D-Keine

Co-authored by Treading Softly

“All happy families are alike; each unhappy family is unhappy in its own way”

This is posited by Leo Tolstoy in his book Anna Karenina.

When we think about it, it’s often very true when the market is climbing, or things are going well. We often don’t give it a second thought. We’re just happy with the outcome of the situation. Yet, when things seem to be falling apart and everything seems to be going wrong, we often dig around to find the unique bring about. For many of us, those causes are as unique as we are.

So many retirees are struggling to save for their retirement and the reason for it is as unique as their situation. So many retirees are struggling in retirement because their income is not meeting what they need and the reason for this is unique and diversified as they are. Yet, for so many, the answer to happiness could be the same.

For decades, I’ve been a professional income investor, highlighting to people how to produce the most income from the market, and pointing out excellent opportunities. What never surprises me is that no matter how many people read our articles or combine our investment group here on Seeking Alpha, we’re able to point out the opportunities that are uniform to them all to benefit them in their unique situations. Whether you have a portfolio that is $20,000 or a portfolio that is $200 million, our unique Income Method can help you produce more income.

Today, I want to highlight an extremely attractive sector that is ripe full of opportunities for you to take advantage of.

Let’s dive in!

Beaten-Down Bonds Are Highly Attractive

2022 through 2023 is going to be remembered in history as one of the “worst” bond markets in history. And by “worst”, I mean one of the best markets for bond investors in history. Before I explain what I mean, let me tell you a little story:

I go to a local coffee shop on a regular basis to visit with my friend, Hapless Hal. We relish a cup of coffee and discussion on a variety of topics. Well, last week, I showed up at our usual table, and the coffee was on sale. It is half of the usual price until 8 AM. Noting the discount, I decided to go with the 24 oz cup instead of my usual 16 oz. After all, if I can get more coffee for a lower price – I’m all in!

Then I noticed Hal didn’t have any coffee in front of him. When I asked why, he said:

“The coffee market is terrible, it is down 50% today! Why would I want to buy something that has fallen in price so quickly?”

So I sat down, sipped on my coffee, and then at 8:00 the sale ended, Hal leaped up and ran to the counter. He came back with two cups of coffee:

“The coffee market is bullish, it’s up 100% in the past hour, I had to buy before the price went up even more!”

If Hal sounds more than a little irrational to you, exchange the word “coffee” with “income”. Hal’s actions, which we can all recognize as utterly irrational in a coffee shop, are how the vast majority of investors approach investments. They are ecstatic when they are more expensive and rush to buy more. They are angry and upset when they are down in price and prone to avoid buying or even selling.

Bond prices have fallen, and the primary reason is that interest rates have gone up. This is an unmitigated positive for investors who are buying bonds. Lower prices are always good for buyers. It’s a truism that we recognize in our daily lives with every other product we purchase. Yet when it comes to buying income, people get upset at lower prices, even when they are positioned to be a buyer!

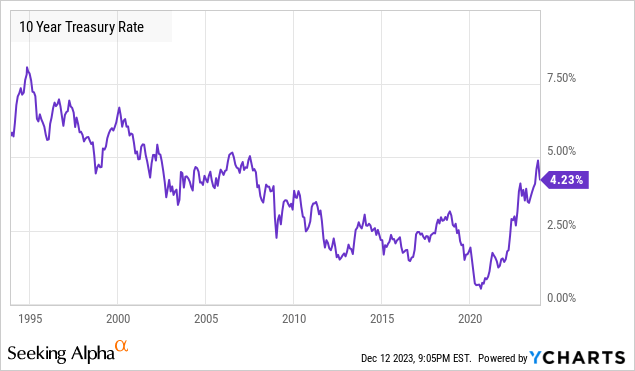

For the past 30 years, bond yields have been on a steady downtrend. Since 2022, they spiked up.

Now, I know some very intelligent investors who describe 1993 to 2021 as a very “good” market for bonds. They will point out that bond prices have generally risen. However, a rising bond price is only useful if you are selling bonds – reducing the number of bonds you own. If you are maintaining or increasing the number of bonds you own, the rising price has resulted in lower and lower returns.

Suppose a conservative investor with a sizable fortune of $1 million in 1993 didn’t want to take any risk and bought $1,000,000 in 10-year Treasuries in December 1993; they would have received a coupon of about 6%. For 10 years, they would have collected 6% or $60,000/year. Not a bad income in the early 1990s.

In December 2003, they would have gotten their $1,000,000 back and could reinvest in a new 10-year Treasury at about 4.25%. For the next 10 years, their income would now be $42,500/year on the same $1 million investment. Then, in December 2013, when the bond matures, they get $1 million and reinvest at about 2.75%. They are now receiving $27,500 in annual income on the same $1 million investment. They went from a pretty decent income in 1993, to being below the poverty line in 2013 while still being a millionaire. Tell me again how this is a “great” market for bond investors?

Ten years later, that bond matures, and today, they have the opportunity to invest in a 10-year Treasury at about 4.25%, which will pay an annual interest of $42,500. Following “the worst” market for bonds, the income of this bond investor went up 54%.

Investors often confuse price with an investment being “good” or “bad”. Yet when your goal is to withdraw income from an investment, the lower prices are, the better off you are. As illustrated above, even with a zero credit risk fixed-income strategy, the investor’s income changed dramatically for the worse when rates declined and for the better when they rose. In theory, our 1993 millionaire could have sold the Treasuries for a profit, five years into holding them, but what would they have done with the money? They needed the income, so while they could sell for a premium, any other Treasuries bought would be at the same yield. They could only have benefited from selling and reinvesting elsewhere if they were willing to take on a different (and greater) risk.

When you unveil credit risk, this core principle still applies. It is shrouded by other factors, such as default risk. Yet higher Treasury rates will enhance rates, and therefore income, for bond investors at all levels of risk. This makes it the best time in two decades to be buying bonds of all stripes.

Building a diversified portfolio of debt investments can be difficult for the average retail investor. You have to consider the credit risk of each investment, and a diversified portfolio of debt investments can easily necessitate $100,000+ of investment capital deployed to debt alone.

PIMCO Dynamic Income Fund (PDI) – yield 15.2%

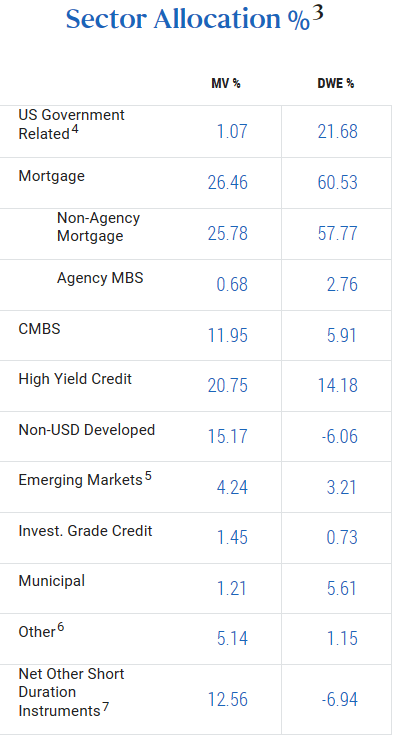

Debt funds admire PDI, furnish leveraged exposure to a variety of different fixed-income investments. Source

PDI Website

Including non-agency mortgage-backed securities, corporate bonds, asset-backed lending, non-US debt, commercial MBS, and more – all of which have seen their prices refuse due to rising interest rates and are, therefore, paying higher yields. With an investment in PDI, you gain access to PIMCO’s expertise in debt investments. Since PDI uses leverage and is invested in assets that have default risk, you will see a lot more volatility than Treasuries, but you will also see a much larger income.

Don’t be Hal, waiting for prices to go up before racing to buy. Buy when prices are down, and you can get more income for your dollar.

Conclusion

With PDI, you can gain exposure to highly discounted and heavily oversold bonds and fixed-income securities, which, admire a coiled spring, are primed to go flying upwards once rates are cut. I’m paid a 15% yield simply to expect, to expect for the Federal Reserve to start cutting rates when economic data sources allow, to expect for other investors to come crowd back into these investments because interest rate cuts mean that bonds are more attractive again. I’m finding the 15% yields attractive today, and the coming capital gains are going to be highly attractive when they happen as well.

When it comes to your retirement, you don’t need to be constantly playing a two-step game at the market following everyone else as they flood into equities and then back into fixed income and then back into equities again. So many retirees are spending their precious retirement years chasing their tails in their portfolios, trying to capture some sort of mythical gain instead of simply enjoying their retirement with an outstanding income stream that can be provided by the market. When you no longer have to worry about what the market is doing because you have a sufficient income to simply relish your life, you unlock a new level of reduced stress in your life. A new period of your life that can be filled with more enjoyment and less worries. Our Income Method can help you unlock that.

That’s the beauty of my Income Method. That’s the beauty of income investing.