The SPDR Gold Trust (GLD) is up 10.84% over the last year. While that is less than the S&P 500, which is up 18.89% in the last year, gold’s advance is significant since it is pushing the price toward a significant breakout.

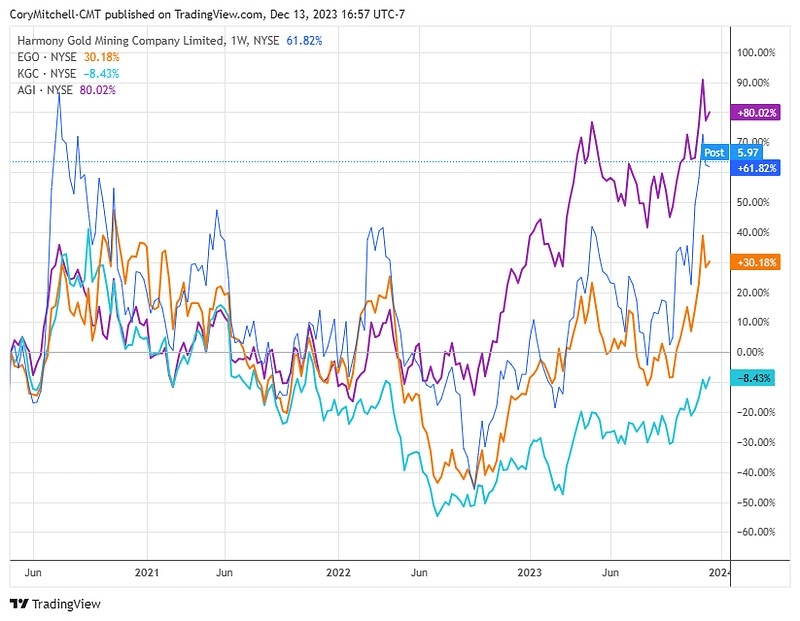

Top-performing gold stocks are up more than 40% in the last year.

Gold has been moving sideways since late 2020, with GLD stuck below $195. “If it can break above the $195 region, that could usher in the next bull cycle in gold. Based on the size of the range, a breakout could push GLD to $240 and gold to $2600.” According to Trading.biz analyst Cory Mitchell. GLD’s closed at $187.63 on December 13.

The breakout hasn’t occurred yet. Gold is simply approaching and hanging out below that breakout level.

With that in mind, let’s look at some top-performing gold stocks over the last year. Only stocks that trade more than 500,000 shares per day on average, have a price above $5, and trade on the NYSE or Nasdaq stock exchanges were included.

Harmony Gold Mining (HMY)

- Up 76.6% over the last year

- Up 41.4% in the last three months

- Operations in Papua New Guinea, Australia, and South Africa

- 1.49 million ounces of gold produced in 2022

Eldorado Gold (EGO)

- Up 55.3% over the last year

- Up 30.4% in the last three months

- Operations in Canada, Turkey, and Greece

- 0.454 million ounces of gold produced in 2022

Kinross Gold (KGC)

- Up 44.8% over the last year

- Up 22.7% in the last three months

- Operations in Canada, the United States, Chile, Brazil, and Mauritania

- 2.2 million ounces of gold produced in 2022

Alamos Gold (AGI)

- Up 42.7% over the last year

- Up 17.8% over the last three months

- Operations in Canada and Mexico

- 0.46 million ounces of gold produced in 2022

Harmony and Eldorado are working toward the highs that formed in late 2020. Kinross is trying to do the same, but is advance below the highs from a few years ago than Harmony and Eldorado.

While Alamos has had the weakest performance over the last year, of the four stocks discussed here, the stock is actually trading at a multi-year high.

While Alamos has had the weakest performance over the last year, of the four stocks discussed here, the stock is actually trading at a multi-year high.

Going back to 2013, Alamos is the best-performing stock on the list; it is up 1% over that time frame while all the other stocks are down 17% to 80%. A reminder that very few gold stocks perform well over the long-term. Investors in mining companies generally do well with being involved while the sector is hot and gold is increasing; many of the gold miner stock prices can fall dramatically when the gold price is falling or even flat.

For right now, all these stocks are in at least short-term uptrends and moving higher since October.