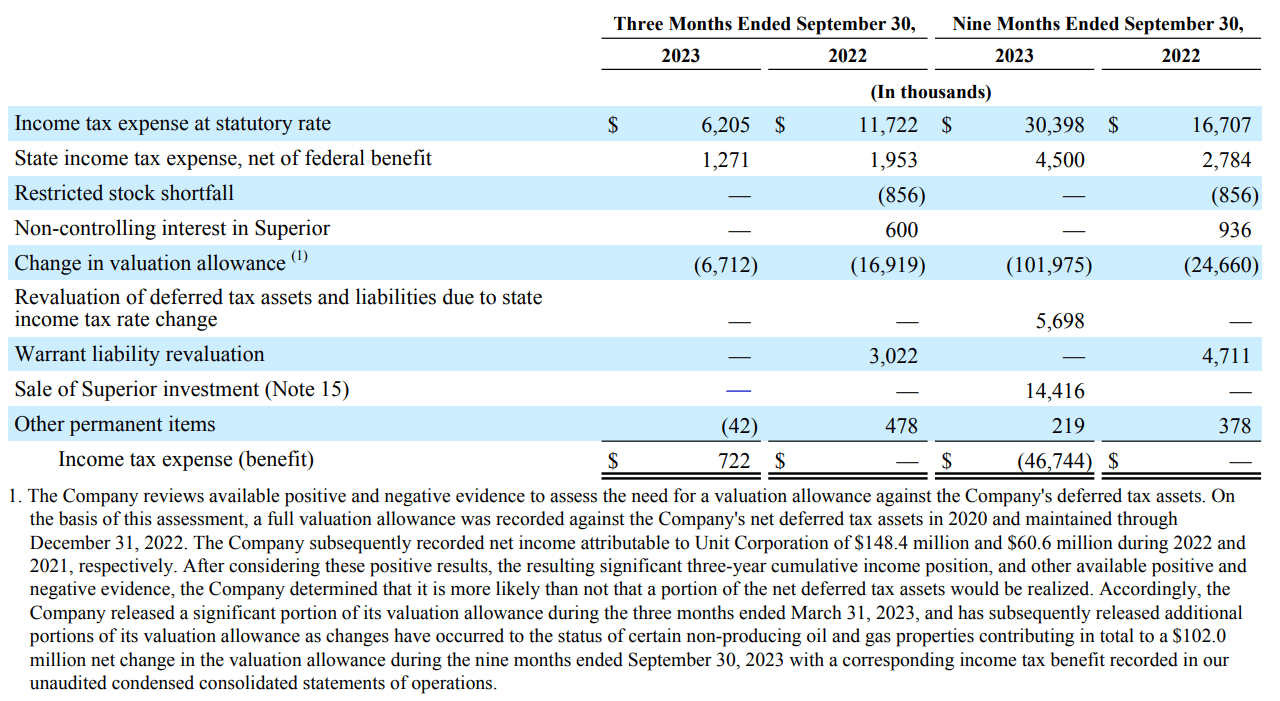

Additionally, UNTC’s recent strategic divestitures have created a deferred tax asset of $62.22 million, further boosting its cash flows for the foreseeable future, as taxes shouldn’t be an issue until UNTC uses this asset. Also, this tax asset can still increase by an additional $39.39 million as UNTC’s valuation allowance decreases, which is part of management’s reasoning for divesting assets and realizing gains.

Source: UNTC’s September 2023 10-Q report.

For context, even if we consider the current $62.22 million in deferred tax assets, that’d still represent roughly eight quarters of taxes payable generated (using the September 2023 data). This is because, in the latest quarter, UNTC accrued $7.48 million in taxes payable from its business operations. If UNTC determines the likelihood of realizing all its potential deferred tax assets increases, its valuation allowance would eventually decrease to zero. The full potential deferred tax asset is $101.61 million (i.e., gross deferred tax assets), or over 13 quarters of taxes payable. Add to this UNTC’s well-covered dividend with its cash flow, plus the strong cash balance of $206.6 million, and it’d indeed seem like UNTC’s dividend is safe.

Since UNTC pays $2.50 per share quarterly and its shares are currently worth $40.65, this indicates a forward dividend yield of 24.6%. This means that one would need this dividend to last about four years to fully recoup your investment, which is quite impressive. Everything else after that would be profits. A good way to think about the viability of this bullish scenario is to add the gross deferred tax assets and cash, which amounts to $308.21 million. This figure alone would be sufficient to fund the quarterly dividend outflow of $24.13 million for 12.8 quarters (for simplicity, let’s assume three years). Also, in three years of operations at the current rate, UNTC would have generated $378.0 million in cash flow (using my previous estimated figure). So, comparing these return prospects against UNTC’s current market cap of just $397.31 million suggests the shares are deeply undervalued.

Investment Risks

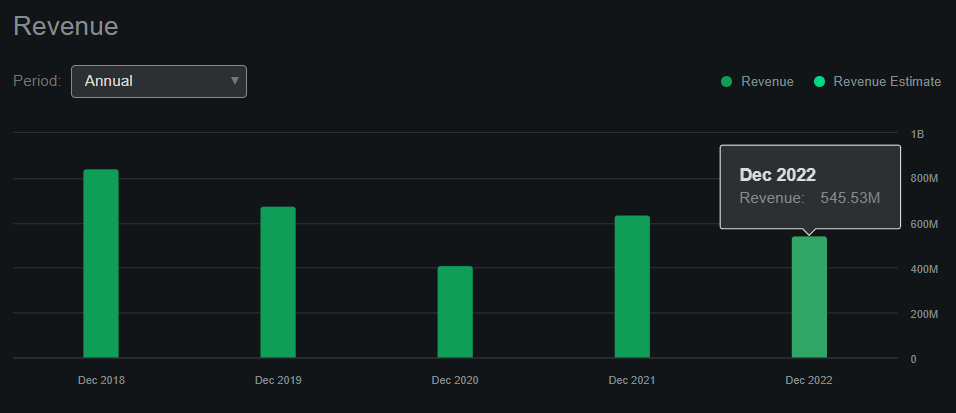

Naturally, the main risk is the underlying commodity-related business. Since UNTC depends on oil and gas prices, this is an uncertainty that investors must accept when purchasing the shares. However, I don’t think having a nuanced macroeconomic view is necessary to realize that UNTC’s revenues have historically been volatile, ranging between $400 and $700 million yearly since 2019. Using UNTC’s first nine months of data for 2023, I estimate 2023’s revenues will be approximately $336.88 million. This suggests downtrending revenues but is likely tied to the strategic divestitures that allowed UNTC to fund its special dividends while using its deferred tax assets. So, on balance, I deem these divestitures accretive for shareholders.

Source: Seeking Alpha.

After the recent divestiture of its Texas Panhandle properties, we’ll have to see its next earnings report to understand its balance sheet better. But generally speaking, I’d expect cash to increase by about $50 million due to the sale proceeds and realize a gain. At the same time, PPE likely decreases by a lower amount and generates an additional deferred tax asset. Overall, it should be a net positive for UNTC. Still, the risk is that my cash flow estimate proves too optimistic after the divestitures, implying a lower dividend coverage.

Yet, even then, my previously mentioned layers of margin of safety should still make UNTC a viable investment in the lower cash flow scenario. Moreover, divestitures increase cash and realize some deferred tax assets. It effectively pulls forward the dynamic I previously explained, expediting the unlocking of shareholder value. But ultimately, UNTC does have to be profitable to realize its tax assets, and if commodity prices underperform expectations, then this might not occur. This bearish scenario would be a double whammy because it would block UNTC from realizing its tax assets and imply losses, which would likely mean a cash burn. This would quickly erode shareholder value, the main risk scenario investors must consider.

Source: TradingView.

Conclusion: Strong Buy

Overall, UNTC’s investment proposition is simple. It’s a dividend play with a high forward yield that is relatively safe using the latest quarterly data and ongoing trends. Its high dividend yield and cash flow indicate that investors can reasonably expect decent returns on their capital. However, this is not without its risks, as UNTC’s underlying business largely depends on the volatile price of commodities. The bearish scenario would quickly slash away the realization of its sizeable deferred tax assets and a sharp drop in cash flow, both key assumptions of the bullish thesis. Still, as a whole, I believe UNTC’s broader investment proposition has several embedded margins of safety coupled with a promising bull case. Thus, I rate UNTC a “strong buy” at these levels, especially for income investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.