TBE

Dear readers/followers,

My position in thyssenkrupp (OTCPK:TYEKF) has not done superbly well during most of 2023, and the estimates for 2024E seem somewhat difficult to forecast as well. My work on the company didn’t garner much attention when it actually was worth investing in, so my position is still in a strong outperformance, but I’ve revisited the company a few times to see what can be expected not only in 2023 but going into 2024-2026E.

It’s always tricky to invest in a BB-rated commodities business. Commodities businesses have an inherent high volatility and uncertainity, and the way thyssenkrupp works and is structured increases this even further.

In one of my previous articles, the last of which by the way you can find here I made it clear that I believe in the company being able to outperform triple digits over the long term. That’s the reason I continue to invest in thyssenkrupp here, despite what can only be called a significant weakness over the past 8-9 months.

There are reasons for that though, and in this article, we’ll take a look at them and see what can be expected as we move forward.

thyssenkrupp – The company in 2024E.

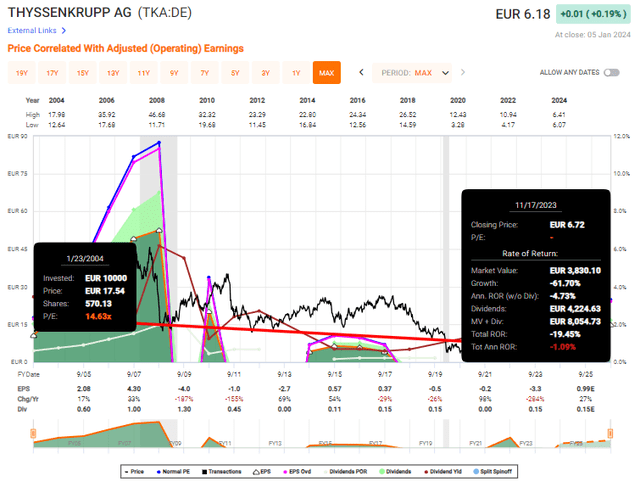

Estimating this company is just as hard as it has always been, at least for the past 20 years. thyssenkrupp is the sort of company that sees earnings drops as massive as 150-200%, only to be followed by bouncebacks in the same range. It’s the epitome of a cyclical commodity company, and with its BB rating and less than 2.5% yield, it’s not hard to understand why investors may seem a bit hesitant going all that deeply into thyssenkrupp.

There’s also the fact that if you are a long-time thyssenkrupp investor for the past 2 decades, you have clearly been underperforming the overall market. Even if you avoided the worst of the GFC valuations and bought below 15x P/E, your RoR would be negative here, which means you’d have missed out on quadruple-digits worth of growth by simply investing in conservative, solid companies.

thyssenkrupp RoR (F.A.S.T Grraphs)

I invested when the company was at multi-year lows, though the business here is still where I would consider it a “BUY” for the long term, but it’s far from my highest conviction potential.

3Q23 is the latest quarter we have here. Like before, a large part of thyssenkrupp is in the process of transformation, so the way that the segments, including Material services, industrial components, Steel Europe, Multi-tracks, and others look today, may not be the way they look in a few years or even just one year.

The group is capable of annual sales of over €40B during good times, with an operating income of above €2B. This is far from the best margin in the industry, but it’s still decent if the company was able to keep this mostly stable – which it unfortunately currently is not.

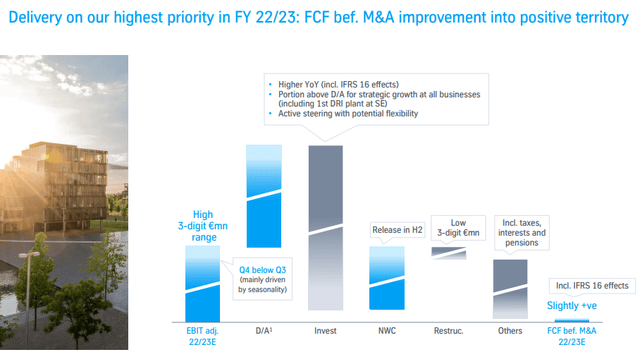

in 3Q23/9M, the company saw a margin improvement and actual positive free cash flow – at least prior to adjustments for M&A. Because the company is in the midst of a transformation, those M&A processes and activities are going to have fairly heavy impacts here. Performance and restructuring initiatives continue both costing capital, as well as generating savings. The company’s FCF was slightly positive during 22/23 before M&A, with the target being that the company wants significant, pre-M&A FCF.

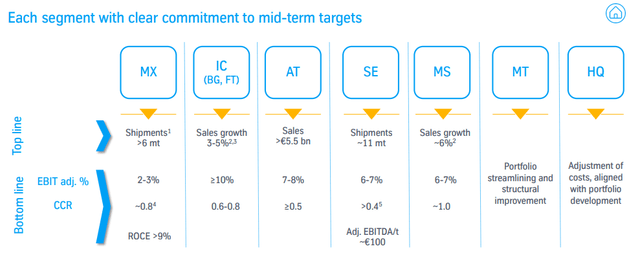

Each of the company’s expansive segments has clear profitability and return targets.

thyssenkrupp IR (thyssenkrupp IR)

However, I believe it fair to say that the company is a long way from realizing these. This can be, I believe, confirmed with the company’s target of “paying a dividend”, or dividend payment being “a clear target for thyssenkrupp”.

Still, there are positives for the company, even if current trends do not look all that encouraging. TK managed to IPO Nucera, and this was one of the largest IPOs in all of Europe in 2023, with an initial market cap of €2.5B, and TK retaining a 50%+ management/majority stake in the company. In doing this, TK does a similar process to Siemens, where it spun off many businesses, but retained ownership of them.

3Q23 sales came in at €9.6B, realizing a respectable run rate, and the company generated both positive adjusted EBITDA and EBIT, with significant pre-M&A FCF of almost €350M, an increase of over €750M.

The journey TK is on is a long one, and it will still take years, as I see it. But at the same time, TK has zero debt, it has an almost 40% equity ratio, and its backing by listed companies like Nucera and Elevator adds to the appeal here. The effects from the Nucera IPO are not yet included in the balance sheet for 3Q23 either (Source: thyssenkrupp 3Q23).

Most importantly, thyssenkrupp delivered according to plan. Price normalization in the materials business is ongoing, and auto is seeing improved demand. On the other hand, several of the company’s segments are seeing negative price normalizations from last year’s highs, and restructuring costs and performance initiatives continue to weigh things down, leading to a 51% and 66% decline in EBIT and EBITDA on an adjusted basis, respectively.

The outlook for the market across the world, with the exception of some segments in Europe, is actually pretty positive, as most of them are expected to grow by 1-5% or even higher than 5% (Source: thyssenkrupp IR). However, due to trends and difficult comps, TK is still expecting a significant decrease in YoY sales, below €1B in adjusted EBIT which would be less than half of that of YoY, and probably more than a 50% drop in adjusted EBITDA as well.

It is these things that are, despite successful execution on the planning and restructuring side, weighing thyssenkrupp down, because there is very little that the company can do about these trends.

The company argues its highest-order priority target was delivered – pre-M&A FCF into positives – but to me, this was almost a given with macro trends as they currently are.

thyssenkrupp IR (thyssenkrupp IR)

Hitting guidance is obviously important. But so is, I believe, clear continued upside and some sort of timeframe when we can expect earnings to really turn around.

As of right now, that’s something that I believe is lacking for this company.

Let’s look at the risks and upsides for thyssenkrupp.

Risks & Upsides

There are execution risks to thyssenkrupp that should not be underestimated. TK is committed to essentially restructuring the company in its operational entirety. Not only will that continue to take time, it will take resources, and in this (or any) macro is fraught with risks. A historical look-back will show you that thyssenkrupp, since the GFC, has really not done anything that by its shareholders from a return perspective could be considered “impressive”, unless you consider losing investor money most of the time to be impressive.

The lack of visibility here makes this a speculative investment that probably should be avoided by many investors unless they are in it for the very, very long haul. That’s What thyssenkrupp can give you.

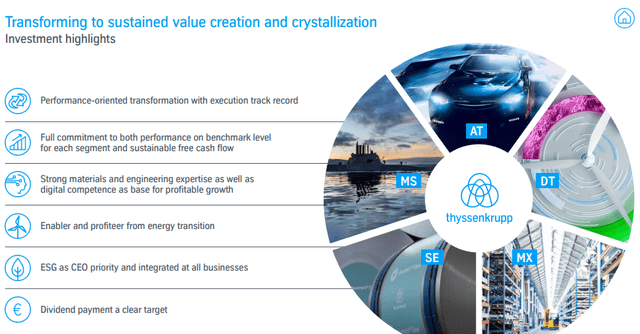

thyssenkrupp IR (thyssenkrupp IR)

The upside here, and the reason why you should invest in the company should be self-explanatory. Triple-digit upside potential when this company goes up, as it should if it continues executing. The company’s new structure is already finished and can be viewed on the homepage, including the segments Automotive Tech, Decarbon Tech, Materials services, Steel Europe, and Marine Systems – everything else will be folded into them or sold.

This new structure should be able to generate group-wide sales of over €35B p.a. with an EBIT adjusted of over €700M.

That’s the upside, and if it materializes, I do believe this company will be worth not only what I paid for my shares, but far more than that.

Valuation for thyssenkrupp

The company’s valuation is somewhat made difficult by how long the company has been in negative territory for things like stable earnings and positive FCF. However, now the company is confident its positive FCF numbers are here to stay, which should cushion the valuation quite a bit.

Despite the company’s operational improvements, the market has not allowed leeway for thyssenkrupp to trade higher here. It’s still at €6/share or thereabouts. 8 analysts follow the company, and these analysts go from a €7/share low to a €17/share high with an average of €10/share. Due to the undervaluation in commodities and basic materials, I’m lowering my target to €12.5/share, but that still gives us more than a 100% upside for the native ticker from today’s valuation. 5 analysts out of 8 have the company at a “BUY” , indicating a good conviction.

The key here lies in overcoming what I would consider to be one of the worst track records in the space.

How good has TK been at hitting analyst targets?

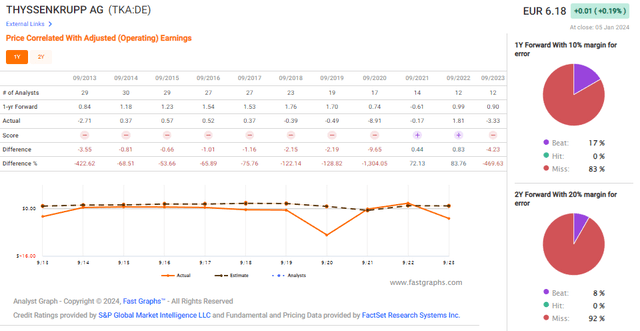

thyssenkrupp Analyst Forecast Accuracy (F.A.S.T Graphs)

I’ve reviewed companies with 100% faultless miss ratios before – but none that are this bad with this size and with this history. TK has simply, since the GFC, had one of the absolutely worst performances that I have seen barring bankruptcy.

But I believe the time for a turnaround lies somewhere in the next 1-3 years, with more and more of that crystallizing as time goes on. That’s where the upside lies, and the current forecast that I have for this company includes an EPS, on a GAAP-equivalent basis, that rises into the positive in 2024, and stays there, growing slowly. By 2025 and 2026E, I believe the company, based on an expected revenue number of between €36-€38B for those years, would bring in EBIT of about €700-€1000M, which based on SO and the current trends would bring about between €0.6-€1.1 EP, enabling a dividend of around 15 euro cents or thereabouts, without impairing the company in any way. This would imply a yield of 2.5%, nothing to crow home about, but something to build on.

The largest upside here is from share price appreciation, because if the company manages a euro in EPS, then this company trades at a P/E of 6x – and that’s not something that I consider fair.

I would estimate it at around €12.5 in its €1/share EPS state, which gives us a triple-digit upside.

Again though, I want to be clear that this is a speculative investment.

Thesis

- thyssenkrupp remains one of the more interesting global plays on steel, forging and the steel sector in Europe. While there are peers I’ve made money on that are not thyssenkrupp, like Gerdau and Arcelor, I consider this one, despite its 50% RoR in the last year, to still have an upside. I added to it not that long ago, and I will continue to hold and build my position in the business.

- thyssenkrupp is undervalued on the basis of NAV, Peers, and forecasts – because of that, my rating for 2023 for the company is a very clear “BUY”, albeit a clearly speculative one.

- 3Q23 saw the company hitting almost all its forecast targets, but there’s still uncertainity as to exactly when investors can expect that significant upside, based on earnings (not sentiment), and for that reason I caution this company as being quite speculative.

- My PT for thyssenkrupp is at €12/share native.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The only flaw with thyssenkrupp, aside from its credit rating, is the lack of a dividend. But, I still consider it a “BUY” here.

This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.