SOPA Images/LightRocket via Getty Images

Twilio (NYSE:TWLO), the leading communications platform as a service (CPaaS) provider, has been facing a series of challenges in the past year that have eroded its competitive edge and growth prospects. The company has announced several employee layoffs, faced activist demands for board changes and strategic review, and replaced its co-founder and CEO Jeff Lawson with a new leader.

In this article, we will examine why Twilio is losing its momentum in the CPaaS market, how its growth strategy is failing to deliver results, and what are the risks for the company going forward.

CPaaS Market is Growing Double-Digits but Twilio is Stalled

The CPaaS market is one of the fastest-growing segments in the cloud communications industry, driven by the demand for digital customer engagement platforms. According to IDC, the worldwide CPaaS market is expected to grow from $14.3 billion in 2022 to $29.7 billion in 2026, at a CAGR of 15.8%.

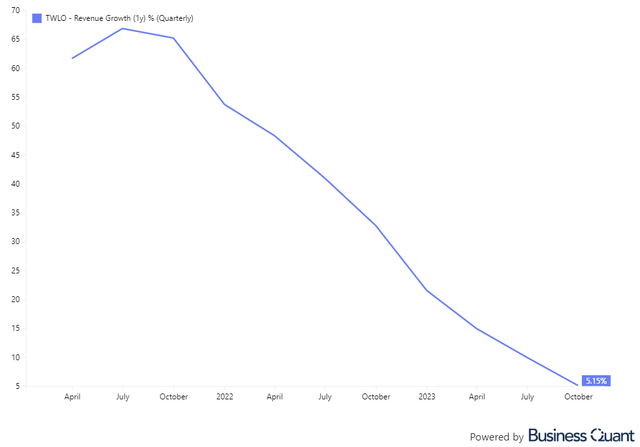

However, Twilio’s growth has not kept pace with the market. In Q3 2023, Twilio reported a revenue of $1.03 billion, up only 5% year-over-year, compared to 10% growth in Q2, and 15% growth in Q3 2023. This rate of revenue slowdown is very alarming. The company has seen its revenue growth drop by 85% in the past year, which is among the worst in the SaaS market (see below). This very severe slowdown can’t be explained by the macroeconomic headwinds alone.

Twilio Revenue Growth (quarterly) (Business Quant)

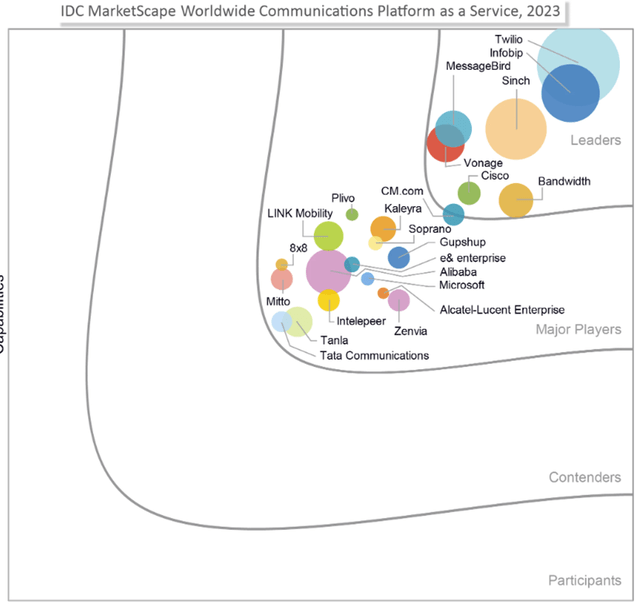

We think that Twilio’s severe slowing growth is a result of its weakening competitive position in the CPaaS market. Twilio faces competition from various players, including other CPaaS vendors, such as Sinch, Infobip, and MessageBird, local operators, such as AT&T, Verizon, and Orange, hyperscalers, such as Amazon, Microsoft, and Google, and SaaS companies, such as Salesforce, Zendesk, and HubSpot. According to IDC, Twilio’s share of the CPaaS market is now 24%, which is a considerable fall from three years ago when it held more than a third of the market.

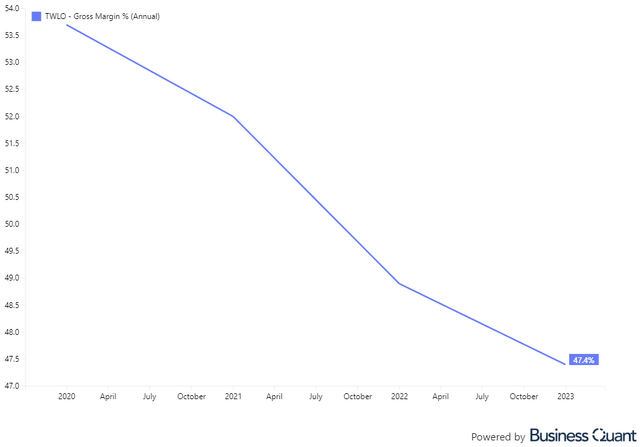

Twilio’s main competitive advantage is its API business model, which allows developers to easily and flexibly build and customize communication applications. However, we think that a communications API business model doesn’t have much moat as it is vulnerable to commoditization, as communication services become more standardized and interchangeable. Twilio’s gross margin has declined from 54% in 2020 to 47% in 2023, indicating the competitive pressure on its pricing.

Twilio Gross Margin (Business Quant)

Twilio Growth Strategy is Not Working

Twilio’s growth strategy is based on three pillars: releasing new products, cross-selling to existing customers, and expanding internationally. However, none of these pillars have delivered the expected results, as Twilio’s growth has decelerated.

Twilio has been launching new products, such as Twilio Flex, Twilio Frontline, Twilio Conversations, and Twilio Video, to diversify its revenue streams and address new use cases. However, these products have not gained significant traction, as they face competition from established or emerging players in their respective markets. For example, Twilio Flex, a cloud-based contact center platform, competes with leaders such as Talkdesk, Genesys, Five9, Vonage, as well as newcomers such as Amazon Connect.

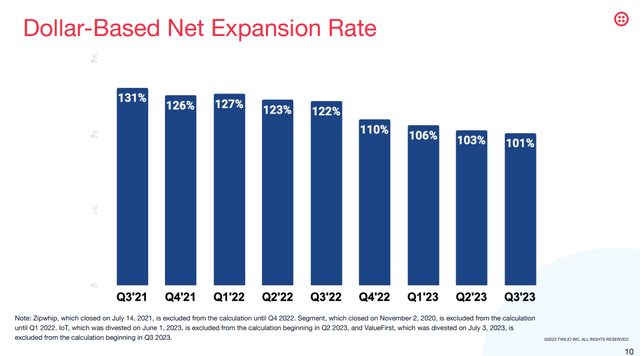

Twilio has also been trying to cross-sell its products to its existing customers, especially the large accounts that generate most of its revenue. However, Twilio’s cross-selling efforts have not been very effective, as its dollar-based net expansion rate (DBNER), which measures the revenue growth from existing customers, has declined from 131% in Q3 2021 to 101% in Q3 2023 (see below). This indicates that Twilio’s customers are not buying more of its products or increasing their usage.

Twilio DBNER (Twilio Q3 2023 Earnings Presentation)

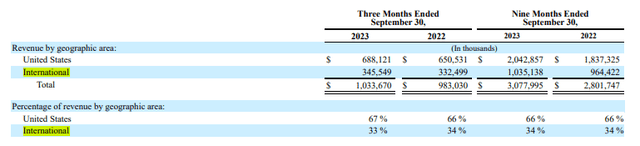

Twilio has also been expanding its international presence, as it operates in over 180 countries and regions. However, Twilio’s international growth has been slowed down by regulatory, operational, and competitive challenges. The International revenue mix has stalled around 34% in the last 2 years as the company has to comply with different laws and regulations in each country, such as data privacy, security, and localization requirements, which increase its costs and risks.

Twilio revenue by geography (10-Q)

Data & Applications Business Challenges

Twilio’s Data & Applications business, which includes its Segment, has been underperforming and dragging down Twilio’s overall growth and valuation. Twilio’s acquisition of Segment has been widely criticized by analysts and investors, as it was seen as a costly and risky move that diverted Twilio’s focus from its core CPaaS business. Twilio paid $3.2 billion in stock for Segment, which had a revenue of $200 million in 2020 and implies a revenue multiple of 16x.

This segment has been facing several challenges, such as integration issues, product overlap, customer churn, and competitive threats. It faces competition from various players, such as Salesforce, Adobe, Oracle, and HubSpot, which offer comprehensive and integrated solutions for customer data and engagement.

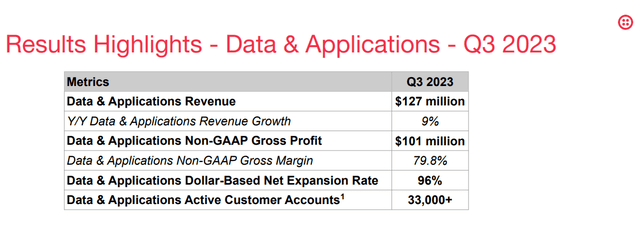

The company has also been struggling to integrate Segment into its platform and culture, as they have different architectures, technologies, and go-to-market strategies. As a result, the segment has started to face customer churn as the Net Expansion Rate dropped to 96% during Q3 2023. The segment revenue was $127 million in Q3 2023, up only 9% year-over-year, compared to 12% growth in Q2 2023 and 19% in Q1 2023.

Data & Apps Results (Twilio Q3 2023 Earnings Presentation)

Management Focusing on Profitability Rather than Growth

Twilio’s management has been shifting its strategy from pursuing growth at all costs to focusing on profitability and cash flow. Twilio has been cutting costs, improving operational efficiency, and optimizing its pricing and product mix. As a result, Twilio has improved its financial performance and strengthened its balance sheet.

Twilio’s non-GAAP income from operations was $136 million in Q3 2023, compared to a loss of $35 million in Q3 2022. This shows that Twilio has reached positive operating cash flow as of 2023, with its free cash flow rising to $195 million in Q3 2023, a significant profitability improvement.

However, we think that Twilio’s focus on profitability and cash flow will come at the expense of growth and innovation, which are essential for long-term success in the dynamic and competitive CPaaS market. Twilio’s R&D expenses were $241 million in Q3 2023, down 9% year-over-year; sales and marketing expenses were $263 million in Q3 2023, down 20% year-over-year. We prefer increasing the gross profit margin as the primary way of profitability improvement, rather than reducing R&D and SG&A expenses.

Upcoming Earnings

Twilio is scheduled to announce Q4 earnings on February 14th, 2024. Analysts expect the firm to report an EPS of $0.58 and revenue of $1.04 billion (+2% Y/Y).

We expect Twilio to beat its earnings expectations slightly, as the company announced it expects Q4 earnings to come above its guidance.

Valuation Fair as the Risks are Priced in

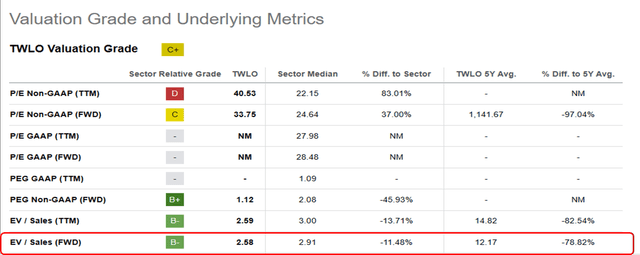

Twilio faces many challenges in its growth prospects, but its strong balance sheet and improving financials provide some cushion. Based on its 2024 full-year revenue estimate of $4.44 billion, Twilio has a forward EV/S ratio of 2.5. This is below industry averages, indicating that the market has accounted for the negatives of a company that is growing single digit with a decelerating growth rate. Market valuation looks fair to us.

TWLO Valuation Metrics (Seeking Alpha)

Conclusion

Twilio is facing multiple challenges that have affected its growth and competitive edge. Twilio’s data and applications segment, which was expected to be a growth driver, has not performed as well as anticipated and has impacted its valuation. Company has been prioritizing profitability and cash flow, but this may have compromised its growth and innovation, which are crucial for long-term success.

We think that the market has priced in Twilio’s growth challenges as its sales multiples trade at below market averages. We give it a Hold rating for now due to its improving cash flow situation, but investors should monitor Twilio’s future, as it may encounter more problems and underperformance.