Paul Morigi

This article is part of a series that provides an ongoing analysis of the changes made to Berkshire Hathaway’s 13F stock portfolio on a quarterly basis. It is based on Warren Buffett’s regulatory 13F Form filed on 2/14/2024. Please visit our Tracking 10 Years Of Berkshire Hathaway’s Investment Portfolio article series for an idea on how his holdings have progressed over the years and our previous update for the moves in Q3 2023.

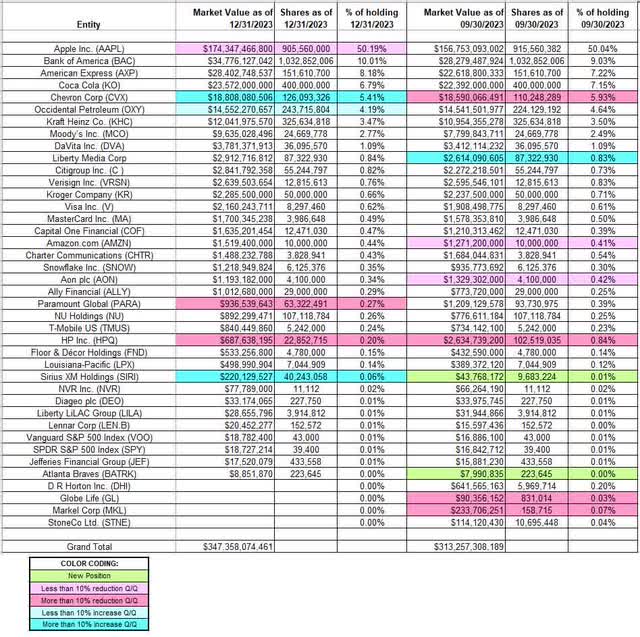

During Q4 2023, Berkshire Hathaway’s (NYSE:BRK.A) (NYSE:BRK.B) 13F stock portfolio value increased ~11% from ~$313B to ~$347B. The top five positions account for ~80% of the portfolio: Apple Inc., Bank of America, American Express, Coca Cola, and Chevron. There are 36 individual stock positions many of which are small compared to the overall size of the portfolio.

Warren Buffett’s writings (pdfs) are a treasure trove of information and are a very good source for anyone starting out on individual investing.

Note 1: Berkshire Hathaway has a ~8% stake in BYD Company (OTCPK:BYDDY) at a cost-basis of ~8 HKD per share. It currently trades in Hong Kong at ~168 HKD. Berkshire’s ownership is down from ~20% as of Q3 2022.

Note 2: It was disclosed in August 2020 that Berkshire had built ~5% stakes in five Japanese trading businesses: ITOCHU, Marubeni, Mitsubishi, Mitsui, and Sumitomo. The stakes were increased to ~8.5% each during Q2 2023. The 2021 AR had the following regarding the initial purchases in three of them: 5.6% ownership stake in ITOCHU Corporation (OTCPK:ITOCF) at a cost-basis of $23.52, 5.5% ownership stake in Mitsubishi Corporation (OTCPK:MSBHF) at a cost-basis of $8.57, and 5.7% ownership stake in Mitsui & Company (OTCPK:MITSF) at a cost-basis of $17.29. ITOCF, MSBHF, and MITSF currently trade at ~$43, ~$20, and ~$40 respectively. Mitsubishi had a 3-for-1 stock split in December 2023. The cost basis is adjusted to reflect this.

Stake Disposals:

StoneCo Ltd. (STNE): STNE was a 0.04% position purchased in Q4 2018 at ~$21 per share. Q1 2021 saw a ~25% reduction at prices between ~$60 and ~$94. The disposal this quarter was at prices between ~$9.60 and ~$18.50. The stock is currently at $17.50.

Note: In October 2018, WSJ reported that Berkshire had invested ~$300M each in two Fintech’s – India’s Paytm and Brazil’s StoneCo (STNE). The Paytm investment was made in August 2018 while the STNE purchase was following its IPO in October 2018. The Paytm stake was also sold this quarter for ~$165M.

D.R. Horton Inc. (DHI): The 0.20% of the portfolio DHI stake was established during Q2 2023 at prices between ~$96 and ~$123. The elimination this quarter was at prices between ~$101 and ~$153. The stock currently trades at ~$146.

Markel Corp (MKL): The 0.07% MKL stake was built during H2 2022 at prices between ~$1187 and ~$1504. The last quarter saw a two-thirds reduction at prices between ~$1365 and ~$1544. The disposal this quarter was at prices between ~$1301 and ~$1506. It now goes for ~$1469.

Globe Life (GL): The minutely small 0.03% stake in GL was reduced by ~67% last quarter and sold this quarter.

Stake Increases:

Chevron Corp (CVX): CVX is a large (top five) 5.41% of the portfolio position purchased in Q3 2020 at prices between ~$72 and ~$91. Q1 2021 saw a ~50% selling at prices between ~$85 and ~$112 while in Q3 2021 there was a ~25% stake increase at prices between ~$94 and ~$106. That was followed with another one-third increase next quarter at prices between ~$102 and ~$119. Q1 2022 saw a whopping ~315% stake increase at prices between ~$119 and ~$171. The last three quarters saw a one-third selling at prices between ~$150 and ~$188. There was a ~14% stake increase this quarter at prices between ~$142 and ~$169. The stock currently trades at ~$151.

Note 1: Berkshire has a ~6.2% ownership stake in the business.

Note 2: Berkshire likely avoided disclosing these stakes in the Q3 2020 13F filing by making use of the “section 13(f) Confidential Treatment Requests”. An amendment filed later disclosed the activity.

Occidental Petroleum (OXY): Berkshire made a $10B investment in OXY in April 2019 through 100,000 preferred shares that has a liquidation value of $100,000 per share. Those shares pay 8% dividend, and the transaction came with warrants to purchase 83.86M shares at $59.62. In Q1 2022, Berkshire purchased ~136.4M shares at prices between ~$31 and ~$59 per share. That was followed with a ~22M share net-increase in Q2 2022 at prices between ~$57 and ~$60. The next quarter also saw a ~23% stake increase at prices between ~$57 and ~$75. The stock currently trades at $57.30. This quarter also saw a ~9% stake increase.

Note: Including warrants, Berkshire owns ~34% of the business (~328M shares).

Sirius XM Holdings (SIRI): The stake came about as a result of a redistribution transaction by Liberty Media Group. The stake was increased by ~315% this quarter as SIRI traded between ~$4.10 and ~$5.70. It is now at $4.81.

Stake Decreases:

Apple Inc. (AAPL): AAPL is currently the largest 13F portfolio stake by far at ~50%. It was built between Q1 2016 and Q1 2018 at a cost-basis of ~$35 per share. Since then, the activity has been minor. The stock currently trades at ~$184. There was a ~1% trimming this quarter.

Note: Berkshire has a ~6% ownership stake in the business.

Paramount Global (PARA): PARA is a 0.27% of the portfolio position purchased in Q1 2022 at prices between $27.85 and $38.48. There was a ~14% stake increase next quarter at prices between ~$24.25 and ~$38. That was followed with a similar increase during Q3 2022 at prices between ~$19 and ~$27. The stock currently trades below the low end of their purchase price ranges at $13.19. This quarter saw the position sold down by ~32% at prices between ~$10.70 and ~$16.85.

HP Inc. (HPQ): HPQ is a 0.20% of the portfolio stake established in Q1 2022 at prices between ~$34 and ~$40 and the stock currently trades at $28.58. This quarter saw the stake reduced by ~75% at prices between ~$26 and ~$31.

Kept Steady:

Bank of America (BAC): Berkshire established this large (top three) ~10% of the portfolio position through the exercise of Bank of America warrants. The warrants had a strike price of $7.14. The cost to exercise was $5B and it was funded using the $5B in 6% preferred stock they held. There was a ~30% stake increase in Q3 2018 at prices between $27.75 and $31.80. Since then, the activity has been minor. The stock currently trades at $33.13.

Note: Berkshire’s overall cost-basis is ~$14 and ownership stake is at ~13%.

American Express (AXP) and Coca-Cola (KO): These two very large stakes were kept steady during the last ~10 years. Buffett has said these positions will be held “permanently”. Berkshire’s cost-basis on AXP and KO are at around $8.49 and $3.25 respectively and the ownership stakes are at ~20% and ~9.2% respectively.

Kraft Heinz Co. (KHC): KHC is currently a fairly large position at 3.47% of the portfolio. Kraft Heinz started trading in July 2015 with Berkshire owning just over 325M shares (~26.5% of the business). The stake came about because of two transactions with 3G capital as partner: a ~$4B net investment in 2013 for half of Heinz and a ~$5B investment for the acquisition of Kraft Foods Group in early 2015. Berkshire’s cost-basis on KHC is ~$30 per share compared to the current price of $34.16.

Moody’s Inc. (MCO): MCO is a 2.77% of the 13F portfolio stake. It is a very long-term position and Buffett’s cost basis is $10.05. The stock currently trades at ~$367. Berkshire controls ~13% of the business.

DaVita Inc. (DVA): DVA is a ~1% of the portfolio position that was aggressively built over several quarters in the 2012-13 timeframe at prices between $30 and $49. The stock currently trades at ~$123 compared to Berkshire’s overall cost-basis of ~$45 per share. Q3 2020 saw a ~5% (2M shares) selling at $88 per share.

Note: Berkshire’s ownership stake in DaVita is ~40%.

Liberty Media Corp (LSXMA) (LSXMK) (FWONK) (LLYVK) (LLYVA): These tracking stocks were first acquired as a result of Liberty Media’s recapitalization in April 2016. Shareholders received 1 share of Liberty SiriusXM Group, 0.25 shares of Liberty Media Group and 0.1 shares of Liberty Braves Group for each share held. Berkshire held 30M shares of Liberty Media for which he received the same amount of Liberty SiriusXM Group shares. Since then, there have been several transactions, redistributions, etc. Last August saw another reclassification whereby Liberty SiriusXM common stock was reclassified, and shareholders received 0.25 shares of Liberty Live for each share of Liberty SiriusXM. Also, Liberty Formula One was reclassified, and shareholders received 0.0428 shares of Liberty Live for each share of Liberty Formula One. The net share count increased by ~23% as a result of these transactions. LSXMK, FWONK, and LLYVK currently trade at ~$30, ~$67, and ~$36.60 respectively.

Citigroup Inc. (C): The 0.82% of the portfolio stake in Citigroup was purchased in Q1 2022 at prices between ~$53 and ~$68 and it is now at ~$54.

Verisign Inc. (VRSN): VRSN was first purchased in Q4 2012 at prices between $34 and $49.50. The position was more than doubled in Q1 2013 at prices between $38 and $48. The buying continued till Q2 2014 at prices up to $63. The stock currently trades at ~$195 and the position is at 0.76% of the portfolio (~10% of the business).

Kroger Company (KR): KR is a 0.66% of the portfolio position established in Q4 2019 at prices between $24 and $29. The five quarters through Q3 2021 had seen a ~225% stake increase at prices between ~$30 and ~$40. The three quarters through Q3 2022 saw a ~20% selling at prices between ~$44 and ~$52. The stock currently trades at $45.69.

Note: Berkshire’s ownership stake in Kroger is ~7%.

Capital One Financial (COF): The 0.47% of the portfolio stake in COF was purchased last quarter at prices between ~$90 and ~$122. There was a ~25% stake increase during Q2 2023 at prices between ~$86 and ~$114. The stock currently trades at ~$135.

Amazon.com (AMZN): AMZN is a 0.44% of the portfolio stake established in Q1 2019 at prices between ~$75 and ~$91 and increased by ~11% next quarter at prices between ~$85 and ~$98. The stock currently trades at ~$171. The last quarter saw a ~5% trimming.

Charter Communications (CHTR): CHTR is a 0.43% of the portfolio position. It was established during the last three quarters of 2014 at prices between $118 and $170. In Q2 2015, the position was increased by ~42% at prices between $168 and $193 and that was followed with another ~21% increase the following quarter at prices between $167 and $195. The six quarters thru Q4 2018 had seen a combined ~25% selling at prices between $250 and $395 and that was followed with a ~20% reduction in Q1 2019 at prices between $285 and $366. H2 2021 saw another ~25% reduction at prices between ~$605 and ~$821. The stock currently trades at ~$287 compared to Berkshire’s cost-basis of ~$178.

Snowflake Inc. (SNOW): SNOW had an IPO in September 2020. Shares started trading at ~$229 and currently goes for ~$236. Berkshire acquired ~2% of the business at the IPO price of ~$120 per share.

Aon plc (AON): AON is a 0.34% of the portfolio position established in Q1 2021 at prices between ~$202 and ~$234. Next quarter saw a ~7% increase at prices between ~$230 and ~$259. The stock currently trades at ~$309. There was a ~5% trimming last quarter.

Ally Financial (ALLY): The 0.29% ALLY stake saw a whopping ~235% increase in Q2 2022 at prices between ~$32 and ~$53. The stock currently trades at ~$36.

Note: Berkshire has a ~9.6% ownership stake in Ally Financial.

NU Holdings (NU): NU had an IPO last December. Shares started trading at ~$10 and currently goes for $10.37. Berkshire’s ~$1B stake goes back to a funding round in early 2021.

T-Mobile US (TMUS): TMUS is a small 0.24% of the portfolio stake purchased in Q3 2020 at prices between ~$104 and ~$119 and more than doubled next quarter at prices between ~$110 and ~$135. It currently trades at ~$161.

Floor & Décor Holdings (FND): The 0.15% of the portfolio FND position was established in Q3 2021 at prices between ~$104 and ~$131. Q1 2022 saw a ~470% stake increase at prices between ~$81 and ~$130. The stock is now at $109.

Louisiana-Pacific (LPX): The 0.14% LPX position was established during Q4 2022 at prices between ~$48.40 and ~$65. There was a ~22% stake increase in the next quarter at prices between ~$51 and ~$66. The stock is now at $70.13.

Note: Berkshire has a ~9.8% ownership stake in the business.

Atlanta Braves (BATRK), Diageo plc (DEO), Jefferies Financial Group (JEF), Lennar Corp (LEN.B), Liberty LiLAC Group (LILA) (LILAK), MasterCard Inc. (MA), NVR Inc. (NVR), SPDR S&P 500 Index (SPY), Vanguard S&P 500 Index (VOO), and Visa Inc. (V): These small positions (less than ~1% of the portfolio each) were kept steady this quarter.

The spreadsheet below highlights changes to Berkshire Hathaway’s 13F stock holdings in Q4 2023:

Warren Buffett – Berkshire Hathaway Portfolio – Q4 2023 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Berkshire Hathaway’s 13F filings for Q3 2023 and Q4 2023.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.