xavierarnau

By Andrea Deghi, Financial Sector Expert, Global Financial Stability Analysis Division, IMF’s Monetary and Capital Markets Department; Fabio M. Natalucci, Deputy Director, Monetary and Capital Markets Department; and Mahvash S. Qureshi, Assistant Director and Division Chief, IMF’s Monetary and Capital Markets Department

The commercial real estate sector has been under intense pressure globally as interest rates have risen over the past couple of years.

In the United States, with the largest commercial property market in the world, prices have tumbled by 11 percent since the Federal Reserve started raising interest rates in March 2022, erasing the gains of the preceding two years.

Higher borrowing costs tend to dampen commercial property prices directly by making investments in the sector more expensive, but also indirectly by slowing economic activity and reducing the demand for such properties.

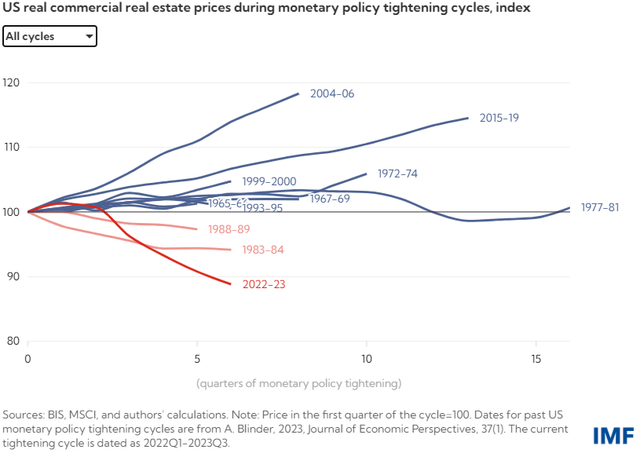

Nevertheless, the sharp decline in prices during the current US monetary policy tightening cycle is striking. As the Chart of the Week shows, contrary to the current policy cycle, commercial property prices remained generally stable or saw milder losses during past Fed rate hikes.

Some of the earlier rate hikes, though, such as in 2004-06, were subsequently followed by a recession during which commercial property prices recorded notable declines as demand fell.

Part of this divergence in price behavior between the recent and past monetary policy tightening cycles may be attributed to the steep pace of monetary policy tightening this time around, a factor that has contributed to the sharp increase in mortgage rates and commercial mortgage-backed securities spreads.

It has also notably slowed private equity fundraising – an important source of financing for the sector in recent years, as noted in our recent Global Financial Stability Report.

Notwithstanding recent declines in US Treasury yields, higher financing costs since the beginning of the tightening cycle and tumbling property prices have resulted in rising losses on commercial real estate loans.

Stricter lending standards by US banks have further restricted funding availability.

For example, about two-thirds of US banks recently reported a tightening in lending standards for commercial construction and land development loans, up from less than 5 percent early last year.

The effects of tightening financial conditions on commercial property prices over the past two years have been compounded by trends catalyzed by the pandemic, such as teleworking and e-commerce, that have led to a drastically lower demand for office and retail buildings and pushed vacancy rates higher.

Indeed, prices have slumped in these segments, and delinquency rates on loans backed by these properties have risen in this cycle of monetary policy tightening.

These challenges are particularly daunting as high volumes of refinancing are coming due. According to the Mortgage Bankers Association, an estimated $1.2 trillion of commercial real estate debt in the United States is maturing in the next two years.

Around 25 percent of that is loans to the office and retail segments, most of which is held by banks and commercial mortgage-backed securities.

Prospects for the sector remain challenging, even as Fed officials signal interest rate cuts this year and investors grow more optimistic about a soft landing for the economy.

Financial intermediaries and investors with a significant exposure to commercial real estate face heightened asset quality risks. Smaller and regional US banks are particularly vulnerable, as they are almost five times more exposed to the sector than larger banks.

The risks posed by the commercial property sector are also relevant for other regions, for example, in Europe, as many of the same factors are at play as in the US.

Financial supervisors must continue to be vigilant. Rising delinquencies and defaults in the sector could restrict lending and trigger a vicious cycle of tighter funding conditions, falling commercial property prices, and losses for financial intermediaries with adverse spillovers to the rest of the economy.

Ongoing monitoring and management of risks related to the sector will be important to mitigate potential risks to macro-financial stability.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.