AerialPerspective Works/E+ via Getty Images

Silicon Carbide Headwinds Coming From EV Manufacturers

I have recently revised my Silicon Carbide (“SiC”) sales projections downward, marking my first such adjustments in four years of monitoring the industry. The primary reasons behind these revisions include a decrease in demand for EVs due to increasing interest rates, shifts in global original equipment manufacturers’ (OEMs) EV strategies, and a rise in regulatory uncertainty.

Recent headwinds facing the EV industry have attracted media attention. In the past few days, for example, the German government decided to terminate a seven-year subsidy program for new EV buyers, which provided up to €6,750. The subsidy is jointly funded by the state and automakers, with the state contributing 4,500 euros and the car manufacturer contributing 2,250 euros.

Recently, we have seen the downward revisions made by three of the largest automobile companies, General Motors (GM), Ford (F), and Volkswagen (OTCPK:VWAGY):

1. General Motors has retracted its plans to produce 100,000 EV units in the second half of 2023 and delayed the production of 400,000 units in North America from 2022 to the first half of 2024. This adjustment contradicts the company’s earlier commitment to the 400,000-unit target stated in its second-quarter 2023 earnings call.

2. Ford has adjusted its EV production timeline, shifting the target for achieving a 600,000-unit capacity from 2023 to 2024. Additionally, the company has abandoned its previous guidance of manufacturing 2 million units annually by the end of 2026.

3. Volkswagen, in response to a slowdown in near-term demand, has suspended its EV production lines twice this year, in June and October.

Other automakers, including Toyota (TM), Lucid (LCID), Polestar (Volvo) (PSNY), and Fisker (FSR), have also announced more conservative EV sales targets in alignment with the current market conditions.

Power IC Companies Impacted by EV Sales

Power semiconductors stand as indispensable core components in the realm of vehicle electrification, which is the most expensive component of an EV, as shown above in Chart 3. Silicon carbide power devices showcase distinct advantages in terms of withstand voltage levels, switching loss, and high-temperature resistance, contributing significantly to the realization of lightweight and efficient power electronic drive systems for new energy vehicles. Consequently, SiC power devices find widespread application in the main drive inverters of new energy vehicles, where key electronic control components, including controllers, assume an increasingly pivotal role.

The advantages of silicon carbide technology become particularly evident in the context of the 800V high-voltage platform. Public reports indicate that numerous automotive companies, such as Tesla (TSLA), BYD, NIO (NIO), XPeng, among others, have embraced silicon carbide power modules, incorporating them into multiple models.

The growth in electric vehicle sales is experiencing a gradual slowdown, prompting automakers to reassess significant investments in the historic shift from internal combustion to electric powertrains. Surveys indicate that the contributing factors to this deceleration include concerns about costs, restricted driving range, and an inadequate number of charging stations-unlike the readily available gas stations that are typically nearby.

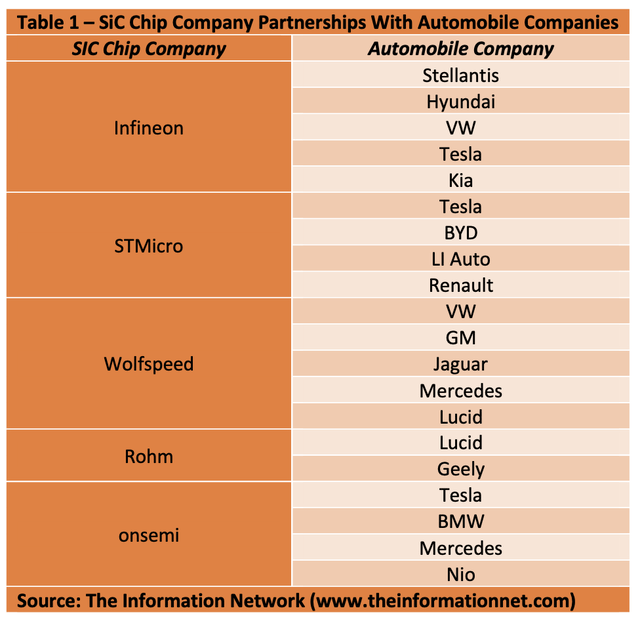

In Table 1, I show a partial list of partnerships between SiC Chip companies and Automobile manufacturers. As SiC chips increase their penetration rate into the Automobile sector, these partnerships will continue to grow.

On the flip side, Auto companies discussed above, which are experiencing slowing EV sales, will impact their SiC ship suppliers. According to Table 1, Wolfspeed (NYSE:WOLF) will be most impacted by an EV slowdown in the U.S. and Europe. WOLF supplies SiC chips to VW and GM, both of which were discussed briefly above, and Jaguar and Mercedes, both of which are European auto companies.

ON Semiconductor (NASDAQ:ON) has already reported in its Q3 earnings call that it cut its 2023 SiC revenue guidance from $1 billion to $800m because a European tier-1 automotive OEM pushed out deliveries.

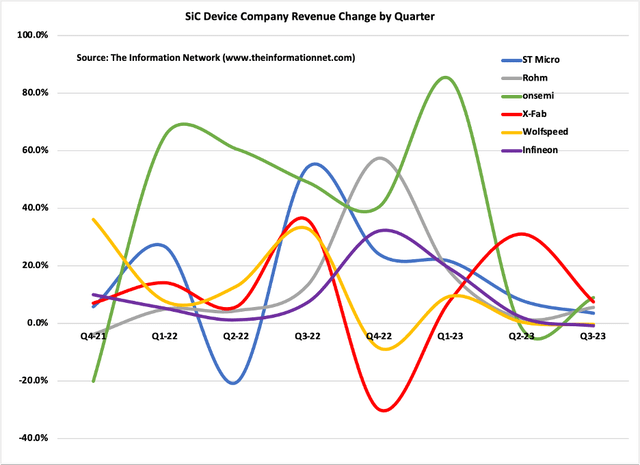

On a competitive basis, I show in Chart 1 how Wolfspeed’s SiC device revenue QoQ changed compared with those companies that have reported CY Q3 revenues so far – ON Semiconductor, X-FAB (OTCPK:XFABF), and Infineon (OTCQX:IFNNY), Rohm (OTCPK:ROHCF) and STMicroelectronics (STM).

Chart 1

Investor Takeaway

There are between 100 and 180 MOSFETs used per vehicle in ~90 different applications in all segments: body, chassis, safety, ADAS/AD, and powertrain. The EV market makes up 63% of MOSFET’s in 2025 on SiC device market, according to The Information Network’s paywalled report “Power Semiconductors: Markets, Materials and Technologies“. So, the success of SiC hinges on the success of the EV market.

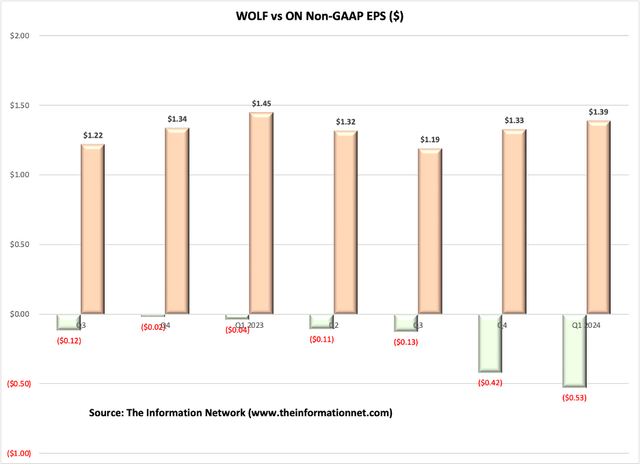

That said, any slowdown in EV sales will affect SiC suppliers, not only MOSFET chips but wafers. With a focus on two SiC chip companies, WOLF and ON, Chart 2 shows Non-GAAP EPS for both companies. Over the past seven quarters, WOLF has net to make a profit. ON’s earnings are strong, but I anticipate a drop in CY Q4 based on the aforementioned slowdown in EV sales.

Chart 2

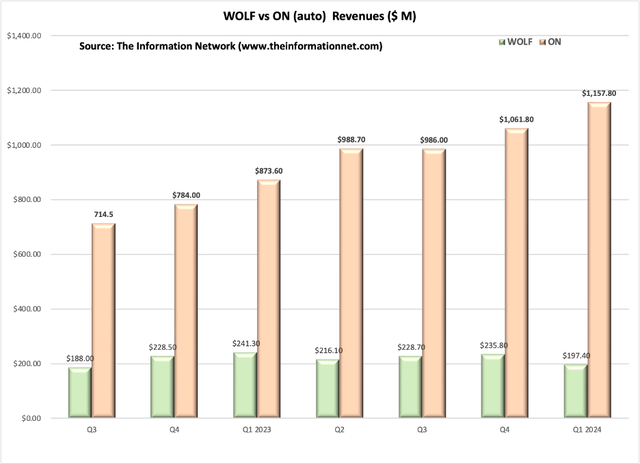

Chart 3 shows revenue for the two companies. Data for ON only include its Auto segment. Here we see consistent growth for ON for the past seven quarters, but CY Q4 will show a temporary pause that may last a few quarters. In contrast, WOLF’s revenues have been anemic.

Chart 3

That said, my near-term focus is on ON, and whether it sees a continuation of further customer cancellations. I maintain my BUY rating on ON and will re-evaluate after its next earnings.

On WOLF, I have had a STRONG SELL rating on the company since early 2023. With possible headwinds because of its exposure to GM, VW, and German auto companies, I continue my STRONG SELL rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.