We-Ge/iStock Unreleased via Getty Images

trivago (NASDAQ:TRVG), established in 2005, is a leading hotel metasearch engine, aggregating and comparing prices from over 5 million hotels and other types of accommodation across 190 countries. TRVG provides users with comprehensive price comparisons and simplified hotel discovery.

TRVG generates revenue by acting as a middleman, connecting users with hotel booking sites. They don’t sell hotels directly but instead utilize a cost-per-click / CPC model. When a user clicks a link to a specific hotel on a partner platform like Expedia or Booking, trivago earns a fee from that platform based on the click, regardless of the final booking outcome.

The stock’s performance has been underwhelming since going public in 2016 when the share price was over $59. It briefly reached its all-time high of $118 the following year, before gradually declining to reach high single digits for most of 2020 during COVID-19. Despite climbing back to over $20 upon the post-COVID recovery, TRVG appeared to struggle to maintain the momentum. Share price would then gradually decline to $5 pre-1-to-5 reverse splits and special dividend events in November 2023. Since the split, shares have been trading sideways around the $2.4 – $2.7 range.

I initiate my coverage with a buy rating. My modeled 1-year target price of $5.9 presents a projected 1.3x upside from today’s price of $2.55.

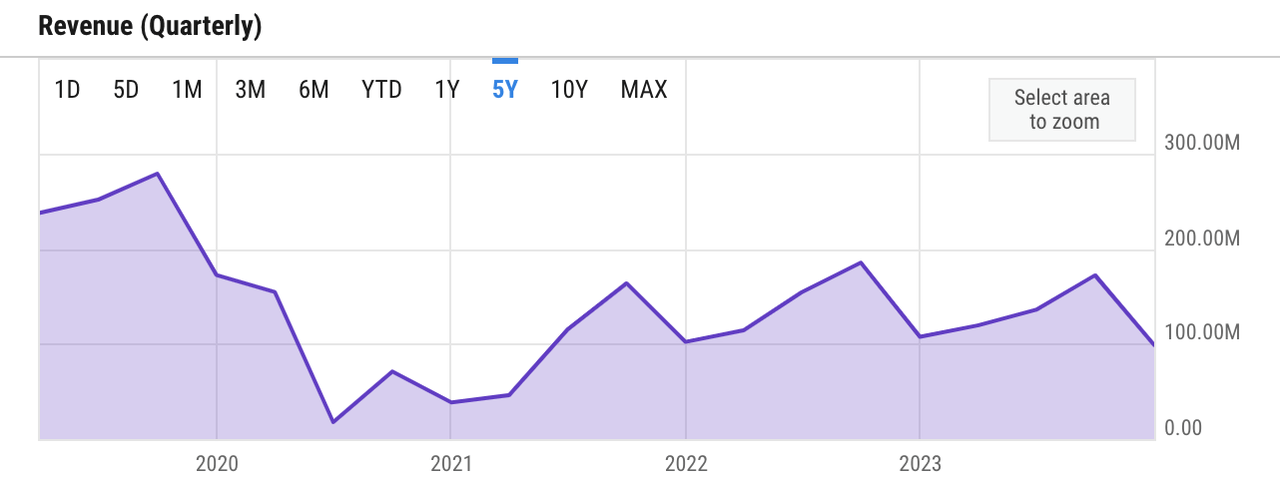

Financial Reviews

Revenue growth has been volatile in the last five years. Even before COVID-19, TRVG already started experiencing a moderate decline in revenue. Exacerbated by COVID-19, revenue saw an even steeper decline. Throughout 2020, quarterly revenue declined 70% – 90% YoY. Despite the post-COVID recovery in 2021 – 2022, momentum appeared to wane as several macro issues were unfolding, such as shifts in performance marketing landscape and inflation. Nonetheless, the decline in revenue since the past few quarters appears to have normalized in the negative single-digit zone.

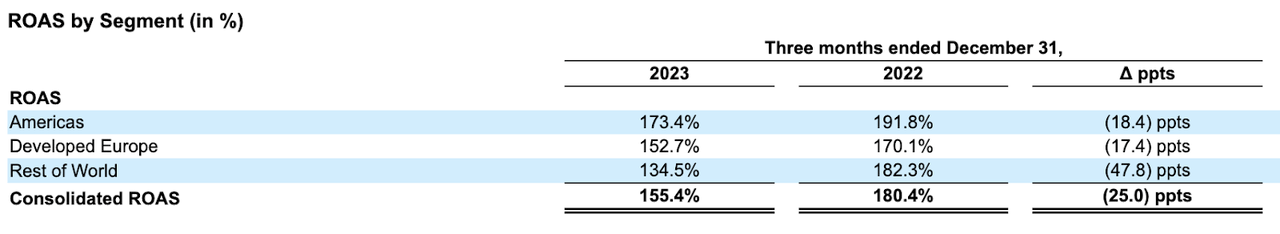

net income (YCharts)

TRVG’s slow growth since 2020 has forced them to be disciplined in terms of spending. Layoffs have helped cut costs, but revenue growth continues to struggle. Despite this, they’ve achieved occasional net profits, like $2.7 million in Q4 2023. In my opinion, this shows promise for financial stability, but long-term success depends on finding ways to grow revenue.

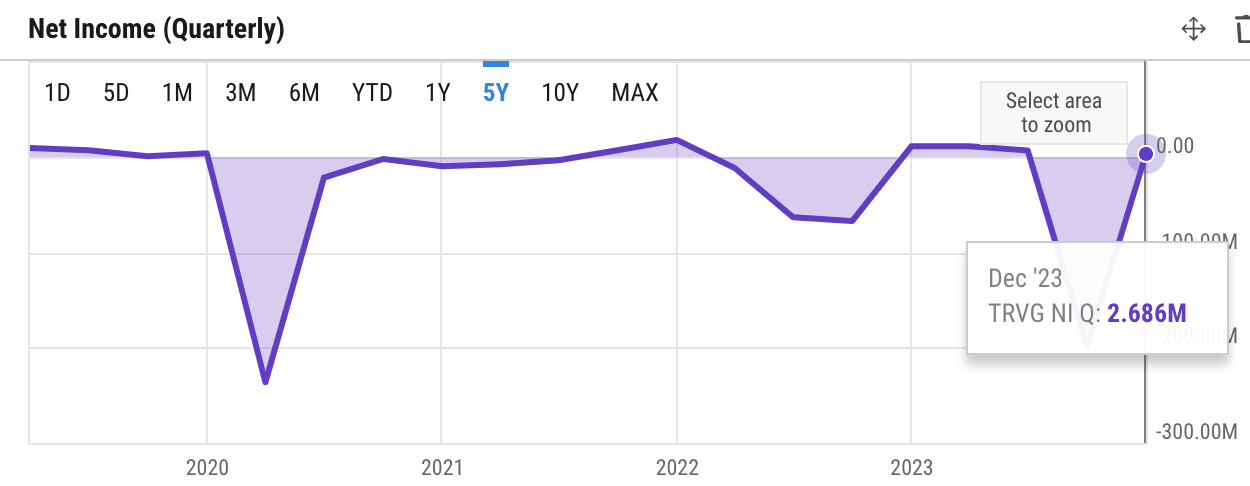

OCF (YCharts)

I also see signs of the disciplined approach in cash flow generation. TRVG has always been consistent in delivering positive operating cash flows / OCF. OCF was $70 million and $30 million for the past two fiscal years. In Q4, TRVG generated over $16 million of OCF, over half of the past fiscal year’s OCF already in a single quarter.

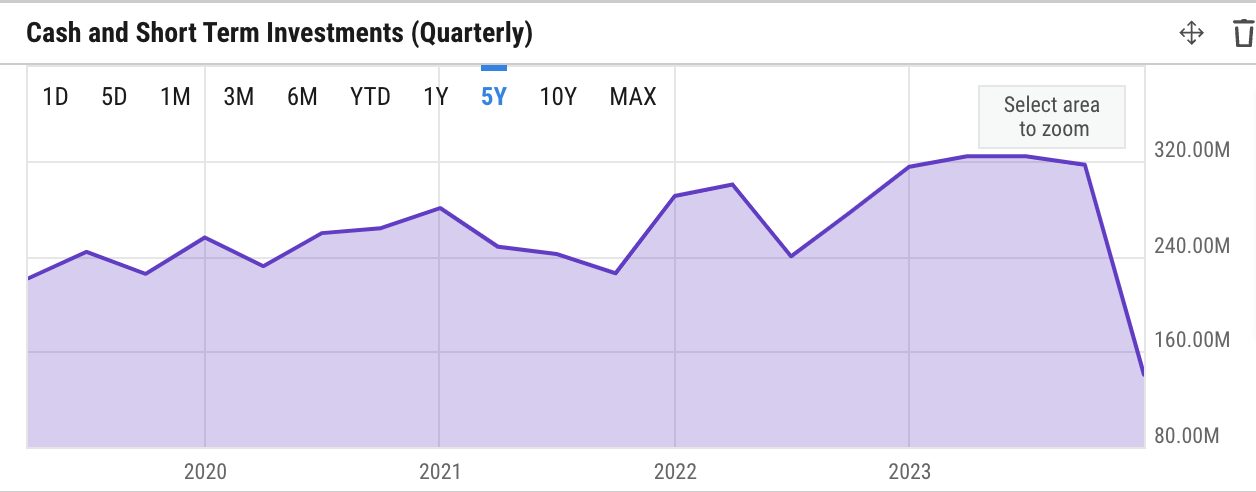

cash and cash (YCharts)

The consistent OCF outlook supports its liquidity position, which remains moderately solid. Cash and short-term investments were also on an uptrend and stood at $320 million as of Q3 2023. They declined to over $140 million in Q4, however, as a result of the $184 million use of cash for a one-time special dividend payment in November 2023. However, given TRVG’s consistent OCF generation, I believe the lowered cash outlook would not impact TRVG materially.

Catalyst

In the Q4 earnings call, the management suggests a few ways to drive revenue growth and profitability: 1) branded growth, 2) improved hotel search experience, 3) offering the best deal discovery experience, and 4) optimizing the new pricing auction model with the partners. In my view, there are some catalysts that will support TRVG in delivering some of these key objectives in 2024.

Considering the challenge of the increased competition in performance marketing in recent times, I believe that the focus towards brand marketing could be the right strategy at this time.

In my opinion, the advertising landscape in the post-cookie world will only continue to get more challenging and uncertain as Google looks to comply with the DMA / Digital Markets Act. Meanwhile, the emphasis on branded growth aligns with TRVG’s strong expertise and track record in delivering brand awareness campaigns in the past. As such, I would expect TRVG to have a good chance of success with the branded growth strategy.

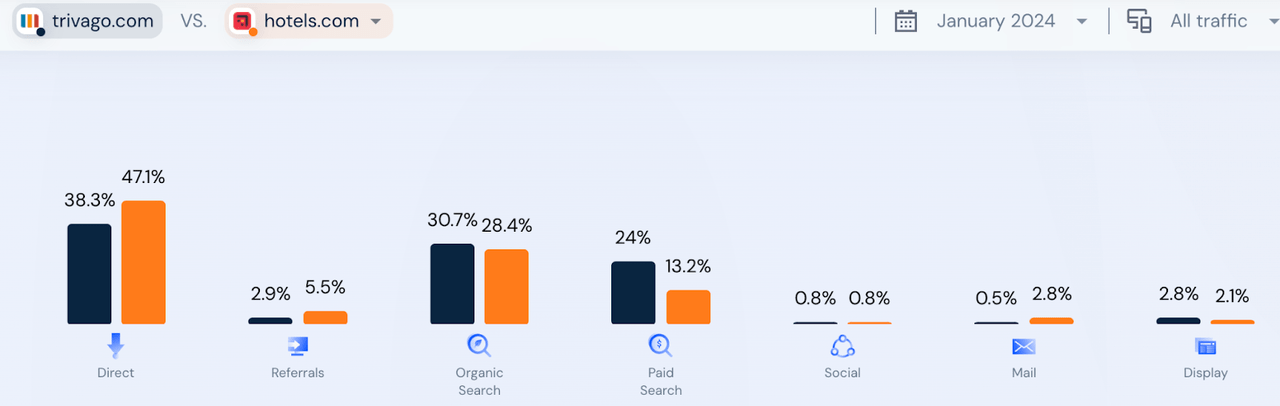

traffic breakdown (similarweb)

Upon a successful campaign, I would expect TRVG to see an increasing share of the direct channel in its traffic mix, potentially making up close to half of the total traffic generation. This means having a more similar outlook to its sister company, Hotels.com. With 47.1% of its traffic from the direct channel and only 13.2% from paid search, Hotels.com seems to have also been shifting away from a performance marketing strategy. This means reducing traffic dependencies from search engines like Google.

traffic trivago vs hotels.com (similarweb)

Most importantly, they seem to have been quite successful in maintaining an upward trend in traffic, even post the holiday season. Hotels.com grew its visits by almost 19% while TRVG was trailing behind with only 16% growth, despite having a smaller base to start with.

Furthermore, I also think that TRVG’s focus on improving the deal discovery experience aligns with the shifting customer preference in 2024. Research done by Skift suggests that customers may continue to lean on deal-shopping through comparison sites in 2024 given the still weak macro outlook. This trend should favor demand for TRVG, effectively creating the potential for stronger conversion and revenue growth:

Our third strategic priority is to offer the best deal discovery experience. We have travelers find great hotel deals and better prices. Our experiments have been aimed at refining how we display and rank deals on our search results. Furthermore, we have improved the rate accuracy on our platform by evolving our deal intelligence and rate accuracy scoring system for our partners, continuing to improve our deal exposure and rate accuracy will be focused in the coming months as we expect these improvements to foster trust and retention among our users.

Source: Q4 earnings call.

Risk

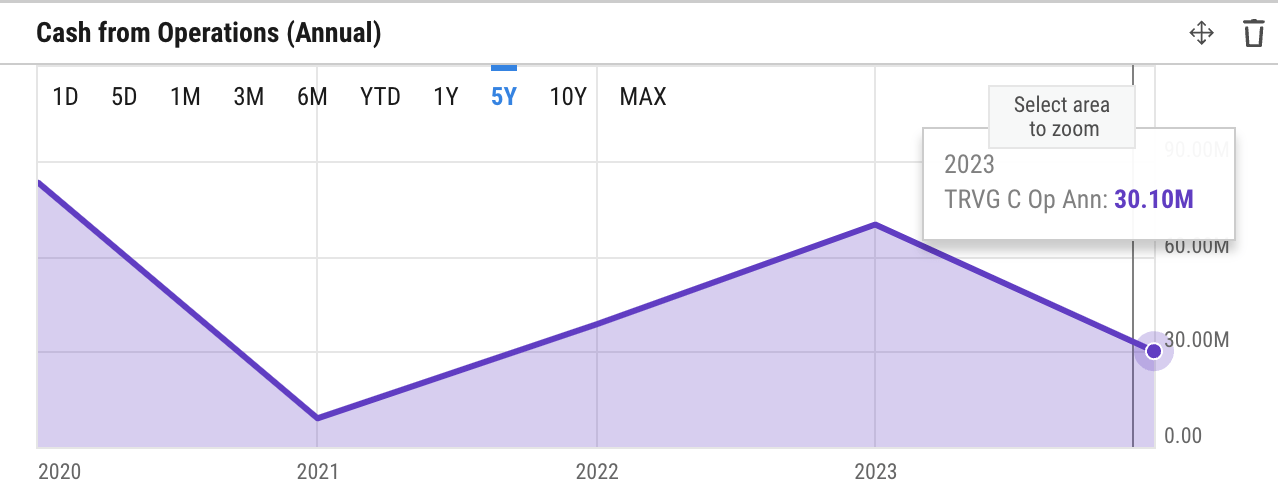

Risk remains high. Despite the positive prospect, the branded growth strategy will remain expensive for TRVG. It may also not yield immediate results in terms of ROAS / Return on Ad Spend, with revenue growth only picking up sometime in the second half of the year:

And then maybe I can extend to the rest of the year. I think overall expectation for us that first half is negative and the second half turns into positive when our brand investments are paying off because there are compounding effects kicking in and the early signals that we are seeing in all segments are supporting our hypothesis on this.

Source: Q4 earnings call.

Furthermore, the increased investments into the marketing campaign will also create temporary pressure on profitability:

Sure. So for the adjusted EBITDA, with these additional investments into our brand, we will expect to have a negative impact on the near-term profitability level. So in the first half of the year, we would expect that adjusted EBITDA to be negative, but we would stay disciplined. So this would be a low single-digit number, that’s negative.

Source: Q4 earnings call.

Due to the outlook, my view is that there is a risk of TRVG not seeing meaningful upward price action until there is a positive sign of successful execution. As such, this remains a key item to monitor in the following quarters.

In the worst-case scenario, TRVG may also not realize the expected outcome from its branded campaign and its improved hotel deals offering due to a worsening macro outlook or even higher difficulties in performance marketing due to the DMA. For instance, despite the recovery of travel in Japan that fueled marketing spend in the Rest of the World / RoW segment, the overall segment still saw weak ROAS in Q4 2023. This suggests possible issues beyond the recovered Japanese market, indicating potentially weak conversion in other RoW segments.

Valuation / Pricing

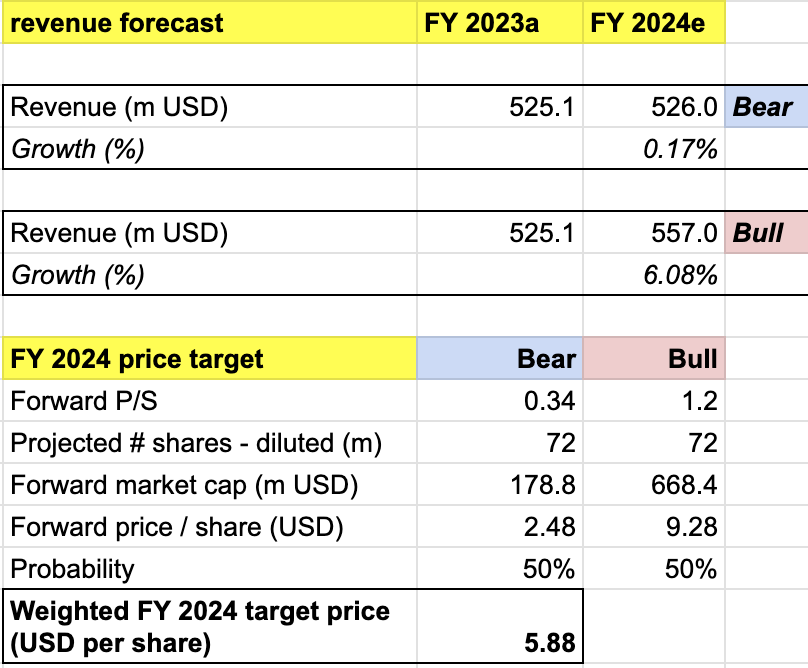

My target price for TRVG is driven by the following assumptions for the bull vs bear scenarios of the FY 2024 projection:

-

Bull scenario (50% probability) assumptions – TRVG to achieve FY 2024 revenue of $557 million. Despite the analyst’s estimate that projects over 10% growth, I believe that 6% growth already represents a realistic bullish scenario. This would mean bringing revenue level back up to where it was in FY 2022 as travel pattern normalizes away from the post-pandemic elevated level. I assign TRVG a 1.2x P/S, an expansion from 0.34x today. At 1.2x P/S, TRVG will revisit its valuation back in 2022 to reflect the similar sentiment.

-

Bear scenario (50% probability) assumptions – TRVG to deliver a revenue of $526 million in FY 2024, at the low end of the analysts’ estimate. I assign GWRE a 0.34x P/S, where it is trading today.

price target (own analysis)

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of $5.9 per share, suggesting a 1.3x or over 130% upside from the current price level. I rate the stock a buy.

Given the uncertainties, TRVG appears significantly undervalued at $2.55, implying attractive risk-reward.

Conclusion

TRVG, a leading hotel metasearch platform, presents a compelling buy opportunity with a projected 1.3x upside to $5.9 within a year. The shift towards branded growth marketing aligns with the company’s strength and may yield a turnaround after a series of declining revenue growth. However, historical underperformance, ever-evolving marketing landscapes and customer preferences, and uncertain macro outlook demand cautious optimism. Investors should closely monitor TRVG’s ability to navigate these headwinds before diving in.