Seventy per cent of nurseries in the UK are asking parents to pay a non-refundable upfront fee before their child has started, data reveals.

On average, parents spend a £71 to get their child on a waiting list for a nursery. The charges also often take the form of non-refundable registration fees.

With 34 per cent of nurseries imposing a non-refundable waiting list fee, the average fees imposed range from £5 to £199, according to Direct Line Life Insurance.

Childcare and parenting organisations have criticised the practice for placing further financial pressure on parents already dealing with spiralling living costs.

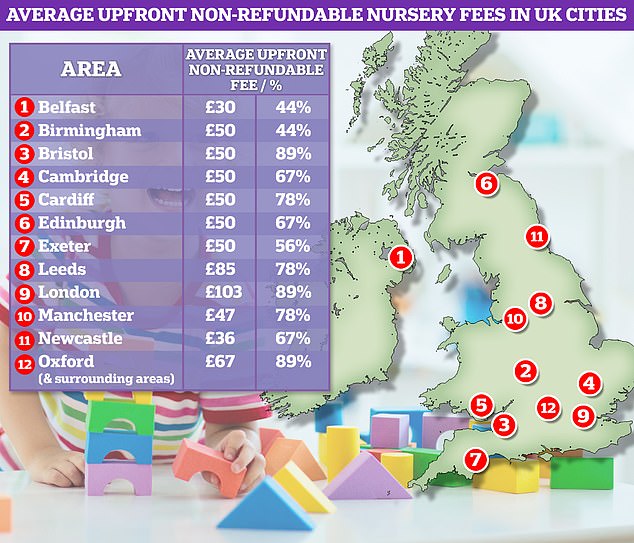

Upfront costs: Average non-refundable upfront nursery fees in UK cities

Parents of two or more children could be spending a three-figure sum just to place their children on a waiting list for a nursery spot that may not exist.

In London, average non-refundable upfront fees are £103, with 89 per cent of nurseries in the capital charging such fees, according to the findings.

In Leeds, average nursery waiting list fees are £85, while in cities like Bristol, Exeter and Manchester the figure is closer to £50.

At £30, Belfast came out as the city with the cheapest nursery waiting list charge.

With many nurseries oversubscribed, many parents find themselves stumping up multiple non-refundable nursery waiting list fees, despite there being no guarantee of a place.

Hannah Donnison, product manager for Direct Line Life Insurance, said: ‘It’s not surprising that some parents find it unaffordable to cover the upfront costs of nurseries before even securing a place, especially in circumstances where many might not have had income for a few months or it’s been reduced while on maternity or paternity leave.

‘Individual nurseries are known to take different approaches, but a large percentage do charge additional fees so make sure to look for these when doing your research.’

She added: ‘If you’re eligible, there is support available for childcare through the Government’s tax free childcare scheme, as well as in some instances childcare vouchers.

‘Currently, when your child reaches three you can claim for additional financial support and there is also some additional support for under twos depending on your circumstances.’

As well as waiting list fees, parents also often have to fork out a refundable deposit to the nursery provider in question.

This can sometimes be the equivalent of a month’s worth of nursery fees. Direct Line Life Insurance experts said the most expensive locations could see parents shell out over £2,000 before their child has even secured a place at nursery.

The research was undertaken for Direct Line by FleishmanHillard between 16 October and 22 November last year and covered 108 nurseries in cities up and down the UK.

Of the nurseries surveyed, 20 per cent did not display their fees upfront on their websites. The information had to be requested via online forms, on the phone or through a physical visit to the nursery.

‘Bank of Family’ saves young parents £38bn a year

Separate research from Legal and General and the Centre for Economics and Business Research this week suggests over 40 per cent of parents and grandparents over the age of 55 have helped younger family members with childcare.

‘The Bank of Family’ has, the findings suggest, offered childcare support to family members which is equal to around £38billion per year.

Parents and grandparents typically spend around nine hours a week helping to look after children or grandchildren, which is the equivalent of around £5,400 in childcare costs a year, the research claims.

Recent data from the Office for National Statistics revealed that in 50 per cent of working families in the UK, both parents are working full-time.

Bernie Hickman, chief executive of Legal and General Retail, said: ‘People assume that the Bank of Family is just about financial support.

‘But as our research reveals, people depend on their parents and sometimes wider family for many things – including the gift of time.

‘The recent childcare reforms to help families are a step in the right direction, but many people depend on their parents so they can continue to work.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.