Daniel Grizelj

“For 2024, I’m going with Muni funds [CEFs]”

– Peter Tchir.

The combination of overbought financial assets and frothy valuations means that the future returns we discussed in the September letter are even more dour. The massive liquidity injection of 2020-2021 pulled forward years of returns, I fear.

The most crowded trade according to the BofA Fund Manager Survey is long the Magnificent 7. It beats out the short China trade by a wide margin.

The narrative has not changed, but we are progressing through it. The long-awaited pivot has arrived and we have now fully priced that in along with the soft landing. Any deviation from that path means markets are susceptible to a fall.

The economy continues to defy expectations of a recession – or even a slowdown. Inflation has been moderating and remains on track to fall in line with Fed targets later in 2024 or early 2025.

I still see the downside risks being far greater than the upside surprise potential in 2024. The possibility of a soft landing remains 50/50 at best, but rates are likely to stay higher for longer despite the cuts projected for this year. That is likely due to the large new supply of treasuries coming to the market in 2024.

Right now, the market is pricing in DOUBLE the amount of cuts that the Fed is projecting. That’s another risk if that doesn’t come to fruition.

My thoughts/thesis are simple: We likely see some semblance of a harder landing next year while inflation continues to fall- with rates falling faster. A more prolonged slowdown is likely in 2025 as the government is forced to slow spending growth. That should push down rates a bit further. In summary, we see upside to bond prices and downside risks to growth.

Takeaways:

- The Fed will likely cut rates quickly but the risk is that they don’t cut as fast as the market expects. It will be difficult for them to cut faster so the risk is to the downside there.

- Corporate margins are falling thanks to de-globalization and shipping concerns coupled domestically with wage costs as the advantage shifts from corporate to labor. Reduce Low moat equity exposure

- International stocks are now extremely cheap relative to U.S. stocks – about as cheap as they’ve ever been. And interestingly, the larger the better the relative valuation. Long: EFA & EEM, short SPY

- Bonds look very favorable relative to stocks, especially U.S. stocks. The implication would be to shift the asset allocation from stocks to bonds but within stocks, according to the last bullet point, shift to international, especially emerging markets. Long: EDV, IGLB, SPLD, FIGB

- In bonds, keep up quality like investment grade bonds. The allocations made to treasuries over the prior months look to be well-timed but now you must be willing to take yields sub-4.0% to lock in yields for more than 5 years. Long: IGLB, FIGB, FCOR, BSCX

- In closed-end funds, or CEFs, discounts remain very wide in munis and we think that remains the trade for 2024. The top picks change daily so follow the daily notes and Weekly Commentaries but for the most part, you could throw a dart or follow Saba’s lead. Long: NMZ, NMCO, RFMZ, BMN, ETX, MMD

- We would continue to avoid higher-risk, lower quality areas of the bond market, especially within CEFs as a new default cycle has started. I see relatively no advantage for going into the lower quality areas of the bond market on a risk-adjusted basis. Spreads are just too tight. Avoid high yield and reduce floater exposure

- The Mag7 stocks look very reminiscent of the Nifty Fifty from the 1970s. Today, they sport an average P/E of more than 50x earnings. This for companies that are already $2T+ in market cap. This is being fueled by AI euphoria. Underweight Mag7

The story of 2024 will be the end of the inflation story and the focus on cutting rates while growth slows dramatically. It is also an election year, which means there will be a lot of diversions out there to the markets.

As core inflation is on track to return to the 2% target by the middle of next year, we expect the Fed to cut interest rates by 25bp at every meeting next year from March onwards, with rates eventually falling to between 3.00% and 3.25% in early 2025.

“This time is different” continues to be discussed in the media and while likely true to some extent, it often rhymes with history and past parallels and relationships eventually hold true. Excessive liquidity from Covid is likely delaying, not obviating, those traditional relationships.

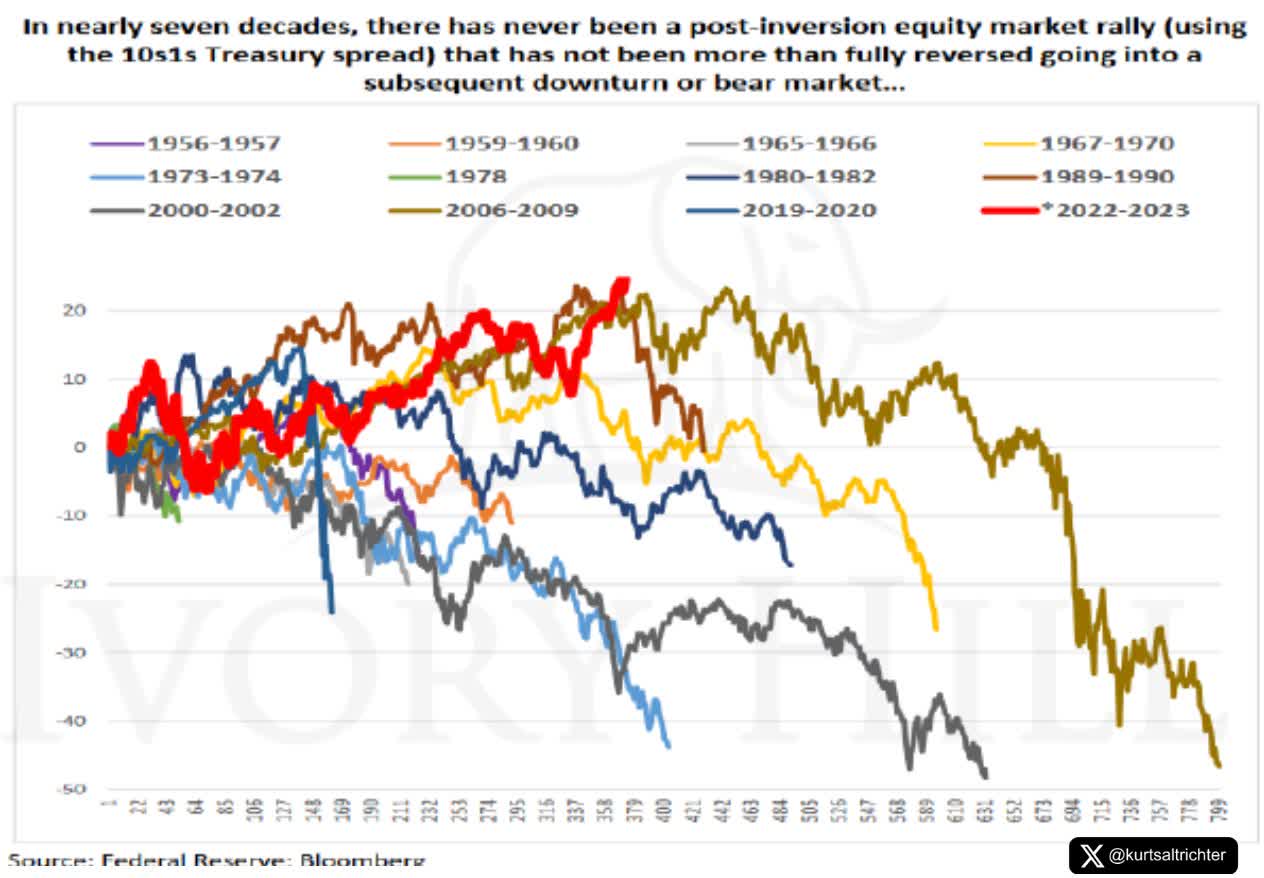

From Kurt Altrichter:

This is indicating that officially something is “different this time.” Yet, this doesn’t guarantee a different end result. While we’re witnessing a record-breaking rally post-inversion, the future remains unpredictable.

Considering the yield curve’s consistent success in predicting recessions and the following equity bear markets since the 1950s, history says the risk of a significant and painful drawdown looming ahead is near 100%.

kurthaltrichter

So what is different this time?

The tsunami of cash. Literally, the Federal Reserve and Congress together created a figurative tsunami of stimulus. In essence, the combined central banks of the world tossed three decades of money supply into the system in a mere 16 months. It is just not possible for that NOT to distort all economic theory – at least for a time.

The question is, do things normalize eventually and the normal laws of physics return.

Markets are complex and influenced by various factors like monetary policy, global events, and technological shifts. While the risk of recession is real, predicting their scale and timing remains extremely challenging. A long-term investment strategy is key in navigating such uncertainties.

This means that we simply allocate to the areas of the market that present the best opportunities. Our focus is on the bond and income side of the ledger and will typically not take big equity calls outside of shifts in asset allocations (shifting some capital towards equities and away based on medium-term RSIs).

Today, within equities, we would focus on the smaller companies and emerging markets as interest rates fall faster in the U.S. than in developing nations.

Smalls caps experienced a recession with the index down more than 65% at its worst. It remains excessively cheap when compared to the S&P 500 index (SP500) as a whole. Some of that is the larger companies (“Magnificent 7”) getting super big in 2023, while the rest is small caps falling much more than mid-caps or even large caps, ex-the Mag7.

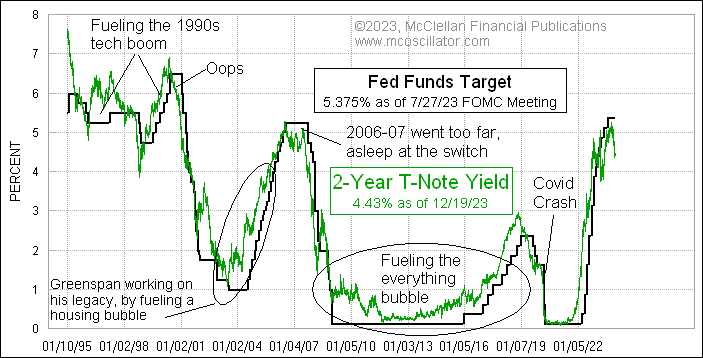

Tom McClellan:

The Fed Funds rate is now almost a full point above the 2-year yield, reflecting an immense amount of overly tight monetary policy from the Fed. They were slow to respond just like this in 2001 and 2007, and each time it caused big problems.

macrobond

I think the source of the decline will be the weakening balance sheet of the consumer as their stimulus cash runs out. However, this will be coupled with a massive drag on the fiscal side as the government is forced to cut back the growth of spending.

Remember, the government rarely cuts spending. They just cut the growth of spending.

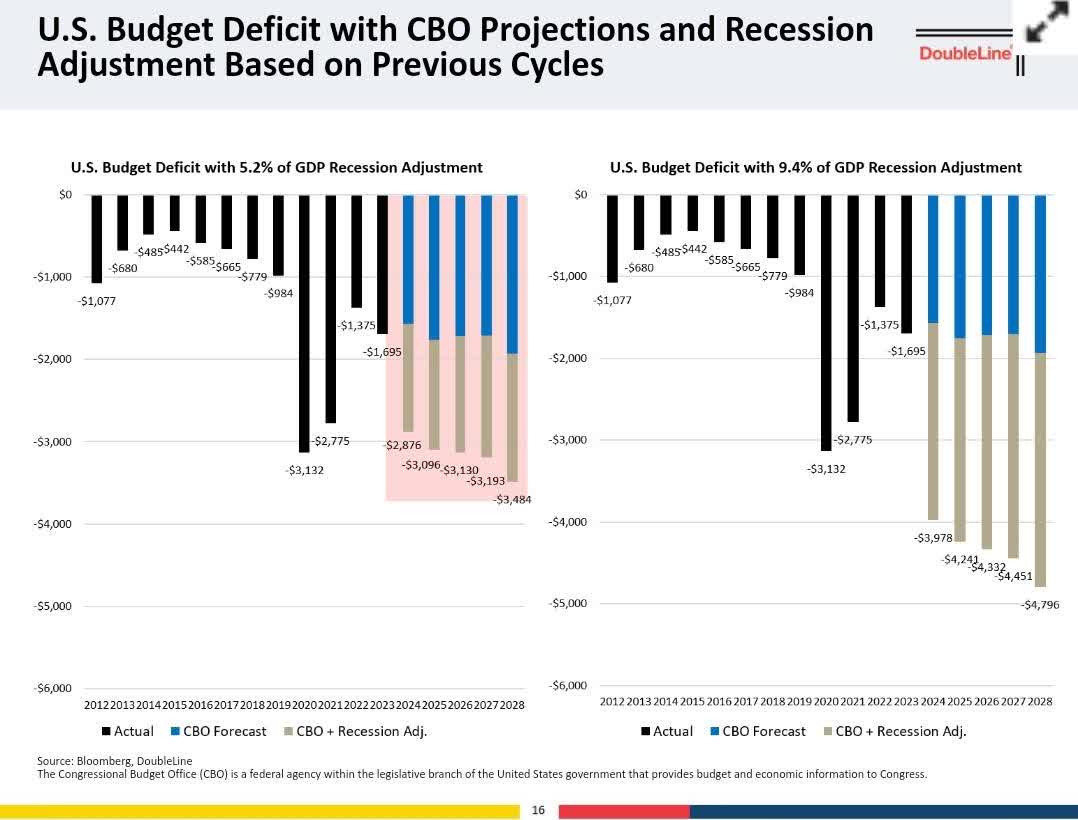

Deficits are on track to really explode over the next five years, after having already grown massively over the previous four years.

Doubleline

By 2025, we have a truly massive fiscal cliff approaching. Provisions of the Affordable Care Act and most provisions of President Donald Trump’s tax cuts are both set to expire in 2025, and at the same time the debt ceiling will unfreeze, and the spending caps instituted under the Fiscal Responsibility Act will expire.

From Brookings:

The White House faces an uphill battle to avoid default and pursue other fiscal priorities, like taxes on the wealthy and extending parts of the Affordable Care Act, while Republicans will likely be able to again hold the entire global economy hostage. The ransom this time around may well be even more drastic. The GOP, emboldened by their victory, could try to win extensions of spending and tax cuts along with kneecapping the Democratic agenda.

I wrote not long ago that for most of the last three decades, it was the Republicans willing to “hold the US hostage” and damage the credit rating of the country for their agenda. However, that may change as the truly heroic amounts of new debt being added to future generations could sway the public to their side for once.

In any event, the outcome is likely to be similar though not the same. With a Republican congress and Democratic presidency, you are likely to see massive spending cuts- sequestration (see 2010) on steroids.

That curtailment of spending growth will create a massive fiscal drag to the economy and could cause a recessionary environment for several years in a worst-case scenario. Even if the worst-case scenario doesn’t materialize the economy will slow and interest rates will slow.

Continue To Lock In These Yields While You Can

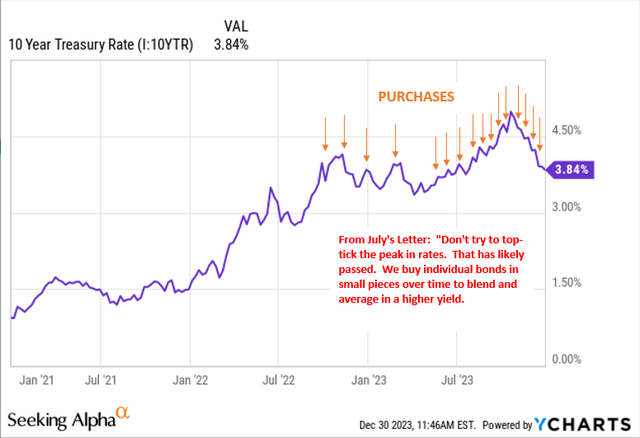

CommishJW recently posted a Barron’s article by Amey Stone titled “Lock In Higher Rates on your Portfolio While You Still Can.” In it, they discussed what we have been doing for most of 2023- extending maturities out and buying individual bonds to LOCK IN these yields for many years to come.

For those at or near retirement, you have been handed a golden opportunity. If you thought you couldn’t retire because of lower interest rates or because your hurdle rate (the rate of return you needed to achieve in order to make your retirement “work”) was too high, then that may be different today.

Interest rates are handing you an annuity-like opportunity- an income stream to last perhaps the remainder of your life- without the need to cannibalize your assets to purchase said annuity stream.

But is it too late? From the Barron’s article (emphasis added):

Investors who are now accustomed to 5% yields on their cash may feel like they are running out of time to put money into bonds with longer maturities, something both fixed-income strategists and Barron’s [and Yield Hunting] have been recommending they do for a while now.

But it’s far from too late. “You don’t want to miss out on locking in 4%yields for five to seven years because you’re waiting to get back to 5%,”says Kathy Jones, chief fixed-income strategist at Charles Schwab.

Yes, keep some savings in those high-yielding money-market funds, but stretch into longer-term maturities as well. The main goal is to avoid the risk that when short-term rates fall, you’ll be left to reinvest at much lower rates.

“The threat of reinvestment risk becomes reality in 2024,” says Michael Arone, an investment strategist at State Street Global Advisors.

This is why we have blended and “yield-on-cost” averaged in over the last year or more into individual bonds of longer maturities to lock these yields in.

It is not too late but I would be getting a bit more aggressive here in adding new bonds. The problem is supply is fairly limited and yields are coming down fast as money flows in.