yasindmrblk

The last time I wrote on Titan Machinery (NASDAQ:TITN) was in April 2023. It had reported solid results and was doing well, but despite these positive factors, I told investors to avoid it, which proved to be right. Since my last article, TITN has underperformed in the time of a bull run. However, I think now might be the right time to buy it because I think the market conditions are improving, and TITN might perform better in the coming quarters. Hence, I am upgrading my hold rating to a buy.

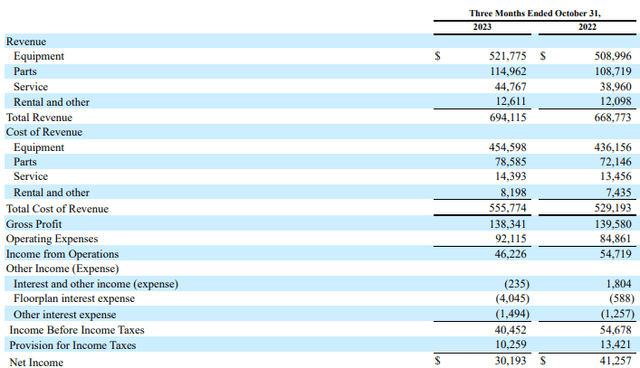

Financial Analysis

It announced its Q3 FY24 results. The total revenue for Q3 FY24 was $694.1 million, a rise of 3.4% compared to Q3 FY23. Its agriculture segment performed quite well, which was the major reason for the rise in revenue. The agriculture segment’s revenue was up by 7.7% in Q3 FY24 compared to Q3 FY23. The agriculture segment benefitted from the Pioneer Farm Equipment acquisition. Its gross margin for Q3 FY24 was 19.9%, which was 20.8% in Q3 FY23. The margins were affected mainly due to lower equipment margins.

Its net income for Q3 FY24 was $30.1 million, a decline of 26.8% compared to Q3 FY23. Other than the low margins, increased expenses due to acquisitions and higher interest expenses affected the profitability. Honestly, I am impressed by the results because Q3 FY24 was one of the toughest times for the company because the market conditions weren’t favorable. The interest rates were sky-high in the U.S. and Europe. So, to be able to grow the revenues in adverse market conditions is impressive, and I expect them to perform way better in the coming quarter because the recent rate cuts are positive, and the farmers’ income is still above the historical average. So looking at the improvement in market conditions, I think it might perform better in the coming quarter.

Technical Analysis

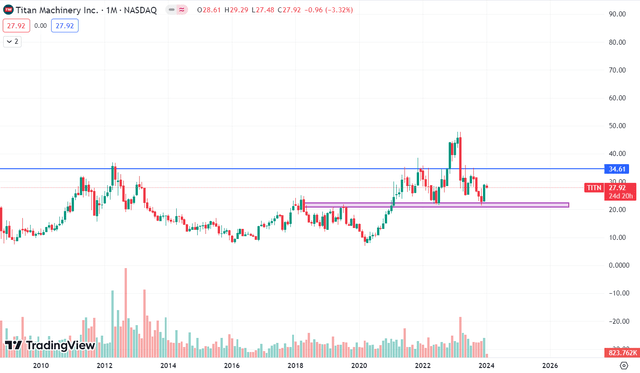

It is trading at $27.9. This stock has corrected around 38% since March 2023. The stock has been bearish at the time of a bull run. But I see some strong signs of reversal in this stock. The first sign is the double bottom pattern, which the stock has made recently. After falling continuously for four months, the stock took support from the $21.5 level, and after touching the level, the stock formed a huge green candle. So, the formation of the double bottom pattern is a positive for the stock, and what makes the pattern more impressive is that the pattern has been formed near the historical support level of $21.5 level. So, I think the chances of reversal from the current level are quite high, and the chances of a downside are low due to the strong support zone.

Should One Invest In TITN?

I think TITN can be a good bet right now because of the improving market conditions. It was performing well when I last covered it, and it is still performing well in tough market conditions. I think the stock has already been punished enough, and with positive expectations going ahead, I believe it can be rewarding. In addition, its valuation looks quite cheap now. It is trading at a P/E [FWD] ratio of 5.69x, which is way lower than its five-year average of 15.89x. It is trading at a PEG [FWD] ratio of 0.23x compared to the sector median of 1.72x. I believe one cannot hold a quality stock down for a long time, and TITN is looking quite cheap now. Its revenues have been growing consistently, future expectations are positive, the price chart is showing signs of reversal, and the valuation is quite cheap. So, considering the improving market conditions, I am upgrading my rating to a buy from a hold.

Risk

The sale and distribution of new equipment, after-market parts supplied by CNH Industrial, and equipment maintenance made by CNH Industrial comprise a significant portion of the company. About 76% of the new equipment sold in Agriculture, 76% in Construction, and 60% in the International segments of the company were supplied by CNH Industrial in the fiscal year 2023. The company also provided a sizable amount of its parts inventory. CNH Industrial is essential to their business in a number of important ways, including the success of their stores. To start, they depend on CNH Industrial for their inventory of new equipment. Market share growth and maintenance depend on CNH Industrial’s capacity to create, produce, distribute, and deliver attractive, high-quality products to their stores on schedule. These products must outperform those of their main rivals in terms of autonomy, connected and digital solutions, quality, functionality, and price. Supply chain problems, labor disputes, including strikes, and labor shortages could impact the manufacturing output of CNH Industrial’s factories. As a result, the stores would not get the inventory in the anticipated quantities and timeframes required to meet customer demand.

Bottom Line

TITN has performed quite well in tough market conditions, and I believe it might continue to do better due to improving market conditions. In addition, its price chart shows signs of reversal, and its valuation also looks cheap. Hence, with positive expectations for the coming quarter, I think investing in TITN might be rewarding. So, I am upgrading my rating to a buy from a hold.