DariaRen

iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) is a popular and highly liquid ETF that invests primarily in U.S. Treasury Bonds. In early 2020, this ETF hit highs of about $180 per share. It now trades for about half that level, at just around $92 per share. Since the portfolio holdings for this ETF are longer term, these long-duration holdings could increase in value more significantly than shorter duration bonds. TLT pays a monthly dividend and it currently yields about 4.34%.

The Chart

As the chart below shows, this ETF has just about been cut in half in the past 4 years, and it now trades well below some significant support levels. The 200-week simple moving average is around $116, and it is represented by the brown trendline on the chart. The 50-week simple moving average is about $126, and this is represented by the orange trendline on the chart. I believe that TLT will rebound back to at least this key support level between now and 2026, and it could even go above this $126 level in the event of a hard-landing recession. Even with a rebound to the $126 level, this would still be 30% below the 2020 high of $180.

finviz.com

Even though inflation is proving to be a bit sticky lately, Jerome Powell recently reiterated plans to cut interest rates three times in 2024. Inflation is certainly a problem for the Federal Reserve, and it is one that gets all the attention it seems. However, behind the scenes and an appearance of a tough facade, I believe it is very clear that the Fed has huge concerns and that they are probably desperately wanting to lower rates as soon as possible. There are multiple reasons for why the Fed needs and possibly desperately wants to lower rates as soon as possible, so let’s take a closer look:

Reason #1: Massive Debt Loads That Keep Growing

The U.S. national debt is now over $34 trillion and about every 100 days, another $1 trillion in debt is added to the existing debt load. This level of debt is hard to finance at almost any interest rate, but it is especially challenging when interest rates are higher now than they have been for years. The Fed has to be concerned about the risks this rapidly growing debt load poses to the economy. By lowering rates, the interest expense for the U.S. Government could decline significantly.

Reason #2: Higher Rates Act As A Stimulus Program

What I have not seen talked about much is the fact that high interest rates are actually contributing to inflation. Not long ago cash just sitting idle in a bank or in a money market fund was earning essentially nothing. But now it is easy to get paid 5% or more in a bank CD, or a money market. This has created a huge amount of newly found income for millions of Americans. As a consequence, this is serving as a massive stimulus program for many middle class and upper class households. By reducing rates, the Fed will also reduce the significant windfall Americans have been receiving ever since the rate hike cycle began. Plus, it is not just American households getting this “stimulus”, because companies are getting boatloads of income off the cash balances they hold right now.

Reason #3: Losses At U.S. Banks

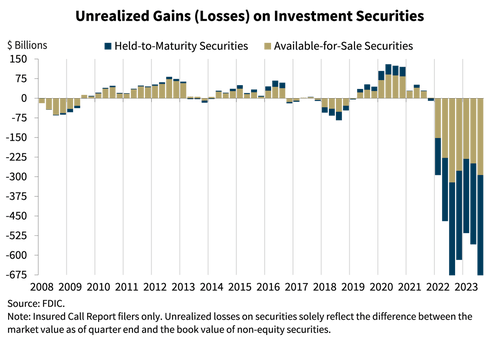

The banking system is another concern and reason why the Fed is possibly desperate to reduce interest rates. Many U.S. banks have massive losses on their bond portfolios. A number of banks went under in 2023, and more could suffer the same fate in 2024, if rates stay at elevated levels. Many banks are also experiencing major losses in commercial real estate loans which only adds to the bond market losses. By reducing rates, the Fed could lessen the bond portfolio losses and mitigate (somewhat) the losses in the commercial real estate sector. As can be seen in the chart below, the level of investment losses that the U.S. banking system has endured is unprecedented. The longer this goes on, the more likely banks will fail and as we know, bank failures can trigger more bank failures as they tend to fall like dominoes.

FDIC

Reason #4: The Housing Market Is Frozen

The housing market has been frozen by the rapid and high level of interest rate increases in the past couple of years. Homeowners don’t want to sell a home when they have often locked in a mortgage at 3% or less because they would have to pay around 7%, if they bought a different home today. This is keeping the supply tight which is keeping prices high and that is warding off homebuyers who are faced with extremely high home prices and interest rates. Housing is a significant catalyst for economic activity as it drives so many ancillary purchases which includes furniture, remodeling projects and more. High housing costs are also contributing to inflation, so lowering rates could be beneficial.

Reason #5 Recession Risks Could Grow

Another big reason why the Fed might be desperate to lower rates is because of the growing risk of recession. The yield curve inversion has been ongoing and it often signals a recession is coming. The longer the Fed keeps rates at restrictive levels, the bigger the chance for a recession. When a recession hits, yields plunge. The jobs market has been deteriorating and that could quickly snowball in the coming months and trigger a recession.

Potential Downside Risks For TLT

If the U.S. debt load grows too large or if bond vigilantes take charge, investors might demand higher yields on U.S. Government debt because the risks are perceived as being higher when a debtor goes deeper into debt. If inflation stays persistent, a higher for longer interest rate policy could delay the investment thesis for TLT.

In Summary

TLT offers an enticing 4.34% yield, with a monthly payout. It also offers the potential for significant capital gains as the Fed cuts rates. I believe the potential downside risks are greatly outweighed by the upside potential this ETF offers.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.