Marco Bello

This article is part of a series that provides an ongoing analysis of the changes made to ARK Invest’ 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 1/17/2024.

ARK Invest was founded by Cathie Wood in 2014. They manage several actively managed ETFs, index ETFs, and certain other international products. Assets Under Management (AUM) has come down from over $50B at the peak to ~$17B now. They invest in what they term “disruptive innovation”. The actively managed ETFs are ARK Innovation ETF (NYSEARCA:ARKK), ARK Autonomous Tech & Robotics ETF (BATS:ARKQ), ARK Next Generation Internet ETF (NYSEARCA:ARKW), ARK Genomic Revolution ETF (BATS:ARKG), ARK Fintech Innovation ETF (NYSEARCA:ARKF), and ARK Space Exploration & Innovation ETF (BATS:ARKX).

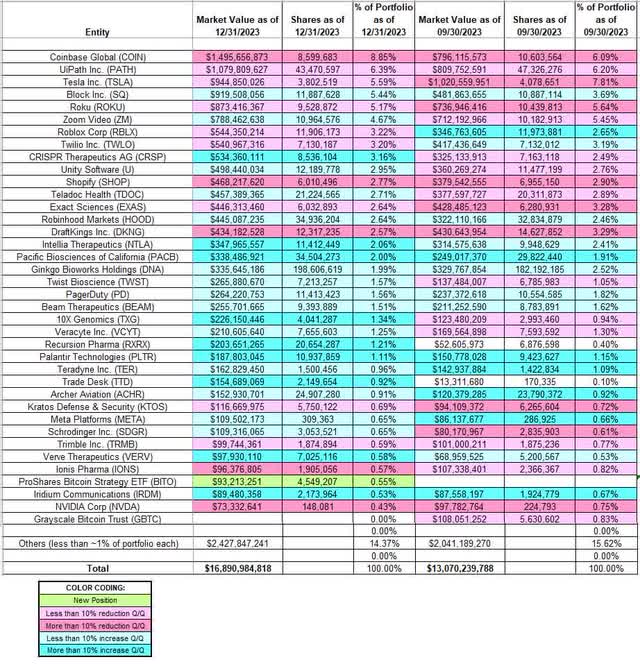

This quarter, ARK Invest’ 13F portfolio value increased ~29% from ~$13.07B to ~$16.89B. The number of holdings decreased from 226 to 223. There are 37 securities that are significantly large, and they are the focus of this article. The top three holdings are at ~21% while the top five are at ~32% of the 13F assets: Coinbase Global, UiPath, Tesla, Block, and Roku. Please visit our previous update for the fund’s moves during Q3 2023.

Note 1: Unlike other investment management businesses, ARK is pioneering an open source model of investment research through a couple of initiatives: a) Valuation models on businesses are being made available to the public through GitHub, and b) daily trades are available to anyone who signs up for it. The open source model along with the outlandish forecasts has attracted criticism as well: in April 2022, RIA lawyers urged SEC enforcement action.

Note 2: The 13F data on which this article is based is as of 12/31/2023. Updated daily holdings data for each of their ETFs are publicly available.

Note 3: Although as a percentage of the overall portfolio the positions are very small, it is significant that they have sizable ownership stakes in the following businesses: 908 Devices (MASS), Arcturus Therapeutics (ARCT), Blade Air Mobility (BLDE), Butterfly Network (BFLY), Cerus Corp. (CERS), Invitae (NVTA), Markforged (MKFG), Materialise NV (MTLS), Personalis (PSNL), Quantum-Si (QSI), Repare Therapeutics (RPTX), Velo3D (VLD), and Vuzix Corp (VUZI).

New Stakes:

ProShares Bitcoin Strategy ETF (BITO): They had a position in the Grayscale Bitcoin Trust. That was partially replaced by a similar stake in BITO this quarter.

Stake Disposals:

Grayscale Bitcoin Trust (GBTC): The very small 0.83% stake in GBTC was partially replaced with BITO during the quarter.

Stake Increases:

Block, Inc. (SQ): SQ was a small stake in the portfolio in their first 13F filing in 2016. The position was built during the 2018-20 period at prices between ~$40 and ~$99. H1 2022 saw a ~45% stake increase at prices between ~$58 and ~$164. There was a ~16% stake increase during Q1 2023 and that was followed with marginal increases in the next two quarters. The position was increased by 9% this quarter at prices between $39.22 and $79.60. The stock currently trades at $64.47, and the stake is now at 5.44% of the portfolio.

Zoom Video (ZM): The large 4.67% of the portfolio ZM stake was built during the two years through Q3 2022 at prices between ~$74 and ~$559. The stock currently trades below the low end of that range at $67.32. The last four quarters saw only minor adjustments. This quarter saw a ~8% increase at prices between $59.29 and $74.21.

CRISPR Therapeutics AG (CRSP): The bulk of the current 3.16% of the portfolio position in CRSP was built in 2020 at prices between ~$38 and ~$169. The stake has wavered. Q1 2021 saw a ~20% selling while in Q4 2021 there was a similar increase. The last several quarters saw only minor adjustments. There was a ~20% stake increase this quarter at prices between $38.62 and $72.18. The stock is now at $60.98.

Note: they have a ~11% ownership stake in CRISPR Therapeutics.

Unity Software (U): The ~3% Unity stake was built during the four quarters through Q2 2021 at prices between ~$68 and ~$165. Q4 2021 saw a one-third reduction at prices between ~$126 and ~$197 while in the next three quarters there was a ~45% stake increase at prices between ~$32 and ~$139. The stock is now at $32.87. There was minor trimming in the last few quarters while this quarter there was a ~6% increase.

Teladoc Health (TDOC): TDOC was a small stake until H2 2020 when a ~7.8M share position was purchased at prices between ~$183 and ~$238. Next quarter saw another ~85% stake increase at prices between ~$177 and ~$294. The stock currently trades well below their purchase price ranges at $19.85. The stake is at 2.71% of the portfolio. There was marginal trimming in the last few quarters while this quarter saw a minor increase.

Note: they have a ~11.6% ownership stake in Teladoc Health.

Robinhood Markets (HOOD): HOOD had an IPO in August 2021. Shares started trading at ~$55 and currently go for $10.67. The 2.64% of the portfolio position was built through consistent buying over the four quarters through Q2 2022 at prices between ~$7 and ~$55. The last few quarters have also seen minor increases.

Intellia Therapeutics (NTLA): NTLA was a minutely small position in ARK’s first 13F filing in 2016. The 2017-2020 time period saw the position built to a ~11.2M share position at prices between ~$12.50 and ~$62. Since then, the stake has wavered. The first three quarters of 2021 saw a ~40% selling at prices between ~$52 and ~$177 while the next four quarters saw a similar increase at prices between ~$38 and ~$138. The last several quarters saw only minor adjustments while this quarter saw a ~15% increase at prices between $23.16 and $32.34. The stock currently trades at $25.24, and the stake is at ~2% of the portfolio.

Note: they have a ~13% ownership stake in Intellia Therapeutics.

Pacific Biosciences of California (PACB): The ~2% position in PACB was increased by 16% this quarter at prices between $5.97 and $10.36. The stock currently trades at $6.36.

Note: they have a ~13% ownership stake in PACB.

Ginkgo Bioworks Holdings (DNA): The ~2% DNA stake was built over the last seven quarters at prices between ~$1.50 and ~$14. There was a ~9% increase this quarter at prices between $1.26 and $1.79. The stock is now at $1.18.

Note: they have a ~13% ownership stake in Ginkgo Bioworks Holdings.

Beam Therapeutics (BEAM): BEAM is a 1.51% of the portfolio position built over the seven quarters through Q2 2022 at prices between ~$22 and ~$130. The last five quarters have seen only minor adjustments. There was a ~7% increase this quarter at prices between $17.69 and $30.76. The stock is now at $23.46.

Note: they have a ~12.5% ownership stake in Beam Therapeutics.

Palantir Technologies (PLTR): The small 1.11% stake in PLTR was established during Q2 2023 at prices between ~$7.40 and ~$16.60 and the stock currently trades at $16.40. There was a ~38% stake increase last quarter at prices between $13.96 and $19.99. That was followed by a ~16% increase this quarter at prices between $14.69 and $21.34.

10X Genomics (TXG), Archer Aviation (ACHR), Iridium Communications (IRDM), Meta Platforms (META), PagerDuty (PD), Recursion Pharma (RXRX), Schrodinger Inc. (SDGR), Teradyne, Inc. (TER), Trade Desk (TTD), Twist Bioscience (TWST), Verve Therapeutics (VERV), and Veracyte, Inc. (VCYT): These small (less than ~1.6% of the portfolio each) stakes were increased this quarter.

Note: they have significant ownership stakes in the following businesses: 10X Genomics, Archer Aviation, PagerDuty, Schrodinger, Twist Biosciences, Veracyte, and Verve Therapeutics.

Stake Decreases:

Coinbase Global (COIN): COIN had an IPO in April 2021. Shares started trading at ~$290 and currently go for ~$124. It is currently their largest stake at 8.85% of the portfolio. It was built during Q2 & Q3 2021 at prices between ~$225 and ~$342. Q4 2021 saw a ~22% trimming at prices between ~$231 and ~$343 while the next two quarters saw a two-thirds stake increase at prices between ~$49 and ~$252. The two quarters through Q1 2023 saw another ~55% stake increase at prices between ~$32 and ~$82. The stake was decreased by 13% last quarter at prices between $70.52 and $110.15. That was followed by a ~19% reduction this quarter at prices between $70.78 and $186.36.

Note: they have a ~4.5% ownership stake in the business.

UiPath Inc. (PATH): PATH had an IPO in April 2021. Shares started trading at ~$72 and currently go for $21.60. The large (top three) 6.39% of the portfolio position was built in the Q2 to Q3 2021 period at prices between ~$52 and ~$80. The four quarters through Q3 2022 saw the position almost double at prices between ~$12.50 and ~$56. H1 2023 saw a ~10% increase while the last quarter saw a minor ~2% trimming. The stake was decreased by 8% this quarter at prices between $14.94 and $26.26.

Note: they have a ~9.5% ownership stake in UiPath.

Tesla, Inc. (TSLA): TSLA is a large (top three) position at 5.59% of the portfolio. It was already a small position in their first 13F filing in 2016. Recent activity follows. Q1 2021 saw a ~40% stake increase at prices between ~$199 and ~$293. The six quarters through Q3 2022 had seen the position reduced by ~80% at prices between ~$217 and ~$407. The two quarters through Q1 2023 saw a ~30% stake increase while in the last two quarters there was a similar reduction. The stock currently trades at ~$212. This quarter saw a ~7% trimming at prices between $197.36 and $263.62.

Roku (ROKU): ROKU is a large (top five) 5.17% of the portfolio position built in the 2019-20 period at prices between ~$33 and ~$357. The four quarters through Q3 2022 saw another ~150% stake increase at prices between ~$56 and ~$345. The stake was decreased by 13% last quarter at prices between $61.60 and $97.49. This quarter saw a ~8% selling at prices between $56.35 and $106.87. The stock is now at ~$84.

Note: they have a ~8% ownership stake in Roku.

Roblox Corp. (RBLX): The 3.22% RBLX position was built during the four quarters through Q3 2022 at prices between ~$23 and ~$135. There was a ~10% stake increase in H1 2023. That was followed by a ~28% increase last quarter at prices between $25.31 and $45.54. The stock currently trades at $38.89. This quarter saw marginal trimming.

Twilio Inc. (TWLO): The 3.20% of the portfolio TWLO stake was built during the four quarters through Q2 2021 at prices between ~$224 and ~$435. Q3 2021 saw a ~13% trimming while the next five quarters have seen a ~130% stake increase at prices between ~$43 and ~$369. The stock currently trades at $72.52. There was a ~16% reduction during Q1 2023 at prices between ~$50 and ~$75 while the next quarter saw a ~13% increase at prices between ~$46 and ~$70. The last two quarters saw only minor adjustments.

Shopify (SHOP): The bulk of the current 2.77% position in SHOP was built during the three quarters through Q2 2021 at prices between ~$92 and ~$147. The stake has since wavered. H2 2021 saw a ~40% reduction at prices between ~$135 and ~$169 while the next three quarters saw a stake doubling at prices between ~$27 and ~$136. There was a ~37% reduction during Q2 2023 at prices between ~$45 and ~$66. The stake was decreased by another ~22% last quarter at prices between $51.51 and $70.37. This quarter also saw a ~14% selling at prices between $46.40 and $79.11. The stock is now at $77.52.

Exact Sciences (EXAS): The EXAS stake is currently at 2.64% of the portfolio. It was built over the nine quarters through Q4 2022 at prices between ~$32 and ~$155. There was a ~30% reduction during Q1 2023 at prices between ~$47 and ~$71. That was followed with a ~37% selling next quarter at prices between ~$63 and ~$95. The last quarter also saw a ~12% reduction and that was followed by a ~4% trimming this quarter. The stock currently trades at $65.20.

DraftKings Inc. (DKNG): DKNG came to market through a De-SPAC transaction in Q1 2021. The 2.57% of the portfolio stake was built through consistent buying every quarter at prices up to ~$70. Q2 2023 saw a ~25% selling at prices between ~$18 and ~$27. That was followed by a ~19% reduction last quarter at prices between $25.23 and $32.38. The stake was decreased by 16% this quarter at prices between $26.22 and $39. The stock is now at $37.54.

Ionis Pharma (IONS), Kratos Defense & Security (KTOS), NVIDIA Corp. (NVDA), and Trimble Inc. (TRMB): These very small (less than ~1% of the portfolio each) stakes were reduced during the quarter.

Note: they have significant ownership stakes in the following businesses: Kratos Defense & Security, and Trimble.

The spreadsheet below highlights changes to ARK Invest’ 13F holdings in Q4 2023:

Cathie Wood – ARK Invest’s Q4 2023 13F Report Q/Q Comparison (John Vincent (author))

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.