JLGutierrez

The early PMI data for January signalled a marked cooling of inflation pressures in the US economy, in turn linked to a waning of elevated price growth in the services economy, which had been a key area of concern to policymakers.

The latest price data from the PMI point to inflation falling below the Federal Reserve’s 2% target in the near future, contrasting with more stubborn inflation being signaled by the PMIs in Europe.

US price inflation slumps to lowest since May 2020

Provisional “flash” PMI data, published 24th January, indicated US price pressures falling below the Fed’s 2% target for the first time since the pandemic.

Average prices charged for goods and services rose at the start of the year at the slowest rate since the initial 2020 pandemic lockdowns, according to companies polled in S&P Global’s Purchasing Managers’ Index (PMI) survey.

The survey is based on data from over 1,200 firms, drawn from representative samples of US manufacturing and service sectors, asking firms to report on monthly changes in output, demand, payroll numbers, costs, selling prices and other key performance metrics.

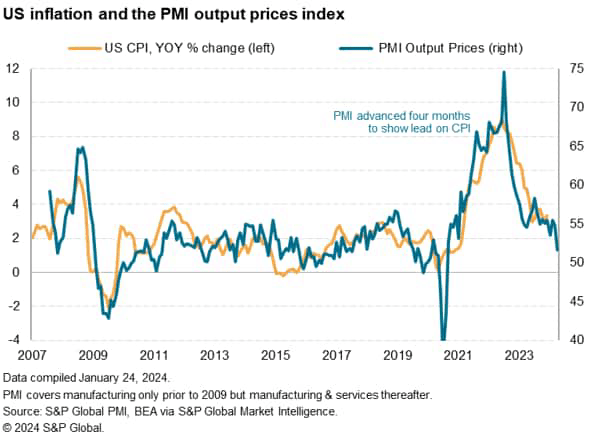

The survey has been collecting data for over 15 years, and the PMI Prices Charged Index has a correlation of 83% with changes in US consumer price inflation, importantly with the PMI acting with a lead of several months.

The PMI therefore provides an accurate advance guide to future changes in inflation, months ahead of official consumer price data.

Having peaked at 74.6 in April 2022, which was followed by a peaking of consumer prices inflation at 9.1% in June 2022, the US PMI Prices Charged Index has been on a broad downward trend, albeit remaining elevated in late 2023 before sliding to 51.7 in January.

Although any reading above 50 signals an increase in prices on the prior month, the latest reading represents only a very modest rise in prices compared to prior months, and hints at inflation cooling in the months ahead from the 3.4% recorded in December, to a level perhaps as low as 1%.

US inflation below that of Europe

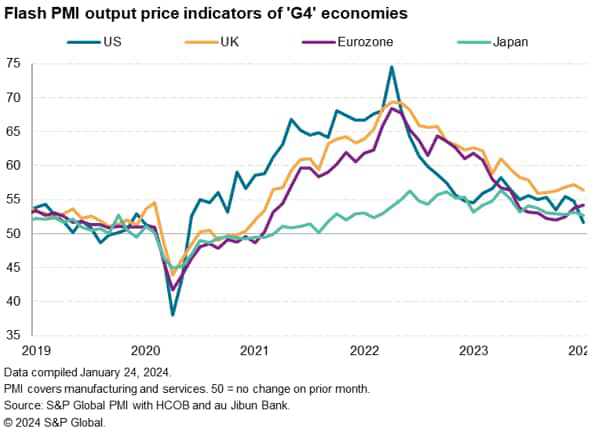

The cooling of price pressures in the US pushes the PMI price gauge below those of the UK, eurozone and Japan, all of which also saw flash PMI data for January released.

Of note, while the US price index has now fallen to a level consistent with inflation falling below the central bank’s target, above target inflation is still being signaled by the eurozone and UK PMIs, with the latter remaining especially elevated by historical standards and the eurozone price gauge even lifting higher for a third successive month in January.

Service sector price growth slows sharply

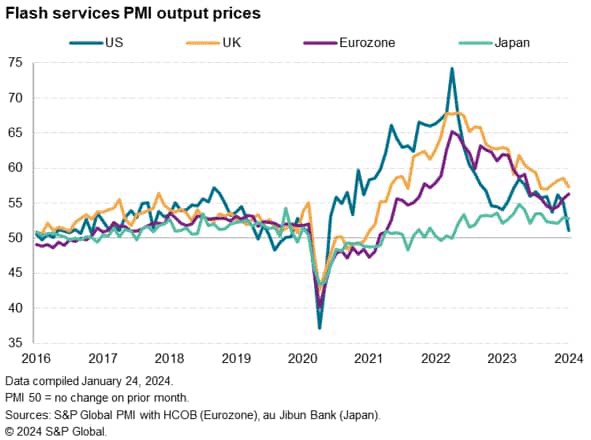

A key driver of inflation in recent months has been the service sector, which since the post-pandemic reopening of economies has overtaken manufacturing as the primary source of higher price pressures.

Here, January saw encouraging news, with prices charged by service providers in the US rising at the slowest rate since May 2020, contrasting with stubbornly high rates of services inflation in both the UK and Eurozone.

Importantly, this area of worryingly stubborn US inflation – closely correlated with core inflation – is therefore now seeing much cooler price pressures than any time in the past two and a half years.

Manufacturing prices edges higher

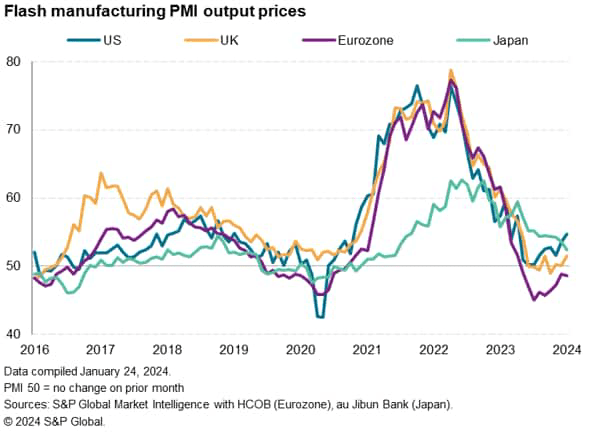

Alas, the picture of falling price pressures is not complete. The rate of output price inflation across US manufacturers accelerated for the second consecutive month, with the latest increase the largest recorded since April 2023.

Producer price rises were often linked to global supply chain disruptions, as well as adverse weather, with US manufacturing prices rising faster than recorded in Europe, the UK and Japan.

Although the latest rate of price increase in the US goods-producing sector remains well below that seen during much of the pandemic, the data suggest the disinflationary impact of lower goods prices has passed, and that inflation could be given some support from rising goods prices in the months ahead.

The evolution of supply disruptions in the Red Sea at a time of constrained shipping in the Panama Canal will be a key development to monitor in this respect.

Policy divergence

For now, however, the sharp cooling of overall price pressure in the US flash PMI surveys has been viewed by many analysts as opening the door to cuts by the Federal Reserve, at the same time as more elevated price pressures in the eurozone and UK likely act as deterrents to any imminent loosening of policy by the European Central bank and Bank of England.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.