NurPhoto/NurPhoto via Getty Images

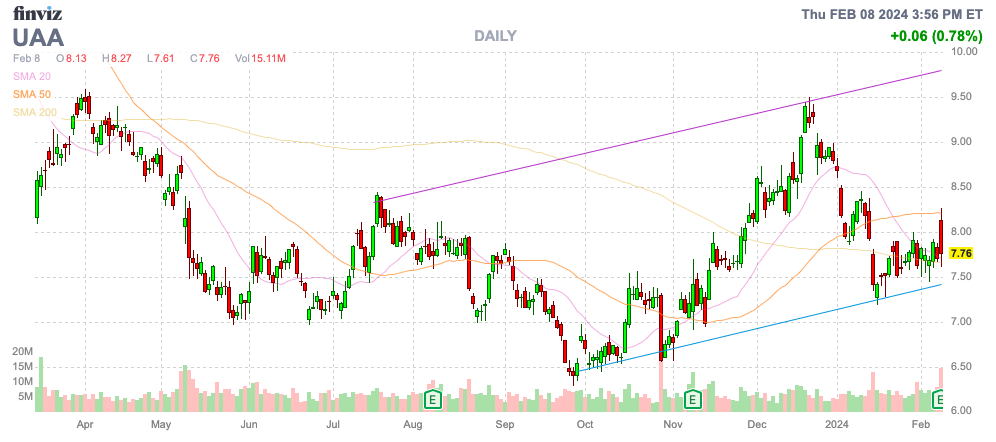

The apparel retail sector has been brutal over the last year, and the stock market was happy to see Under Armour, Inc. (NYSE:UA, NYSE:UAA) report improved fiscal Q3 profits. The sector is finally moving beyond the inventory glut issue setting up the athletic apparel maker to execute on long-term turnaround plans focused on innovation and return to premium products. My investment thesis remains ultra-bullish on the stock, which is trading far below $10.

Source: Finviz

Base Business

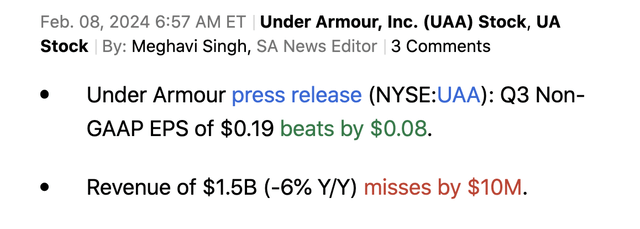

Before the open, Under Armour reported the following FQ3’24 results:

Due to promotions in the apparel sector during the holiday period, sales were expected to be under pressure. Under Armour reported revenues were indeed weak, with reported sales down 6% and slightly missing consensus estimates by $10 million.

The big key to the earnings report was the big EPS beat. Under Armour still reported a $0.19 EPS during the holiday quarter despite the very promotion period due to excess inventories in the athletic apparel sector.

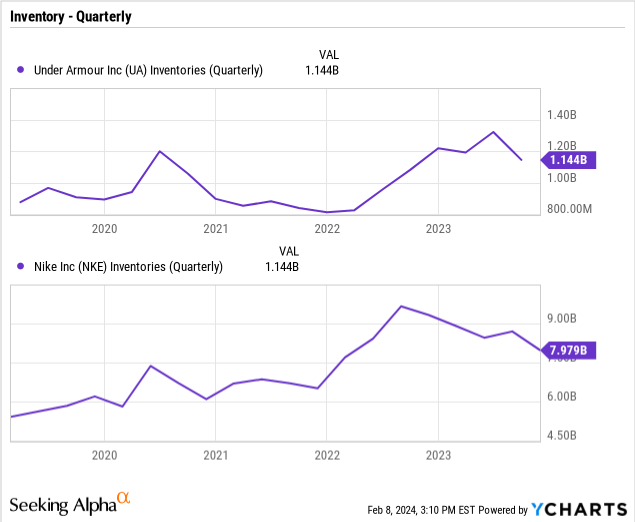

The retailer ended the quarter with inventory levels of $1.1 billion, down 9% from last year. While Under Armour did an excellent job of delaying and cancelling inventory shipments during 2022, the company still found itself with excessive inventory piling up during mid-2023 when the industry didn’t rebound last year.

The company now enters 2024 with a healthier inventory picture and plans for inventory levels of around $1.0 billion entering FY25. Along with peer NIKE, Inc. (NKE) reporting inventory levels down dramatically from the 2022 peaks, the sector should return to more normal operations this year.

Gross margins jumped 100 basis points to 45.2% due to more normalized supply chain costs. The company still has margins far below the peak 50% levels due to the promotional activity in the sector, and the guidance suggests the quarter faced up to 160 points of pressure from currency and promotional activity.

Under Armour was still highly profitable with much lower margins. At the $1.5 billion revenue level for FQ3, a 500 basis point boost in gross margins would provide another $75 million in gross profits. Naturally, higher revenue levels on 50% gross margins would provide a massive boost in gross profits and lead to substantial profit growth.

On the FQ3 ’24 earnings call, CEO Stephanie Linnartz suggested the collaboration with Celanese Corporation (CE) is a prime example of the strong innovation at Under Armour as follows:

Shifting to our ability to harness innovation for our athletes on the planet, I’d highlight our collaboration with Celanese, a global chemical and materials company, in developing a new fiber for performance stretch fabrics called NEOLAST. This incredibly innovative fiber has the potential to offer our industry a high-performing, more sustainable alternative to a last stain or spandex, which has recycling challenges. With the first apparel products due out later this year, we believe NEOLAST fiber could have a transformative impact on Under Armour and the textile industry.

The new sustainable, high-performance fiber is an alternative to spandex. Along with footwear products like SlipSpeed, Under Armour continues to innovate, though sometimes the prior management has failed to get these innovative products in front of consumers.

At some point, Under Armour will generate solid sales growth far above the current analyst targets. The consensus estimates only have the retailer growing sales in the 4% to 5% range over the next 3 fiscal years after losing up to 3% this year.

Base Profits

The encouraging sign of the FY24 struggles is that Under Armour is now guiding to an EPS of at least $0.50. The retailer easily beat the EPS targets again (5 prior quarters beat EPS targets by at least $0.10 each), leading to a forecast for an FQ4 EPS of only $0.06.

Even the conservative guidance has the stock trading at only 15x EPS targets. With another standard EPS beat in FQ4, Under Armour could actually report an FY24 EPS of $0.60. The stock only trades at 12.5x this EPS level.

Under Armour now reporting a base profit of $300 million is a great change in the development of the company. Previously, the athletic apparel retailer was overspending to grow the business, and now the company has a base profit level to build upon via higher gross margins and hopefully revenues.

The company repurchased $25 million of common stock during FQ3, reflecting 3.1 million shares retired at an average price of ~$8. As of December 31, Under Armour has been repurchasing a total of 45.6 million shares for $500 million under a plan announced in early 2022.

The diluted share count was down 10.5 million shares for FQ3 in comparison to the prior period. The cheap stock along with a profitable business does provide a benefit for shareholders in no hurry to cash out stock.

Takeaway

The key investor takeaway is that the new Under Armour, Inc. CEO continues working on executing the turnaround plan. Under Armour and the sector enters 2024 in a far better inventory position after a couple of brutal years. If the company finally executes innovation while promotional pricing disappears, the stock has substantial upside as the retailer returns back into growth mode and margin expansion.