Ethan Miller

This article is part of a series that provides an ongoing analysis of the changes made to David Einhorn’s Greenlight Capital 13F portfolio on a quarterly basis. It is based on Einhorn’s regulatory 13F Form filed on 11/14/2023. Please visit our Tracking David Einhorn’s Greenlight Capital Holdings article series for an idea on his investment philosophy and our previous update for the fund’s moves during Q2 2023.

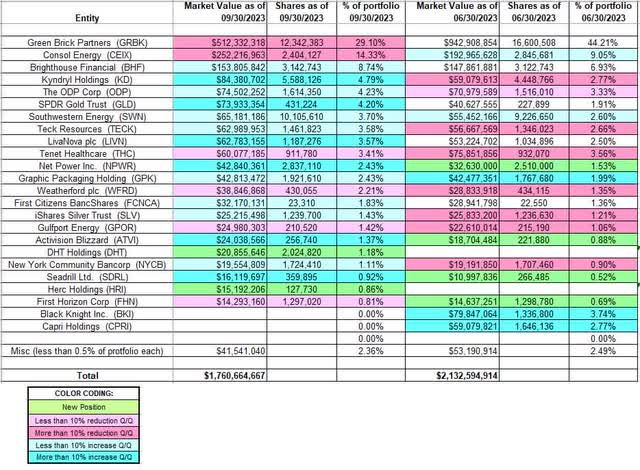

Greenlight Capital’s 13F portfolio value stood at $1.76B this quarter. It is down ~17% compared to $2.13B as of last quarter. Einhorn’s Q3 2023 letter reported that the fund returned 27.7% YTD through Q3 2023 vs 13.1% for the S&P 500 Index. Since 1996 inception, Greenlight has returned ~13% annualized vs 9.4% annualized for S&P 500 index. In addition to partner stakes, the fund also invests the float of Greenlight Capital RE (NASDAQ:GLRE). To learn about David Einhorn and the perils of shorting, check-out his “Fooling Some of the People All of the Time, A Long Short (and Now Complete) Story“.

New Stakes:

DHT Holdings (DHT) and Herc Holdings (HRI): The small 1.18% DHT position was established at prices between $8.15 and $10.30. The stock currently trades at $9.79. HRI is a very small 0.86% stake established at prices between ~$119 and ~$147 and it now goes for ~$123.

Stake Disposals:

Black Knight Inc.: Black Knight was a merger-arbitrage stake established during Q1 2023 at a cost-basis of $60.59. Intercontinental Exchange (ICE) acquired them for a $75 per share cash-and-stock deal that closed in August thereby eliminating this position.

Capri Holdings (CPRI): The 2.77% CPRI position was purchased in 2021 at prices between ~$40.50 and ~$67. Q1 2022 saw a ~12% trimming while next quarter there was a ~20% stake enhance. That was followed by a ~75% enhance in the last two quarters at prices between ~$34 and ~$68. They sold the position this quarter immediately after Tapestry’s (TPR) $57 per share cash offer. The stock is now at $48.21.

Stake Increases:

Brighthouse Financial (BHF): BHF is a large (top three) stake at ~9% of the portfolio. The position was established in Q3 2017 and increased by ~60% in the following quarter at an overall cost-basis of $57.92. There was a ~70% selling in Q4 2018 at prices between $29 and $46.50. The stock is currently at $52.49. This quarter saw a marginal enhance.

Note: BHF is a spinoff of MetLife’s (MET) U.S. Retail business (annuities and life insurance) that started trading in July 2017.

Kyndryl Holdings (KD): KD is a 4.79% of the portfolio position built over the five quarters through Q4 2022 at prices between ~$8.25 and ~$41 and the stock is now at $18.32. There was a ~50% selling last quarter at prices between ~$11.50 and ~$15 while this quarter there was a ~25% enhance at prices between $12.22 and $16.92.

The ODP Corp. (ODP): ODP is a 4.23% of the portfolio position primarily built over the three quarters through Q4 2021 at prices between ~$36 and ~$50. The stock currently trades at $46.57. There was a ~20% stake enhance in Q2 2022 at prices between ~$29 and ~$46. The last three quarters saw minor trimming while this quarter saw a ~7% enhance.

Note: Greenlight’s cost-basis is ~$44.

SPDR Gold Trust (GLD): The 4.20% GLD stake was built in Q3 2020 at prices between $167 and $194. Q1 2021 saw a ~70% selling at prices between ~$158 and ~$183. H1 2022 had seen a ~140% stake enhance at prices between ~$167 and ~$192. The next two quarters saw a ~24% reduction at prices between ~$151 and ~$170. This quarter saw the position rebuilt at prices between ~$172 and ~$184. It currently trades at ~$188.

Southwestern Energy (SWN): SWN is a 3.70% of the portfolio stake established in Q1 2022 at an average price of $6.58. The stock currently trades at $6.27. There was a ~48% stake enhance during Q3 2022 at prices between ~$5.60 and ~$8.10. That was followed by a similar enhance in the next quarter at prices between ~$5.50 and ~$7.25. This quarter also saw a ~10% stake enhance.

Teck Resources (TECK): TECK is a 3.58% of the portfolio position purchased in Q2 2020 at prices between $7 and $12.25. There was a ~40% stake enhance in Q4 2020 at prices between ~$12.25 and ~$18.85 while next quarter there was a ~25% selling at prices between ~$18 and ~$23.75 The two quarters through Q3 2021 had seen a stake doubling at prices between ~$19.50 and ~$26.80. There was ~55% selling over the next three quarters at prices between ~$26 and ~$46. The three quarters through Q1 2023 saw a ~25% enhance at prices between ~$26 and ~$44. The last quarter saw a ~45% reduction at prices between ~$36.50 and ~$49. The stock currently trades at $37.27. There was a ~9% stake enhance this quarter.

LivaNova plc (LIVN): The 3.57% of the portfolio stake in LIVN was built over the six quarters through Q3 2022 at prices between ~$44 and ~$92. The stock is now near the bottom of that range at $45.07. There was a ~23% stake enhance during Q1 2023 at prices between ~$41 and ~$58. That was followed by a ~15% enhance this quarter at prices between ~$50 and ~$59.

NET Power Inc. (NPWR): NPWR is a 2.43% of the portfolio position purchased last quarter at a cost-basis of $10.10 per share. The stock currently trades at $9.42. This quarter saw a ~13% stake enhance.

Graphic Packaging Holding (GPK): The 2.43% stake in GPK saw a two-thirds enhance last quarter at prices between ~$23.50 and ~$27. The stock currently trades at $23.43. This quarter also saw a ~9% enhance.

First Citizens BancShares (FCNCA): FCNCA is a small 1.83% of the portfolio position purchased during Q1 2023 at prices between ~$509 and ~$973 and the stock currently trades well above that range at ~$1429. There was a minor ~3% enhance this quarter.

iShares Silver Trust (SLV): SLV is a 1.43% of the portfolio position established in Q3 2021 at prices between ~$20 and ~$24.50 and the stock currently trades at $21.79. There was a ~17% trimming last quarter and a marginal enhance this quarter.

New York Community Bancorp (NYCB): The 1.11% NYCB stake was established during Q1 2023 at prices between ~$6.40 and ~$10.40. It was sold down by ~25% last quarter at prices between ~$8.50 and ~$11. The stock is now at $9.82. There was a marginal enhance this quarter.

Activision Blizzard, and Seadrill Ltd. (SDRL): These two small (less than ~1.5% of the portfolio each) stakes were increased during the quarter. Microsoft acquired Activision Blizzard in a $95 cash deal that closed in October.

Stake Decreases:

Green Brick Partners (GRBK): GRBK is currently the largest position at ~29% of the 13F portfolio. The stake was acquired as a result of BioFuel Energy’s JGBL Builder Finance acquisition and rename transaction. The deal closed (October 2014) with Greenlight owning 49% of the business. David Einhorn was appointed Chairman of the Board following the transaction. Q1 2021 saw a ~28% selling at ~$20.50 per share through an underwritten offering. This quarter saw a similar reduction at prices between $41.51 and $58.51. The reduction was primarily due to in-kind distributions to redeeming shareholders rather than actual sales in the open market. The stock currently trades at $50.62.

Note: They have a ~27% ownership stake in the business.

CONSOL Energy (CEIX): CEIX is a large (top three) 14.33% of the portfolio position that came about as a result of the merger with Consol Coal Resources that closed in December 2020. Terms called for 0.73 shares of CONSOL Energy for each share of Consol Coal held. Greenlight had a position in Consol Coal for which they received these shares. There was a ~30% reduction in Q1 2021 at prices between ~$6.75 and ~$12.20. That was followed with a ~25% selling in Q2 2021 at prices between ~$8.75 and ~$18.70. The three quarters through Q4 2022 saw a ~23% net enhance at prices between ~$35.50 and ~$77.50. There was another ~50% enhance during Q1 2023 at prices between ~$51 and ~$64. This quarter saw a ~16% selling at prices between ~$63 and ~$105. CEIX currently trades at ~$104.

Tenet Healthcare (THC): THC is a 3.41% of the portfolio position purchased during Q4 2022 at a cost-basis of $48.61. The stock currently trades at $68.94. There was a ~117% stake enhance during Q1 2023 at prices between ~$49 and ~$62. The last quarter saw a one-third reduction at prices between ~$58 and ~$82. There was a ~2% trimming this quarter.

Weatherford plc (WFRD): The 2.21% of the portfolio position in WFRD was purchased in Q1 2022 at an average price of $32.27 and it is now at $85.03. Q4 2022 saw a ~22% reduction at prices between ~$32 and ~$51. That was followed by similar selling last quarter at prices between ~$56 and ~$66. There were marginal trimming this quarter.

Gulfport Energy (GPOR): GPOR is a 1.42% of the portfolio stake built in the two quarters through Q1 2023 at prices between ~$61 and ~$97. There was a ~25% selling last quarter at prices between ~$76 and ~$108. It is now at ~$134. This quarter saw a minor ~2% trimming.

First Horizon Corp. (FHN): The very small 0.81% stake in FHN saw marginal trimming this quarter.

The spreadsheet below highlights changes to Greenlight’s 13F stock holdings in Q3 2023:

David Einhorn – Greenlight Capital’s Q3 2023 13F Report Q/Q Comparison (John Vincent (author))

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.