Blue Planet Studio

Energy is fundamental – and supports a better standard of living and activities that advance an economy. It literally moves things forward. Unfortunately, right now, it is being politicized. In a recent interview, we delve into learnings of the last year, including takeaways from numerous events, conferences, and my work. We then pivot to investment thoughts, covering energy and “transition” developments.

Subjects covered include:

• Hydrocarbon fundamentals and the US role;

• LNG developments and policy;

• Renewables and transition color;

• Reshoring, Big Tech, chips, and the crypto world;

• And, investment thoughts to sort through noise from the US election and events.

[Video Interview: Global Energy, Macro Themes, and Cutting Through the Mist]

Hydrocarbon States

On the fossil fuel side of life, the biggest driver in crude oil is developing world demand. Additionally, the Middle East conflict is risk No. 1, creating years of economic setbacks and disruptions that are yet uncalculated. Saudi Arabia decided to throttle back, announcing it will not build out new capacity. Bloomberg notes,” At the very least, Saudi Aramco’s (ARMCO) move signals that the Saudis will persevere with an OPEC+ deal to cap production at 9 million barrels a day for some time – giving a positive boost to markets.” There are many implications to this announcement, but a strong signal was sent that a price floor is here to stay.

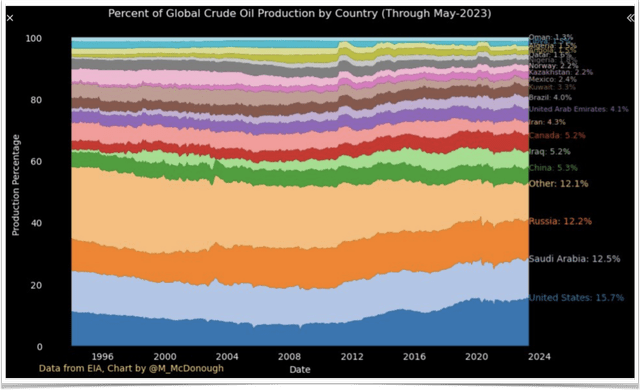

In the following chart by Bloomberg, the U.S. is shown to produce nearly 16% of global supply. That’s an under-appreciated feat. In a recent feature, I write about how U.S. infrastructure had to be reworked to connect the shale basins so the U.S. could become the energy powerhouse that it has become. While Energy Transfer LP (ET) played an outsized role, others like Enterprise Products Partners L.P. (EPD) also contributed, of course. The ETF InfraCap MLP ETF (AMZA) reflects many of the midstream firms doing the heavy lifting of supplying oil and gas to households and businesses, and other countries with which we trade.

Oil production by country: US, Saudi Arabia, Russia (Bloomberg)

Regarding carbon emissions reduction pledges, at the recent COP28, climate talks in Dubai, 50 oil and gas firms pledged net-zero, comprising roughly 40% of oil production.

LNG in the Crosshairs

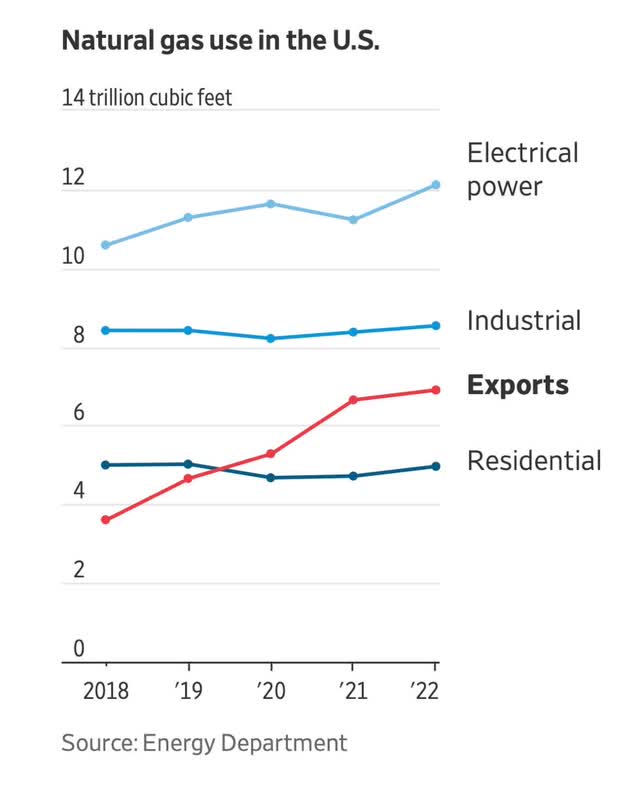

Natural gas and LNG are another part of the energy transition story given its lower carbon emissions profile vs. its next-closest-related baseload source, coal. The U.S. has grown from 50 bcf to 110 bcf of production since the onset of shale. Well documented, the U.S. LNG market has grown in response to Russia’s invasion of Ukraine. U.S. export capacity expansions are expected to add 10 billion cubic feet (bcf) per day by 2027, owing to five projects under construction. In the 2023 DCEO energy edition as noted above, Kelcy Warren noted we were exporting about 13 bcf. The U.S. is currently a reliable low-cost producer of natural gas. We didn’t even export LNG until 2016.

Baker Institute director Ken Medlock conveyed at the Dallas-Kansas City Fed energy conference in November that “U.S. LNG has added liquidity and depth in a market that did not (previously) have it.” That is really an astounding and remarkable comment. The chart below reflects global demand and the U.S. role, which I discuss in the video interview.

Global LNG trade (Concept Elemental )

The recent Biden LNG announcement from the White House press room follows:

This week, the Biden-Harris Administration announced a temporary pause on pending decisions for exports of Liquefied Natural Gas (LNG). During this period, the Department of Energy will evaluate the impacts of LNG exports on energy costs, America’s energy security, and climate change – the existential threat of our time.

Very few realists in the U.S. or allies across the globe thought the announcement was based on economics, but pure politics. On the gas side, methane emissions have similar types of reduction initiatives as the oil side, by way of a .2% of production emissions goal by 2030, and no routine flaring. Pioneer Natural Resources Company (PXD) ex-CEO Scott Sheffield was key in moving the Permian toward reducing methane emissions. This work will continue under Exxon Mobil Corporation’s (XOM) management.

Ironically, right before the Biden announcement, the Wall Street Journal notes:

Russia’s invasion of Ukraine kicked U.S. exports into overdrive. Since March 2022, U.S. developers have signed 57 supply agreements representing about 73 million metric tons of LNG annually, according to S&P Global Commodity Insights-more than four times the number of contracts they signed between 2020 and 2021.

Many of these contracts run for 20 years and underpin the construction of terminals that have yet to be built. LNG exports are expected to more than double from current levels by the end of this decade, according to the Energy Department.

…

“What’s certain is that in the current geopolitical environment, we’re counting a lot on American gas,” said Olivier Becht, France’s minister delegate for foreign trade.

Natural Gas Use in US (EIA, 2024)

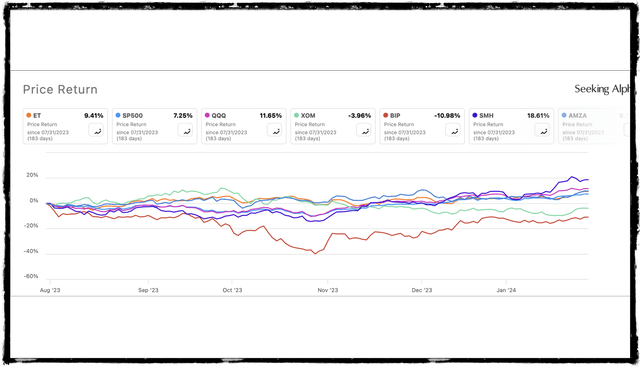

Here’s what markets thought of the Jan. 26 announcement through midstream, majors, and natural gas-related stocks: ET, XOM, AMZA, LNG, EQT, Chesapeake Energy Corporation (CHK) and EnLink Midstream, LLC (ENLC).

Stocks react to LNG policy announcement (Seeking Alpha/Warren interpretation)

(“After the Fed: Hybrid World…” video discusses this and more detail about the IRRs associated with projects of all types).

Other Infrastructure

Infrastructure plays are of increasing interest as they mirror how economic development is changing. BlackRock’s $15 billion purchase of GIP reflects that trend. Bloomberg writes:

The deal for GIP marks a new conviction that the biggest institutions will pay higher fees to put money to work in illiquid funds that back major, complex projects.

…While infrastructure bets can include more mundane projects such as toll roads and bridges, investing giants have also increasingly seen opportunities in energy-transition projects and data centers. They’re drawn by the typically stable, recurring returns those assets can generate.

(We also discussed this early last year in a February article: Global Energy Transition: Methods and Soft Landings (Video Interview).

It’s still highly relevant. The consultancy McKinsey projects a $15 trillion spending gap on global infrastructure through the end of the decade.

Cleaner Electrification

The transition to cleaner energy sources is facing challenges and inflationary forces. In the U.S. and globally, power generation in renewables is revealing the costs and inefficiencies as more capacity is added. But still, growth rates look to be 35% pa to 2030. There’s a preference and demand for more electrons, i.e., electricity demand. However, increased use of gas is required for baseload power, dispatchable energy, as policymakers like to say, but it is also needed to support those states and countries where renewables are growing because of their intermittency. Otherwise, coal will be used and/or substituted as in India, Germany, and China.

Headwinds in clean energy include:

• Critical minerals supply chains; with China decades ahead.

• Grid integration and last-mile challenges.

• High demand for clean energy to power modern tech-economy growth.

• Continued need for reliable, affordable baseload.

Grid integration requires engineering, science, and technological advances. And tech is a heavy energy user, by way of data centers and other facilities. Bloomberg writes:

“Server racks for AI computing can consume four times the power currently used in cloud processes, according to Newmark Group. That calls for data centers that can support surges in workloads, and more advanced cooling systems to handle the heat emitted.” At a recent Blockchain Summit (#NABS on X), I spent a day with Bitcoin miners.

(Reset and Regenerate: Themes After the Fed Conference – this has videos that capture the AI run-up).

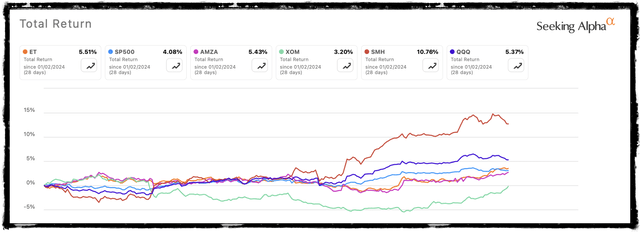

The following charts look at six-month and one-month intervals with energy, tech (QQQ) (SMH), and infrastructure plays.

Stocks comparison: energy, Tech, chips (Seeking Alpha) Energy, tech and infrastructure stocks (Seeking Alpha)

The year behind us with the current environment looks a bit like “rinse and repeat,” but with continued and new resetting ahead. The big tech stocks run-up is starting to power down a bit, in nuanced ways.

In conclusion

Right now, everything looks political, and the environment is noisy and cluttered with conflicting information. Asked about how I’m sorting through this, my response is to simply focus on fundamentals, including not having an overly U.S.-centric point of view. Geopolitics, economics, and physics are all guideposts for my investment lens. Energy is fundamental and underlies economic activity. Investment choices are partly belief and conviction, but there are signs along the way for a rational approach. My course is charted by a blend of energy and tech-specific funds alongside specific energy- and infrastructure-related stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.