PM Images

After narrowly missing recession in 2022/23, during unprecedented 525 basis points of rate hikes in a span of 16 months, 2024 has started on strong footing with the major indices up close to 10% on a year-to-date basis.

Historically, during election years in US, the S&P 500 (SP500) delivered on average 11.28% return and 19 of 23 years or 83% have seen positive performance, meaning there is still a bit of runway left for the indices to run, if 2024 would prove to be average election year.

With no recession in sight, inflation falling down and labor market remaining strong, there appears to be little to worry about in today’s market, which led to some equities trading at stretched valuations compared to their historical standards:

- S&P 500 (SPY): Blended P/E of 23.7x, 15Y avg. of 19.05x

- Nvidia (NVDA): Blended P/E of 57.7x, 15Y avg. of 35.8x

- Meta Platforms (META): Blended P/E of 31.5x, 13 avg. of 29.3x

- Microsoft (MSFT): Blended P/E of 37.3x, 15Y avg. of 22.4x

- Costco (COST): Blended P/E of 46.2x, 15Y avg. of 31.5x

While there is currently the AI driven euphoria in the market, which is lifting many of these great growth stocks, we have to remain with both feet on the ground, making sure we do not overpay for these superior businesses. Buying great, but overpriced business is similarly bad idea as buying poor business at a fair price.

Despite the valuation being rather stretched by conventional thinking of most high quality equities, there appear to be two great growth stocks which I am still buying with both hands this month, let me show you.

1. MercadoLibre, Inc. (MELI)

MercadoLibre is generally referred to as the Latin version of e-commerce giant Amazon (AMZN). The company is approximately 20x smaller by a market cap compared to the US giant and its domestic shares are traded in Buenos Aires, but international investors can buy the NASDAQ-listed ADRs instead.

Even though MercadoLibre is generally viewed as online marketplace, the company has in recent years became fintech powerhouse. Mercado Pago, similar to Venmo, service provided by PayPal (PYPL), has become a popular method to handle payments in South America with over 53 million active users and transaction volume exceeding $135 billion during 2023.

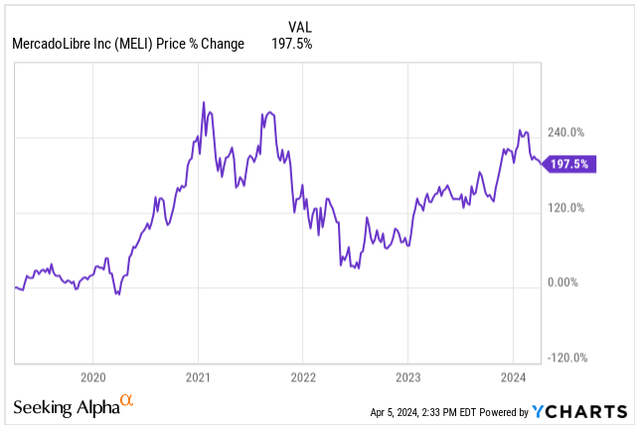

In the last 5 years, MELI’s shares are up 197% and revenue is up 681%, partially thanks to the tailwinds many e-commerce and fintech businesses experienced during COVID-19 and general switch towards online retail.

MELI’s online marketplace is very similar to eBay’s (EBAY), creating a platform which connects potential customers and sellers in one place, with the benefit of their own integrated payment system, advertising and logistics alike.

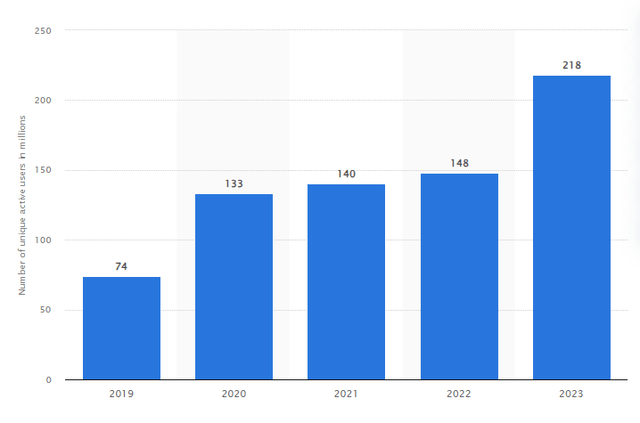

In 2023, MELI’s services had more than 218 million unique active users, or roughly 31% from the roughly 700 million population in the markets, where the company operates such as Argentina, Brazil and Mexico.

South America being composed of developed and emerging nations, is facing major challenges such as political turmoil, hyperinflation in Argentina, reliability on strong USD with potential stunt of economical growth and poverty.

So far, these issues did not inflict any damage on MELI’s growth, instead the company benefited from countries in the region becoming wealthier and widespread digitalization in the remote parts of the world, a trend which in my opinion will drive MELI’s growth for years to come, giving investors a good chance to diversify their portfolio and capitalize on strong economic growth in emerging markets.

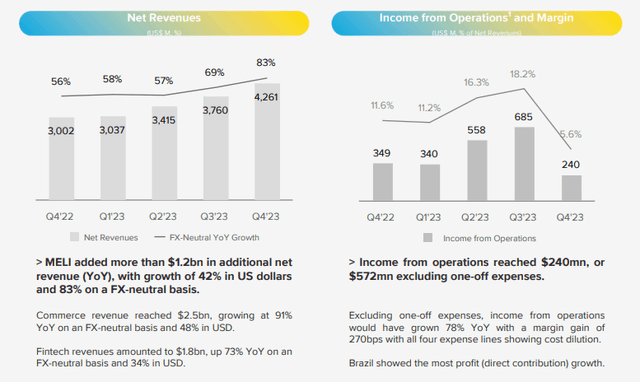

Back in February, MELI reported its Q4 earnings with revenue growth of 42% YoY to $4.26 billion. The EPS came at $3.25, compared to the $7.02 analysts were expecting as a result of incurred non-recurring cash expense of $351 million related to outstanding tax liability from 2014.

The major, one-off tax expense sent the stock tumbling, now trading 18% below its all-time-high and giving long-term investors a reason to celebrate and buy high-quality stock at a discount.

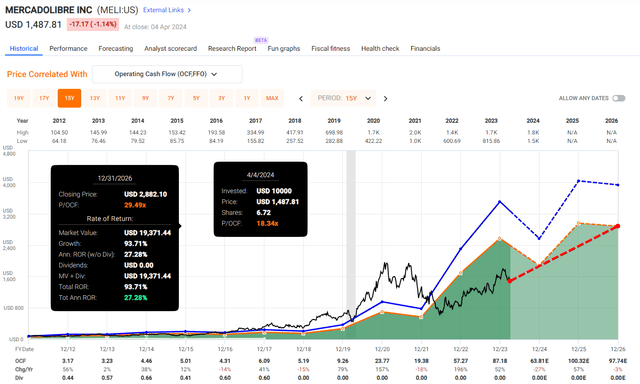

When valuing a business like MELI or AMZN, instead of looking at traditional P/E ratio, I always argue that looking at Operating Cash Flow to Price or OCF/P is superior, given the businesses heavily reinvest into their capabilities and looking into the cash-generating capacity depicts the true value of the firm better.

Since 2011, MELI has proven to be a great compounder with average annual OCF growth of 29.5%.

One would assume as the company becomes larger and the market becomes saturated, the growth would fall-off the cliff, but the opposite is the truth and MELI has managed to re-accelerate its growth, delivering 36.1% OCF annual growth since 2017.

MELI’s OCF growth has been historically volatile, negative years followed by major expansion and the same is expected by the analysts polled by S&P Global to continue:

- 2024: OCF of $63.81E, YoY growth of -27%

- 2025: OCF of $100.32E, YoY growth of 57%

- 2026: OCF of $97.74E, YoY growth of -3%

Currently the stock is trading at “only” 18.34x its P/OCF, significantly below the normal P/OCF of 40.2x over the past 15 years.

Naturally, we need to adjust the valuation for the slowing growth, which should average at around 15% annually over the next 3 years, so expecting P/OCF of around 30x is completely feasible.

For reference, Amazon being significantly larger in size, is currently trading at P/OCF of 20.33x.

Even though, the expected growth over the next three years is somewhat muted based on historical standards for MELI, as the company navigates near-term challenges, such as borrowed demand from COVID-19 and slower economic growth in 2022 and 2023 in the countries it operates in, I am expecting resumption of OCF growth in the mid to upper 20%’s, with deployment of new products and further market share gains.

Given the growth materializes and the valuation expands to 30x its OCF from today’s depressed level, long-term investors could expect up to 27% annual returns with a share price target of $2,880 by the end of 2026.

2. Booking.com (BKNG)

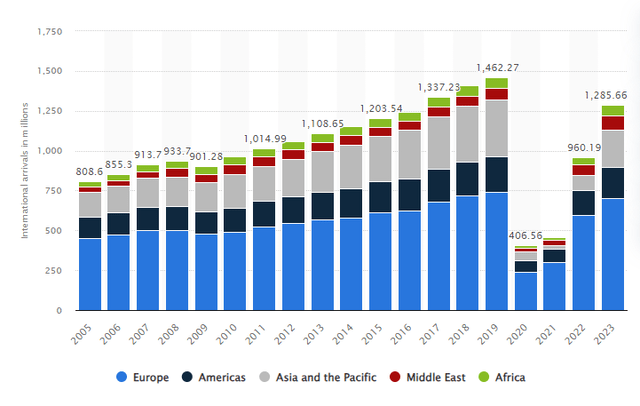

After the COVID-19 crushed hotels, airlines, travel agencies and travel industry as such, the industry is once again experiencing a “renaissance” with increasing number of travelers every year, widespread use of social media and people prioritizing experiences over material luxury goods.

Back in 2023 the number of international tourists arrivals worldwide still stood below the peak of 1.46 billion from 2019, prior to the pandemic, however, the tourist industry is swiftly catching up and 2024 is widely expected to be the record year, with further growth in-sight.

Tourist Arrivals Worldwide (Statista)

Booking.com being oriented both on leisure and business travel across 200 countries, is one of the main beneficiaries of the ever-growing trend and presents a good investment opportunity with a diversified portfolio across the industry, ranging from hotels, experiences, car rentals to airfares. Booking currently owns many brands, you may be familiar with:

- Agoda.com

- Kayak.com

- CheapFlights

- Rentalcars.com

- OpenTable

… and many others.

The core business model is rather straight forward with Booking earning a commission ranging from 10% to 30% of the booking value from accommodation providers for each completed reservation booked through one of their platforms. On top, the platforms generate revenue through advertising displayed on their websites.

Personally, whenever I travel anywhere in the world, I always use Booking.com even though their website is generally not the cheapest, but provides me with one place for all my bookings or whenever issue occurs (and it does often with bookings) I can always rely on their superior customer service to resolve the issue, which is especially helpful in non-English speaking countries. All in all, the company has a very strong moat.

After particularly strong 2023 partially driven by the industry recovery, with Booking growing their EPS by 52% to $152.22, we should expect a level of normalization, yet still strong mid double-digit growth.

Some investors might make the point that investing into discretionary companies is especially tricky due to its cyclicality, being driven by the underlying economic development and FED’s interest rates impacting disposable income of households, eventually cutting travel expenses if needed among the first.

I fully agree, yet the consumer is still strong especially in US, despite the highest interest rates in 22 years. On Friday, the hot labor market data confirmed the strong economy, adding 303k jobs last month, blowing past the expectations of 205k job gains.

Strong economy, falling inflation and eventual rate cuts all point to a favorable setup for more growth in the travel industry, from which Booking will benefit.

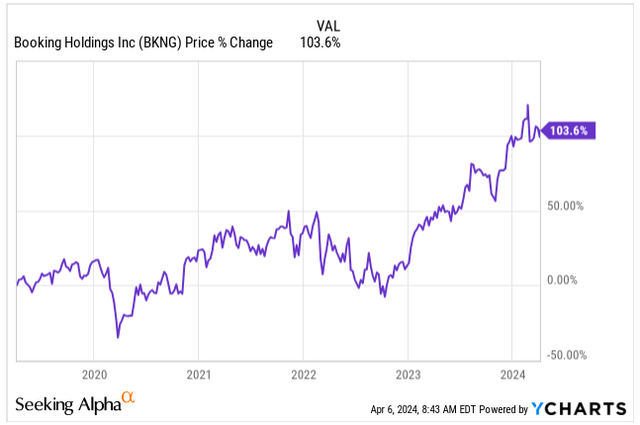

Despite the strong setup and industry tailwinds which should keep lifting Booking’s stock price for years to come, the company’s stock has slipped by over 10% on February 22nd after the company reported its Q4 and full-year 2023 earnings.

The company reported for Q4 EPS of $32.0 and revenue of $4.78 billion, beating expectations by $1.95 and $70 million respectively. Net profit has improved by 29% and revenue was up 18% from same quarter, last year.

The drop was in stock price driven by the military conflict in the Middle East, which led to muted room reservations during the holiday season, increasing by 9.2% in Q4, below the estimates of 9.7%, dragging companies like Airbnb (ABNB) and Tripadvisor (TRIP) down alike. The conflict could weight on the industry for the time being, giving long-term investors a chance to grab the shares for cheaper, as all conflicts eventually get resolved.

Just to put Booking’s sheer size into a perspective, in 2023, customers’ booking reached all-time high of 1 billion room nights on the company’s platform.

During the last earnings call the company also announced its first-ever dividend of $8.75 or roughly 1% dividend yield, alongside its existing stock-buyback program.

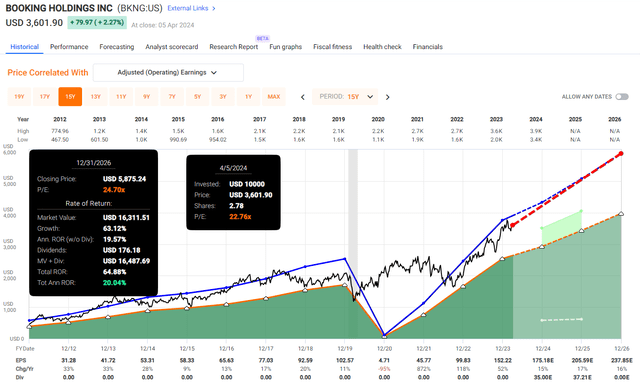

In the last 15 years the company managed to grow its EPS at 16.7% annually with average valuation of 24.7x its earnings.

Today, the stock is trading at 22.8x its blended P/E, implying a slight discount to its fair value, with more growth expected:

- 2024: EPS of $175.18E, YoY growth of 15%

- 2025: EPS of $205.59E, YoY growth of 17%

- 2026: EPS of $237.85E, YoY growth of 16%

The EPS growth expectations of around 16% annually over the next three years, is very similar to the growth rates the company managed to deliver over the past 15 years, making it very likely to happen.

With the valuation below the historical range, investors buying the shares today can expect good degree of margin of safety, alongside of potential total ROI annually 20% until end of 2026 with the share price target of $5,875.

But keep in mind, that potential recession or significant GDP growth slowdown could negatively impact the share price and the growth expectations alike.

Takeaway

US election years have historically delivered positive stock returns in 83% cases with average annual return of 11.3%, giving 2024 a good chance to be one of the better years.

While many high-quality growth stocks are already trading at stretched valuation in the face of the optimism, there are still two superior quality stocks which I am buying hand over first on a monthly basis into my own portfolio with both trading below its fair value, alongside strong double-digit expected growth in the near future, potentially delivering 20%+ returns in the following years.

Both MercadoLibre and Booking.com are benefiting from strong tailwinds such as e-commerce growth, emerging markets improving economies, people prioritizing experiences and travel over material luxuries and strong, resilient consumers.

While a potential recession or GDP growth slowdown could inflict damage on either of the companies, today each of these remains a “Strong Buy”, especially in a pricy market.