A combine harvester harvests wheat in a field.

Young777

One of my favorite sayings that most readers have probably heard that applies to life in general but can especially apply to investing is as follows: Actions speak louder than words.

When I research potential investments for my dividend growth-oriented portfolio, I pay attention more to actions than words. Oftentimes, a company’s management team will say one thing and do another. Many companies may talk about how much they value their shareholders, but few display the actions that demonstrate such a claim.

Tractor Supply (NASDAQ:TSCO) is arguably a rare example of a company that both talks the talk and walks the walk in terms of returning value to shareholders. My argument can be supported by two key facts. First, the company’s quarterly dividend per share has soared 692% in the last 10 years to the current rate of $1.03. This is all the while the payout ratio is still sustainable as I will soon show.

Secondly, Tractor Supply has retired 31.5 million shares from Q3 2013 to Q3 2023. That equates to 22.5% – – or nearly a quarter of the company’s outstanding shares at the beginning of that time frame. For the first time in three months, I will take another look at Tractor Supply’s fundamentals and valuation to elaborate on why I am keeping my buy rating.

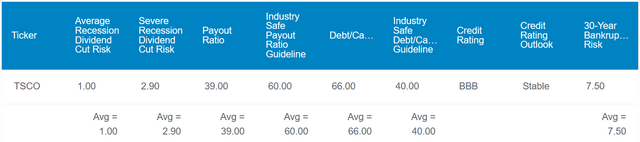

DK Zen Research Terminal

All else being equal, a low dividend yield tends to suggest one of two things: Either a company is significantly overvalued or it is still finding sensible uses for its capital. In the case of Tractor Supply and its 1.9% yield, I believe it is the latter.

The company’s 39% EPS payout ratio is considerably lower than the 60% payout ratio that credit rating agencies want to see from its industry. This offsets the fact that its debt-to-capital ratio of 66% is elevated beyond the 40% that rating agencies desire from Tractor Supply’s industry. That is why S&P awards the company with a BBB credit rating on a stable outlook.

According to Dividend Kings, this implies the retailer’s risk of going to zero by 2053 is a non-zero, but still reasonably low 7.5%. Considering these variables, Dividend Kings puts the probability of a dividend cut in the next average recession at just 1%.

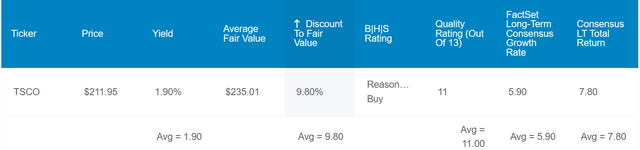

DK Zen Research Terminal

Tractor Supply is a fundamentally intriguing business. What makes it all the more interesting is its current valuation. Relative to Dividend Kings’ $235 fair value per historical dividend yield and P/E ratio, Tractor Supply is 10% undervalued from the current $211 share price (as of December 8, 2023).

If the company meets the analyst growth consensus (keep in mind that Tractor Supply tends to outperform expectations) and returns to fair value, here are the total returns it could produce in the next 10 years:

- 1.9% yield + 5.9% FactSet Research annual growth consensus + 1% annual valuation multiple expansion = 8.8% annual total return potential or a 10-year cumulative 132% total return versus 9% annual total return potential of the S&P 500 (SP500) or a 10-year cumulative 137% total return

Growing Despite A Tough Environment

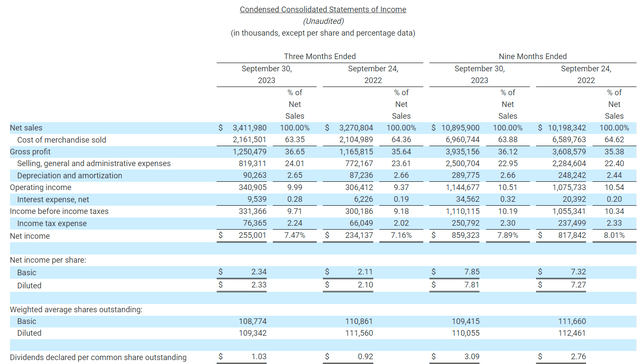

Tractor Supply Q3 2023 Earnings Press Release

Sometimes, no matter how great a business is, it has to roll with the punches of the macroeconomic environment. This was the case for Tractor Supply in its third quarter ended September 30, 2023.

The retailer’s net sales edged 4.3% higher year-over-year to $3.4 billion during the third quarter. However, this fell short of the analyst consensus by 180 basis points, or about $60 million.

Tractor Supply’s comparable store sales declined by 0.4% for the third quarter. For context, the company’s comparable store sales grew by 5.7% in the year-ago period. The biggest factor that led to a reversion in comparable store sales growth from positive to negative was a customer base that was less willing to spend due to concerns about the economy. Additionally, less-than-ideal weather conditions were also to blame, according to CEO Hal Lawton’s opening remarks in the earnings call. These factors were offset by a higher store count, which explains how net sales still grew in the third quarter.

Tractor Supply’s diluted EPS surged 11% higher year-over-year to $2.33 during the third quarter. Disciplined cost management helped the company’s net margin better by 30 basis points to nearly 7.5% for the quarter. Coupled with a lower share count, that’s how the retailer’s diluted EPS growth outpaced net sales growth in the quarter.

These results did prompt Tractor Supply to lower its net sales and diluted EPS guidance for the fiscal year. The company’s net sales midpoint came down from $14.85 billion on the previous outlook to $14.55 billion. However, this would still be a 2.4% year-over-year growth rate over the $14.2 billion from last fiscal year.

Tractor Supply revised its midpoint diluted EPS downward from $10.30 to $10.05. Yet, this is still good enough for a 3.5% growth rate over the prior fiscal year.

Tractor Supply’s interest coverage ratio was also 33.1 through the first nine months of fiscal year 2023. This is a helpful indicator that the company is financially sound.

Healthy Dividend Growth Can Be Sustained

Tractor Supply’s days of massive dividend growth are probably over. However, the company should have no problem continuing to hand out respectable raises to shareholders.

Tractor supply generated $937.9 million in operating cash flow through the first nine months of 2023. Against the $526.7 million in capital expenditures (much higher than last year due to Orscheln Farm and Home store conversions, garden center transformations, and distribution center constructions), this is free cash flow of $411.2 million.

Compared to the $338.2 million in dividends paid during that time, the dividend is covered with an 82.2% free cash flow payout ratio (info sourced from page 8 of 35 of Tractor Supply’s 10-Q). As these investments made by Tractor Supply pay off, there’s reason to believe high- single-digit annual dividend growth can continue while the payout ratio comes down.

Risks To Consider

Tractor Supply has demonstrated itself to be a superb business, but it still has risks.

The company has done an admirable job of providing customers with products that are in high demand. If Tractor Supply wants to keep thriving, it will have to stay ahead of trends in consumer needs and preferences. Otherwise, the company’s growth prospects could be hurt.

Another risk is again one that all retailers face, which is macroeconomic spending. If spending slows even advocate, Tractor Supply could have a more difficult fiscal year or two ahead. This could guide to much smaller dividend increases over that time and weigh on stock performance.

Summary: A Resilient Business Worth Buying

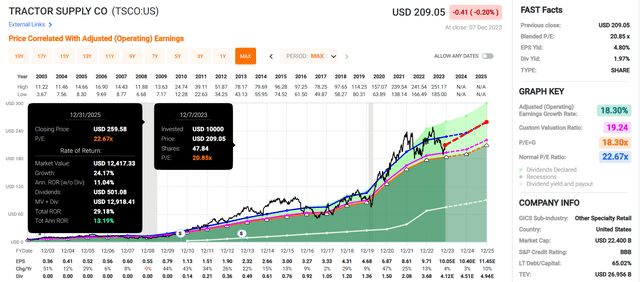

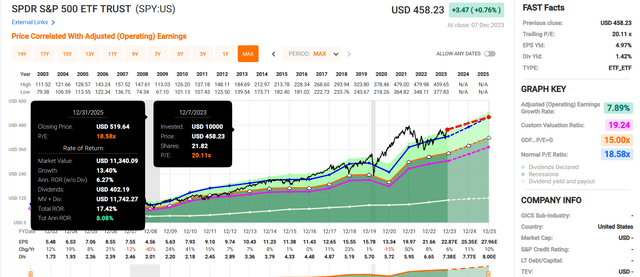

FAST Graphs, FactSet

FAST Graphs, FactSet

Tractor Supply is undoubtedly a proven business with a culture geared toward doing right by customers and rewarding shareholders. After all, it couldn’t have grown through every challenge of its 85-year operating history to date without a grounded culture.

The stock also seems to offer solid value from its current P/E ratio of 20.9, which is below the normal P/E ratio of 22.7. If Tractor Supply returns to this multiple and grows as anticipated, it could produce 29% total returns through 2025. That’s meaningfully ahead of the 17% cumulative total returns through 2025 that the SPDR S&P 500 ETF Trust (SPY) is projected to deliver. This is why I rate shares of Tractor Supply a buy for the moment.