pupunkkop

This article is part of a series that provides an ongoing analysis of the changes made to Baupost Group’s 13F stock portfolio on a quarterly basis. It is based on Klarman’s regulatory 13F Form filed on 2/13/2024. Please visit our Tracking Seth Klarman’s Baupost Group Holdings article for an idea on how his holdings have progressed over the years and our previous update for the fund’s moves during Q3 2023.

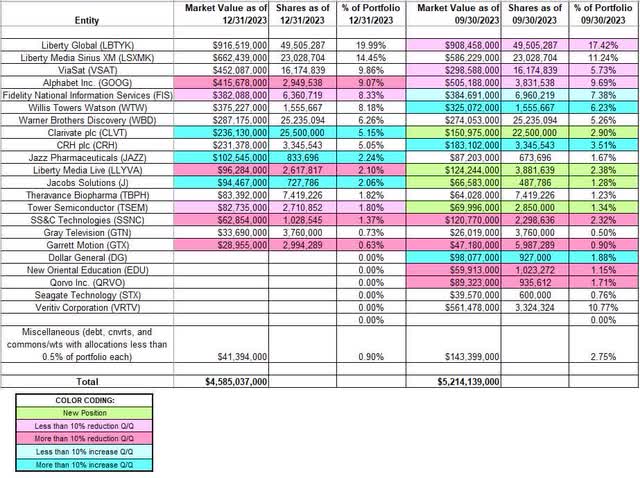

Baupost Group’s 13F portfolio value decreased from $5.21B to $4.59B this quarter. The total number of 13F securities decreased from 32 to 23. The portfolio is heavily concentrated with Liberty Global, Liberty SiriusXM, Viasat, Alphabet, and Fidelity National Information Services together accounting for ~62% of the 13F holdings.

Since inception (1982), Baupost Group’s 13F portfolio has accounted for between 2.4% to 15% of the Assets Under Management (AUM). The current allocation is at the high-end of that range. The rest of the AUM is diversified among cash, debt, real estate, and hedges. On average, the fund has held ~25% cash over the last decade. Seth Klarman’s distinct investment style is elaborated in his 1991 book “Margin of Safety: Risk-averse value investing strategies for the thoughtful investor”. The book is out-of-print and copies sell for a huge premium.

Note: They have a ~8% ownership stake in Just Eat Takeaway.com N.V. (OTCPK:JTKWY).

Stake Disposals:

Veritiv Corporation (VRTV): VRTV was a ~11% of the 13F portfolio position established in Q3 2014 at prices between $32.50 and $50.50. Q4 2017 saw a ~20% stake increase at prices between $22.50 and $32.50. Klarman’s ownership interest in VRTV was ~25%. Last August, they received a $170 per share cash offer from an affiliate of Clayton, Dubilier & Rice, LLC. That transaction closed during the quarter, thus eliminating this position.

Dollar General (DG): The 1.88% DGEN stake was established during the last two quarters at prices between ~$105 and ~$222. The disposal this quarter was at prices between ~$102 and ~$140. The stock is now at ~$132.

Qorvo, Inc. (QRVO): QRVO was a 1.71% portfolio stake established in Q1 2017 at prices between $53 and $69 and increased by ~25% the following quarter at prices between $63 and $79. There was another ~22% stake increase in Q4 2017 at prices between $65 and $81. 2019 had seen a ~75% selling at prices between $60 and $118. Q4 2020 saw an about-turn: ~50% stake increase at prices between ~$125 and ~$170. That was followed with a ~18% further increase next quarter. The two quarters through Q1 2022 saw another ~31% stake increase at prices between ~$119 and ~$178. The three quarters through Q2 2023 saw a ~61% reduction at prices between ~$78 and ~$114. There was a similar reduction last quarter at prices between ~$94 and ~$110. The elimination this quarter was at prices between ~$85 and ~$115. The stock is now at ~$112.

New Oriental Education (EDU): EDU was a 1.15% of the portfolio position purchased in Q2 2022 at prices between ~$9.75 and ~$23.50. There was a ~25% selling during Q4 2022 at prices between ~$19 and ~$40. That was followed by a similar reduction during Q2 2023 at prices between ~$36 and ~$46. The last quarter saw another ~75% selling at prices between ~$40 and ~$59. The remainder stake was disposed this quarter. The stock is now at ~$88.

Seagate Technology (STX): The 0.76% STX stake was primarily built during Q2 2023 at prices between ~$55 and ~$67. It was sold this quarter at prices between ~$65 and ~$87. The stock currently trades at $87.16.

Stake Increases:

Clarivate Plc (CLVT) and Jacobs Solutions (J): These two positions were built in the last two quarters. The 5.15% of the portfolio CLVT position was established last quarter at prices between $6.60 and $9.90 and the stock currently trades at $8.94. There was a ~13% stake increase this quarter. Jacobs Solutions is a ~2% of the portfolio stake, established at prices between ~$119 and ~$140. The stock currently trades at ~$143.

Jazz Pharmaceuticals (JAZZ): The 2.24% position in JAZZ stake was purchased during Q1 2023 at prices between ~$134 and ~$161. There was a ~40% stake increase during Q2 2023 at prices between ~$123 and ~$147. That was followed by a ~25% increase this quarter at prices between ~$114 and ~$136. The stock is now at ~$122.

Stake Decreases:

Alphabet Inc. (GOOG): The large (top five) ~9% GOOG stake was purchased in Q1 2020 at prices between ~$53 and ~$76. The last three quarters of 2020 had seen a ~75% selling at prices between ~$55 and ~$92. There was a ~265% stake increase in Q1 2021 at prices between ~$86 and ~$105. Q4 2021 saw a ~22% trimming at prices between ~$133 and ~$151 while next quarter there was a ~7% increase. The zig-zag trading pattern continued in the next quarter: ~30% reduction at prices between ~$106 and ~$144. That was followed with another ~60% selling during Q3 2022 at prices between ~$96 and ~$123. The stake was rebuilt next quarter at prices between ~$83.50 and ~$105. Q1 2023 saw a ~47% stake increase at prices between ~$87 and ~$109 while the next quarter saw a ~30% selling at prices between ~$104 and ~$128. There was another ~23% reduction this quarter at prices between ~$123 and ~$143. The stock is now at ~$146.

Fidelity National Information Services (FIS): The 8.33% FIS position was purchased during Q3 2022 at prices between ~$76 and ~$105 and it is now at $61.24. There was a ~250% stake increase during Q4 2022 at prices between ~$57 and ~$85. That was followed with a ~125% increase in the next quarter at prices between ~$50 and ~$78. Q2 2023 also saw a ~40% increase at prices between ~$52 and ~$59. There was a minor ~3% increase last quarter and a ~9% trimming this quarter.

Liberty Live Group (LLYVA) and Tower Semiconductor (TSEM): These two positions established last quarter were reduced this quarter. Liberty Media Live came to market through a spin-out and reclassification of Liberty SiriusXM. Shareholders received 0.25 shares of Liberty Live for each Liberty SiriusXM. Baupost has a large position in Liberty SiriusXM, for which they received these shares. LLYVA started trading in August at ~$36, and it is currently at ~$35. There was one-third selling this quarter at prices between ~$30 and ~$37. TSEM is a 1.80% of the portfolio stake established at prices between ~$24 and ~$38. The stock is now at ~$29. There was a minor ~5% trimming this quarter.

SS&C Technologies (SSNC): SSNC is a 1.37% position built in Q3 2020 at prices between ~$56 and ~$65. The two quarters through Q1 2021 had seen a ~25% stake increase at prices between ~$63 and ~$71. There was a ~22% selling in Q2 2022 at prices between ~$55 and ~$79. The next quarter saw a similar increase at prices between ~$48 and ~$63. There was a ~13% trimming during Q1 2023 while in the next quarter there was a similar increase. There was a ~40% selling last quarter at prices between ~$53 and ~$63. That was followed by a ~55% reduction this quarter at prices between ~$49 and ~$61. The stock is now at ~$61.

Garrett Motion (GTX): Baupost controlled ~32% of Garrett Motion as of Q1 2023. The bulk of the ownership was through a series A preferred share offering. They were converted to common stock during Q2 2023. The last quarter saw an ~80% reduction at prices between $7.23 and $8.04. That was followed by a ~50% selling this quarter at prices between ~$7 and ~$9.70. The stock is now at $8.34.

Kept Steady:

Liberty Global (LBTYK): LBTYK is currently the largest position at ~20% of the portfolio. It was established in Q3 2018 at prices between $25 and $28.50 and increased by ~120% next quarter at prices between $19.50 and $27.50. There was another ~27% stake increase in Q1 2019 at prices between $19.80 and $25.80. Since then, the activity had been minor. There was a ~10% reduction in Q2 2022 at prices between ~$22 and ~$26. The last two quarters have seen another ~10% trimming. The stock currently trades at $19.76.

Liberty SiriusXM (LSXMK): The ~15% LSXMK stake was primarily built in Q3 2020 at prices between ~$23 and ~$28. Q4 2020 saw a ~14% stake increase. The four quarters through Q2 2022 saw the position doubled at prices between ~$26 and ~$47. The stock currently trades at $29.77.

Note: The prices quoted above are adjusted for the Liberty Live spin-out and reclassification last August.

Viasat (VSAT): VSAT is a fairly large position at ~10% of the portfolio. Klarman first purchased VSAT in 2008 at much lower prices, and his overall cost-basis is in the high-teens. In July 2020, Baupost participated in Viasat’s 4.47M share private placement by acquiring ~2.56M shares at ~$39 per share. The stock currently trades at ~$19. There was marginal trimming last quarter.

Note: Baupost’s ownership stake in the business went down from 21% to 13% following Viasat’s acquisition of Inmarsat due to the related dilution.

Willis Towers Watson (WTW): WTW is an 8.18% of the portfolio stake established in Q1 2021 at prices between ~$200 and ~$235. The two quarters through Q3 2021 saw a ~60% selling at prices between ~$202 and ~$270 , while the next quarter there was a ~25% stake increase at prices between ~$226 and ~$249. There was a similar reduction in Q2 2022 at prices between ~$191 and ~$243. Q3 2022 saw a ~40% increase at prices between ~$192 and ~$221 while during Q1 2023 there was a one-third reduction at prices between ~$220 and ~$257. The last quarter saw a ~72% stake increase at prices between ~$196 and ~$234. The stock currently trades at ~$271.

Warner Bros. Discovery (WBD): The fairly large 6.26% of the portfolio stake in WBD was established in Q2 2022 at prices between ~$13 and ~$26. The next quarter saw a ~60% increase at prices between ~$11.30 and ~$17.50. The stock is now at $9.54. There was a minor ~7% stake increase during Q4 2022 while the next quarter saw a ~19% trimming.

CRH plc (CRH): The ~5% CRH stake was primarily built last quarter at prices between ~$53 and ~$60. The stock currently trades at $72.42.

Theravance Biopharma (TBPH): TBPH is a 1.82% of the portfolio position established in Q2 2014 as a result of the spinoff of TBPH from Theravance (now Innoviva). The spinoff terms called for Theravance shareholders to receive 1 share of TBPH for every 3.5 shares of Theravance held. The two quarters through Q3 2021 saw a ~50% stake increase at prices between ~$7 and ~$22.50. The three quarters through Q2 2023 saw a ~45% selling at prices between ~$9.70 and ~$12. The stock is now at $8.35.

Note: they have a ~13% ownership stake in the business.

Gray Television (GTN): The very small 0.73% GTN stake saw a ~75% increase in Q2 2022 at prices between ~$17 and ~$22. That was followed with a ~45% increase in the next quarter at prices between ~$16.25 and ~$20.75. The stock currently trades at $7.93.

The spreadsheet below highlights changes to Klarman’s 13F stock holdings in Q4 2023:

Seth Klarman – Baupost Group’s Q4 2023 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Baupost Group’s 13F filings for Q3 2023 and Q4 2023.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.