landbysea

Note:

Tidewater Inc. (NYSE:TDW) has been covered by me previously, so investors should view this article as an update to my earlier publications on the company.

Q3 Report Disappoints

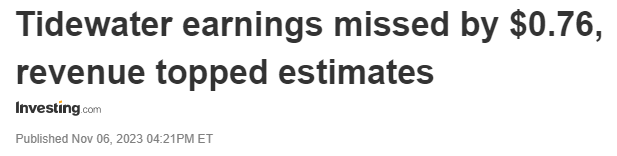

Last month, leading offshore preserve services provider Tidewater Inc. or “Tidewater” reported mixed third quarter results, with minor top line outperformance more than offset by earnings per share coming in well below consensus estimates for a second quarter in a row.

Investing.com

However, the miss appears to have been largely a function of analysts not properly adjusting their models for the recent $580 million acquisition of 37 platform supply vessels from competitor Solstad Offshore (OTCPK:SLOFF) and the resulting, material boost in depreciation.

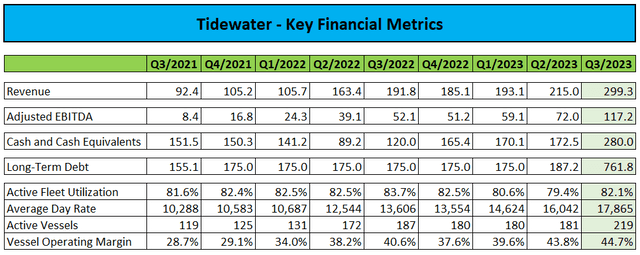

From an adjusted EBITDA perspective, things were looking much better as the reported $117.2 million number was just slightly below expectations due to higher-than-anticipated downtime for repairs, as outlined by management on the conference call.

In addition, average day rate and vessel operating margin (gross margin) reached new multi-year highs:

Third quarter revenue nicely exceeded our expectations as a continued push on day rates globally drove consolidated day rates up by approximately $1,800 per day sequentially, representing the largest sequential improvement in day rates since the recovery began.

The pace of day rate expansion was largely a combination of legacy contracts rolling on to current market day rates and a meaningful step up in leading edge term contract day rates; leading edge term contracts increased to $28,609 sequentially, an improvement of approximately $5,100 per day over the same measure in the prior quarter.

The momentum in day rates is being driven by a global supply shortage of large and small offshore vessels, and, in fact, our medium and small classes of PSVs showed the most relative improvement in leading edge term contract day rates during the third quarter.

However, the above-discussed repairs resulted in the company missing its margin target for the quarter:

Gross margin was up 1%, excluding the $4 million of one-time charges associated with the Solstad integration. We were pushing to be up 5 percentage points, but the additional time down for repair decreased revenue and increased costs. The 2% of excess downtime this quarter cost us $6 million in revenue and $6 million in costs, which would have been another 3 percentage points of gross margin.

It’s not uncommon for vessels to encounter higher downtime as newly reactivated vessels return to high service intensity after a period of low-to-mid level intensity, but our recent encounter has been higher than we anticipated.

Company To Miss Out On Full-Year Gross Profit Target

For the fourth quarter, the company projected revenues of $309 million and gross margin of 47%. While this would be in line with previously-issued full-year top line guidance of slightly above $1 billion, gross profit would miss management’s $500 million target by approximately 10%.

During the questions-and-answers sessions of the conference call, management pointed to expectations for another quarter of higher downtime and related, elevated repair costs as the reason behind the lower margin guidance.

Material Improvement Projected For Next Year

Looking into 2024, Tidewater expects revenues of $1.40 billion to $1.45 billion and gross margins of 52%.

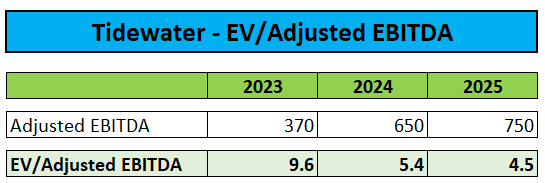

Based on my assumptions, full-year adjusted EBITDA would boost to approximately $650 million, up from an estimated $370 million this year. Please note that a meaningful part of the upside will be contributed by the vessels acquired from Solstad Offshore at the beginning of Q3.

But given the recent lull in contracting activity for deepwater rigs and a resulting boost in anticipated idle time for a meaningful number of floaters next year, management’s outlook might verify aggressive again.

Valuation And Price Target

However, with the medium-term outlook for the offshore drilling industry still promising and more and more low-margin legacy contracts rolling over to prevailing market rates, I would expect advocate improvements in utilization and margin over time, thus resulting in 2025 adjusted EBITDA increasing to an estimated $750 million.

Author’s Estimates

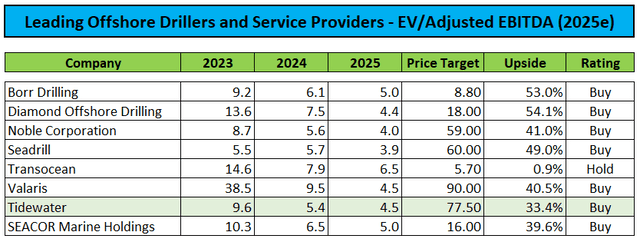

Assigning an EV/Adjusted EBITDA multiple of 6x would yield a $77.50 price target for the shares, thus providing for more than 30% upside from current levels:

That said, with the majority of offshore drillers and smaller competitor SEACOR Marine Holdings (SMHI) offering considerably higher upside, I wouldn’t chase Tidewater’s shares aggressively at this point.

In fact, with oil prices under pressure and a somewhat disappointing near-term outlook for the majority of deepwater drillers, I would advise against overweighting offshore energy service stocks right now.

On the flip side, investors looking for exposure to the industry might consider scaling into selected stocks with Seadrill (SDRL), at least in my opinion, currently offering the best risk/reward scenario.

Key Risk Factor – Oil Price Correlation

Please note that offshore energy services stocks remain heavily correlated to oil prices, so any sustained down proceed in the commodity would almost certainly result in industry shares taking a hit, as very much evidenced by the setback experienced in recent weeks.

Bottom Line

For the second time in a row, Tidewater’s quarterly earnings per share missed consensus estimates by a wide margin, mostly due to analyst models not yet reflecting materially higher depreciation expense related to the recent $580 million acquisition of 37 platform preserve vessels from competitor Solstad Offshore.

In addition, the company’s financial performance was impacted by a combination of unplanned vessel downtime and resulting, elevated repair costs which are expected to continue for the remainder of the year.

Consequently, Tidewater now projects full-year gross profit to come in 10% below previously stated expectations.

For 2024, the company expects revenue and gross profit to boost materially. Based on the numbers provided by management, I would expect adjusted EBITDA to jump by 75% to approximately $650 million.

However, with the majority of offshore drillers and smaller competitor SEACOR Marine Holdings currently offering higher upside and considering less-than-stellar investor sentiment, I wouldn’t chase Tidewater’s shares aggressively at this point.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.