Ion-Creations

Note:

I have covered Transocean Ltd. (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

Fleet Status Report Discussion

After the close of Wednesday’s session, leading offshore driller Transocean Ltd. or “Transocean” released a rather disappointing fleet status report.

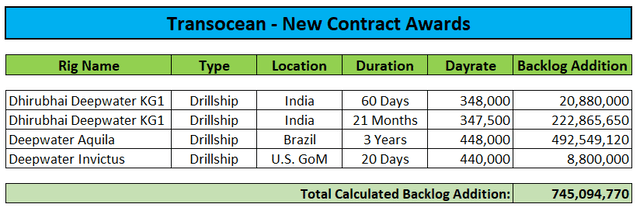

While the company added approximately $745 million in incremental backlog, the vast majority was derived from previously disclosed long-term contract awards for the ultra-deepwater drillships Dhirubhai Deepwater KG1 and Deepwater Aquila.

Please note that the drillship Deepwater Invictus has already completed its 20-day contract and is now sitting idle again in the U.S. Gulf of Mexico.

In addition, the drillship Dhirubhai Deepwater KG1 secured a two-month extension in India at slightly improved terms with customer Reliance Energy (“Reliance”). The rig is now expected to work for Reliance until December. Subsequently, the drillship will undergo contract preparations before commencing its 21-month contract with ONGC in February.

Recently acquired newbuild drillship Deepwater Aquila is expected to be delivered from the shipyard later this month with commencement of the rig’s maiden contract scheduled for June 2024.

Total backlog increased by approximately 2% sequentially to a new multi-year high of $9.4 billion.

However, the fleet status report also contained a number of negative developments:

- The semi-submersible rig Development Driller III has been sitting idle since August already despite the July fleet status report showing a contract with TotalEnergies (TTE) in Suriname until October. I would estimate the negative impact on H2/2023 revenues at approximately $22 million.

- The 8th generation drillship Deepwater Atlas will work for another month at a reduced dayrate of $268,000 in the U.S. Gulf of Mexico with a return to the original contract rate of $455,000 now expected for December. I would estimate the delay to negatively impact Q4 revenues by approximately $5.5 million. However, Transocean will make up for the delay next year as the contract has been extended by one month until September 2024.

- Contract commencement for the drillship Deepwater Orion’s new three-year contract offshore Brazil has been delayed by approximately two months to January 2024. I would estimate the delay to negatively impact Q4 revenues by up to $25 million.

- The term of the drillship Deepwater Mykonos’ new contract offshore Brazil has been shortened by one month with the contract end now scheduled for December 2024 with an estimated negative revenue impact of up to $11.5 million.

- Contract commencement for the drillship Dhirubhai Deepwater KG2’s new three-year contract offshore Brazil has been delayed by approximately two months to November with an estimated negative impact on Q3 revenues by up to $25 million.

- Harsh environment semi-submersible rig Transocean Spitsbergen won’t roll over to an increased dayrate under its contract offshore Norway with Equinor (EQNR) until November, two months later than originally expected. However, the negative impact on H2/2023 revenues will be below $1.5 million.

As usual, there have been a number of other minor variances, mostly due to currency fluctuations and, to a lesser extent, cost escalation clauses.

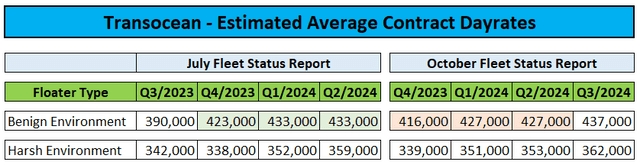

In sum, these changes required the company to reduce its average dayrate estimates for its benign environment floater fleet by approximately 1.5% for the next few quarters:

Given the lack of material, previously undisclosed contract awards in combination with the slight reduction to the company’s near-term average dayrate projections, Wednesday’s fleet status report is unlikely to provide a catalyst for the shares which have experienced some major selling pressure as of late.

Since reaching a new multi-year high of $8.88 last month, the stock has retreated by approximately 17%. Even the most recent oil price rally caused by the Hamas’ attack on Israel hasn’t really helped the shares.

Convertible Debt Exchange Overhang

For my part, I would attribute at least some of the recent underperformance to last week’s exchangeable bonds conversion:

On October 10, 2023, Transocean Ltd. (the “Company”) announced that, as part of its ongoing efforts to optimize its capital structure, Transocean Inc., a wholly owned subsidiary of the Company, entered into individually negotiated agreements (i) on October 3, 2023 (the “2025 EB Agreements”) with certain holders (the “2025 EB Holders”) of its 4.0% Senior Guaranteed Exchangeable Bonds due 2025 (the “2025 Exchangeable Bonds”), and (ii) on October 4, 2023 (the “2029 EB Agreements”) with certain holders (the “2029 EB Holders”) of its 4.625% Senior Guaranteed Exchangeable Bonds due 2029 (the “2029 Exchangeable Bonds”).

Pursuant to the 2025 EB Agreements, (i) the 2025 EB Holders agreed to exercise their rights to exchange U.S.$60,000,000 aggregate principal amount of 2025 Exchangeable Bonds for 11,428,568 shares, CHF 0.10 par value, of the Company (“Shares”) in accordance with the exchange ratio and other terms of that certain Indenture, dated February 26, 2021, by and among Transocean Inc., the guarantors party thereto and Computershare Trust Company, N.A., as successor trustee to Wells Fargo Bank, National Association, and (ii) Transocean Inc. agreed to deliver, in consideration therefor, in aggregate 1,921,298 additional Shares to such 2025 EB Holders. Pursuant to the 2029 EB Agreements, (i) the 2029 EB Holders agreed to exercise their rights to exchange U.S.$41,000,000 aggregate principal amount of 2029 Exchangeable Bonds for 11,917,130 Shares in accordance with the exchange ratio and other terms of that certain Indenture, dated September 30, 2022, by and among Transocean Inc., the guarantors party thereto and Truist Bank, as trustee, and (ii) Transocean Inc. agreed to deliver, in consideration therefor, in aggregate 1,223,550 additional Shares to such 2029 EB Holders. The issuances of Shares to the 2025 EB Holders and the 2029 EB Holders is exempt pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended, which exempts transactions by an issuer not involving a public offering.

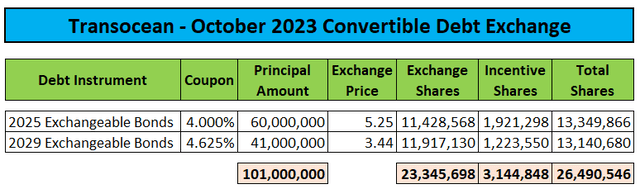

In aggregate, the company issued approximately 26.5 million new shares in exchange for holders converting $101 million in principal amount of the company’s exchangeable bonds:

While management hinted to a number of bondholders looking to exercise their conversion option on the Q2 conference call, I was surprised by the fact that holders managed to extract more than 3.1 million additional shares as conversion premium, particularly when considering the bonds’ rather low coupons.

On the flip side, bondholders relinquished approximately $16.3 million in future interest payments.

With former bondholders likely looking to take their sizeable gains off the table (otherwise there would have been no need to accelerate conversion), I would expect near-term selling pressure to persist.

However, there might be some offset as former bondholders employing convertible arbitrage strategies cover their short positions.

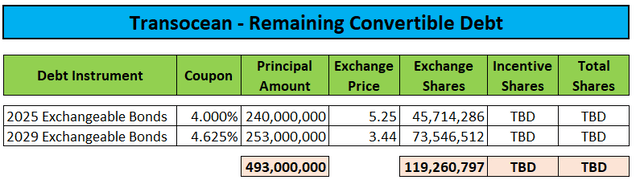

Please note that Transocean has close to $500 million in additional exchangeable notes outstanding. Assuming full conversion, outstanding shares would increase by approximately 120 million and this number does not include any potential incentive shares.

Following the most recent convertible debt conversion, outstanding shares are approaching the 800 million mark. On a fully-converted basis, this number would increase to approximately 920 million.

Valuation

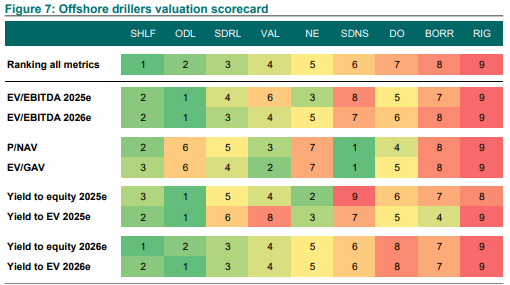

Valuation-wise, Transocean’s shares remain expensive relative to peers on most key metrics including EV/EBITDA:

DNB Markets

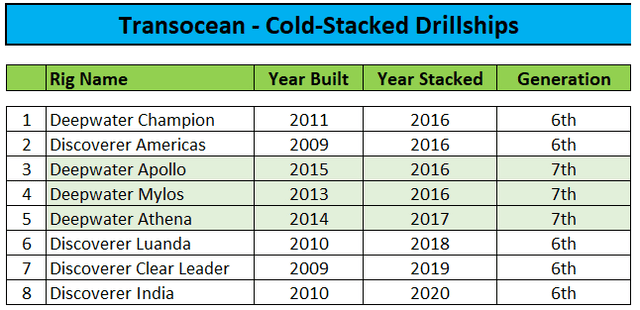

However, I do not expect the premium to decrease anytime soon as investors continue to place substantial value on the company’s large fleet of cold-stacked drillships:

For my part, I do not expect Transocean’s lower-specification 6th generation assets returning to service but reactivation of the three 7th generation drillships inherited from Ocean Rig could still add approximately $250 million in annual EBITDA at prevailing dayrates.

On the flip side, I wouldn’t be surprised to see aggregate reactivation costs for these rigs substantially exceeding the range of $225 million to $375 million provided by the company.

Bottom Line

Transocean’s uninspiring fleet status report is unlikely to provide the catalyst required for the shares to overcome apparent pressure from the recent convertible debt exchange.

Moreover, given the sizeable amount of deeply in-the-money exchangeable bonds still outstanding, investors are likely to remain wary of potential, additional near-term conversions.

Furthermore, the above-discussed delays might result in management guiding Q4 contract drilling revenues below current consensus expectations on the upcoming Q3 conference call scheduled for October 31.

Lastly, shares are likely to remain vulnerable to a potential reversal in oil prices following the most recent rally.

In sum, the near-term outlook for Transocean’s shares has become more uncertain but given ongoing, strong industry fundamentals, I would advise investors to consider scaling into the shares on further weakness.

While the stock remains expensive relative to peers, I would expect the premium to persist for the time being as investors continue to place their bets on the future earnings power of the company’s cold-stacked assets.

Assigning a multiple of 7x to my 2025 Adjusted EBITDA estimate of $2 billion would yield a price target of $10 for the shares.

Risk Factors

Not surprisingly, offshore drilling stocks remain heavily correlated to oil prices so any sustained down move in the commodity would almost certainly result in industry shares taking a hit.

In addition, further near-term conversions of the company’s exchangeable notes could exacerbate selling pressure.

Lastly, should management indeed lower near-term expectations on the upcoming Q3 conference call, shares are likely to take a hit.