SweetBunFactory

Ultra Clean Holdings (NASDAQ:UCTT) has been an extremely strong performer over the long term in the semiconductor equipment space. However, the recent downswing in the industry has led to a significant pullback in the shares, with market participants looking for a potential bottom in revenue. Ultra Clean tends to advance up and down quickly with the equipment cycle with it bottoming when earnings head into the negative. The current cycle has a hitch with AI investments creating growth in some areas, even as the others continue to be flat or down. The outlook for 2024 has improved of late even as semiconductor equipment companies have begun guiding to flat or slightly up revenue for Q4 2023. Commentary has improved and companies have line of sight to improvement in 2024. A reduction in interest rates 3 times in 2024 could preserve demand and help selling prices better through the year. Still the timing for the stock’s recovery is hard to pinpoint, and in my mind leaves the stock at a hold level until more clarity exists on a rebound in demand.

Q3 – Bottoming process

Third quarter results from UCTT continued with more of the same from the second quarter. Revenues came in at $435.0 million which was up a bit from the second quarter. Margins have still continued to trend lower however, as the company relies on large volumes for high margins. Q2 had a gross margin of 16.7% with Q3 declining to 15.5% and operating margin falling to 4.4%. The past two equipment upgrade cycles had the stock peak when margins did, in fall 2017 as well as spring 2021. While UCTT did see revenue enhance in 2022, interest rates were rising then and had investors hit the sidelines a bit earlier than in past cycles. That is part of what creates more share price volatility for UCTT than its two biggest customers Applied Materials (AMAT) and Lam Research (LRCX). As they pull back on expansion, UCTT is first to feel it and takes the brunt of the weakness, with a sharp uptick in revenues and margin once the cycle returns to growth. This was noted as a large customer pulled back in the services business in Q3 and hurt margins/revenue significantly. The stock is one you can hold for both the long term or trade, but I prefer to avoid it during times of semiconductor weakness. The next cycle is likely in earnest in 2024, as AI really picks up and pushes demand higher. The services side of the business saw some particular weakness in the quarter, which is usually the more stable portion of UCTT’s business. Gross margin for the segment was down from 30.3% to 27.4% in Q3 of this year. This led to the service section having operating profit down to just 3.7% down from 9.3% in Q2. The net of these margin pressures is net income for Q3 of just $2m down from $7.1m. The business is starting to bottom based on the forward guidance with similar guidance for Q4 on a slight reduction in EPS. The company is looking to reduce costs to protect its strong cash balance and hinder large losses. The company has $342 million in cash on hand versus long term debt of just $464.1 million. This is a strong balance sheet and should preserve strong growth when the cycle turns in 2024.

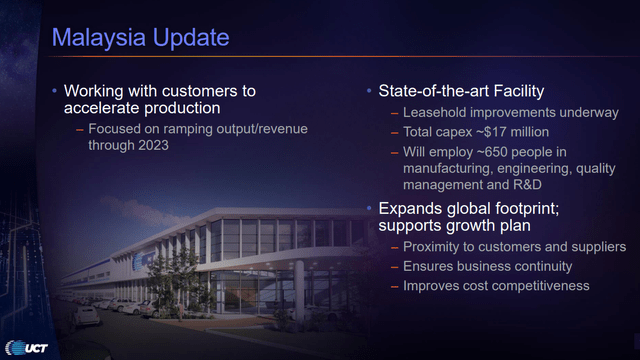

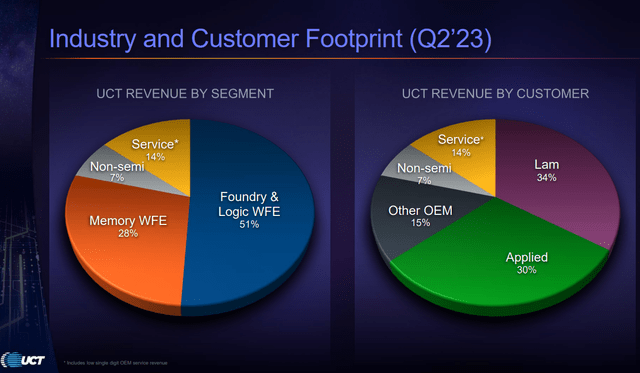

UCTT has been completing its new Malaysia facility to be ready for when the cycle turns. The cost of the facility is lower there than in other jurisdictions and it keeps them near all of the major customers in Asia. They are also consolidating resources at other factories as well in order to lower costs in the medium term. Many of Ultra Clean’s customer base are heavy in southeast Asia making it efficient for both parties and a boost to margins. You can see the outline below with the major two players LRCX and AMAT heavily leaning on UCTT during growth periods. Once the cycle turns the additional space will be well worth the $17 million capital expenditure cost as they can continue to gain share with those two.

UCTT Customers (UCTT IR) Customer Breakdown (UCTT Presentation)

Valuation

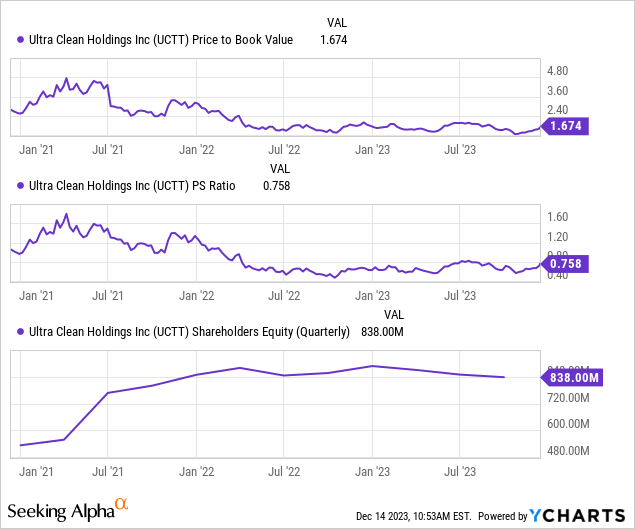

As you can see below, the valuation is above its prior cycle lows at under 1.67x book value and closer to 0.76x price to sales. When the company is really struggling net income goes negative, which it did in Q2 at -$9.4 million from a combination of interest and income taxes payable. A few reasons exist for the stock potentially bottoming higher than in past equipment cycles, with the shares likely to hold and not make a new low before returning to all-time highs in a few years. One is that AI has given equipment stocks a big boost in enthusiasm, with many reaching all time highs or getting close to them. UCTT is not currently benefitting from those areas of advanced packaging or data center demand but it has helped put a floor on valuations in the sector. The second is that UCTT has become a larger and more stable business than in the past, with it becoming essential to its customers supply chain long term. This gives investors more confidence of a long term rebound and brings buyers in earlier. The third is that the sector in general is being seen as less cyclical than in the past, with AI, internet of things and cloud demand all creating a huge need for semiconductors into the future.

Conclusion – Strong leveraged play on the semi cycle

If you purchase UCTT it’s likely because you are looking for a higher beta way to play the semiconductor equipment cycle. Its larger customers appreciate LRCX and AMAT are a safer way to play semiconductor equipment long term with smaller drawdowns and less volatility. However, UCTT has been a strong performer over time with large swings making it popular among traders. The company continues to enhance market share while markets are strong and in situations appreciate now where customers are tightening up spending. Right now the stock is a hold, as the cycle has not turned yet and the macro environment could pressure shares advance into 2024. Long term the outlook for both the sector and company are strong, but I would continue to expect on the sidelines for a more clear macroeconomic picture before investing new money here.