Torsten Asmus

In anticipation of a rate cut next year

There have been multiple ways analysts and pundits have been discussing how to play rate cuts next year. The most popular of which is iShares 20+ Year Treasury Bond ETFTLT (TLT). The way I’m playing it is a bit different, with high-yield corporate bonds, mainly the SPDR Portfolio High Yield Bond ETF (NYSEARCA:SPHY). As it stands right now, SPHY has about half the volatility of TLT with double the dividend yield. This highly diversified 1,800+ holding corporate bond ETF is at an all-time high yield since inception.

In this article, let’s examine the risks in duration versus credit along with catalysts that could bring a rate cut policy to the table versus the FED’s current “hold” stance. My thesis is, that I would prefer to get paid to expect in case the trade takes longer than expected or I’m forced into holding the position due to a rate cut not happening or encourage rate hikes ensuing. The lesser credit quality, shorter duration fund may be the less risky bet.

State of California faces a record $68 Billion deficit

Hot off the presses, it seems the State of California may have misjudged their budget:

A series of damaging storms last winter have made the problem worse. The storms were so bad that state officials decided to give people and businesses more time to pay their taxes this year. Californians did not have to pay their 2022 taxes until November of this year. That meant Newsom and the Legislature had to come up with a budget over the summer without knowing how much money the state had to spend.

It turns out that they badly misjudged how much taxes people and businesses would pay. The nonpartisan Legislative Analyst Office said tax collections were off by $26 billion, a major driver of the deficit. When combined with the economic slowdown California has been facing since last year, it leads to a predicted deficit of $68 billion, Legislative Analyst Gabriel Petek announced Thursday.

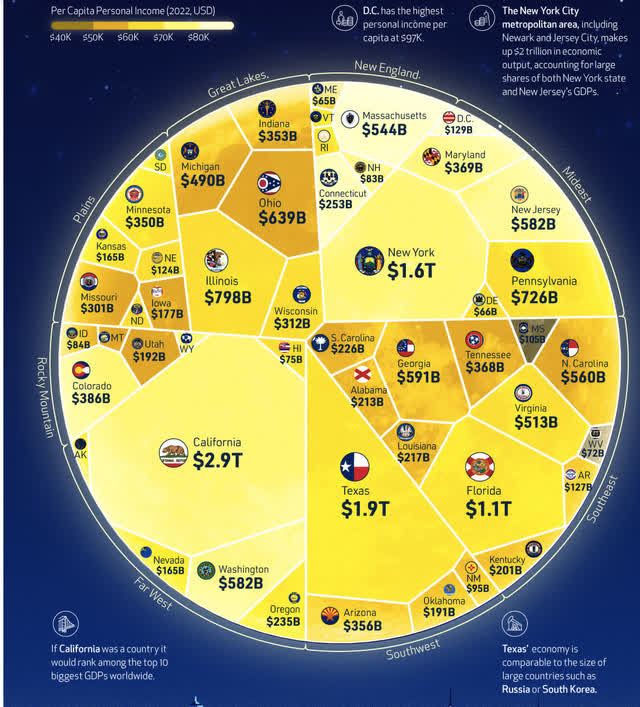

Seeking Alpha has great investors from all around the world, we do have to recollect when playing the yield curve, how the U.S. operates. The Federal Government can print money into oblivion by issuing Treasury securities, most of the 50 States have to run, or at least sign and propose, a balanced budget and rely on taxes to finance their subsidies and operations. Debt is much more difficult for a state to approve and acquire, often times requiring the preserve of the public in addition to the legislature. The state of California is the largest “state” economy in the U.S at a $2.9 Trillion per annum GDP.

If you frequent California, as I do, you achieve there is so much infrastructure to preserve. Deteriorating roads demolished by semi-trucks coming to and fro, delivering freight coming in from the Pacific to the rest of the nation. Over growth in the forests, especially along the Sierra Nevada mountains that bring about forest fires. Endless acres of farm land near Sacramento and Fresno in constant states of draught. And of course, the social welfare programs to aid low income earners in one of the most expensive cost of living states.

With this in mind, the state governments, especially those in fiscal deficits, will have to pick carefully which projects to keep and which to scrap. Their borrowing costs have gone up as well and interest payments will get more and more difficult to cover without raising taxes. With a new fiscally conservative house in Washington D.C., raising the debt ceiling is only expected to get more difficult going forward.

Clarence Anthony, the executive director of the National League of Cities, said in a statement regarding any in-ability for the Federal government to keep raising its debt ceiling:

A default by the federal government would likely bring about … rates to skyrocket temporarily, making it unfeasible for local governments to utilize short-term borrowing facilities,” Clarence Anthony, the executive director of the National League of Cities, said in a statement. “In turn, cities, towns and villages would have to delay or cancel many projects, such as bridges and sewer system upgrades, until interest rates return to normal.

Why does this matter?

Really, why should California and its unbalanced budget matter in the grand scheme of things when I’m comparing a 20-year Treasury bond fund to a high-yield corporate bond fund? The point is, that the states are under even more duress due to high interest combined with their slower process to issue debt and the need to run a balanced budget. California doesn’t have much more room to tax their fleeing tax base. Cities and municipalities can, and have bankrupted when debt loads become too great. Detroit is a good example with the city’s bankruptcy in 2013.

States have not bankrupted, but the cities are the centerpiece that makes up the tax base for the state. Their normal functioning is vital. States and municipalities coming under pressure will trickle up the food chain to Washington D.C. becoming a squeaky wheel. California has the largest share of U.S. Congressmen by state at 52 of the 435 representatives.

Effects of the first rate hike in 3 years, March 16th, 2022

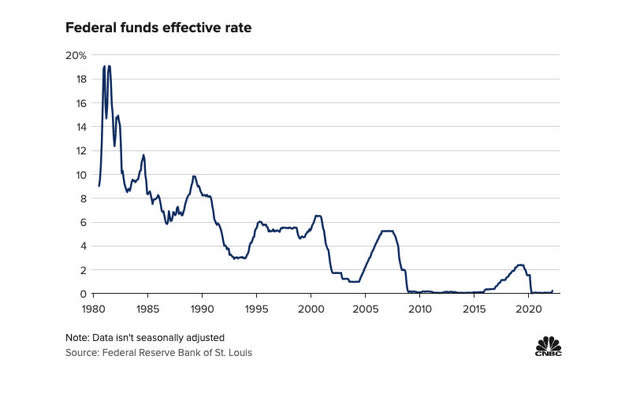

The bond bull market since 1980 has been all about rate cuts. From 20% to zero was an amazing ride. We sit here in the 5-5.5% range crying mercy. “Higher for longer” should not mean the current rate is the top and then back to zero, cuts that happen outside of an emergency, should settle into a happy mean rather than create another zero percent asset-feeding frenzy.

List of hikes since

As we can see, we have hit 7 hikes since the first post-Covid era hike. If cuts happen, we shouldn’t expect an equal amount of cuts back to zero. At best we get half the cuts and maybe settle back into the 2.5-3% range, something that was discussed by Howard Marks when interviewed about his forward outlook on the rate environment.

Zero is an emergency measure, so neither of these funds may ever make it back to the all-time highs that they achieved when the rate was cut to zero. If an investor is salivating about getting the full snap back on TLT, they may be disappointed. For this very reason, I’m choosing the higher yield plays versus the return to zirp. Outside of a true emergency, I agree with Marks that this may be unlikely to ever happen again.

Immediate effect on the funds

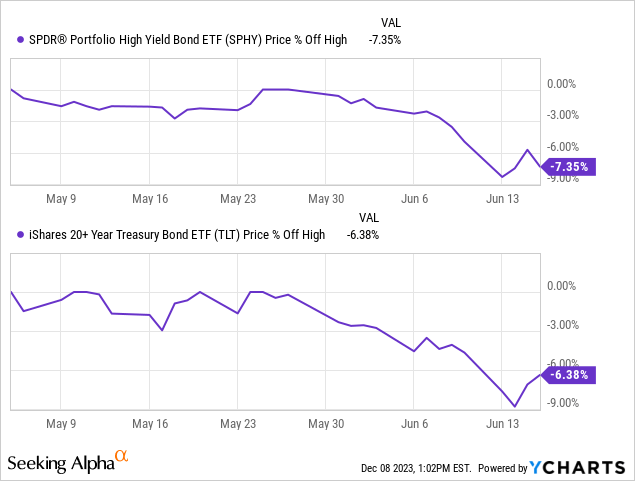

We can see from the above, the first hike period was +25 bps for the period of March 17, 2022 to May 5th 2022. Here is the effect on price of the funds during that period at 25 basis points:

Now, let’s perceive the effect of a +50 basis point hike that occurred in the period of May 5th 2022 to June 16th 2022:

At this point, for the second hike of 50 basis points, SPHY took about a 1% harder hit. However, some of it could have been due to perceptions of corporate debt and reversion to the mean for a smaller sell off in SPHY for the prior period versus TLT.

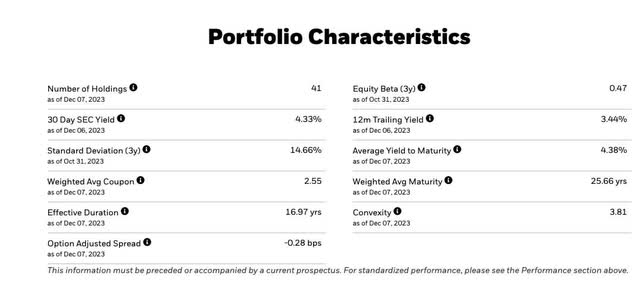

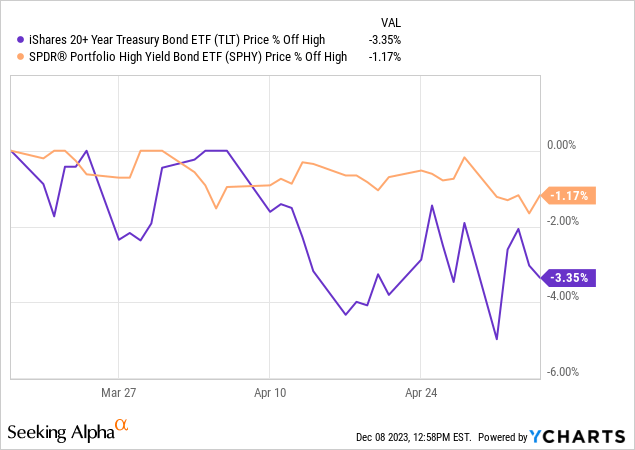

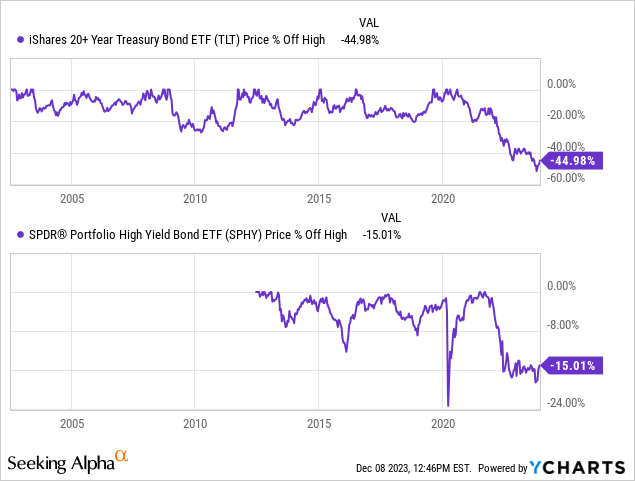

Off all-time highs

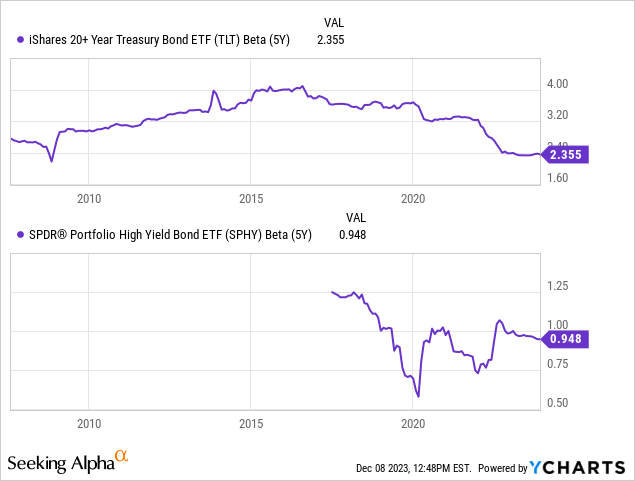

Looking at the two funds from where we sit just from a percentage off all-time high perspective, SPHY is showing far less volatility than TLT even though the fund holds much riskier high-yield corporate debt, albeit at much shorter durations. The duration aspect amplifies the gains and losses in TLT. My thesis in this play is yes, the corporate high-yield portfolio has contents with higher default risk, but the vast diversification and shorter duration still make for a lower beta.

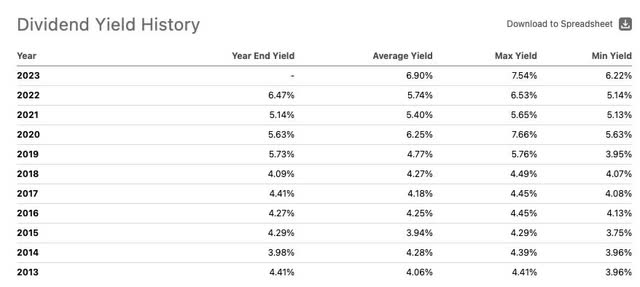

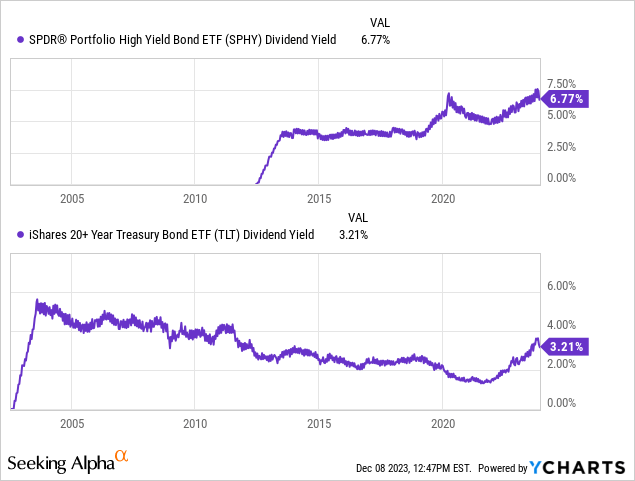

Record yields

While TLT has been around for longer than SPHY, both are at record high yields at least when comparing the last decade. However, SPHY is currently at it’s absolute high:

SPHY

Volatility

Back to volatility, you can see the running average 5-year betas for the two funds. SPHY is less than 1 while the beta for TLT is over 2. In this case, credit quality is less risk than duration at least for now.

TLT holdings and durations

From ishares.com:

The iShares 20+ Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than twenty years.

Composition

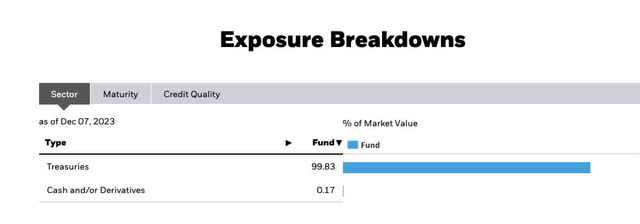

The fund is not exotic, 99.83% Treasuries focused on 20 year durations.

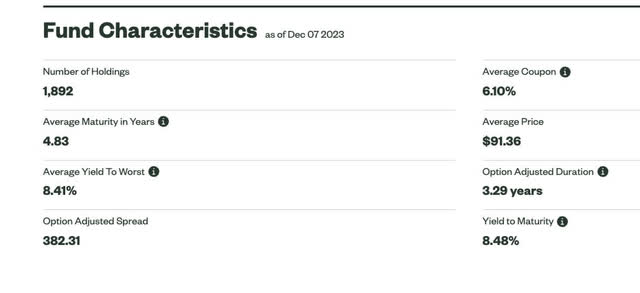

SPHY holdings and durations

From State Street:

The index includes publicly issued USD high yield bonds with a below investment grade rating, at least 18 months to final maturity at the time of issuance, at least one year to maturity, a fixed coupon, and a minimum amount outstanding of $250M

The ICE BofA US High Yield Index is market capitalization weighted and is designed to measure the performance of U.S. dollar denominated below investment grade (commonly referred to as “junk”) corporate debt publicly issued in the U.S. domestic market.

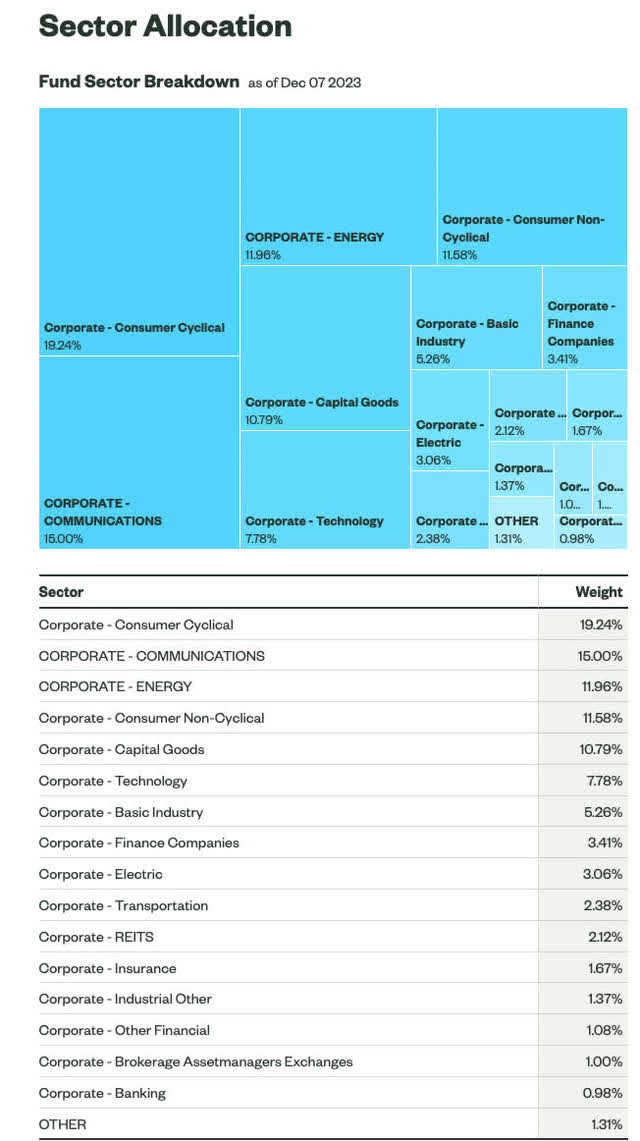

Composition

Cyclical, communications, and energy weight the top of the portfolio. These are sectors where equities already yield big dividends. The debt is just a more ensure, contractual way of taking advantage of their yield profiles.

Get paid to expect

I’ve made the argument in previous articles that government interest payments at the Federal and Municipal levels would be the determining factor on when rates get cut, or at least when they’re discussed with more frequency. With more states and municipalities now facing deficits, they need tax hikes, [which are never good for elections], or finding a way to articulate concern to the FED that they need cheaper access to capital. States appreciate California, with the largest GDP in the country, are already losing much of their wealthy tax base to more tax-friendly states appreciate Texas, Nevada, and Florida.

While there are already several predictions of how many cuts will happen and in which meetings next year, it’s all just speculation. In the meantime, if you are trying to swing trade with either of these funds, you are collecting over 7% on SPHY and only 3.45% on TLT. Both funds pay monthly, which is positive in the respect that you can collect as many interest payments as possible before trading the funds for a profit should the rate cuts ensue.

Yes, the Beta on TLT due to the duration of the holdings suggests that the capital gains opportunity is greater on this fund, but the total return could be greater due to the yield on SPHY should you be aiming to trade out at the first rate cut. Should it take longer than expected to get a cut, the total return on SPHY is much more attractive.

Looking at the betas alone, the volatility is about double on TLT, but the yield is double on SPHY. Pick your poison. My guess is rate cuts of significance, to the point where 75 basis points or more are cumulatively cut, could take at least 12 months. I’d rather have a larger yield and less volatility than a larger capital gain. Also, at this yield on cost, the SPHY is much more attractive to hold on to long-term if I execute not to trade it.

Stuck in a trade

One of the biggest issues in this rate-cut trade is what if the FED continues to raise rates? The beta would tell you that TLT would get hit harder. The only thing that could flip the volatilities is if corporate default rates, especially within SPHY’s portfolio boost due to a recession which destroys high-yielding corporate balance sheets and interest coverage. I am betting that the near 2,000 holding diversification holds the line and maintains the lower beta over TLT. If I get stuck in a trade and switch to holding this fund rather than trading it after successive rate cuts, I’d much rather have a higher yield on cost.

Examining just how diversified SPHY is, most holdings even in the top ten are .35% of the portfolio or less.

Summary

I’ve started to nibble at SPHY. I have not determined how long I intend to hold the fund. At 7+% yield on cost, it’s tempting to just buy and hold at least until this current lot of durations have worked its way through the portfolio. TLT risk/reward is not in my wheelhouse. I believe the high beta, low yield compared to high yield income proxies appreciate REITs, BDCs, and high yield debt, which are also sensitive to rate cuts and hikes, is a safer play. I prefer diversified credit risk versus duration risk.