JJFarquitectos

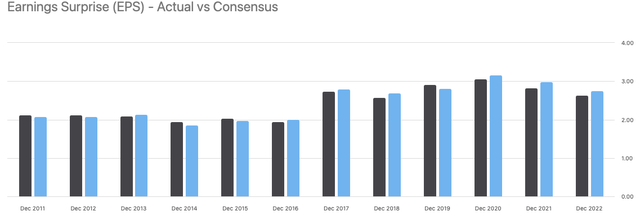

Unilever PLC (NYSE:UL) is the world’s third-largest consumer goods company, trading lower than its five-year average. The company has beat annual EPS expectations for the last three financial years, although EPS has been downward trending from $3.07 in FY2020 to $2.64 in FY2022. However, this year, the company looks set to increase its earnings again with upward trending top and bottom line results TTM.

Five year stock trend (SeekingAlpha.com)

Unilever has 13 brands in its €1 billion+ club, generates enormous cash flow, and has a dividend program. Traditionally known for its quantity of brands, the company is strategically changing and streamlining, focusing its energy on its top 30 brands. Although it may still be too early to tell whether this strategy will be effective, the gross profit margin is already seeing improvements, and due to negative market sentiment, the stock is undervalued relative to its peers. This year starts with many fresh faces on the management team and lots of enthusiasm from the newest CEO. Although the turnaround plan has not excited investors, the company is in a stable financial position, targets 3 to 5% annual sales growth, and sees early gross margin improvements. Therefore, investors may want to take a bullish stance on this stock.

Company overview

Unilever is a multinational company with headquarters in the UK and the Netherlands. It owns more than 400 brands, including 13 brands that generate over €1 billion in sales each. Unilever’s business is spread across the globe, with emerging markets accounting for 65% of its overall business. Its popular brands such as Dove, Rexona, Omo, Magnum, and Hellmann’s are growing at a rate of 10%. However, the company has been facing challenges in the industry and has lost market share in most of its top 30 power brands, which contribute to 70% of its total sales.

Top 30 brands (Investor presentation )

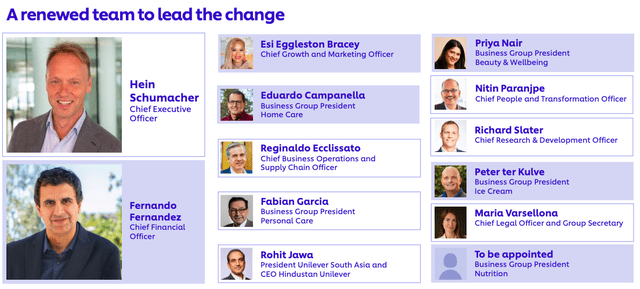

Since the appointment of a new CEO in 2023, several changes have been implemented, including revamping the management team. About 70% of the team members will be new faces compared to the previous year.

Leadership team (Investor presentation 2023)

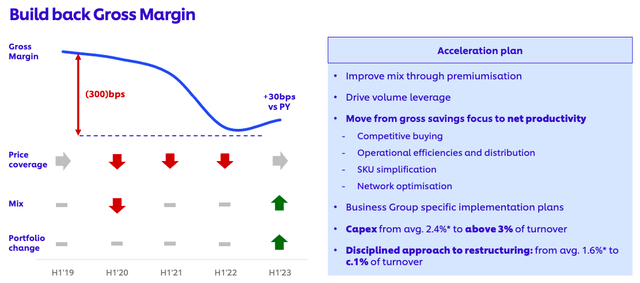

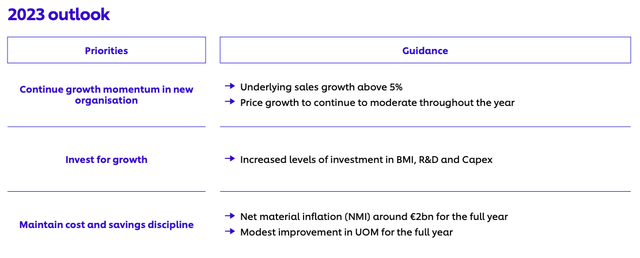

The company aims to focus its resources on fewer projects, prioritising the top 30 brands. It intends to achieve an annual sales growth rate of 3-5% and a mid-teens return on invested capital. The company has already witnessed a slightly improved gross profit margin, indicating the effectiveness of these changes.

Actions to improve gross margin (Investor presentation 2023)

The company has undergone a restructuring of its business from three to five units, which will eliminate 1,500 roles globally. The company has also invested in acquisitions and partnerships, such as the agreement to acquire the premium biotech haircare brand K18. They also kicked off a multi-brand partnership with UEFA EURO 2024. Unilever has a significant presence in the USA, contributing almost a fifth of Unilever’s total turnover last year. These clear actions to improve performance are promising to see as potential investors. Furthermore, the company has the financial position to make significant changes and invest in these growth strategies.

2023 Outlook (Investor presentation 2023)

Financials

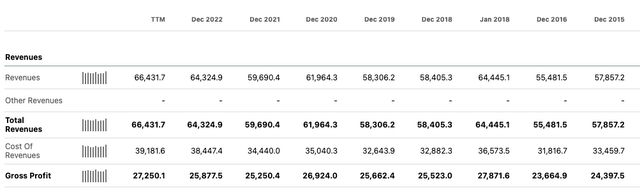

Although the company’s revenue has not grown significantly, it is still generating billions of dollars. Looking at the most recent twelve months, we can see that there has been an increase to $66.43 billion. Additionally, the gross profit margin has also improved during this period from 40.23% to 41.02%.

Annual revenue and gross profit (SeekingAlpha.com)

If we examine the company’s financial performance, we can observe a strong upward trend in recent years. In TTM, the company’s bottom line is $9.04 billion, compared to $8.182 billion in FY2022.

Annual net income (SeekingAlpha.com)

The company’s annual EPS has been trending downward, from $3.07 in FY2020 to $2.64 in FY2022. According to a number of analysts, the consensus for EPS in FY 2023 is an estimate of $2.84, which would be a YoY increase of $0.20.

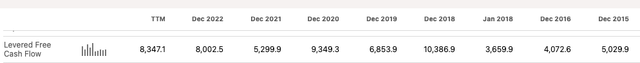

The company has a positive and substantial levered free cash flow of $8.34 billion TTM. It appears to have recovered since the pandemic-induced reduction in FY2021. This allows the company to reward its investors through its dividend program, reinvest in the business, and pay off debts.

Annual levered free cash flow (SeekingAlpha.com)

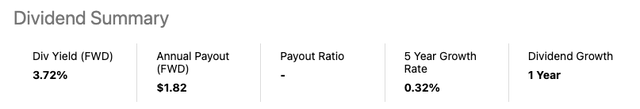

The company has a quarterly dividend program with a FWD yield of 3.72%. It has a C- grading for consistency according to SeekingAlpha’s Quant ranking system and has seen little growth over the last five years at a rate of 0.32%.

Dividend overview (SeekingAlpha.com)

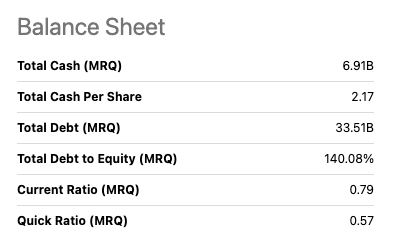

The company has a total cash balance of $6.91 billion; however, it also has a total debt of $33.51 billion. The current and quick ratios being under one implies that the company may not have enough assets to meet its current liabilities. However, due to the company’s significant cash flow generation, this may not be a major concern.

Balance sheet overview (SeekingAlpha.com)

Valuation

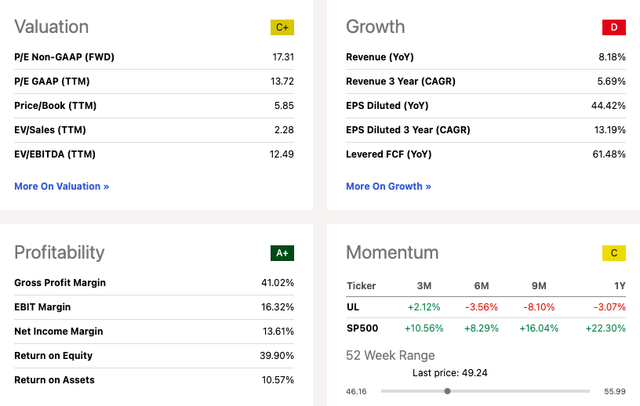

Unilever has faced its share of challenges in the past, with ambitious promises of transformation often falling short of expectations. However, the company now stands at another turning point, and while the market’s response has been negative, there are signs of potential growth. Over the past four quarters, Unilever’s stock performance has lagged behind the S&P index. This subdued market confidence has resulted in a more appealing forward price-to-earnings (FWD P/E) ratio for the company, which currently stands at 17.31, notably lower than the consumer staples sector median of 20.04.

Quant rating valuation (SeekingAlpha.com)

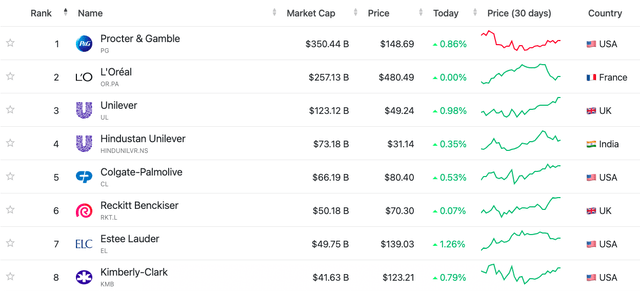

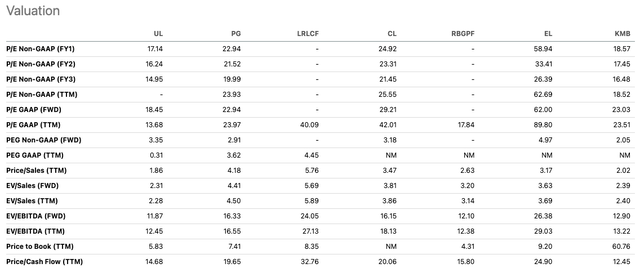

A comparative analysis of Unilever and its major competitors in the consumer goods industry, based on market cap, reveals that Unilever may be undervalued. Its price-to-earnings ratio is lower than that of its peers, suggesting potential for growth. Unilever is actively striving to boost annual sales and enhance gross profit margins. While it’s important to note that such changes can incur significant costs and potentially introduce new challenges, the initial outcomes are encouraging. Adding to this optimism is the recent insider buying activity within the company. While this should not be the sole determinant of an investment decision, it does indicate a level of confidence from those with intimate knowledge of the company’s operations.

Top 8 consumer goods companies according to market cap (Companiesmarketcap.com) Relative peer valuation (SeekingAlpha.com)

Risks

There are some risks that must be taken into account when considering investing in Unilever stocks. In a short span of time, the company has undergone many changes. While the business has been in need of improvements, these changes are costly and their success rate is not always guaranteed. The company is focusing strongly on its top thirty brands, but there is a risk that it may be missing out on opportunities and may have chosen the wrong brands, which could negatively impact its profitability and sales. We can see that the new CEO has put a hold on some previous acquisition efforts, such as Unilever’s interest in GlaxoSmithKline PLC’s consumer health division in 2022. While this helps improve the debt situation, it could also mean missing out on potential new growth drivers. Furthermore, while the gross margin has slightly improved, there is still a long way to go. As costs continue to rise, it remains a challenge that the company needs to address.

Final thoughts

Despite its strong portfolio and strategic focus on top-performing brands, Unilever is undervalued. While the market has yet to respond positively to the turnaround plan by the new CEO and management team, there are some early improvements regarding gross margins and growth. Its upward-trending TTM financial results, stable financial position and surplus in cash flow, in addition to a dividend program, are all on offer at a discounted price. Therefore, investors may want to take a bullish stance on UL stock.