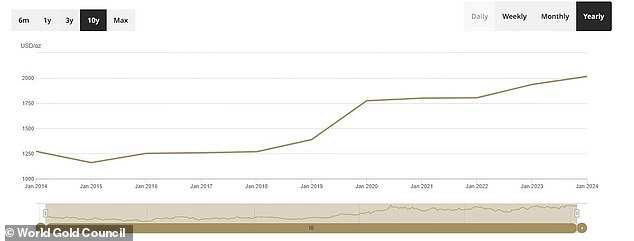

- The value of gold has surged by more than 100% over the past decade

- Watches, engagement rings and gold chains could all have increased in value

- Making a claim based on an old insurance valuation could see you lose out

Jewellery owners could be putting themselves at risk of losing thousands of pounds to theft or damage by failing to have their property revalued, data suggests.

Many Britons could be unknowingly sitting on a gold mine, following a decade-long trend of growth in the value of the precious yellow metal.

And the value of engagement rings, watches and gold chains will all have increased in value over the past 10 years, with the value of some pieces having risen by thousands of pounds, according to Admiral Home Insurance,

The insurer said the average price of a gold chain, for example, has increased to £2,631, rising by a whopping £485 from just £2,146 in 2018.

Up to dat valuations are important to ensuring that you get an accurate payout when making an insurance claim

Gold prices have surged by 112 per cent over the past ten years, according to Admiral, with its value by £575 in 2023 alone, according to Admiral.

Gold reached an average of £2,401 per ounce in 2023, rising from an average of £1,826 in 2022.

Many people may not realise the value of some of their possessions. Not only does this mean that they are likely to lose out if they plan to cash in on the items, but it could also put them at risk of finding themselves thousands of pounds out of pocket if their items are stolen, lost or damaged.

‘Watches and jewellery are often valuable, both financially and sentimentally, so it’s really important that people make sure they are properly covered should the worst happen, and they need to make a claim,’ Noel Summerfield, head of household at Admiral Insurance says.

The price of gold has soared over the last decade

What to consider when revaluing

When it comes to taking out insurance on your valuables, though, it is important to ensure that the valuation you use to take out your policy is up to date.

If you make a claim based on an old valuation, you might find that you only recover part of the value of your possessions due to rising prices.

‘The price of gold has been on an upward trajectory for the last 10 years, so if your jewellery and watches have been insured for a long time and you’ve never thought to check if the value has gone up, now is the time to make sure you’ve got the level of cover that you need,’ Summerfield addsed

‘In fact, we’ve even received claims from customers who haven’t updated the value of their items since the 1980s, with some pieces of jewellery increasing in value by over 700 per cent.’

‘Providing up-to-date item values to your insurer is vital for making sure that if you do have to make a claim, you will be covered for the full value of your items.’

When looking to have your gold valued, it is best to shop around for the best price – don’t just take the first offer you receive.

The National Association of Jewellers-regulated Institute of Registered Valuers is a good starting point to find a reputable valuer near you. Alternatively, the Association of Independent Jewellery Valuers is also a good place to begin.