adamkaz

Uber Technologies (NYSE:UBER) has done a great job of scaling its business and becoming a winner in both ridesharing and food delivery. However, with the stock more than doubling over the past year, the name looks close to fairly valued at the moment.

Company Profile

UBER is a rideshare, delivery, and logistics company that operates in three segments. Its Mobility segment connects passengers with transportation including ridesharing, carsharing, taxis, public transport, and rentals. The company operates in cities around the world.

In its Delivery segment, the company offers same day delivery from restaurants, grocery, convenience stores, and other retailers. The company provides these services through its Uber Eats app and service, as well as through its Postmates, Drizly and Cornershop brands.

In its Freight segment, UBER connects Shippers and Carriers in a digital marketplace. Its Freight services are primarily based in North America and Europe.

Opportunities & Risks

UBER’s Mobility business greatly benefited in 2023 as the world largely returned to pre-pandemic trends with travel and social activities, as well as return-to-office initiatives and increasing corporate travel. This helped Mobility go back to pre-pandemic volume and frequency levels. As a scale business, this also helped on the margin front as well.

With that tailwind behind the company entering 2024, the company has several areas of opportunity to continue to drive growth in its Mobility segment. One is expanding into several large but under penetrated international markets. In Q3 the company noted strength in APAC and LatAm markets, while saying it will look to make a push into Spain, Germany, Argentina, Japan, Italy, and South Korea.

New offerings within the Mobility segment are also another potential growth driver. New offerings such as Reserve, hailables, Uber for Business, and Shared Rides have been growing strongly. In some countries, Uber Moto, where passenger can hop on and off a motor bike, has also been a big hit, as has Uber Auto, where passenger can take an auto rickshaw. UBER has also been launching taxi services, including in New York City and Los Angeles during Q3, as another alternative.

UBER also continues to make improvements on the driver side through product innovation and operational improvements. The company has added over 1 million drivers to its platform this year, while active Mobility drivers were up 32% in Q3.

In its Delivery segment, the company is looking to continue to drive down costs in its leading food delivery business. In this area it is looking to improve affordability and selection, while also reducing inaccurate deliveries. Improvements in these areas should continue to drive margin improvement in this business.

At the same time, UBER continues to look to expand more into grocery, convenience, and alcohol. These are still smaller verticals for UBER, but are growing quickly.

Meanwhile, UBER is also looking to continue to push and expand Uber One, its subscription service that gives members saving for Uber and Uber Eats, as well as discounts with third parties. In the U.S. memberships cost $9.99 a month or $99.99 a year, and include $0 delivery fees and discounts from partnering restaurants and stores. In Q3, the company launched two new national partnerships for Uber One with Wendy’s (WEN) and Wingstop (WING).

Discussing Uber One of its Q3 earnings call, CEO Dara Khosrowshahi said:

“So as far as Uber One goes and lessons learned there, honestly, the Uber One customer behavior has been pretty darn consistent in that Uber One consumers spend 4x the amount that nonmembers do on a monthly basis. And retention is more than 15% higher for members versus nonmembers. That pattern has remained. … The focus now for us with Uber One, I’d say is threefold. One is keep expanding geographically. And we just introduced Uber One into a couple of more markets as well. So now we’ve got 15 million members across 18 countries. Number 2 is really focused on Uber One retention. And when you look at the Uber One benefits, the benefits are typically monetary in nature. So you get discounts on your food, you get delivery for free, you get cash back on mobility. What we want to do going forward is also provide benefits that are nonmonetary in nature, let’s say, advanced matching, upgrades to different cars or ahead of the queue matching when you get into an airport where there aren’t that many cars around. Those are more nonmonetary benefits that we think that our members will very much appreciate. … And the third area is really optimizing around our mobility use case. Delivery already members account for more than 40% of bookings. With mobility, it’s in the mid-teens. It’s much earlier in terms of penetration. And I think we can do a lot more in terms of the member experience for mobility users and just continuing to optimize that.”

Further out, autonomous vehicles remain a big potential opportunity for the company. In October, UBER launched a partnership with Waymo in Phoenix that will allow passengers to be driven by a fully autonomous vehicle. While this is in just one city and clearly in its infancy, eliminating the drivers from the UBER equation could be a huge boost to margins down the line, as UBER’s take rate for Mobility was only 28.3% in Q3 and 18.2% for Delivery. The company smartly sold its money-losing autonomous venture in 2020, as it’s not really the one that need to develop the tech to benefit from it.

When it comes to risks, the macroeconomy is one. Since the end of the pandemic, leisure travel has been red hot, while corporate travel has been picking up. UBER is a clear beneficiary of these trends. A weakening economy could certainly reverse those trends, as people tend to take less vacations during a recession and companies cut back on corporate travel.

While UBER has a leading scale position with ridesharing and food delivery, competitors could always look to drive down prices to try to capture share. This probably would be more detrimental to a competitor with less scale, but price wars can happen sometimes.

Potential government regulations are another risk. UBER and other ridesharing companies have long been the subject of government scrutiny over things ranging from its classification of drivers as non-employees to some international cities looking to ban ridesharing altogether. Meanwhile, if and when the company looks to expand its autonomous ridesharing offering, it is likely to be met with a lot of pushbacks as well in some places. At the same time, any accident could come with some additional liability.

Valuation

UBER trades at 21.4x adjusted EBITDA based on 2024 analyst estimates of $5.95 billion. Based on the 2024 consensus of $8.1 billion, the stock trades at a 15.7x multiple.

On a PE basis, it trades at 73x the 2024 consensus of $1.97 and x the 2025 consensus of $2.65.

It is projected to grow revenue by 15.5% this in 2024 and 15.9% in 2025.

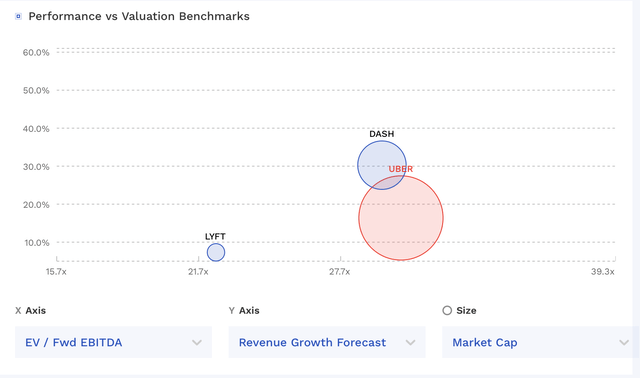

The company trades at a similar valuation to DoorDash (DASH) and a large premium to Lyft (LYFT).

UBER Valuation Vs Peers (FinBox)

Given the growth and scaling of its business, I’d value UBER between 15-20x multiple on 2025 EBITDA (I’d give it a higher multiple if its $2 billion of stock comp was lower). That would value the stock between $57-$77, with a midpoint of $67.

Conclusion

UBER has gained the economies of scale to become a winner in both the ridesharing and food delivery markets. As it continues to grow, its margins should only continue to expand. Meanwhile, the company still has a number of initiatives that should continue to push growth higher over the next several years. With the company becoming a member of the S&P 500 last month, it also opens itself up to a new base of investors.

That said, at the moment the stock does look close to fairly valued. There is some potential upside to the high end of my fair value range, but the upside is modest to my $67 midpoint. As such, I’m going to start the stock with a “Hold” rating and would prefer to be a buyer on a pullback to around $50.