By Andrew Prochnow

Given the substantial 37% year-to-date return in the Nasdaq 100, it’s unsurprising that mega-cap tech giants like Nvidia (NVDA) and Meta (META) have been the center of attention in 2023.

Nevertheless, one could argue that smaller-cap tech stocks have been somewhat unfairly overshadowed. These stocks typically have market capitalizations below $2 billion. Unlike their larger-cap counterparts, smaller-cap tech stocks don’t boast eye-popping revenues or earnings. Instead, these companies are primarily focused on the development of new, and at times, cutting-edge products and services.

At some point down the road, these innovative products and services may find success in the market, leading to the commencement of revenue and profit generation. Nonetheless, even in their early stages of development, smaller-cap tech stocks can present a captivating prospect. After all, some of these emerging companies could evolve into the tech giants of the future.

Furthermore, smaller-cap stocks can also hold appeal due to their potential for acquisition. Larger corporations, often equipped with surplus capital, may find it more convenient to acquire novel technologies than to cultivate them internally. For instance, in May, Crosspoint Capital Partners acquired Absolute Software (ABST) for approximately $870 million.

Highlighted below are some of the top-performing small cap stocks from the tech sector so far this year (with market capitalizations between $50 million and $2 billion):

- Cipher Mining (CIFR), +298%

- Applied Optoelectronics (AAOI), +298%

- MicroAlgo (MLGO), +180%

- Applied Digital (APLD), +168%

- Archer Aviation (ACHR), +165%

- Riot Platforms (RIOT), +162%

- Innodata (INOD), +138%

- Arlo Technologies (ARLO), +136%

- FingerMotion (FNGR), +133%

- Bitfarm (BITF), +130%

- Eltek (ELTK), +130%

- Marathon Digital Holdings (MARA), +128%

- Hut 8 Mining (HUT), +117%

- CSP Inc. (CSPI), +105%

- Qudian (QD), +104%

- RxSight (RXST), +94%

- CleanSpark (CLSK), +94%

- Ehang Holdings (EH), +92%

- HIVE Digital (HIVE), +92%

- Rigetti Computing (RGTI), +75%

Of the 20 companies listed above, three are especially interesting because they are involved in the burgeoning artificial intelligence (AI) niche. Led by companies such as Nvidia and Open AI, valuations in the AI niche exploded in 2023.

More Details on the Small Cap Tech Winners in 2023

Many of the factors that have propelled the larger-cap tech stocks to new heights in 2023 have also spilled over into the realm of smaller-cap companies. Foremost among these is the influence of artificial intelligence (AI), but it’s worth noting that the surge in Bitcoin has ignited a rally in cryptocurrency-related stocks as well.

An essential facet of the AI narrative is data centers, and this is a significant factor behind the positive performance of Applied Digital (APLD) in 2023. Beyond operating data centers, Applied Digital also provides cloud services with a focus on artificial intelligence.

In a similar vein, Innodata (INOD) has garnered favor among small-cap investors and traders this year. Innodata specializes in data engineering, particularly in the domain of artificial intelligence. A noteworthy segment of the company is Innodata’s AI data preparation division, which encompasses the collection, optimization, and annotation of training data, along with providing deployment and integration services for AI models.

Apart from Applied Digital and Innodata, another company making waves in the AI sector in 2023 is Rigetti (RGTI). Rigetti specializes in the construction of quantum computers, which are poised to be the next major breakthrough in the tech world, as they are expected to facilitate the next significant phase of AI development.

The primary driver of this sector’s potential lies in the sheer computing power associated with quantum computers. These machines outpace the world’s most powerful supercomputers in terms of speed and capability, rendering them exceptionally well-suited for running complex generative AI models like ChatGPT.

Rigetti went public through a SPAC merger in early 2022 and is presently working on building an 84-qubit quantum computer named Ankaa. In a similar vein, shares in IONQ Inc. (IONQ) have also seen significant increases due to the company’s promising prospects in quantum computing. However, IONQ’s market capitalization exceeds $2 billion, which is why it doesn’t feature on the list of top performers mentioned earlier.

Another standout among small-cap performers in 2023 comes from the medical technology sector, marking a somewhat unconventional shift from traditional tech companies. Nevertheless, the remarkable doubling of shares in RxSight (RXST) this year is justified.

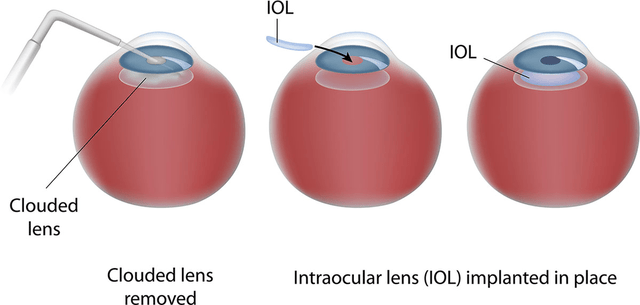

Back in 2021, RxSight successfully commercialized the first and only customizable intraocular lens approved by the FDA. This innovation empowers surgeons to customize and optimize visual acuity following cataract surgery, as demonstrated below.

RxSight

RxSight’s technology stands as a true breakthrough, delivering superior post-surgery results in comparison to existing technologies. The company’s Light Adjustable Lens (LAL) technology has demonstrated, through a wide array of studies, its ability to provide optimized vision after cataract surgery.

The recent success of the commercial application of LAL technology has unquestionably fueled increased optimism in the company’s shares. RXST’s shares currently trade at approximately $26 per share, with an average price target of $32.80. It’s worth noting that the stock began the year at under $13 per share.

Two other companies featured in the previously mentioned list of top-performers come from the unmanned aerial vehicle (UAV) sector: Archer Aviation (ACHR) and EHang Holdings (EH). For further insights into recent developments in the UAV industry, interested readers can refer to a recent article on Seeking Alpha.

Given the more than 70% surge in Bitcoin’s value in 2023, it’s hardly surprising that several smaller cryptocurrency miners are among the list of top-performing small-cap tech stocks.

Of the 20 stocks outlined above, seven are actively engaged in cryptocurrency mining, including Cipher Mining (CIFR), Riot Platforms (RIOT), Bitfarm Ltd (BITF), Marathon Digital (MARA), Hut 8 Mining (HUT), Hive Digital (HIVE), and CleanSpark (CLSK). Given their high correlation with Bitcoin’s price, one’s perspective on these stocks will likely pivot on their outlook for the broader crypto industry, with a specific emphasis on Bitcoin.

Finally, four of the top 20 performers noted earlier have their headquarters in China. These include EHang Holdings, FingerMotion (FNGR), MicroAlgo (MLGO), and Qudian (QD).

FingerMotion specializes in mobile payment and recharging systems, while Qudian operates online platforms offering consumer credit products. MicroAlgo assists clients in optimizing algorithms and accelerating their computing power, often without the need for new hardware acquisitions.

In this context, MicroAlgo’s connection to the AI sector positions it as another significant stock to watch in 2024, alongside Applied Digital, Innodata, and Rigetti.

Parting Shots

Investing in smaller companies can often feel like a thrilling rollercoaster ride, given the swift changes in their fortunes. However, small-cap stocks also present the chance to enter at an early stage with a reasonable valuation.

In light of the transformative potential of AI, the three previously mentioned stocks—Applied Digital, Innodata, and Rigetti—are particularly captivating at this juncture. Nevertheless, as is customary with any investment opportunity, it’s crucial for investors and traders to carry out thorough due diligence before initiating new positions.

For market participants who favor exchange-traded funds ((ETFs)) over individual stocks, the Invesco S&P SmallCap Information Technology ETF (PSCT) is an option to explore, as it has achieved a 3% increase year-to-date.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

da-kuk

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.