Fischerrx6

Introduction

As most of my readers know, I am massively underweight consumer stocks.

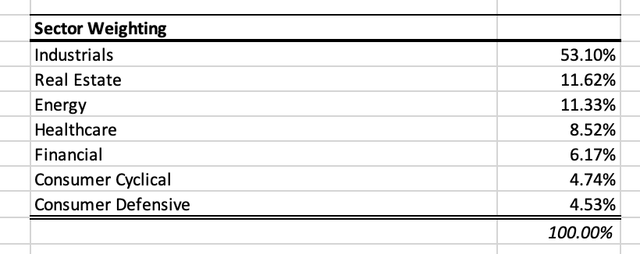

Looking at the overview below, we see that industrials account for more than half of my dividend growth exposure, followed by real estate, energy, and healthcare. My total energy exposure is higher than 11%, as I have a number of energy stocks in my trading account as well.

Leo Nelissen (Dividend Growth Portfolio Sector Breakdown)

My smallest segments are both consumer segments, accounting for less than 5% each.

In fact, both segments hold just one stock, PepsiCo (PEP) and Home Depot (HD), the latter being the cyclical consumer play.

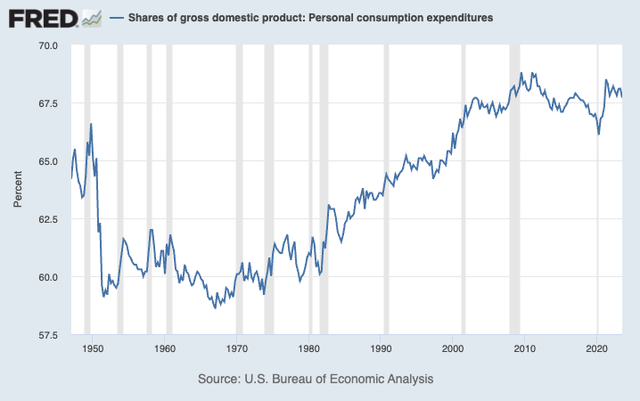

Although my goal is not to make my portfolio more cyclical, I would like more consumer exposure. After all, private consumption accounts for roughly 68% of America’s GDP. That’s up from less than 60% in the two decades following the Second World War.

Federal Reserve Bank of St. Louis

Unfortunately, consumer stocks make me a bit nervous, as I want companies with wide moats. The consumer space is highly competitive, which is why I mainly invest in the consumer through intermodal railroads like Norfolk Southern (NSC) and companies further up the value chain.

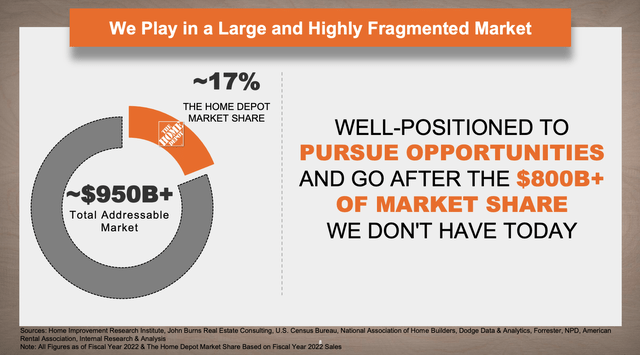

I bought Home Depot because of its size and business model. The company is large enough to be a go-to market for most Americans when it comes to DIY projects, yet not large enough to be considered a “value” stock. It’s still a dividend growth stock benefitting from its ability to penetrate a market that is still surprisingly fragmented.

Home Depot

Although it would make sense to buy a consumer stock with a low correlation to Home Depot, I decided to highlight the Tractor Supply Company (NASDAQ:TSCO) on my watchlist.

It’s a stock I’m looking to buy this year after frequent coverage throughout the past few years.

My most recent coverage was on October 13, when I discussed similar developments. However, in this article, I’ll elaborate on this, using new economic developments, the company’s comments at a major conference, and other changes that strengthen my belief that TSCO is an underappreciated long-term dividend growth gem.

So, let’s get to it!

The Power Of The Rural Consumer

If I had to describe Tractor Supply Company using just one sentence, it would be something like this: “It’s a rural mini-Home Depot.”

The three bigger differences between TSCO and HD are:

- Size: the average HD store is 105 thousand square feet. The average TSCO is between 15 and 20 thousand square feet.

- Products: while HD is a go-to-market for everything, ranging from faucets to plywood, TSCO mainly sells to the rural consumer, which explains why its product breakdown looks like this:

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Livestock and Pet |

5,984 | 47.0 % | 7,102 | 50.0 % |

|

Seasonal, Gift, and Toy |

2,674 | 21.0 % | 2,983 | 21.0 % |

|

Hardware, Tools and Truck |

2,674 | 21.0 % | 2,699 | 19.0 % |

|

Clothing and Footwear |

1,018 | 8.0 % | 994 | 7.0 % |

|

Agriculture |

382 | 3.0 % | 426 | 3.0 % |

- Locations: while HD stores are pretty much everywhere (mainly close to densely populated areas), TSCO focuses on the rural consumer. It has stores in smaller towns, which is a major benefit in the current environment of elevated crime and theft (companies call this “shrink”).

Going into 2023, the company had 2,333 stores in 49 states, including Tractor Supply retail stores and Orscheln retail stores.

Tractor Supply Company

As a result, the company’s strategic approach involves targeting customers in suburban, exurban, and rural areas.

The company strategically places stores around major cities, creating what it calls concentric circles of locations that cater to the specific needs of customers living in these regions.

This spatial distribution allows Tractor Supply to serve a diverse customer base, primarily characterized by land ownership, outdoor lifestyles, and a passion for animals, which is reflected in the product breakdown I just sowed.

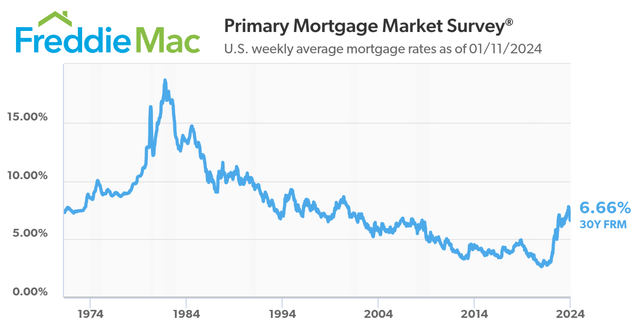

Even better, during the November Stephens Annual Investment Conference, the company mentioned something that explained why its consumers are doing relatively well in an environment of elevated interest rates.

FreddieMac

According to the company, the core of its consumer base is characterized by individuals who own land, with a significant percentage having fixed-rate mortgages.

These customers exhibit a strong passion for outdoor living and animals, with approximately 85% owning at least one animal, which could range from companion pets to livestock.

This means:

- Lower interest rate sensitivity.

- Less price sensitivity, as animals need to be fed regardless of the economic environment.

According to the company, during previous challenging economic periods, such as the financial crisis of 2007-2009, customers did not compromise on their passion for outdoor living and animals.

Unfortunately, the weather is a major factor, as outdoor life heavily depends on weather conditions. Luckily, these factors tend to remain subdued as macroeconomic forces are stronger.

Thanks to these benefits, the company has become a dividend growth to be reckoned with.

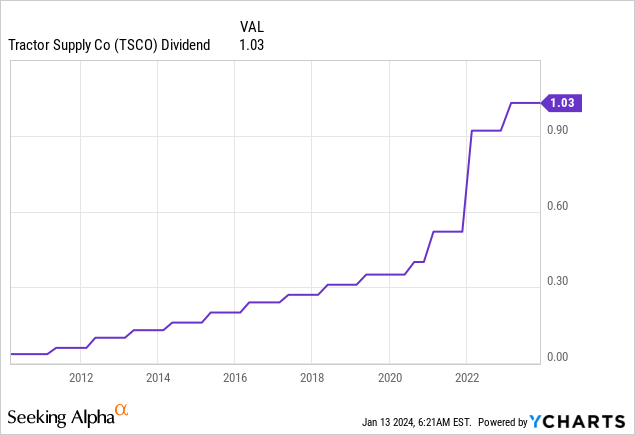

- After hiking its dividend by 12% on February 8, 2023, it currently pays $1.03 per share per quarter, which translates to a yield of 1.8%. That’s roughly 40 basis points above the S&P 500 yield.

- The five-year dividend CAGR is 28%, which was highly skewed by the positive impact of the pandemic on TSCO’s financials.

- This year, the company is expected to generate $10.39 in EPS, which translates to a payout ratio of 40%, which is very low.

The dividend is also protected by a healthy balance sheet.

At the end of this year, the company is expected to have $1.5 billion in net debt, which translates to an expected net leverage ratio of 0.8x EBITDA.

This is low and confirmed by an investment-grade credit rating of BBB.

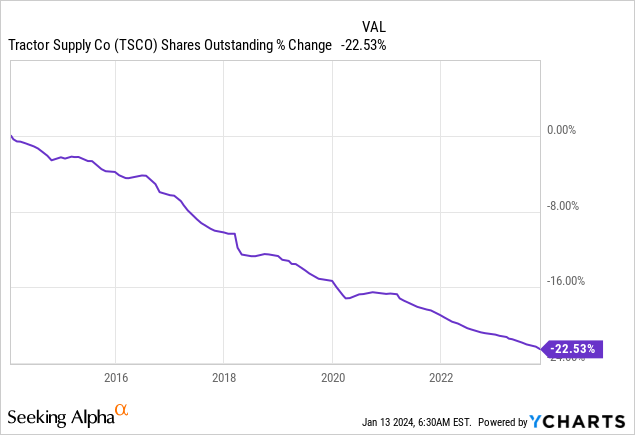

Thanks to a healthy balance sheet, the company has used excess cash to buy back stock.

Over the past ten years, it bought back more than a fifth of its shares.

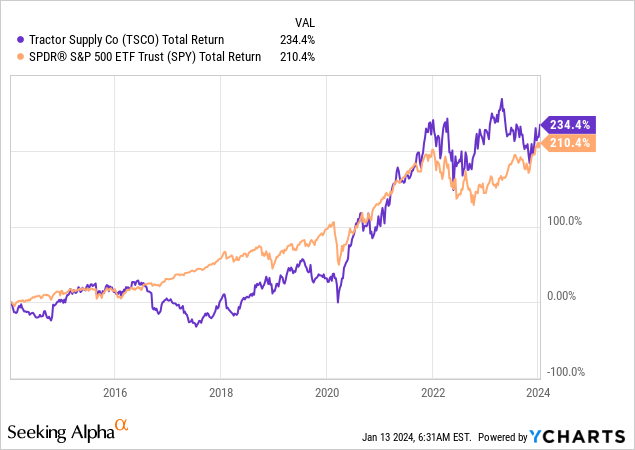

These aggressive buybacks, on top of a solid business model and steady dividend growth, have allowed the company to beat the market by a considerable margin, returning more than 230% during the past ten years.

With all of this in mind, the economic environment is challenging, and new measures are required for TSCO to stay on top of its game.

Paving The Road For Prolonged Growth

TSCO, although in a better position than some of its peers, is not immune to headwinds.

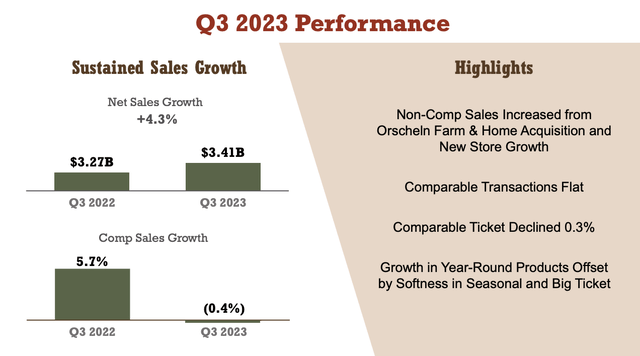

In its third quarter, the company reported a comparable sales contraction of 0.4%, while diluted earnings per share for the quarter saw a notable increase of 11% over the prior year, reaching $2.33.

Tractor Supply Company

The company faced headwinds from unfavorable weather conditions during the quarter.

Extreme heat, drought in certain regions, and excessive rainfall in others impacted sales performance.

Combining these headwinds (pun intended), adverse weather conditions contributed to more than a 1-point sales shortfall compared to initial expectations.

During its earnings call, the company commented on a noticeable shift in consumer spending from goods to services, a trend reverting to pre-pandemic levels.

The company acknowledged the impact of these macroeconomic shifts but emphasized the resilience of its business model, particularly its alignment with the “Out Here” lifestyle we have discussed in this article.

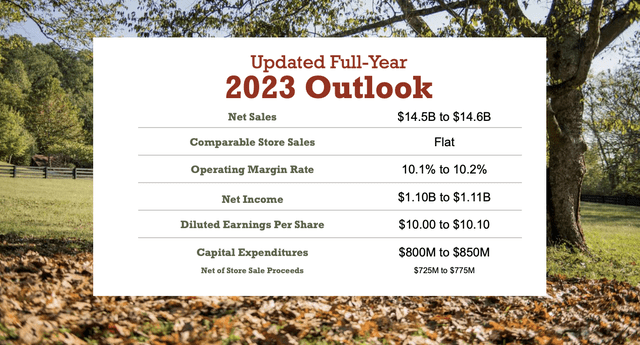

Hence, on a 2023 full-year basis, it expects to keep comparable store sales flat.

Tractor Supply Company

Furthermore, the company is working on changes to continue long-term growth.

During its earnings call, the company noted that more than 35% of its stores adopted the Project Fusion layout and the active transformation of more than 420 Garden Centers.

Adding to that, the acquisition of Orscheln Farm and Home remained on track, with almost 50 stores converted to the Tractor Supply brand.

During the aforementioned Stephens conference, the company noted that Orscheln allows it to grow more rapidly in the Midwest.

By entering the Midwest market, Tractor Supply has not only expanded its geographical reach but also gained access to a customer base that aligns with its product offerings.

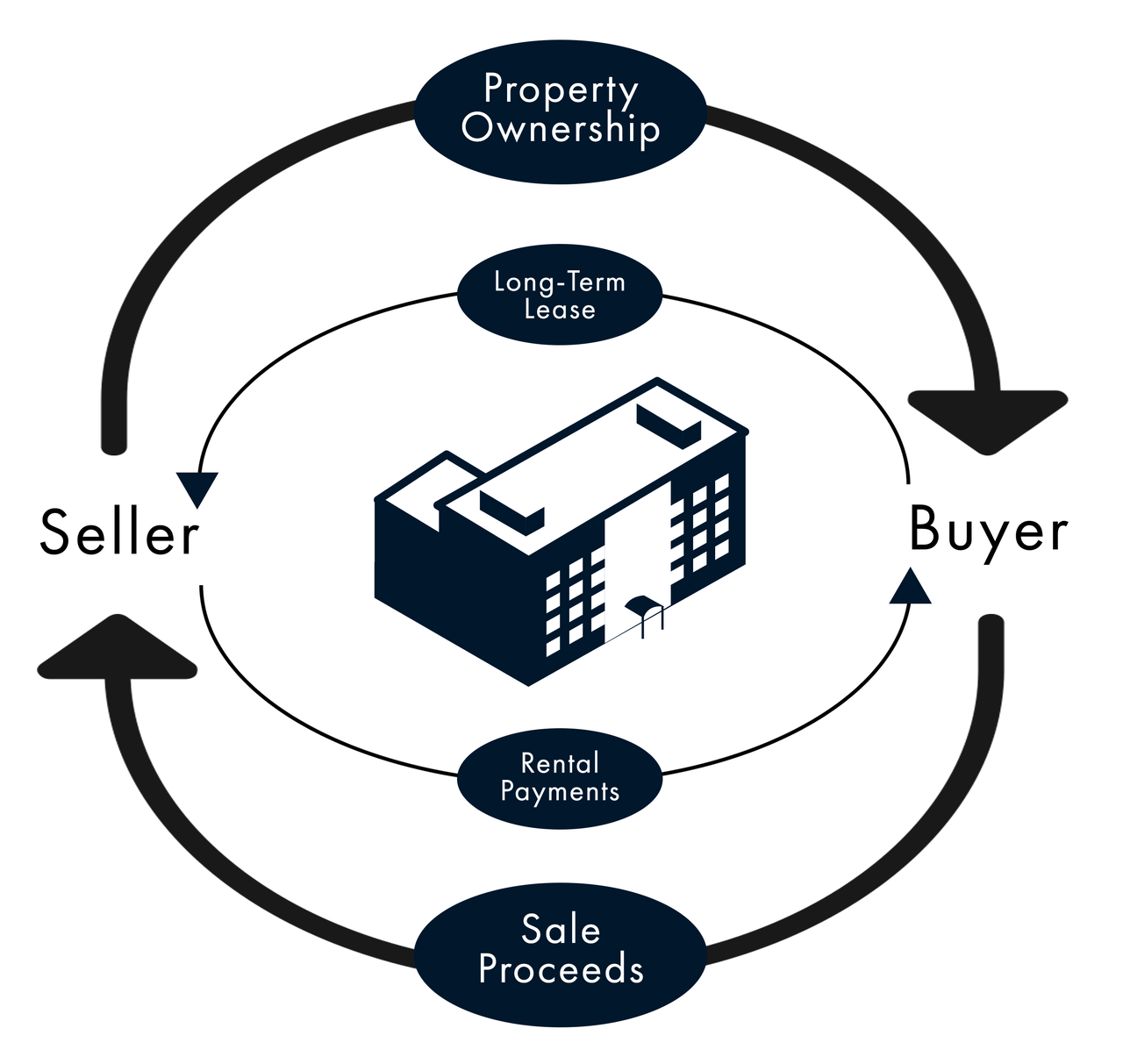

Real estate efforts were also notable, with the opening of 51 new stores, successful sale-leaseback transactions, and a robust pipeline for future store openings.

Note that TSCO tends to use sale-leaseback deals to grow efficiently. These are deals where the company sells its real estate to an investor. This frees up cash in return for regular rent payments. It’s an efficient way to grow without stressing the balance sheet.

Access Working Capital

Another driver of growth is the Neighbor’s Club loyalty program.

With a substantial membership base exceeding 32 million, representing 77% of sales, Tractor Supply sees the potential to further grow this program, which should result in improved loyalty.

With regard to customer satisfaction, the company is also improving last-mile delivery, including leveraging third-party services and in-house team member delivery.

The emphasis on bulk delivery options caters to customers requiring larger quantities of feed or other products for their ranch or property.

Related to this, the company is expanding its distribution network and implementing AI to improve operations and margins.

Tractor Supply hopes to obtain greater real-time visibility into its supply chain, enabling the company to better anticipate the needs of its 2,100-plus stores and nine distribution centers while providing forecasts to vendor partners. Leveraging the Relex solution, Tractor Supply will streamline forecasting, replenishment and allocations.

[…] “Relex allows us to scale our supply chain to support growth with same store sales, new stores and e-commerce,” said Clay Jackson, VP of inventory and planning at Tractor Supply Company. “By centralizing and automating our demand planning, Relex has added a new level of optimization to our supply chain, allowing us to continue to deliver legendary service to our customers.” – Chain Storage Age

So, what does this mean for the valuation?

Valuation

The company’s growth plans not only sound ambitious, analysts seem to agree.

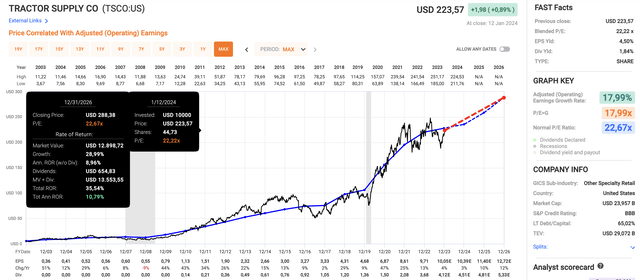

Using the data in the chart below:

- TSCO is expected to grow its EPS by 4% in 2023, followed by 3% growth in 2024. These numbers are impacted by slow economic growth.

- Both 2025 and 2026 are expected to see double-digit EPS growth.

- TSCO currently trades at a blended P/E ratio of 22.2x.

- Its normalized valuation is 22.7x earnings per share.

FAST Graphs

Based on these numbers, the company has a path to 10%-11% annual returns, including its dividend.

Since 2003, it has returned 21.4% per year!

While I cannot promise anything, I believe that TSCO is in a good spot to return more than 10% per year, especially once economic growth and consumer sentiment rebound.

Once that happens, I believe we’ll likely be looking at 15% annual returns.

Hence, I have highlighted TSCO on my watchlist, as I want to make 2024 the year I finally make it a core position in my portfolio.

The biggest risks include cyclical risks, which could keep growth expectations subdued. I believe operational risks are subdued, as TSCO’s strategy is based on slower, incremental changes that build on its proven track record and strong consumer profile.

Takeaway

Tractor Supply distinguishes itself in the consumer sector by focusing on the rural market—a niche often overlooked.

With smaller stores strategically located in areas with a passion for outdoor living and animal ownership, TSCO has built a loyal customer base that remains resilient in economic downturns.

Meanwhile, the company’s strategic initiatives, including the Neighbor’s Club loyalty program and advancements in supply chain management, highlight its commitment to customer satisfaction and future growth.

Considering TSCO’s unique market positioning and proven resilience, it emerges as a standout contender for a core position in my 2024 portfolio, promising sustained, above-average returns.