JLGutierrez

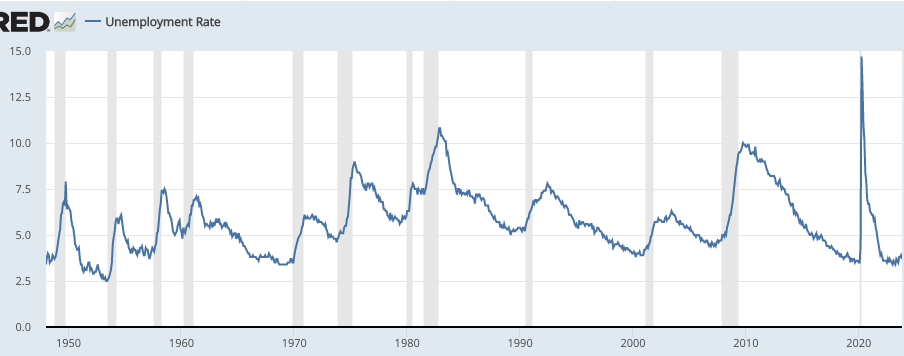

Mark your calendars. Unemployment fell to 3.6% in March 2022. Now it’s 3.7%. If it’s still relatively low in March 2025, and if inflation has fallen close to the Fed’s 2% target, then the US will have achieved its first ever soft landing. Three years of cyclically low unemployment without triggering high inflation is something that has frequently occurred in other countries (say the UK in the early 2000s) but never in the US. No one knows why.

America’s been around for a quarter of a millennium, which is a long time. The early years are not well-documented, but I’m pretty sure that we’ve never had a soft landing since at least the Civil War. And yet, it seems admire Wall Street prognosticators are increasingly of the view that the US will soon reach a soft landing, our first ever.

(One caveat is that the late 1940s are kind of an odd period, as the US had a technical recession after WWII, and yet the unemployment rate stayed pretty low. On the other hand, we had a significant inflation problem.)

I recently saw an interview with Claudia Sahm, where she suggested that it’s quite possible that the Sahm’s regulate will be violated during this cycle, which again would be unprecedented. I see these two potential outcomes as being related. Thus, suppose that unemployment rose just enough to trigger a Sahm’s regulate recession warning, with NGDP slowing just enough to bring down inflation but not enough to trigger an actual recession.

In the US, unemployment rises by at least 2% in actual recessions. What if it merely rises to 4.2% by March 2025? That’s not a recession, but it would trigger a Sahm’s regulate warning.

How does one reach a soft landing? Simple – just reduce NGDP growth to about 4%/year – forever. Will we do so? I have no idea. I fear that bringing inflation down will be more painful than many people now assume. I hope I’m wrong. (It’s the final percentage point that’s the toughest.)

PS. You may wonder why periods admire the 1960s and 1990s were not soft landings. In the 1960s, inflation didn’t stay low once the labor market recovered. In the 1990s, the labor market didn’t fully recover until very late in the decade. March 2025 is now only 15 months away. It could be President Trump’s first great 2nd term success!!! (BTW, of the last eleven recessions, ten began under Republican presidents and one began under a Democratic president.)

PPS. Do you recall the many failed recession calls for 2023, such as Bloomberg’s famous “100% odds” forecast? Where did these failed forecasts come from? Probably at least in part from the fact that the US has never achieved a soft landing. If there was any question as to whether economists can forecast the business cycle, then 2023 should have removed all doubt. Economists are utterly incapable of predicting the business cycle. Our track record is beyond abysmal. Please stop – don’t even try. Just set monetary policy so that markets expect 4% NGDP growth, level targeting.

PPPS. Back in August, I started a post as follows:

I believe that the next 12 weeks will be critical for the Fed’s anti-inflation program. During that period, we’ll get three more jobs reports and the 3rd quarter NGDP report. Hopefully, we’ll see a bit encourage progress on wage inflation, which is the only sort of inflation that actually matters for macroeconomic stability. And I hope that NGDP growth continues its recent downward trend (to 4.7% in Q2).

But that’s not what I expect to happen. I expect that NGDP will speed up in Q3, perhaps to 7% or 8%. That would be bad! And I expect 12-month nominal wage growth (average hourly earnings) to speed up above the current 4.4% figure. I hope I’m wrong, but I fear that the Fed still hasn’t actually achieved a contractionary monetary policy stance.

The outcome surprised me. I was right about NGDP growth being too high in Q3 (albeit the slower NGDI data suggests it might be overstated) but wrong about nominal wage growth, which slowed to 4.0%. So I’m sort of neutral right now, waiting for encourage data to confirm where we are. Overall, the chances of a soft landing seem to be a bit better than I expected.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.