visual7/E+ via Getty Images

By Min Joo Kang, Senior Economist, South Korea and Japan

Exports rose firmly in January with encouraging features in the details

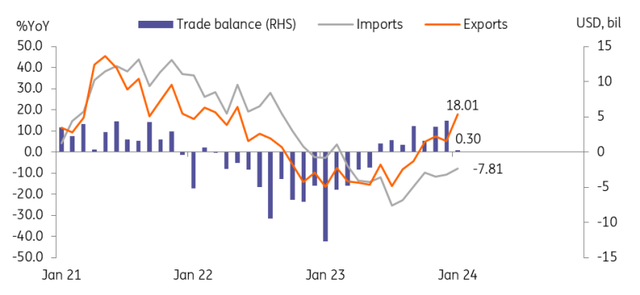

Exports jumped 18.0% YoY in January (vs 5.0% in December, 17.6% market consensus), but the rise was slightly exaggerated due to the Lunar New Year holidays. This January has 2.5 more business days than last January. Even so, daily average exports rose 5.7%, so clearly, the robust export trend continued in January.

Exports of chips shot up 56.2%, rising now for three consecutive months and exports of vehicles also gained 24.8%, rising for 19 consecutive months. The better news is that the export recovery is spreading out to other major export items. It could be temporary, but in January, machinery (14.5%), home appliances (14.2%), and display products (2.1%) all moved up.

By destination, most notable, exports to China rebounded 16.1%, the first increase since May 2022. Exports of chips and computers gained, offsetting the weaker demand for petrochemical products in China. Exports to the US (26.9%) also rose, led by vehicles, machinery and computers.

Imports declined due to falling energy prices and weak domestic demand

Imports declined -7.8% YoY in January (vs -10.8% in December, -9.1% market consensus). Energy imports declined 16.3%. Oil imports increased 6.0% but gas (-41.9%) and coal (-8.2%) imports declined. Due to the Red Sea conflict, imports of commodities will rise a bit soon. Non-energy imports dropped -4.7%. Based on 20 days of import data, machinery, passenger cars, and semiconductor manufacturing equipment all declined, which suggests that domestic consumption and equipment investment will soften in the coming months. Weak domestic demand along with credit risks surrounding the real-estate market will likely partially offset the robust gains from exports and manufacturing.

Exports surged but the trade surplus narrowed in January

GDP outlook

We expect exports to improve in the coming months, but due to the Lunar New Year effect, headline figures will likely fluctuate, and February export growth will slow down quite sharply. Indeed, the sharp rise of semiconductors is an upside surprise and the manufacturing PMI (51.2) also was stronger than we expected (50.0), pointing to a slightly higher GDP in 1Q24 than our current forecast of 0.4% QoQ sa. But the details in the import data also suggest weak domestic demand, so we are keeping our current GDP forecast as it is for now

Content Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.